Ever bought Bitcoin and watched it drop 15% in a single day - then jump back up 20% the next? You’re not crazy. Crypto prices don’t move like stocks or gold. They lurch. And the reason isn’t one single thing. It’s a mix of five powerful forces working together - liquidity, supply limits, human emotion, macroeconomic noise, and institutional swings.

Liquidity Is Thin - Even Small Trades Shake the Market

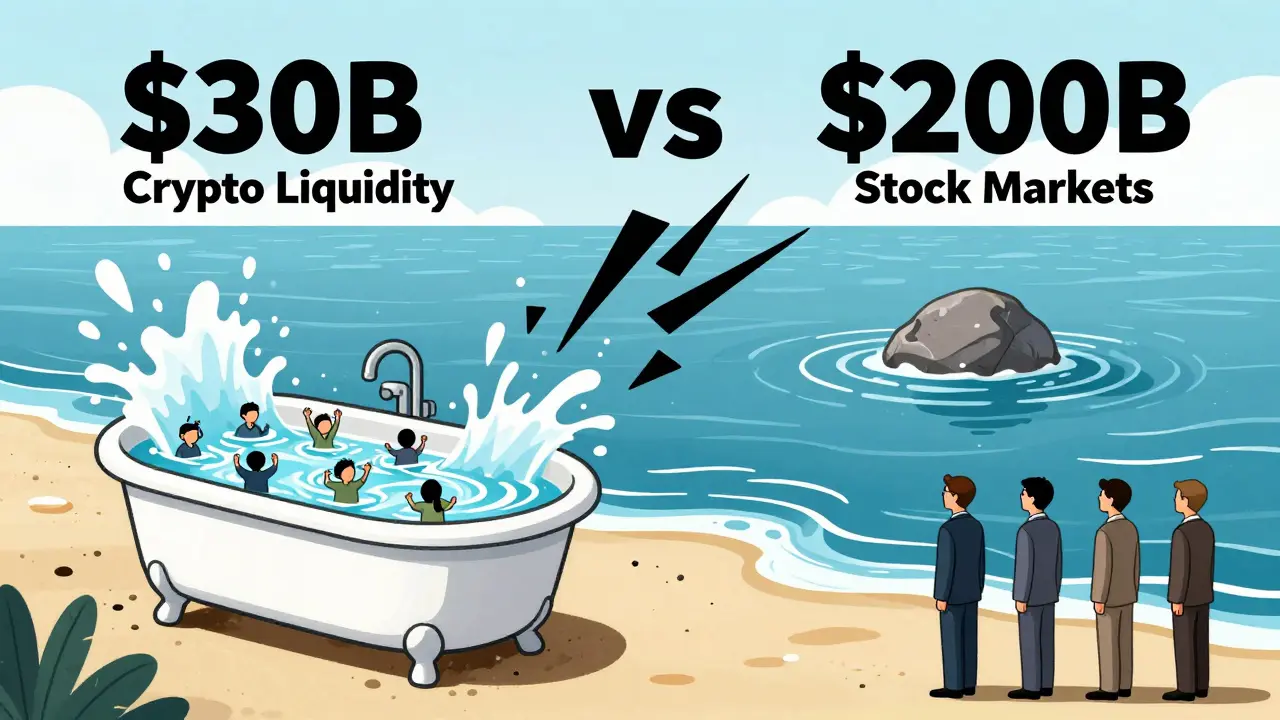

Imagine a pond. Now imagine throwing a rock into it. The ripples spread. Now imagine that same rock thrown into a bathtub. The water sloshes everywhere. That’s crypto liquidity. Crypto markets are tiny compared to global stock or bond markets. Bitcoin’s daily trading volume hovers around $30 billion. The S&P 500? Over $200 billion per day. That means even a $50 million buy order can push Bitcoin’s price up 3-5%. A $100 million sell-off? Down 7% in minutes. Small altcoins? Even worse. A coin with only $2 million in daily volume can swing 30% on a single tweet from a big holder. That’s why you see wild spikes in tokens like Shiba Inu or Dogecoin - they don’t have enough buyers and sellers to absorb trades smoothly. This isn’t a glitch. It’s the default setting. Until crypto markets grow tenfold in liquidity, this will keep happening.Fixed Supply = Amplified Price Reactions

