WoofSwap Asset Calculator

FEED/WBONE

Most active pair with $4,259.98 24h volume.

WETH/USDT

Wrapped Ether paired with stablecoin USDT.

WETH/USDC

Wrapped Ether paired with stablecoin USDC.

USDT/USDC

Stablecoin to stablecoin pairing with minimal volatility.

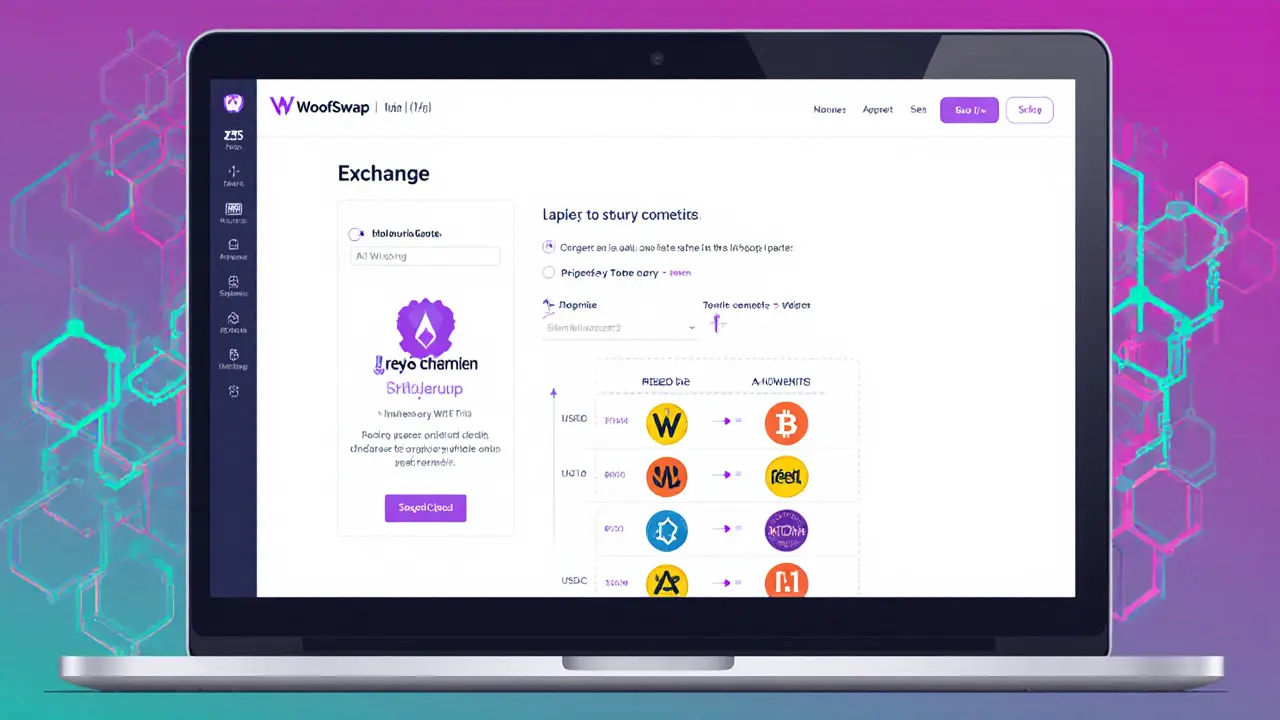

When you hear the buzz around "layer‑2" and "memecoins", it’s easy to overlook the smaller players trying to carve a niche. WoofSwap is a decentralized exchange (DEX) built on Shibarium, the scaling solution for the Shiba Inu ecosystem. Launched in 2023 and incorporated in the Åland Islands, it markets itself as the first ve(3,3) DEX on Shibarium. This review breaks down what the platform actually offers, how its fees and liquidity stack up, and whether its controversial roadmap could turn it into a serious contender or just another flash‑in‑the‑pan project.

Quick Takeaways

- Operates on Shibarium, limiting its user base to the Shiba Inu community.

- Supports only three base assets (WETH, USDT, USDC) and four trading pairs.

- Average bid‑ask spread sits at 0.639%, decent for a niche DEX.

- 24‑hour volume is $6,632, placing it in the 43rd percentile for volume among DEXs.

