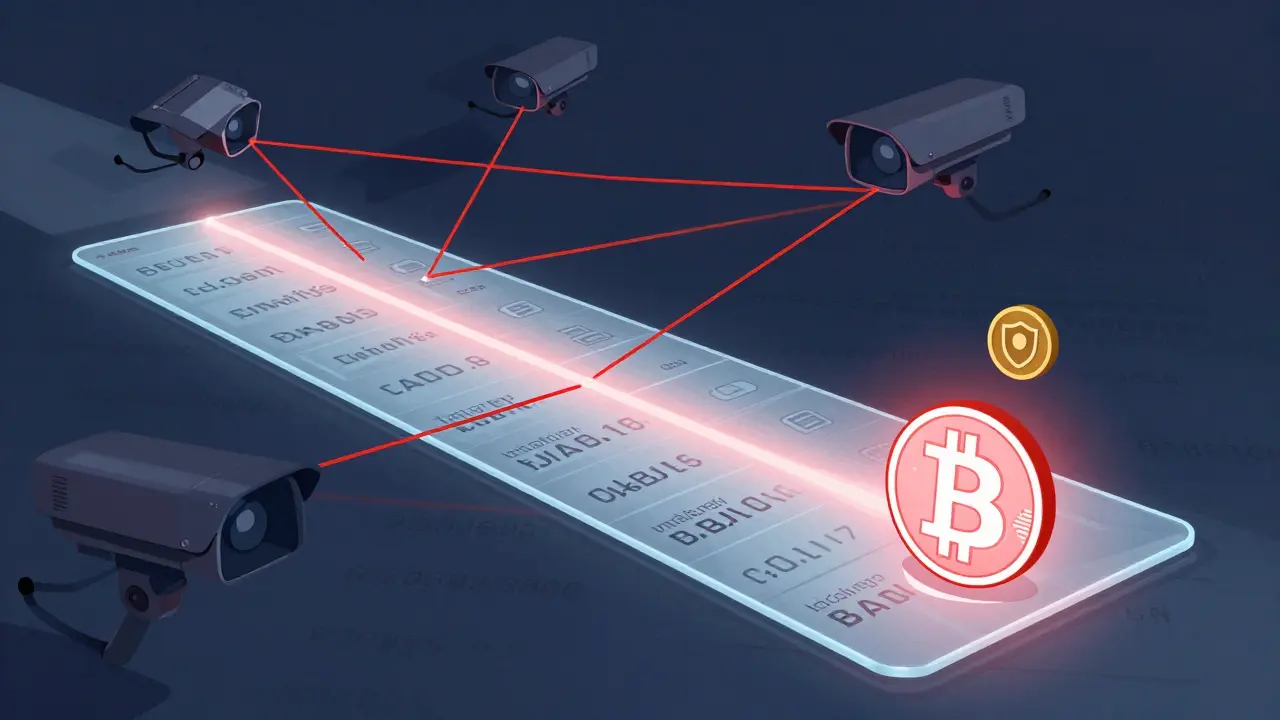

When you send Bitcoin, it’s not as private as you might think. Every transaction is recorded on a public ledger. Someone with the right tools can follow that money from wallet to wallet, even if you used a new address each time. This isn’t a flaw-it’s how Bitcoin was designed. But as more people want real financial privacy, developers built tools to hide those trails. And in response, governments and companies built even better ways to track them. What we’re seeing isn’t just a tech upgrade-it’s an arms race between privacy and surveillance in cryptocurrency.

How Privacy Tech Tried to Fix Bitcoin’s Transparency Problem

Bitcoin’s blockchain is open. Anyone can see how much was sent, when, and between which addresses. That transparency helps prevent fraud, but it also means your financial history is exposed. Researchers proved early on that you could link addresses to real people using simple tricks: timing analysis, address clustering, and transaction graph mapping. If you sent Bitcoin to a gambling site, and later received funds from that same address, you were likely the same person.

So developers built alternatives. Monero came out in 2014 with a radical idea: hide everything. It uses ring signatures to mix your transaction with dozens of others, so no one can tell which one is yours. It hides the amount with RingCT and creates one-time stealth addresses so receivers can’t be tracked. Zcash, launched in 2016, went further with zk-SNARKs-zero-knowledge proofs that let you prove a transaction is valid without showing any details. You can send 10 ZEC and prove you didn’t double-spend it, but no one sees who sent it, who received it, or how much.

These aren’t theoretical. Monero processes over 200,000 transactions daily. Zcash has over 1 million shielded transactions. They work. And they’re not just for criminals-people in Venezuela, Nigeria, and Ukraine use them to protect savings from inflation or freezing accounts. Privacy isn’t about hiding crime; it’s about protecting ordinary people from overreach.

The Surveillance Side: How Companies Track What’s Supposed to Be Hidden

While privacy coins evolved, so did the tools to track them. Chainalysis, Elliptic, and CipherTrace now dominate blockchain analytics. They don’t just watch Bitcoin-they map entire networks. Their software clusters hundreds of addresses into single entities based on patterns: if Address A sends to Address B, and Address B later sends to Address C, and Address C has a history of interacting with a known exchange, they label it all as one user. That’s how they found out that a single person controlled over 100,000 Bitcoin addresses.

They use machine learning to spot anomalies. A wallet that sends small amounts to 50 different addresses every hour? Likely a mixer. A wallet that receives funds from a darknet market and then sends to a regulated exchange? Flagged. These tools are so accurate that even Monero’s privacy features have been partially compromised through timing attacks and traffic analysis. Not perfect-but good enough for regulators.

