Taiwan Crypto Regulation Checker

Below are key points to remember when navigating Taiwan's crypto landscape:

- Never try to link a Taiwanese bank account directly to an exchange.

- Perform thorough KYC on any platform you use - the FSC can shut down non-registered services.

- If you're building a crypto business, budget NT$2-5 million for compliance infrastructure.

- Watch for the stablecoin draft law in June 2025; early adopters may gain a competitive edge.

- Stay tuned to CBC announcements on CBDC pilots - they could change the way fiat moves in digital form.

If you’ve tried buying Bitcoin in Taiwan and hit a wall, you’re not alone. The island’s Taiwan crypto regulations are a mix of clear‑cut rules and puzzling roadblocks that keep traditional banks away from digital assets while still letting people own and trade them. Below you’ll find a plain‑English walk‑through of what the rules are, why they exist, and how they affect everyday users and businesses.

What the regulatory landscape looks like

Financial Supervisory Commission (FSC) Taiwan’s primary financial watchdog that sets policy for banks, securities firms, and emerging fintech. teamed up with the Central Bank of the Republic of China (CBC) the nation’s central monetary authority, responsible for monetary policy and payments infrastructure. to craft a framework that treats Bitcoin and similar tokens as “virtual commodities” rather than legal tender. That distinction, first published in a 2013 position paper, still underpins today’s rules.

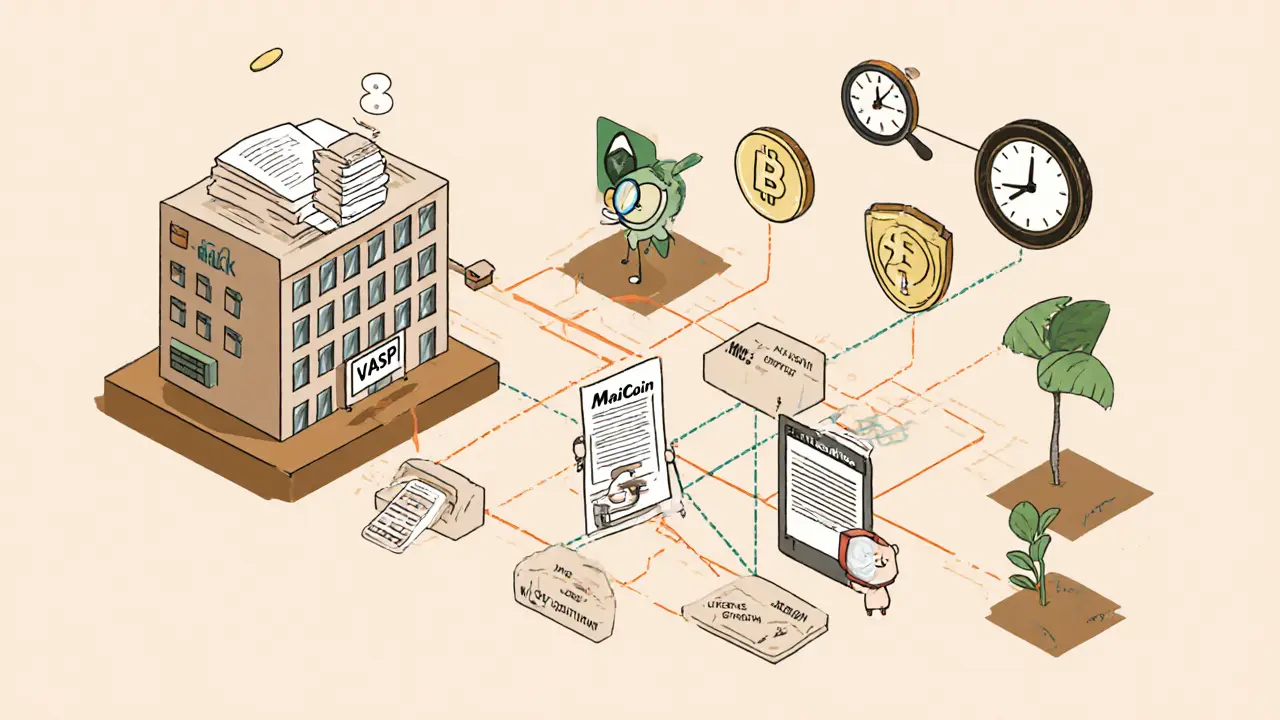

The framework now rests on three pillars:

- Mandatory registration for every Virtual Asset Service Provider (VASP) any business that offers crypto exchange, wallet, or payment services. as of 1January2025.