- Unique ve(3,3) tokenomics give token holders voting power and fee‑share potential, but details are vague.

Platform Overview

WoofSwap’s core proposition is speed and cheap transactions. By leveraging Shibarium’s layer‑2 architecture, it avoids Ethereum’s high gas fees while still offering the Ethereum‑compatible token standards (ERC‑20). The exchange’s UI is minimalist: a single‑page layout where users connect a Web3 wallet (Metamask, Trust Wallet, etc.) and start swapping instantly. There is no KYC, no fiat‑on‑ramps, and no margin‑trading options - it’s a straight crypto‑to‑crypto swap hub.

Tokenomics & Governance (ve‑3,3 Explained)

The "ve(3,3)" model borrows from Curve’s vote‑escrow system. Token holders lock their native WoofSwap token (not publicly named in the data but assumed to exist) for a set period, earning "ve" points that translate into voting weight and a slice of the platform’s trading fees. This is intended to align liquidity providers with long‑term platform health. While the concept is solid, the documentation stops short of revealing reward percentages, lock‑up durations, or supply caps, making it hard for potential investors to gauge returns.

Supported Assets and Trading Pairs

The exchange currently lists three major cryptocurrencies:

- WETH - wrapped Ether, the most liquid asset on Shibarium.

- USDT - a stablecoin pegged to the US dollar.

- USDC - another USD‑backed stablecoin.

These base tokens combine into four pairs, the busiest being FEED/WBONE, which generated $4,259.98 in 24‑hour volume. The remaining pairs rotate between the three base assets and the platform’s native tokens.

Fees, Spreads & Liquidity

WoofSwap charges a variable fee that depends on the pair-generally ranging between 0.20% and 0.30% per swap. The average bid‑ask spread of 0.639% suggests the order books are fairly tight for a DEX with such low volume. Depth metrics place WoofSwap at the 22nd percentile, meaning order‑book depth is shallower than most mid‑size DEXs. For casual traders or meme‑coin enthusiasts, the fees are acceptable; high‑frequency traders may find better pricing elsewhere.

Competitive Landscape

To put things in perspective, here’s a quick side‑by‑side of WoofSwap versus two of the biggest DEXs on Ethereum and its layer‑2s:

| Metric | WoofSwap | Uniswap (v3) | SushiSwap |

|---|---|---|---|

| Chain | Shibarium (L2) | Ethereum (L1) / Arbitrum | Ethereum (L1) / Polygon |

| 24‑h Volume | $6,632 | $1.2B | $420M |

| Avg. Spread | 0.639% | 0.12% | 0.18% |

| Supported Tokens | 3 base + 2 native | >10,000 | ~5,000 |

| Governance Model | ve(3,3) | UNI token | SUSHI token |

WoofSwap clearly operates in a different league-its niche focus gives it lower fees and faster finality on Shibarium, but the trade‑off is a tiny market and modest depth.

Controversy & 11‑Point Reform Roadmap

In 2024, WoofSwap made headlines by publishing a scathing critique of the Shiba Inu leadership, accusing them of favoritism toward the POE token from Positions Exchange. The fallout sparked an 11‑point reform plan aimed at boosting decentralization across the Shibarium ecosystem. Highlights include:

- Re‑allocating the contentious 20million BONE token reserve based on community voting.

- Introducing a BONE burn mechanism to mirror SHIB burns, potentially creating scarcity.

- Opening validator nodes to a broader set of participants to reduce centralization.

- Launching a meme‑coin “Karma” with an airdrop to revive community chatter.

- Adding cross‑chain token support and a presale platform for upcoming projects.

The Shiba Inu dev team responded cautiously, acknowledging the concerns while urging the community to look beyond internal disputes. Whether these proposals will gain enough traction to reshape the ecosystem remains an open question.

Regulatory & Security Considerations

Being incorporated in the Åland Islands gives WoofSwap a degree of regulatory flexibility, yet it also raises red flags for users in jurisdictions with strict crypto laws. The platform does not enforce KYC, which is typical for DEXs but can limit integration with centralized services and may expose users to higher compliance risk. Smart‑contract audits have not been publicly disclosed, so users should treat the platform as experimental and only allocate capital they can afford to lose.

