BiKing isn’t a household name like Binance or Coinbase, but if you’ve seen ads for high-leverage crypto trading with no KYC, you’ve probably come across it. The platform promises access to Bitcoin, Ethereum, Monero, Dash, and more-with leverage up to 100x. Sounds tempting? Here’s the reality: BiKing has been involved in multiple security breaches, has no regulatory oversight, and has lost over $8 million in user funds. This isn’t a review about fees or interface design. It’s about whether you should risk your money on a platform with a documented history of failure.

What BiKing Actually Offers

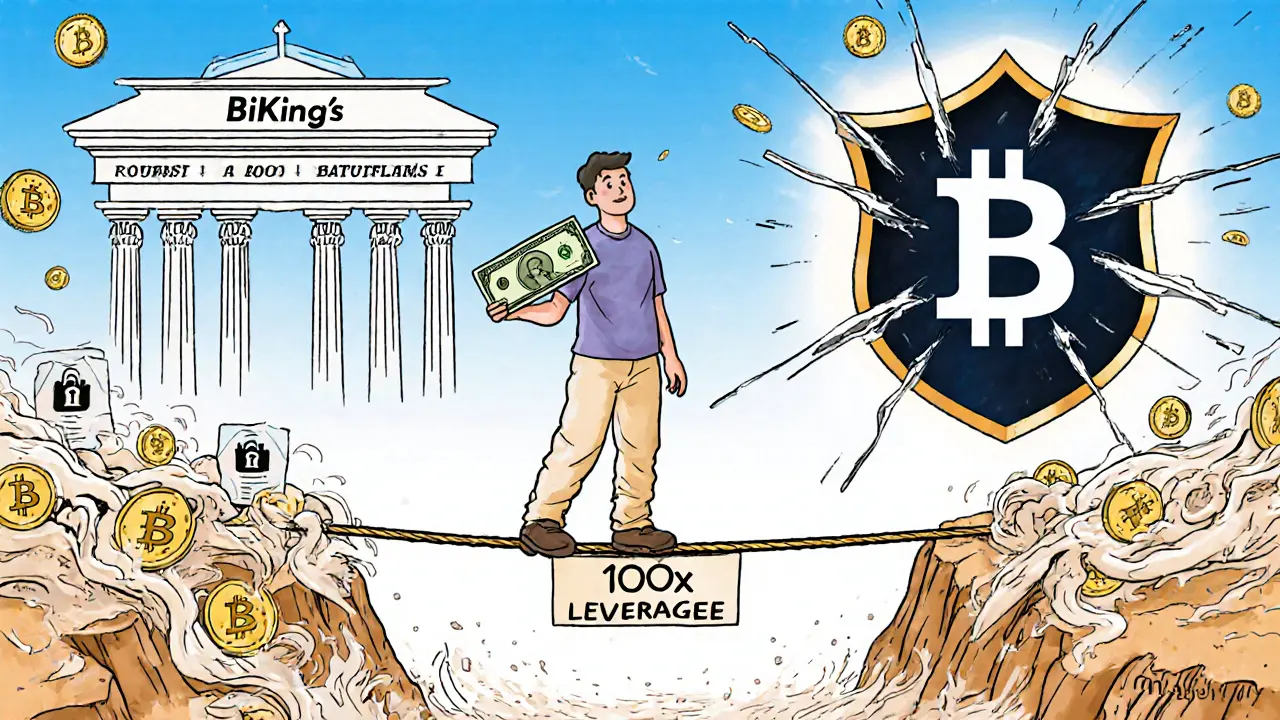

BiKing lets you trade around 10 major cryptocurrencies, including Bitcoin, Ethereum, Tether, Litecoin, Ripple, and privacy coins like Monero and Dash-though those were suddenly removed in 2023. The platform works through a web browser and a mobile app, making it easy to log in from anywhere. It doesn’t require identity verification, which appeals to users who want anonymity. But anonymity comes at a cost: no protections, no recourse, no safety net.Its biggest selling point is leverage. You can trade with up to 100x leverage on some pairs. That means a $100 deposit can control $10,000 worth of crypto. Sounds powerful? It is-if you’re right. But if the market moves just 1% against you, you’re wiped out. For beginners, this isn’t trading. It’s gambling with your life savings.

Security: A History of Breaches

BiKing’s security record is alarming. In 2020 and again in 2021, hackers stole more than $8 million from user accounts. These weren’t one-off incidents. They were avoidable. The attackers exploited two well-known weaknesses: SMS-based two-factor authentication and poorly secured API keys.SMS 2FA is outdated. It’s easy to hijack through SIM-swapping attacks. Every major exchange today uses authenticator apps like Google Authenticator or hardware keys like YubiKey. BiKing still relies on text messages. That’s like locking your front door with a rubber band.

