Finance Hub: Crypto Airdrops, Regulations, and Exchange Reviews

When working with Finance, the system of managing money, assets, and risk. Also known as financial services, it touches everything from daily budgeting to global markets. Within this sphere, Cryptocurrency, digital assets secured by blockchain technology has become a key player, especially through Airdrop, free token distribution events that reward community engagement. At the same time, Regulation, the set of laws governing financial activities shapes how these digital tools can be used safely and legally.

Finance encompasses the rise of cryptocurrency markets, meaning investors now juggle traditional assets and tokens like Bitcoin, Base Reward Token, or the newest airdrops from projects such as Bull Finance. These airdrops often serve as entry points for newcomers, offering a low‑cost way to test strategies while exposing them to tokenomics, liquidity pools, and market volatility. Understanding the mechanics—eligibility criteria, claim timelines, and risk factors—helps turn a simple free token into a meaningful portfolio piece.

Regulation influences finance by setting the rules that protect participants and keep markets fair. Recent moves in China, India, Taiwan, and Bolivia illustrate how governments can either tighten or open doors for crypto activity. For instance, India's 30% crypto tax or Taiwan’s selective banking restrictions directly affect how investors report gains, choose exchanges, and manage compliance. Knowing the current legal landscape lets you navigate tax obligations, avoid penalties, and spot jurisdictions that offer favorable crypto‑friendly policies.

Crypto exchanges act as the bridge between finance and the blockchain world. Platforms like OpenSwap, SuperEx, and Coinext each bring unique fee structures, security measures, and user experiences. Choosing the right exchange means weighing factors such as KYC requirements, AML compliance, liquidity depth, and available trading pairs. When you pair the right exchange with solid tax planning—like handling NRI crypto tax in India or understanding Brazil’s local regulations—you create a resilient financial strategy that can adapt to market swings.

What you’ll find next

The articles below dive deep into each of these areas. From step‑by‑step airdrop guides and fan‑token explainers to detailed breakdowns of Malta’s blockchain strategy and the latest crypto tax penalties, the collection gives you actionable insights you can apply right away. Keep reading to sharpen your finance toolkit and stay ahead of the fast‑moving crypto landscape.

Egypt imposes prison time and fines up to $516,000 for promoting cryptocurrency. Despite millions using crypto, the law bans all promotion without state approval - with strict enforcement and no legal path to compliance.

BitTap crypto exchange offers spot, futures, and margin trading but lacks transparency, regulatory info, and user reviews. Without audits or fee details, it's too risky to use. Stick to verified platforms instead.

RichQUACK's real airdrop isn't tied to CoinMarketCap. Learn how the QUACK token's static rewards, deflationary burn, and community-driven jackpot system work - and how to avoid scams pretending to be official.

Jordan's crypto policy shifted from ban to regulation in 2025. Learn how the new law works, what it costs to get licensed, and why it matters for users and businesses in 2026.

Hyperbot (BOT) is an AI-powered trading terminal that unifies data from decentralized perpetual exchanges, helping traders track whales, detect market signals, and execute trades across multiple DEXs. It’s not a meme coin - it’s a tool built for serious DeFi traders.

NFTs in 2026 are no longer speculative assets - they're a proven revenue tool for creators. With royalties, utility-based access, and no-code tools, digital ownership lets artists, musicians, and content makers earn long-term income outside of platform-dependent systems.

BICC Exchange is a Japan-regulated crypto platform offering 50+ coins, bank transfers, and strong security. Not for global users, but ideal for locals seeking compliance over flashy features.

The Professor (LAB) is a Solana-based meme coin with no utility, minimal liquidity, and extreme volatility. Launched by a self-described crypto enthusiast, it's a high-risk experiment driven by community hype - not fundamentals.