Future Outlook

The success of WoofSwap hinges on two intertwined factors: the broader adoption of Shibarium and the execution of its reform roadmap. If Shibarium’s upcoming Alpha Layer update delivers on promised throughput gains, WoofSwap could attract more liquidity providers seeking cheap swaps. Conversely, failure to implement clear tokenomics or governance incentives could stall growth, leaving it behind faster‑moving competitors on other L2s.

Investors should monitor three signals:

- Release of a detailed ve(3,3) rewards schedule.

- Community voting outcomes on the BONE allocation.

- Audit reports confirming contract safety.

Until those milestones materialize, treat WoofSwap as a high‑risk, high‑potential play within the meme‑coin arena.

TL;DR Summary

WoofSwap crypto exchange offers cheap, Shibarium‑based swaps for a tiny set of assets, employs a ve(3,3) governance model, and is currently embroiled in ecosystem politics. Its low volume and limited token list keep it niche, but the upcoming reform roadmap could unlock growth if the community backs it. Use caution, keep allocations small, and watch for governance updates.

Frequently Asked Questions

What chain does WoofSwap run on?

WoofSwap is built on Shibarium, the layer‑2 solution created for the Shiba Inu ecosystem.

Does WoofSwap require KYC?

No. Like most decentralized exchanges, WoofSwap lets users connect a Web3 wallet and trade without identity verification.

What is the ve(3,3) token model?

It’s a vote‑escrow system where token holders lock their tokens for a set period, earning voting power and a share of trading fees. The model aims to align long‑term interests of liquidity providers with the platform.

Which tokens can I trade on WoofSwap?

Currently the exchange supports WETH, USDT, USDC and two native tokens (FEED and WBONE) for a total of four trading pairs.

How does WoofSwap’s fee structure compare to Uniswap?

WoofSwap’s fees range from 0.20% to 0.30% per swap, slightly higher than Uniswap v3’s typical 0.05%‑0.30% range, but the lower gas costs on Shibarium can make the overall cost competitive for small trades.

Finance

Finance

Ayaz Mudarris

February 21, 2025 AT 16:46Examining the structural design of WoofSwap reveals a deliberate focus on low‑fee swaps, which aligns with the broader trend toward cost‑efficient DeFi solutions. By leveraging Shibarium’s Layer‑2 capabilities, the platform reduces gas overhead, thereby enhancing accessibility for smaller traders. The ve(3,3) governance model, while complex, introduces a mechanism for aligning long‑term stakeholder interests. Investors should monitor the upcoming BONE burn proposals as they may influence token scarcity. Ultimately, disciplined participation combined with vigilant governance oversight can yield sustainable returns.

Irene Tien MD MSc

February 25, 2025 AT 15:31One cannot help but marvel at how WoofSwap positions itself as the savior of meme‑coin enthusiasts, all while whispering sweet nothings about decentralization. The alleged “reform roadmap” smells suspiciously like a PR stunt orchestrated by shadowy figures desperate to keep the Shiba Inu elite comfortably seated on their thrones. Every fee reduction is conveniently timed just before a rumored “mass exit” of whale holders, suggesting a hidden agenda to siphon liquidity under the pretense of community empowerment. The ve(3,3) model, glorified as a beacon of fairness, conveniently mirrors the same power structures it claims to dismantle. Moreover, the opaque audit status raises eyebrows, as no independent entity dares to certify the smart contracts for fear of retaliation. It is as if the developers are playing a high‑stakes chess game where the pawns are everyday users, and the bishops are disguised as “governance tokens.” The launch of the meme‑coin “Karma” feels less like innovation and more like a distraction tactic to keep the hype train chugging. While the platform boasts lower fees, the underlying volatility of the supported assets could accelerate loss of capital for the unwary. In short, the narrative spun by WoofSwap is a masterclass in glossy marketing overlaying a foundation of questionable transparency.

kishan kumar

March 1, 2025 AT 14:15From a dialectical perspective, WoofSwap’s niche focus can be interpreted as a microcosm of the broader DeFi ecosystem’s pursuit of specialization. The juxtaposition of low transaction fees against limited market depth invites a contemplation of trade‑off theory. By operating on Shibarium, the platform adheres to a substrate that promises scalability, albeit with an embryonic user base. Such dynamics underscore the perennial tension between innovation and adoption. One might conclude that the platform’s success hinges upon the collective will of its community to transcend mere tokenomics 😊.

