For the first time in history, governments are sharing your crypto transaction data with each other - automatically, without you asking. If you bought Bitcoin in Germany, sold Ethereum in Japan, or held Solana in the U.S., your tax authorities now have a direct line to find out. This isn’t science fiction. It’s happening right now, starting January 1, 2026.

How the Global Crypto Tax System Works

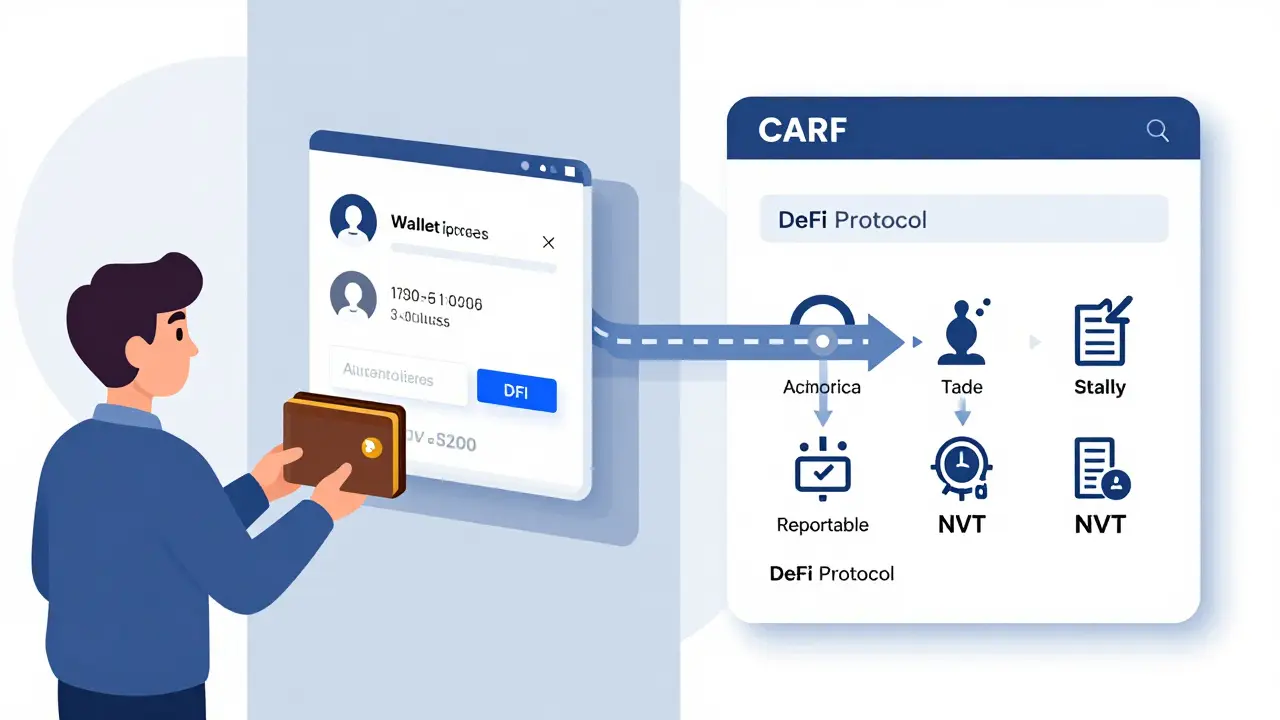

The system is called the Crypto-Asset Reporting Framework, or CARF. It was created by the OECD, the same group that runs the Common Reporting Standard (CRS) for bank accounts. CARF makes it mandatory for crypto exchanges, wallets, and other service providers - called Reporting Crypto-Asset Service Providers (RCASPs) - to collect and send details about your trades to their local tax agency. That agency then shares it with the tax office in your country of residence.What gets shared? Your name, address, tax ID, the types of crypto you traded, when you bought or sold, how much you paid, how much you got, and even the wallet addresses involved. It’s not just about exchanges like Binance or Coinbase. Even peer-to-peer platforms and decentralized finance (DeFi) protocols that act as intermediaries are now in scope.

This isn’t optional. Countries don’t need your permission. They don’t even need to ask. The data flows automatically, once a year, using a standardized XML format published by the OECD in October 2024. Think of it like bank account reporting, but for crypto - and it’s now legally binding in 67 countries.

The EU Is Already Enforcing It

The European Union moved first. DAC8, the eighth update to its Directive on Administrative Cooperation, became law in October 2023. All EU member states had to pass national laws by December 31, 2025. Starting January 1, 2026, every crypto platform operating in the EU must report transactions made by residents - even if the platform is based outside the bloc.For example: If you’re a UK resident who traded crypto on a U.S.-based exchange like Kraken, that exchange now has to report your activity to the U.S. IRS. The IRS, in turn, sends that data to HMRC in the UK. Same goes for any EU citizen using a non-EU platform. There’s no hiding behind borders anymore.

The U.S. Is Playing Both Sides

The United States doesn’t have its own version of CARF, but it’s still part of the system. The IRS requires foreign crypto brokers to report on U.S. taxpayers. At the same time, the U.S. will send data about foreign nationals who traded through American platforms like Coinbase or Gemini.This creates a two-way street. If you’re a Canadian who bought Bitcoin on a U.S. exchange, your Canadian tax office will get your transaction history. If you’re a U.S. citizen who used a German exchange, the IRS will get that data too. The system is designed to be reciprocal - no country gets a free pass.