API keys are another red flag. These are digital keys that let third-party tools or bots trade on your behalf. If they’re not properly restricted, hackers can drain your entire balance. BiKing doesn’t appear to offer key permissions like withdrawal limits or IP whitelisting-features that are standard on platforms like Kraken or Binance.

There’s no evidence BiKing conducts regular security audits, uses intrusion detection systems, or maintains cold storage for the majority of user funds. According to industry standards from Chainalysis and NADCA, these are non-negotiable for any exchange handling more than a few million in assets. BiKing doesn’t meet them.

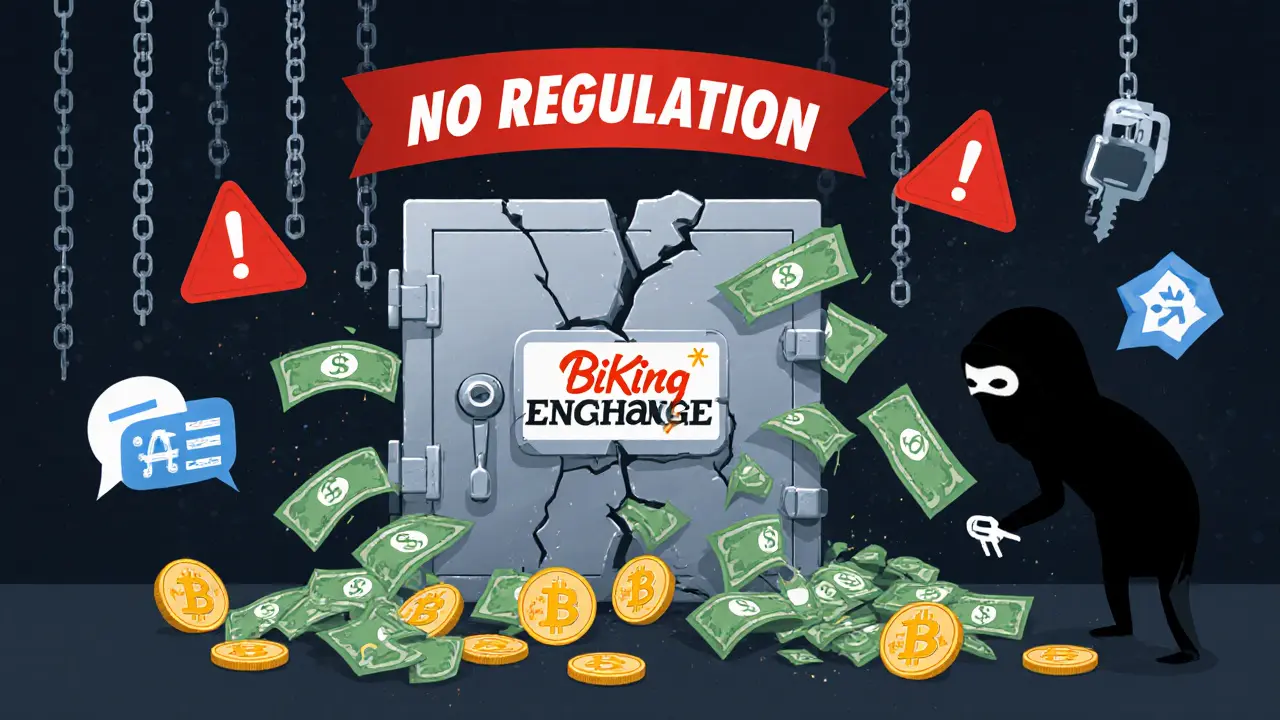

No Regulation, No Protection

BiKing operates without any license from the SEC, FCA, or any other financial authority. That means if your funds disappear, you have no legal rights. No insurance. No compensation fund. No government agency to file a complaint with.Compare that to regulated exchanges. Coinbase carries custodial insurance. Binance has its Secure Asset Fund for Users (SAFU), which has paid out millions in losses. Even KuCoin, which has had its own issues, now complies with KYC and AML rules in multiple jurisdictions. BiKing does none of this.

When regulators pressured BiKing to delist privacy coins like Monero and Dash in 2023, they didn’t give users a heads-up. They just removed them overnight. That’s not compliance. That’s panic. Regulated exchanges follow formal processes: public announcements, grace periods, migration support. BiKing just cut and ran.