Kevin Fellows

March 5, 2025 AT 12:59WoofSwap looks promising for small‑scale traders.

Peter Johansson

March 9, 2025 AT 11:43Think of WoofSwap as a stepping stone for those eager to dip their toes into meme‑coin liquidity without incurring hefty gas fees. Its fee structure, while modestly higher than some L1 alternatives, is mitigated by the rapid finality of Shibarium. The ve(3,3) model fosters long‑term alignment, encouraging users to lock tokens and earn a slice of the swap fees. As the ecosystem matures, the platform could attract additional pairs, enhancing depth and utility. Keep an eye on the governance votes; community decisions will likely shape its trajectory 😊.

Cindy Hernandez

March 13, 2025 AT 10:27WoofSwap operates on the Shibarium layer‑2, offering four primary trading pairs with fees ranging from 0.20% to 0.30%. The absence of KYC aligns it with typical decentralized exchanges, though this may limit integration with regulated services. Users should note that smart‑contract audits have not been publicly disclosed, which adds an element of risk. Diversifying allocations and monitoring the upcoming BONE burn proposal can help mitigate potential exposure.

Karl Livingston

March 17, 2025 AT 09:12I get the excitement around a low‑fee DEX, especially when gas costs on other chains can eat into modest profits. That said, the thin liquidity on WoofSwap means slippage can quickly erode gains, so it’s wise to test small amounts first. The ve(3,3) model sounds promising, but its complexity might deter newcomers. Watching how the community votes on the reform roadmap will be key to gauging future growth. Ultimately, a balanced approach-experimenting cautiously while staying informed-seems prudent.

Kyle Hidding

March 21, 2025 AT 07:56The architecture of WoofSwap is riddled with inefficiencies that reveal a lack of rigorous engineering. Its fee schedule, albeit marginally lower than some rivals, fails to compensate for the shallow order books, resulting in suboptimal execution. The platform’s reliance on an un‑audited codebase introduces systemic vulnerabilities that could be exploited at any moment. Moreover, the governance token distribution appears skewed toward early insiders, undermining true decentralization. In short, the project manifests as a high‑risk speculative vehicle rather than a robust trading hub.

Andrea Tan

March 25, 2025 AT 06:40It's interesting to see a DEX carving out a niche within the meme‑coin space, especially with the promise of cheaper swaps. The community-driven reforms could bring some fresh momentum if they gain traction. I'll be watching the upcoming governance votes to see how the roadmap unfolds.

Gaurav Gautam

March 29, 2025 AT 05:24WoofSwap’s low‑fee model can serve as a catalyst for broader adoption of Shibarium, provided the community rallies around the proposed reforms. By encouraging holders to lock tokens in the ve(3,3) system, the platform aligns incentives for long‑term stability. Engaging in governance discussions not only empowers users but also helps steer the project away from centralized pitfalls. Keep your exposure modest and stay active in the voting process to maximize potential upside.

Robert Eliason

April 2, 2025 AT 05:08i think the platform could be a good opprtunty but make sure you read the fine print. its not risk free.

Cody Harrington

April 6, 2025 AT 03:53WoofSwap presents an intriguing case study of a specialized DEX within a meme ecosystem. Its fee structure is competitive, though limited liquidity may pose challenges for larger trades. Monitoring the forthcoming audit reports will be essential for assessing contract security.

Chris Hayes

April 10, 2025 AT 02:37The narrative surrounding WoofSwap tends to overstate its impact, glossing over fundamental issues like token concentration and shallow depth. While low fees are attractive, they cannot compensate for the inherent risks of a narrow asset selection. The ve(3,3) governance model, though theoretically sound, remains untested at scale. Prospective users should temper enthusiasm with a sober risk assessment.

Samuel Wilson

April 14, 2025 AT 01:21From a strategic viewpoint, WoofSwap’s integration with Shibarium offers a tangible reduction in transaction costs, which could incentivize retail participation. The proposed BONE burn mechanism, if executed transparently, may enhance token scarcity and thereby support price appreciation. It is advisable for investors to allocate only a modest proportion of their portfolio while the platform’s governance structures mature. Continuous observation of community voting outcomes will provide valuable insight into the project's direction. By maintaining disciplined risk management, participants can engage with the platform responsibly.