- Explicit banking prohibitions that bar local banks from dealing with crypto‑related transactions.

- Upcoming rules for stablecoins digital tokens pegged to a fiat currency, such as the New Taiwan Dollar. and a possible Central Bank Digital Currency (CBDC) a state‑issued digital version of the national currency..

Banking restrictions - the core of the “selective” approach

Back in 2014 the FSC issued its first hard line: banks could not accept Bitcoin or provide fiat‑to‑crypto conversion services. The rule was sharpened on 4July2022 when the FSC told the local bankers’ association to also block credit‑card processors from handling crypto purchases. The logic mirrors earlier bans on online gambling and high‑risk securities - the regulator wants to keep speculative, volatile assets out of the traditional banking system.

What does that mean for you?

- You cannot link a Taiwanese bank account directly to a local exchange to deposit or withdraw fiat.

- Credit‑card purchases of crypto are blocked; you’ll see “transaction declined” messages if you try.

- Bank‑issued payment cards, debit or otherwise, are off‑limits for buying Bitcoin, Ethereum, or other tokens.

Instead, most users rely on peer‑to‑peer platforms, third‑party payment processors, or overseas exchanges that have obtained a VASP license.

VASP registration - the new compliance gate

Since 1January2025, any crypto business operating in Taiwan must register with the FSC under the Anti‑Money Laundering (AML) regime. The registration fee ranges from NT$2million to NT$5million, and non‑compliance can result in fines up to NT$5million (about US$155,900) or up to two years in prison.

As of late 2024, exactly 23 entities have cleared the registration hurdle. The market leader, MaiCoin Taiwan’s largest crypto exchange, handling roughly US$70million in daily volume., is even planning an IPO on the local bourse.

The registration process forces VASPs to meet stringent criteria:

- Separated custodial accounts for client assets.

- Robust cybersecurity controls audited annually.

- Full AML/KYC procedures aligned with international standards.

For a startup, that translates into a 3‑ to 6‑month onboarding period and a sizeable upfront cost, but once approved, the firm can operate legally and advertise to Taiwanese customers.

How the restrictions shape everyday experience

Because banks stay out of the picture, Taiwanese crypto users have built a work‑around ecosystem:

- Peer‑to‑peer (P2P) marketplaces where sellers post bank‑transfer details and buyers fund the trade via cash deposits at convenience stores.

- International exchanges (e.g., Binance, Kraken) that have secured a local VASP license, allowing them to accept online payment methods that aren’t blocked by Taiwanese banks.

- Third‑party cash‑out services that act as a bridge between crypto wallets and physical cash.

Reddit threads for r/Taiwan and r/cryptocurrency reveal that while the process is a bit more cumbersome, it hasn’t stopped adoption. Roughly 2.3million citizens-about 10% of the population-report owning crypto, and total daily trading volume sits near US$200million.

Stablecoins and the upcoming regulatory shift

June2025 will bring a brand‑new draft law aimed at stablecoins pegged to the New Taiwan Dollar (TWD). Unlike unregulated USDC or USDT, a government‑backed stablecoin could be issued by a licensed financial institution, effectively giving banks a legal pathway to handle a digital asset.

Key points of the draft framework:

- Only entities that are already registered as VASPs or banks with a special license may issue TWD‑stablecoins.

- Reserves must be held in tier‑1 Taiwanese banks, subject to regular audits.