Bitcoin has a hard cap: 21 million coins. Ever. No more. No printing. That’s great for scarcity. Terrible for stability. When demand rises - say, because a big fund buys $2 billion in BTC - there’s no extra supply to meet it. So prices shoot up. When fear hits and people start selling, there’s no cushion. No buffer. Just fewer buyers and more sellers chasing each other down. This effect is even stronger in coins with low circulating supply. Ethereum, for example, has no hard cap, but its issuance rate dropped sharply after the Merge in 2022. That made it behave more like Bitcoin - and its volatility spiked accordingly. The Stock-to-Flow model (which measures scarcity) shows Bitcoin becoming rarer every year. But here’s the catch: in Q1 2025, Bitcoin’s Stock-to-Flow ratio jumped 20% - yet the price fell from $104,700 to $76,500. Why? Because scarcity alone doesn’t control price. People panic. Institutions pull back. Regulations loom. And suddenly, even the most scarce asset gets dumped.Emotion Rules - FOMO and Fear Drive More Than Data

Crypto is the only major asset class where your cousin’s Instagram post can move the market. Unlike Wall Street, where professionals use models and balance sheets, crypto is full of retail investors. They read headlines. They watch YouTube influencers. They see someone make a million and think, “I need in.” That’s FOMO - fear of missing out. It creates buying frenzies that push prices way beyond fundamentals. Then, when prices dip, fear takes over. A single tweet from a regulator - “We’re looking into crypto exchanges” - can trigger a mass sell-off. No news. No event. Just panic. In October 2025, crypto sentiment tools showed “greed” at 82/100. That’s the highest level since early 2024. And guess what? Every time greed hits 80+, the market has corrected within 14 days. Not because something broke. Just because people got too excited and started cashing out. This isn’t irrational. It’s human. And crypto markets are built for humans, not algorithms.

Big Players Move Markets - Whales and Institutions Play Both Sides

There are maybe 1,000 wallets holding more than 1,000 BTC each. These are the “whales.” One of them sells 500 BTC? That’s $60 million. And since liquidity is low, the price drops fast. They might buy it back 2 hours later at 8% lower. It’s not manipulation - it’s strategy. Institutions are now major players. BlackRock, Fidelity, and others have launched Bitcoin ETFs. In July 2025, ETF inflows pushed the entire crypto market up 13.3% in one month. But here’s the flip side: when institutions rotate out of crypto to chase higher bond yields or fear a recession, they sell in bulk. And because they trade large blocks, they cause big drops. Ethereum became the institutional favorite in 2025, nearly matching Bitcoin in ETF inflows. That’s good for long-term adoption. But it also means when big funds shift money between BTC and ETH, both prices swing hard. The market isn’t just retail vs. institutions. It’s institutions vs. institutions. And when they trade against each other, volatility spikes.Macro Forces Don’t Care About Blockchain

Crypto doesn’t live in a bubble. It lives in the same world as your mortgage, your paycheck, and your inflation rate. When the Federal Reserve cuts interest rates, money flows into riskier assets - including crypto. When rates rise, people pull money out to lock in safer returns on bonds or savings accounts. In early 2025, inflation stayed stubbornly high. That should’ve made Bitcoin more attractive as a hedge. But instead, prices dropped. Why? Because global economic uncertainty made investors nervous. They didn’t trust crypto to hold value - not when banks were failing in Europe, and the UK was flirting with recession. Crypto doesn’t have its own economy. It’s tied to the global financial system. When the dollar strengthens, crypto often weakens. When oil prices spike, inflation fears rise, and crypto gets caught in the crossfire. Even the weather can matter. In late 2024, a major data center fire in Singapore knocked out several crypto mining operations. Prices dipped 5% in 48 hours. Not because of news. Because of fear of supply disruption.