Rae Harris

April 18, 2025 AT 00:05Honestly, I’m not convinced that shaving a few basis points off fees justifies the hassle of moving to a niche DEX. The real value lies in broader liquidity pools, which WoofSwap currently lacks.

Shanthan Jogavajjala

April 21, 2025 AT 22:49The earlier points about fee efficiency overlook the fact that on Shibarium, gas fees are already negligible, so the marginal savings become almost moot. Moreover, the ve(3,3) model introduces extra complexity that can deter casual users, potentially limiting adoption rates.

Millsaps Delaine

April 25, 2025 AT 21:34When assessing the macro‑level implications of WoofSwap within the broader Shiba Inu ecosystem, one must first acknowledge the platform’s ambition to position itself as the flagship decentralized exchange on Shibarium, a goal that is both audacious and fraught with structural challenges. The decision to limit the token roster to a quartet of pairs, while ostensibly designed to concentrate liquidity and reduce slippage, paradoxically creates a shallow market environment that is vulnerable to price manipulation by even modestly sized actors. This concentration of risk is further exacerbated by the platform’s reliance on a ve(3,3) governance framework, a model that, despite its theoretical elegance, demands a sophisticated understanding of token lock‑up periods, voting power accrual, and fee distribution mechanisms-knowledge that most retail participants simply do not possess. Consequently, the barrier to meaningful participation is elevated, potentially alienating the very user base that the platform purportedly seeks to empower. Moreover, the absence of publicly verified smart‑contract audits introduces an opaque layer of uncertainty; without third‑party validation, the code’s resilience against exploits remains speculative at best. The proposed BONE burn mechanism, while appealing from a tokenomic scarcity perspective, lacks a clear implementation timeline and measurable metrics, rendering its impact on market dynamics ambiguous. In parallel, the roadmap’s emphasis on community‑driven token allocation reallocation raises concerns about governance capture, especially if a small cohort of early adopters consolidates voting power through token locking strategies. The platform’s regulatory posture, anchored in the Åland Islands, offers a degree of flexibility but simultaneously flags potential compliance complications for users residing in stricter jurisdictions, a nuance often glossed over in promotional material. From an investor’s standpoint, the interplay between low transaction fees and elevated price volatility of the underlying assets creates a delicate balancing act; the fee savings may be quickly negated by adverse price movements during thinly traded intervals. Additionally, the introduction of the ancillary meme‑coin “Karma” appears to be a strategic move to generate buzz, yet it contributes further to token dilution and could distract from the core value proposition. It is also worth noting that the platform’s on‑chain analytics, currently limited in scope, provide insufficient granularity for informed decision‑making, necessitating reliance on external data aggregators that may not capture the full picture. While the optimism surrounding Shibarium’s upcoming Alpha Layer upgrade holds promise for throughput enhancements, there is no guarantee that such technical improvements will translate into increased user adoption for WoofSwap without concomitant marketing and liquidity incentive programs. In light of these considerations, a prudent approach for potential participants would involve allocating only a small fraction of capital, continuously monitoring governance proposals, and remaining vigilant for any signs of contract vulnerabilities. Ultimately, the success of WoofSwap will be determined not merely by its fee structure but by its ability to foster a robust, transparent, and inclusive governance ecosystem that can withstand the inevitable pressures of market dynamics.

Jack Fans

April 29, 2025 AT 20:18WoofSwap, as it stands, offers a unique set of features-low fees, a ve(3,3) governance model, and Shibarium integration; however, the limited token selection may hinder liquidity growth. Users should be aware of the potential for slippage; careful evaluation of trade sizes is recommended. Additionally, the lack of a publicly available audit report raises concerns about contract security. Monitoring community voting outcomes is essential, as these will shape future tokenomics. Overall, a cautious, diversified approach is advisable.

Adetoyese Oluyomi-Deji Olugunna

May 3, 2025 AT 19:02Ths platform, while ambitous, suffers from a curried liqudity pool and an overstated governnace model. Candidsate investors must excerise due diligence.

Krithika Natarajan

May 7, 2025 AT 17:46WoofSwap shows promise but needs more depth and transparent audits to gain trust