- Consumer protection rules will mirror those for traditional deposit accounts.

If the draft passes, we could see the first “bank‑backed” digital currency in Taiwan, which would soften the current banking ban for that specific class of token.

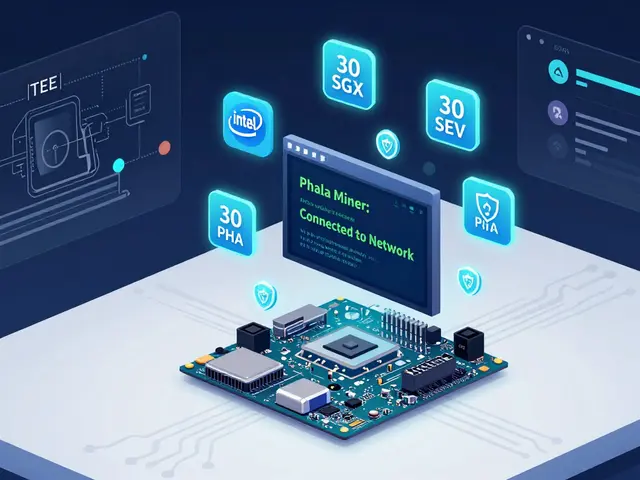

CBDC prospects and the long‑term outlook

The CBC completed a feasibility study for a Central Bank Digital Currency in December2023 and plans pilot testing in late2024 or early2025 using existing digital voucher infrastructure. While a CBDC would be a sovereign digital token, the regulator has repeatedly emphasized that speculative cryptocurrencies will stay outside the banking system.

Industry analysts expect a gradual, measured easing:

- Successful CBDC pilots could lead to limited banking participation for regulated digital assets.

- Stablecoin legislation may open a narrow doorway for banks to offer custodial services.

- Full‑scale integration of Bitcoin‑type assets with banks is unlikely in the near term, as the FSC wants to avoid systemic risk.

In short, the selective restrictions are here to stay, but they may evolve to accommodate government‑approved tokens.

Practical checklist for navigating Taiwan’s crypto scene

Whether you’re an individual trader or a startup founder, keep this cheat‑sheet handy:

- Never try to link a Taiwanese bank account directly to an exchange. Use P2P or an internationally licensed VASP instead.

- Perform thorough KYC on any platform you use - the FSC can shut down non‑registered services.

- If you’re building a crypto business, budget NT$2‑5million for compliance infrastructure and allocate 3‑6months for registration.

- Watch for the stablecoin draft law in June2025; early adopters may gain a competitive edge.

- Stay tuned to CBC announcements on CBDC pilots - they could change the way fiat moves in digital form.

Key restrictions at a glance

| Activity | Allowed for Banks? | Allowed for VASPs? |

|---|---|---|

| Direct fiat‑to‑crypto deposits | No | Yes (with registration) |

| Credit‑card crypto purchases | No | Yes (if VASP is licensed) |

| Custody of client crypto assets | No | Yes (must be segregated) |

| Issuing TWD‑pegged stablecoins | Only with special license | Yes (if VASP obtains stablecoin permit) |

| Providing CBDC services | Future‑possible after pilot | Future‑possible if authorized |

Final thoughts

Taiwan’s crypto policy walks a tightrope between encouraging innovation and protecting its financial system. By forcing VASPs into a rigorous registration regime while keeping banks out of speculative crypto, the government creates a sandbox that’s safe but a bit inconvenient. For users, the work‑arounds are real but manageable; for businesses, the compliance price tag is steep but grants legal certainty.

Keep an eye on the stablecoin draft and the CBC’s CBDC trial - those are the only cracks where the banking wall might thin. Until then, the rule of thumb is: stay registered, use approved VASPs, and don’t expect your local bank to handle Bitcoin.

Frequently Asked Questions

Can I deposit NT$ directly into a Taiwanese crypto exchange?

No. Banking restrictions prohibit any Taiwanese bank from sending fiat directly to a crypto exchange. You’ll need to use a peer‑to‑peer platform, a third‑party payment processor, or an overseas exchange that holds a local VASP license.