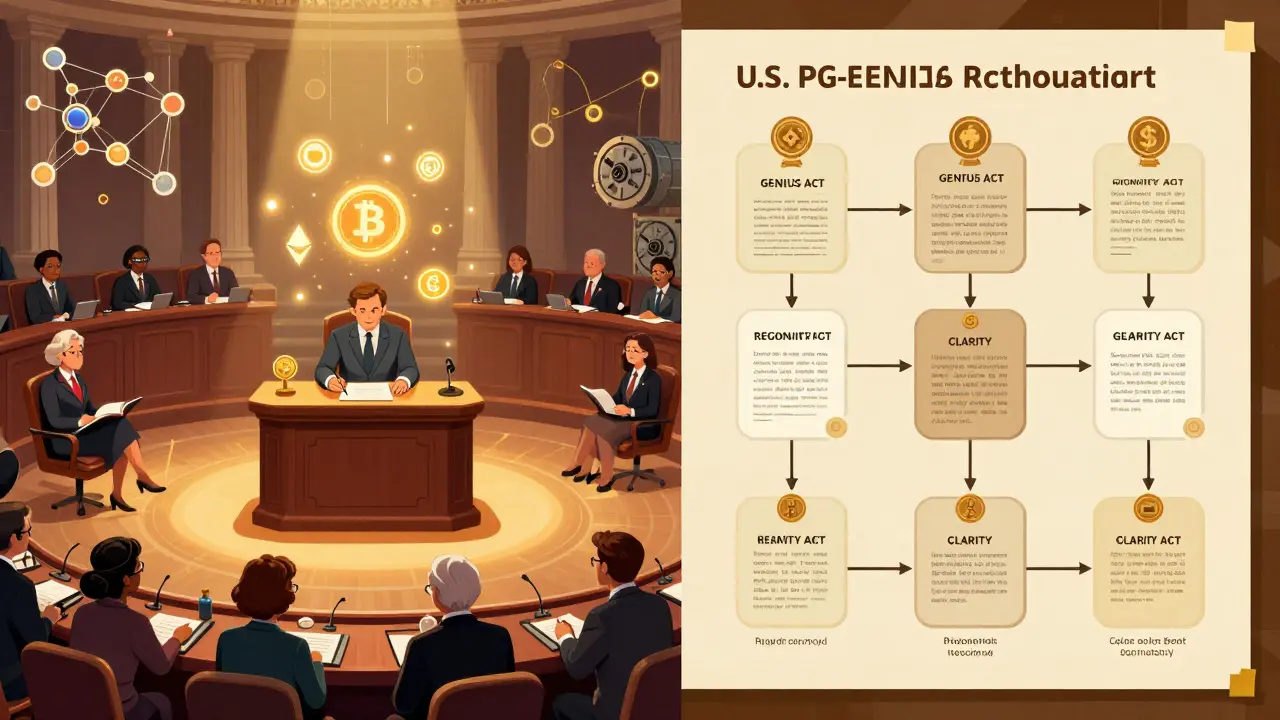

In 2025, the U.S. passed landmark laws that legally recognized cryptocurrency, stablecoins, and blockchain activities. Banks can now custody crypto, mining is protected, and a digital dollar is banned. Here's what changed - and why it matters.

EOSex was a crypto exchange that promised to share 100% of profits with EXP token holders. Launched in 2018, it vanished by 2020. No trading, no updates, no value. Here's what really happened.

No legitimate airdrop called 'The Recharge Incentive Drop' exists. This article explains how to recognize crypto scams, spot fake airdrops, and protect your wallet from fraud - with real examples from Uniswap, ENS, and recent scams.

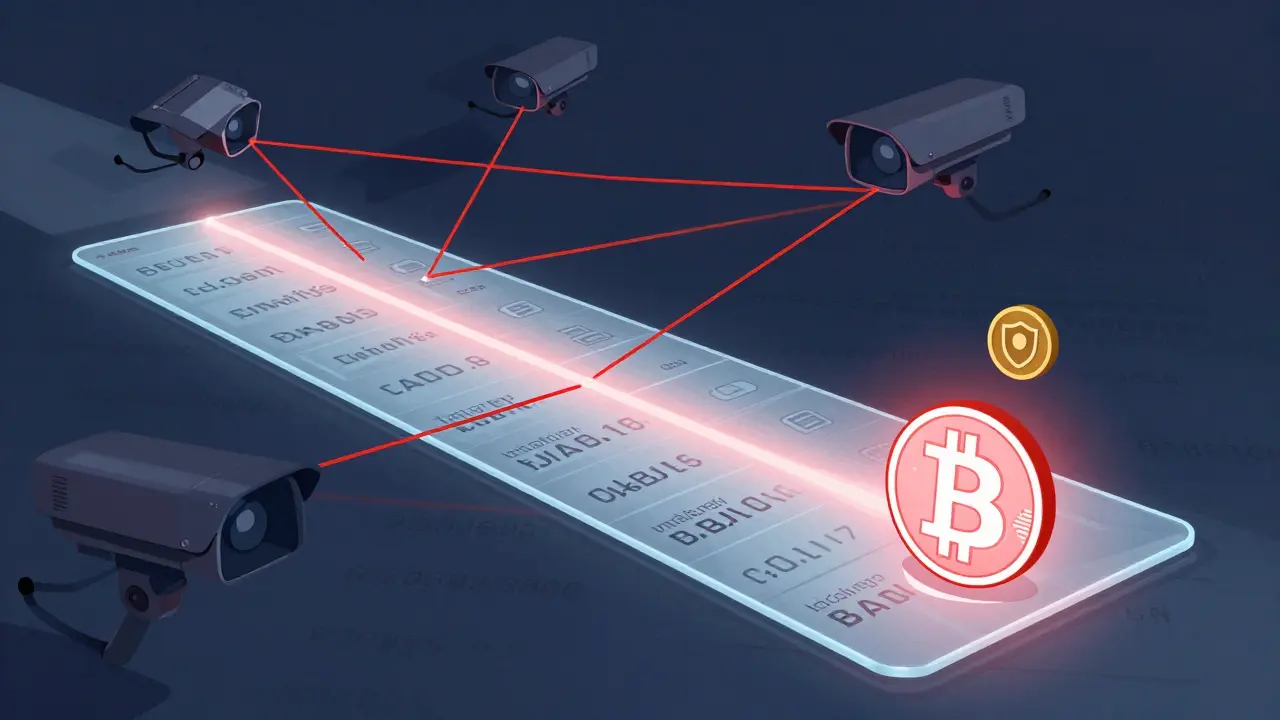

The battle between privacy tech and surveillance in crypto is heating up. Privacy coins like Monero and Zcash hide transactions, while tools like Chainalysis trace them. Who wins? It depends on whether society values financial freedom or control.

Finance

Finance