What Counts as a Reportable Transaction?

It’s not just buying and selling. The rules cover:- Exchanging one crypto for another (BTC for ETH)

- Selling crypto for fiat currency (USD, EUR, GBP)

- Using crypto to buy goods or services

- Receiving crypto as income (staking, mining, airdrops)

- Transferring crypto to a wallet you don’t control

Even if you didn’t cash out, you might owe taxes. In many countries, swapping one crypto for another triggers a taxable event. The platform reports the fair market value at the time of the trade - so the tax office knows exactly what you’re being taxed on.

There’s one exception: transfers between wallets you own. If you move Bitcoin from Coinbase to Ledger, that’s not reportable - as long as it’s your own wallet. But if you send it to a friend, a business, or a DeFi protocol that acts as a broker, it’s reportable.

Why This Is a Big Deal

Before CARF, crypto was the wild west of taxation. Many people assumed their transactions were private. Some used offshore exchanges. Others moved assets through multiple wallets to obscure the trail. Tax authorities had little to no visibility.Now, that’s over. The system was built to close those gaps. It doesn’t just target criminals - it catches everyone who didn’t report. The OECD says the goal isn’t to punish, but to ensure fairness. If you pay taxes on your salary, you should pay taxes on your crypto gains too.

The result? More accurate tax returns. Fewer audits. And less room for mistakes. But it also means more pressure on individuals to get their records in order. If you’ve been ignoring crypto taxes, the first wave of data will hit in 2027 - and it won’t be gentle.

What Happens If You Don’t Report?

Tax agencies aren’t waiting to catch people. They’re building automated systems to match incoming CARF data with your tax filings. If your crypto gains don’t show up on your return, you’ll get a letter. In the EU, penalties can reach 100% of the unpaid tax. In the U.S., the IRS can impose civil fraud penalties of 75% plus interest.Worse, some countries now share audit findings across borders. A discrepancy in your UK return might trigger a review in Germany - even if you never lived there. This isn’t theoretical. In 2024, HMRC matched 12,000 crypto transactions from CARF data to unreported income. Over £47 million in additional taxes were collected.

How to Prepare

You can’t stop the data from being shared. But you can control how you respond.- Track every transaction. Use a crypto tax tool like Koinly, CoinTracker, or TokenTax. They connect to exchanges and wallets and calculate gains automatically.

- Know your local rules. Tax treatment varies. The UK taxes crypto as property. The U.S. treats it as property. Germany has a 1-year holding period exemption. Don’t assume your rules apply everywhere.

- Report everything. Even small trades. Even if you didn’t cash out. The system sees it all.

- Keep records. Save transaction IDs, wallet addresses, and screenshots of trade confirmations. You might need them later.

- Don’t wait. If you’ve missed past years, file amended returns now. Many countries have voluntary disclosure programs with reduced penalties.

What About Privacy?

Some worry this is the end of financial privacy. But CARF isn’t about spying. It’s about tax compliance. Your data isn’t public. It’s only shared between tax authorities. The OECD built in safeguards: encryption, access controls, and strict limits on how the data can be used.Still, it changes the game. If you’re using crypto to avoid taxes, you’re playing a losing game. The infrastructure is now in place. The data flows are live. The penalties are real.

What’s Next?

By 2028, 67 countries will be fully on board. That includes most of Europe, North America, Australia, Singapore, and parts of Latin America and the Middle East. The next phase will likely include non-fungible tokens (NFTs), stablecoins, and central bank digital currencies (CBDCs).Some jurisdictions may still offer low-tax environments - like Portugal or Malta - but even there, CARF means your home country will know what you’re doing. Tax optimization is still possible, but only through legal planning, not secrecy.

This isn’t a temporary crackdown. It’s the new normal. Crypto is no longer a shadow market. It’s part of the global financial system - and it’s being taxed like everything else.

Finance

Finance

Daniel Verreault

January 4, 2026 AT 04:56Jacky Baltes

January 5, 2026 AT 04:00prashant choudhari

January 6, 2026 AT 11:27Willis Shane

January 7, 2026 AT 01:47Jake West

January 7, 2026 AT 23:53Shawn Roberts

January 9, 2026 AT 16:27Abhisekh Chakraborty

January 10, 2026 AT 12:36dina amanda

January 10, 2026 AT 18:53Emily L

January 12, 2026 AT 10:01Gavin Hill

January 13, 2026 AT 09:56SUMIT RAI

January 14, 2026 AT 01:18Andrea Stewart

January 14, 2026 AT 03:43Josh Seeto

January 15, 2026 AT 06:52surendra meena

January 15, 2026 AT 21:25Kevin Gilchrist

January 16, 2026 AT 21:54Adam Hull

January 18, 2026 AT 21:18Bianca Martins

January 19, 2026 AT 07:04alvin mislang

January 20, 2026 AT 11:17Monty Burn

January 21, 2026 AT 08:20Kenneth Mclaren

January 21, 2026 AT 12:05Alexandra Wright

January 22, 2026 AT 12:51Jack and Christine Smith

January 22, 2026 AT 16:22Jackson Storm

January 22, 2026 AT 19:33Raja Oleholeh

January 24, 2026 AT 03:42Prateek Chitransh

January 25, 2026 AT 13:09