Wash Trading and Fake Volume

In 2021, an analysis cited by WikiBit found signs of wash trading on BiKing. That’s when the exchange-or bots controlled by the exchange-buys and sells the same asset back and forth to make trading volume look higher than it is. It’s a classic scam. Fake volume tricks new users into thinking the market is active and liquid, when in reality, you might not be able to sell your coins when you need to.BiKing denied the claims. But the pattern matches what’s been seen on other unregulated platforms. Regulated exchanges are legally required to report suspicious activity. They file SARs (Suspicious Activity Reports) with financial authorities. BiKing doesn’t. Why? Because it can’t. It has no compliance department. No legal team. No accountability.

Who Should Avoid BiKing

If you’re new to crypto, don’t even consider BiKing. High leverage is dangerous. Lack of regulation is terrifying. Security flaws are proven. This isn’t a platform for learning. It’s a platform for losing money fast.Even experienced traders should think twice. The risk-reward ratio is skewed. You might win a few trades with 50x leverage, but one bad day can wipe out months of gains. And if the platform gets hacked again? Your funds are gone forever. There’s no insurance. No refund. No appeal.

Privacy coin supporters were already angry when Monero and Dash were removed. If you hold those assets, you’re better off using a wallet and trading on a decentralized exchange. At least there, you control your keys.

What You Should Do Instead

If you want to trade crypto safely, stick with exchanges that have:- Regulatory licenses (like Coinbase, Kraken, or Bitstamp)

- Custodial insurance (protects your funds if hacked)

- Hardware-based 2FA (not SMS)

- Withdrawal address whitelisting

- Public security audits (published annually)

Platforms like Binance and Kraken may charge slightly higher fees, but they offer real protection. You’re paying for peace of mind-and your money’s safety.

Bottom Line: BiKing Is a High-Risk Gamble

BiKing isn’t broken. It was designed this way. Anonymity. High leverage. No rules. That’s the business model. It attracts users who don’t care about safety-and then takes their money when things go wrong.Over $8 million stolen. No regulation. No insurance. Fake volume. Delisted coins without warning. These aren’t minor flaws. They’re warning signs you can’t ignore.

If you’re looking for a crypto exchange, choose one that treats your money like it matters. BiKing doesn’t. And in crypto, that’s the most dangerous thing of all.

Is BiKing a safe crypto exchange?

No. BiKing has suffered at least two major security breaches, resulting in over $8 million in stolen user funds. It uses outdated SMS-based two-factor authentication and lacks basic protections like withdrawal address whitelisting or cold storage. It also operates without any financial regulation, meaning there’s no insurance or legal recourse if something goes wrong.

Does BiKing have KYC verification?

No, BiKing does not require KYC (Know Your Customer) verification. This makes it attractive to users seeking anonymity, but it also means the platform doesn’t comply with global anti-money laundering (AML) standards. Regulated exchanges like Coinbase and Kraken require KYC to operate legally and protect users from fraud.

Why did BiKing delist Monero and Dash?

BiKing abruptly removed Monero and Dash in 2023 under what was described as "regulatory pressure." Privacy coins face increasing scrutiny from financial regulators due to their anonymity features. Unlike regulated exchanges, which give users advance notice and migration options, BiKing removed them without warning, angering users and raising concerns about its compliance practices.

Can I trust BiKing with my crypto?

No. With a history of security breaches, no insurance, no regulation, and no transparency, BiKing does not meet basic standards for protecting user assets. Even experienced traders should avoid it. If you want to trade crypto safely, use a regulated exchange that offers custodial insurance and strong security protocols.

Is BiKing’s leverage trading worth the risk?

For most people, no. Leverage up to 100x means even small price movements can wipe out your entire position. BiKing doesn’t offer risk management tools like stop-loss orders or margin alerts. Combined with its poor security and lack of regulation, high leverage on this platform turns trading into a high-stakes gamble with no safety net.

What are better alternatives to BiKing?

Better alternatives include Coinbase, Kraken, and Binance-all regulated exchanges with custodial insurance, strong security features, and transparent operations. Even KuCoin and Bybit, while less regulated, offer better security practices and more user protections than BiKing. If you want to trade with leverage, choose an exchange that has proven it can keep your money safe.

Finance

Finance

Komal Choudhary

November 29, 2025 AT 22:10I tried BiKing last year because I wanted to trade Monero anonymously-big mistake. Lost half my stash in a weekend. No warnings, no refunds. Just silence when I contacted support. Don't be like me.

Tina Detelj

December 1, 2025 AT 03:02BiKing isn't just risky-it's a psychological trap wrapped in neon ads and 100x leverage fantasies. It preys on the same impulses that make people buy lottery tickets: the illusion of control, the dopamine rush of 'what if?'-and then, poof. Your life savings evaporate like smoke in a hurricane. This isn't finance. It's emotional manipulation with a blockchain veneer.