Technical Triggers Make It Worse

You think humans are the problem? Algorithms are worse. Most crypto trading today is done by bots. They watch moving averages, support levels, and RSI indicators. When Bitcoin hits $118,000 - a key resistance level in October 2025 - bots automatically sell. Why? Because historically, prices stall there. They don’t care about news. They don’t care about scarcity. They just follow rules. When the 50-day moving average starts falling - like it did in Q1 2025, dropping from $99,300 to $85,400 - more bots jump in to sell. That creates a feedback loop: price falls → bots sell → price falls more → humans panic → more selling. This isn’t prediction. It’s reaction. And it turns small corrections into crashes.Regulation Is a Wild Card

No other asset class has its future decided by a single tweet from a government official. In March 2025, the SEC signaled it might delay approval of new Ethereum ETFs. Bitcoin dropped 12% in 12 hours. Not because Ethereum’s price changed. Because traders feared a broader crackdown. Then, in August, the EU passed the MiCA regulation - the first full crypto framework in the world. Bitcoin jumped 18% in three days. Why? Because clarity replaced fear. Regulation isn’t always bad. But uncertainty? That’s poison. Every time a major economy announces a new rule, crypto reacts like a nervous animal. And since rules change fast - and often without warning - volatility stays high.So, Will Crypto Ever Calm Down?

Maybe. But not soon. As more money flows in - from pension funds, sovereign wealth funds, and global banks - liquidity will improve. Trading volumes will grow. Whales will become rarer. Bots will get smarter. And regulation will bring structure. But the core reasons for volatility won’t disappear:- Fixed supply? Still there.

- Human emotion? Still here.

- Macro shocks? Still happen.

- Regulatory surprises? Still coming.

Why does Bitcoin’s price change so fast compared to stocks?

Bitcoin has far less liquidity than stocks. A $10 million trade on Apple might barely move its price. On Bitcoin, that same trade can swing the price 2-5%. Also, crypto markets are mostly retail-driven, meaning emotions like FOMO and panic spread faster than in institutional-heavy stock markets.

Do whales control crypto prices?

Yes, but not like a conspiracy. Whales - wallets holding over 1,000 BTC - can move markets because crypto liquidity is thin. When they sell even 500 BTC, it can trigger panic selling from bots and retail traders. But they don’t always profit from it. Sometimes they’re just rebalancing portfolios. The key is: small markets = big impact from big players.

Is crypto volatility getting better or worse?

It’s slowly improving. In 2017, Bitcoin swung 80% in a month. In 2025, the biggest monthly swings are around 30-40%. That’s progress. But it’s still far more volatile than gold or S&P 500. As institutional money grows and regulations stabilize, volatility will keep easing - but never disappear. The core drivers (scarcity, emotion, macro) are built into crypto’s DNA.

Can ETFs make crypto less volatile?

ETFs add liquidity and attract long-term investors, which helps. In July 2025, ETF inflows pushed the market up 13.3% in one month. But they also create new risks. When big funds pull out, they sell in bulk. That can cause sudden drops. So ETFs stabilize over time, but can trigger sharp moves in the short term.

Should I avoid crypto because of its volatility?

Not if you understand the risk. Volatility isn’t a bug - it’s a feature. If you’re investing for the long term and can handle 30% drops, crypto can offer high returns. But if you need stable returns or can’t sleep at night when prices dip, it’s not for you. Never invest more than you can afford to lose - and never chase pumps.

Finance

Finance

Danyelle Ostrye

January 7, 2026 AT 18:31Bro this post nailed it. I bought SHIB last year on a meme and lost half my portfolio in a week. No regrets though. That’s crypto. You either ride the wave or get washed out.

Denise Paiva

January 8, 2026 AT 00:23Volatility isn't a bug it's a feature. The fact that a tweet can move markets means the system is alive. Wall Street is a funeral home. Crypto is a rave. Get with it.

greg greg

January 8, 2026 AT 04:28Let’s break this down properly. Liquidity constraints are the primary amplifier, yes, but the real structural issue is the lack of derivative hedging tools for retail. Unlike equities where you can short, hedge with options, or use ETF arbitrage, crypto retail is naked long or short with no safety nets. Add to that the fact that most retail traders use leverage platforms with liquidation cascades-this isn’t just emotion, it’s systemic fragility built into the architecture. The 2022 LUNA collapse wasn’t just a panic-it was a liquidity death spiral triggered by undercollateralized positions. Until we get regulated, transparent, non-custodial derivatives markets, volatility won’t just persist-it’ll intensify as more leverage gets injected.