The U.S. Department of Justice didn’t just rely on tech. In 2024, they arrested the founders of Samourai Wallet, a popular privacy-focused Bitcoin wallet, for allegedly helping users launder money. The indictment claimed the app’s features-like CoinJoin mixing and payee isolation-were designed to evade detection. The case sent shockwaves through the crypto community. If a wallet that lets you obscure your transactions can be deemed illegal, what’s left?

Regulation Isn’t Just About Crime-It’s About Control

Exchanges like Coinbase and Binance have delisted Monero and Zcash. Why? Because compliance is expensive. If a regulator says, “We can’t verify these transactions,” the exchange risks losing its license. So they cut off privacy coins. In Europe, MiCA regulations now require all crypto services to trace the origin of funds. In the U.S., FinCEN requires reporting for transactions over $10,000-even if they’re sent through a privacy coin. Some countries, like China and Saudi Arabia, banned privacy coins outright. Russia is trying to do the same.

But here’s the catch: you can’t ban privacy. You can only ban access to it. People still use Monero through peer-to-peer exchanges, decentralized platforms, and non-custodial wallets. The tech doesn’t disappear-it just goes underground. And that’s exactly what regulators fear: losing control over who sends money to whom.

The Philosophical Divide: Privacy as a Right vs. Privacy as a Risk

This isn’t just a tech fight. It’s a values war. On one side, you have people like Edward Snowden, who says privacy must be the default-not the exception. He argues that if governments make privacy illegal, they’re not fighting crime; they’re criminalizing freedom. On the other side, law enforcement agencies say untraceable money fuels drug cartels, ransomware gangs, and terror financing.

But the data doesn’t fully support the fear. According to Chainalysis’s own 2025 report, privacy coins accounted for less than 1% of all crypto transactions. Most money laundering still happens through traditional banks and centralized exchanges. Yet privacy coins get all the attention. Why? Because they’re visible. They’re easy to blame. And they’re easy to regulate.

The Future: Quantum, AI, and the Next Battle

Both sides are racing ahead. Privacy tech is moving into layer-2 solutions like the Lightning Network with privacy layers, and cross-chain bridges that hide transfers between blockchains. Obyte, a DAG-based system, eliminates miners entirely, making censorship nearly impossible. AI is being used to create synthetic transaction patterns that confuse surveillance tools-making it look like a million users are acting the same way, so no one stands out.

Surveillance tech is responding with quantum-ready algorithms. If a quantum computer breaks ECDSA (the math behind Bitcoin signatures), it could reveal hidden addresses. But privacy researchers are already testing quantum-resistant cryptography like lattice-based encryption. The next generation of privacy coins might be unbreakable-even by quantum machines.

Smart contracts are the new frontier. Imagine a business that wants to pay suppliers without revealing prices or volumes. Current blockchains force full transparency. New protocols like zk-Rollups with private computation could let companies prove they paid correctly without showing the amount. That’s the real challenge: balancing auditability with privacy. Can we have both?

What This Means for You

If you’re using Bitcoin or Ethereum, your transactions are traceable. If you care about privacy, you need to actively choose tools that protect you. That means using privacy coins, mixing services, or non-custodial wallets that don’t require KYC. But you also need to accept the trade-off: you might be blocked from exchanges, flagged by regulators, or treated with suspicion.

The truth is, this arms race isn’t going to end. It will only get more intense. As governments demand more control, developers will build better ways to resist. The real question isn’t whether privacy is possible-it’s whether society will let it exist.

Are privacy coins illegal?

No, privacy coins themselves aren’t illegal anywhere. But many countries restrict their use on regulated exchanges or require extra reporting. In the U.S., using Monero or Zcash isn’t against the law-but if you use them to avoid reporting requirements, you could face legal consequences. The issue isn’t the coin-it’s how you use it.

Can Chainalysis track Monero?

Chainalysis cannot reliably track Monero transactions. Its ring signatures and stealth addresses make it extremely difficult to link senders, receivers, or amounts. While researchers have attempted timing and traffic analysis, no public tool has successfully de-anonymized Monero at scale. That’s why exchanges still delist it-not because it’s breakable, but because regulators demand transparency they can’t get.

Why don’t more people use privacy coins?

Mainstream adoption is low because most exchanges don’t support them, and users don’t know how to use them safely. Many people think Bitcoin is private enough, not realizing how easily it can be traced. There’s also fear-using privacy tools can make you look suspicious to banks or regulators, even if you’re doing nothing wrong. The friction outweighs the benefit for most users.

Is Zcash truly anonymous?

Zcash offers two types of transactions: transparent (like Bitcoin) and shielded (using zk-SNARKs). Shielded transactions are mathematically private-no one can see the amount, sender, or receiver. But only about 15% of Zcash transactions are shielded. Most users default to transparent mode for convenience, leaving their history exposed. True anonymity requires intentional use.

Will quantum computing break crypto privacy?

Quantum computers could break current public-key cryptography, including Bitcoin’s ECDSA and Zcash’s zk-SNARKs. But privacy projects are already developing quantum-resistant algorithms. Monero and Zcash are exploring lattice-based cryptography and hash-based signatures. The race isn’t over-it’s just entering a new phase. The next decade will decide whether privacy survives the quantum age.

Finance

Finance