Wilma Inmenzo

December 2, 2025 AT 12:43Of course they got hacked twice-do you think they're not *in on it*? They let the hacks happen so they can 'lose' funds and then claim it's 'cybercrime.' Meanwhile, the devs are sipping margaritas in a tax haven. And SMS 2FA? Please. They're not incompetent-they're *designed* to be this way. It's a honey pot for the gullible. I bet the 'delisting' of Monero was just them cashing out their last insider positions before the Feds came knocking.

priyanka subbaraj

December 4, 2025 AT 01:54They deleted Monero. No warning. No apology. Just gone. Like my trust. Like my savings. Like my faith in crypto.

George Kakosouris

December 4, 2025 AT 15:38Let’s be real-the 100x leverage isn’t the problem, it’s the retail trader’s inability to manage risk. BiKing’s UI is trash, sure, but if you’re using SMS 2FA on any exchange, you deserve to get rekt. That said, the lack of cold storage and audit transparency? Unforgivable. This isn’t DeFi-it’s a casino with a .xyz domain.

Tony spart

December 5, 2025 AT 17:18Why do y’all keep crying about regulation? I don’t need some suit in DC telling me how to trade my crypto. BiKing’s the real deal-no paperwork, no nanny state. If you lose money, that’s your fault. Not the platform’s. Get tougher. America doesn’t need hand-holding. We built this empire on risk.

Ben Costlee

December 5, 2025 AT 18:55I’ve seen people lose everything on platforms like this-and it breaks my heart. Not because they were greedy, but because they were misled. There’s a difference between high-risk trading and predatory design. BiKing is the latter. If you’re reading this and you’re thinking about signing up-please, pause. Talk to someone who’s been burned. Or better yet, open an account on Kraken first. The difference in peace of mind is night and day.

Mark Adelmann

December 6, 2025 AT 10:19Been trading since 2017. Used BiKing once-just to test it. One week later, my API key got drained. No alert. No email. Just $0. I switched to Binance after that. Yeah, fees are higher. But I sleep at night. That’s worth more than any 100x win.

ola frank

December 8, 2025 AT 05:35From a systemic risk perspective, platforms like BiKing represent a negative externality in the crypto ecosystem. Their operational opacity, absence of compliance infrastructure, and reliance on outdated authentication vectors create cascading trust failures. The normalization of unregulated leverage markets exacerbates systemic fragility, particularly when retail participants lack the cognitive frameworks to assess tail risk. This isn’t market efficiency-it’s structural predation disguised as innovation.

imoleayo adebiyi

December 9, 2025 AT 19:49I used to think anonymity was freedom. Then I lost money on BiKing and realized it was just isolation. No one to talk to. No one to help. I now use a hardware wallet and trade only on regulated platforms. It’s slower. It’s safer. And honestly? It feels more honest.

Angel RYAN

December 10, 2025 AT 23:07Just don’t use it. End of story.

stephen bullard

December 11, 2025 AT 08:27I get why people are drawn to BiKing-the allure of quick gains, the thrill of no rules. But here’s the quiet truth: real wealth isn’t built in 10-minute trades. It’s built in patience, education, and protection. If you’re reading this, you’re already thinking twice. That’s a good sign. Walk away. Your future self will thank you.

SHASHI SHEKHAR

December 11, 2025 AT 17:11Guys, I’ve been in crypto since 2015 and I’ve seen every shady exchange come and go. BiKing? Classic. They use fake volume to lure newbies in-then when you deposit, they make it impossible to withdraw by freezing your account under some ‘risk alert’ nonsense. And the SMS 2FA? That’s like using a paper lock on a vault. I tried to withdraw $500 once and it took 3 weeks. They finally said ‘server error.’ Meanwhile, my funds were sitting in their hot wallet. I lost 30% to slippage and fees trying to move it to Binance. Don’t be fooled. They don’t want you to cash out. They want you to keep betting. And they *win* when you lose.

Vaibhav Jaiswal

December 13, 2025 AT 12:16Been there. Did that. Got the empty wallet. BiKing = crypto roulette. No one wins long-term.

Abby cant tell ya

December 15, 2025 AT 03:09Wow, someone actually wrote a responsible post? Shocking. Most of you are just crypto bros who think leverage is a lifestyle. BiKing’s not the problem-you are. You want 100x? Fine. But don’t cry when you’re begging for rent money on Reddit.

Janice Jose

December 15, 2025 AT 09:24Thank you for this. I’ve been trying to warn my cousin for months. He’s about to deposit $10k. Now I have something real to send him.

Savan Prajapati

December 16, 2025 AT 18:13BiKing is trash. Use Binance. Done.