What penalties do VASPs face for operating without registration?

The FSC can issue fines up to NT$5million (about US$155,900) and may pursue criminal charges that carry up to two years of imprisonment.

Will the new stablecoin law let banks finally work with crypto?

Only for TWD‑pegged stablecoins that are issued by licensed financial institutions. Traditional speculative tokens like Bitcoin will remain outside the banking system.

How many Taiwanese citizens actually own crypto?

The FSC estimates about 2.3million people, roughly 10% of the population, hold cryptocurrency as of late 2024.

Is a Central Bank Digital Currency (CBDC) coming to Taiwan?

A feasibility study was completed in 2023 and pilot testing is slated for late2024 or early2025. The CBDC would be a sovereign token, separate from the speculative crypto market.

Finance

Finance

stephanie lauman

October 5, 2025 AT 08:20The Financial Supervisory Commission’s hard‑line stance is not just bureaucratic over‑reach; it is a calculated maneuver to keep the traditional banking sector insulated from crypto volatility. By barring banks from fiat‑to‑crypto pipelines, the regulator forces all crypto activity into a narrow VASP corridor that is easier to monitor. This creates a de‑facto monopoly for licensed VASPs and stifles any genuine competition that could benefit consumers. Moreover, the timing of the stable‑coin draft suggests a strategic pivot to capture digital assets under a controlled, government‑backed umbrella. In short, the policy is a deliberate gate‑keeping exercise. :)

Patrick MANCLIÈRE

October 13, 2025 AT 22:27For anyone trying to navigate this maze, the key is to use a VASP that has already secured its registration with the FSC. Those platforms will handle KYC, AML and custodial requirements, meaning you don’t have to build that infrastructure yourself. Also, keep an eye on the upcoming stable‑coin legislation – it could open a legitimate pathway for banks to offer pegged tokens. In practice, most Taiwanese traders resort to P2P or overseas exchanges that partner with a local VASP. Staying informed about compliance deadlines will save you headaches later.

Kortney Williams

October 22, 2025 AT 12:35When we examine the philosophical underpinnings of Taiwan’s crypto regimen, we notice a tension between liberty and security. The regulators appear to prioritize systemic stability over individual financial sovereignty, a choice rooted in historical caution. This raises the question: does protecting banks from speculative assets justify limiting citizens’ access to innovative financial tools? One could argue that the existence of a robust VASP ecosystem mitigates systemic risk while preserving user agency. Yet, the prohibition on direct bank‑crypto interactions forces a workaround that is both cumbersome and inequitable. The average citizen, unfamiliar with P2P intricacies, is left to navigate a fragmented market. Such fragmentation may inadvertently foster illicit channels, counter to the regulator’s stated anti‑money‑laundering goals. Furthermore, the upcoming stable‑coin framework could institutionalize a state‑controlled digital asset, consolidating power further. The unintended consequence might be a hybrid model where only approved tokens enjoy bank support, marginalizing decentralized alternatives. This selective endorsement reflects a deeper ideological stance: a preference for controllable, audited assets over open‑source innovation. In the long run, this could stall homegrown fintech entrepreneurship. The real challenge lies in balancing the protective instincts of a nascent regulator with the dynamic potential of decentralized finance. As observers, we must remain vigilant that policy does not become a veil for limiting financial freedom. Ultimately, the evolution of Taiwan’s crypto policy will serve as a litmus test for how societies reconcile innovation with prudence.

Laurie Kathiari

October 31, 2025 AT 01:42Morality demands that banks stay out of speculative chaos.

Matt Nguyen

November 8, 2025 AT 15:49Let’s be crystal clear: the regulator’s "special license" is nothing but a velvet rope for the elite. They’ll hand it out to the big players while the rest of us are left scrabbling for P2P deals. It’s a classic case of regulatory capture – they claim consumer protection but really enforce market consolidation. And don’t even start on the vague language in the draft law; it’s designed to be interpreted in favor of those with lobby power. Bottom line: the system is rigged, and the average user bears the cost.