Jon Martín

January 9, 2026 AT 12:49Y’all act like this is new but it’s not. Remember 2017? We went from 1k to 20k then crashed to 3k. Same script. Same emotions. Same whales. Same bots. Only difference now? More people watching and more money flowing in. So yeah it’s wilder but it’s also growing up. We’re not kids anymore. We’re teenagers with credit cards. Still dumb. Still loud. Still learning.

Valencia Adell

January 10, 2026 AT 23:02Anyone who thinks crypto volatility is 'improving' is delusional. 30% swings in 2025? That's a downgrade from 2021 when you could make 5x in a week. Now you just get to lose 30% slower. Congrats. Progress.

Calen Adams

January 12, 2026 AT 00:29ETFs are the real game-changer. Institutional money isn't here to play. They're here to dominate. When BlackRock starts moving $2B in BTC, they don't care about your FOMO. They care about beta, correlation, and portfolio allocation. That’s why we’re seeing longer bull cycles now-because institutions hold through dips. But don’t get comfy. When rates go up again, they’ll dump faster than retail ever could. This isn’t democratization. It’s institutional colonization.

Sarbjit Nahl

January 12, 2026 AT 22:17The premise is flawed. Volatility is not inherent to crypto. It is inherent to immature markets. Compare Bitcoin's 2025 volatility to the Nasdaq in 1999. The difference is not technology. It is time. Time brings liquidity. Time brings regulation. Time brings institutional discipline. We are in the early innings. Stop romanticizing chaos.

Paul Johnson

January 14, 2026 AT 08:36people keep saying 'dont invest more than you can lose' but if you can afford to lose it why even bother? if you got extra cash just buy a boat or a bike or a damn vacation. crypto is just gambling with extra steps and worse odds. also why do people think whales are 'strategic' theyre just rich guys playing poker with your life savings

Meenakshi Singh

January 15, 2026 AT 04:56macro = the real villain 🤡

fed hikes = crypto sells off

fed cuts = crypto pumps

oil spikes = crypto sells off

war in middle east = crypto pumps

data center fire in singapore = crypto dips 5%

bro what even is this? it's not a market it's a mood ring

Kelley Ramsey

January 15, 2026 AT 20:37Thank you for this. I’ve been trying to explain this to my dad for months. He thinks crypto is just ‘digital gold’ and doesn’t get why it crashes every time someone says ‘regulation’ on TV. This breakdown? Perfect. I’m printing it out and handing it to him with a cup of coffee. He’ll read it. He always does when I use big words and bullet points.

Michael Richardson

January 17, 2026 AT 17:29America’s problem isn’t crypto volatility. It’s that we let 14-year-olds with Discord servers and 1000 SOL decide economic policy. Europe passed MiCA. China banned it. We still have Sam Bankman-Fried’s ghost haunting our exchanges. Fix the idiots first.

Krista Hoefle

January 18, 2026 AT 20:22lol you spent 2000 words explaining why crypto is a dumpster fire. congrats. you just wrote a textbook on why you shouldn’t touch it. also ‘uptober’? really? you believe in seasonal trends in crypto? next you’ll say the moon phase affects btc

Emily Hipps

January 20, 2026 AT 18:12Reading this made me feel so much better about my portfolio. I’ve been holding since 2021 and yes, I’ve lost sleep. But this? This is the map I needed. Volatility isn’t a sign of failure-it’s a sign we’re still early. Keep going. The next bull run will be the one that changes everything.

Jessie X

January 22, 2026 AT 04:30the bots are the real problem. they dont care if you lost your rent money. they just follow the 50dma. if you cant beat em join em. learn to trade like a machine or get out

Kip Metcalf

January 22, 2026 AT 19:13it’s just a game. you play it. you win. you lose. you laugh. you cry. you buy more. you don’t need a 10-page essay to understand that

Jon Martín

January 24, 2026 AT 09:05Man I love how everyone’s acting like they’re the first to figure this out. I’ve been in since 2017. We’ve had this conversation every cycle. The only thing that changes is the price and the memes. The rules? Same. Emotion. Liquidity. Whales. Bots. Regulators yelling into the void. We’re not evolving. We’re just repeating the same damn song with better production quality.