Cynthia Rice

November 17, 2025 AT 05:56Crypto drama is just that – drama. The real story is about compliance headaches.

Promise Usoh

November 25, 2025 AT 20:03The philosophical dimension of this framework cannot be ignored. It reflects a societal choice to prioritize financial stability over absolute freedom. By mandating VASP registration, the FSC creates a gatekeeper that filters out the less scrupulous actors, which is a positive. However, the cost barrier (NT$2‑5 million) effectively excludes many startups, limiting innovation. This paradoxical stance-protecting the system while stifling competition-mirrors many global regulatory approaches. One might argue that a tiered licensing model could yield better outcomes. In any case, the upcoming stable‑coin draft will test the elasticity of this policy. If banks gain a foothold via stablecoins, the entire crypto ecosystem may shift towards a more centralized paradigm. That could either enhance consumer trust or erode the decentralization ethos, depending on execution. Ultimately, the balance struck will shape Taiwan’s fintech future.

Shaian Rawlins

December 4, 2025 AT 10:10From an observer’s perspective, the current ecosystem feels like a patchwork quilt. Users are forced to stitch together P2P deals, third‑party processors, and offshore exchanges just to move fiat. This complexity adds friction, but it also cultivates a resilient community of savvy traders who share tips on local forums. The regulatory clarity provided by the FSC is helpful in that it defines what is prohibited, yet the lack of a clear pathway for banks to safely engage with crypto leaves a vacuum. That vacuum is filled by creative workarounds, which can be both innovative and risky. It’s important for newcomers to understand that while the rules are strict, they are also transparent, which reduces the likelihood of hidden traps. The upcoming stable‑coin legislation could simplify matters if implemented thoughtfully, providing a regulated digital asset that banks can support. However, if the law becomes too restrictive, it may push more activity underground. In any case, staying informed and using licensed VASPs remain the safest bet. Patience and diligence will pay off, and the community will continue to evolve around these constraints.

Tyrone Tubero

December 13, 2025 AT 00:17Wow, talk about a dramatic shift. The banks are basically being told to sit on the sidelines while VASPs step into the spotlight. It’s a classic power shuffle that feels more theatrical than practical. Still, the drama might spark some much‑needed competition.

Taylor Gibbs

December 21, 2025 AT 14:24Hey folks, just a reminder to always double‑check that your VASP is properly registered with the FSC before you start moving funds. A quick look at the official registry can save you from nasty surprises. Also, keep your KYC documents up to date – the regulator can pull the rug out from under you if they suspect non‑compliance. It’s better to be safe than sorry, especially with the upcoming stable‑coin rules. Stay safe and happy trading!

mukesh chy

December 30, 2025 AT 04:31Oh great, another “protective” measure that will only benefit the already‑privileged. They love to talk about consumer protection while they lock out the very people who could drive real innovation. The stable‑coin draft looks like a disguised way to get banks back in the game, but only on their terms. Meanwhile, the average user is left juggling P2P platforms and hoping they don’t get scammed. Yep, just another classic case of regulation serving the elite.

Scott McReynolds

January 7, 2026 AT 18:38Despite the hurdles, there’s a bright side: the growing awareness around compliance is fostering a more mature market. When VASPs invest in robust AML/KYC systems, the overall ecosystem becomes safer for everyone. The upcoming stable‑coin framework could also open new avenues for legitimate financial products, bridging the gap between traditional banking and crypto. If we remain optimistic, these developments might attract institutional investors who bring liquidity and stability. That, in turn, could lower transaction costs and improve user experience. Let’s focus on the possibilities rather than the restrictions – innovation often thrives under constraints. By staying informed and adaptable, traders can turn these regulations into an advantage. The future looks promising if we all play by the rules and keep pushing forward.

Kimberly Kempken

January 16, 2026 AT 08:45Enough with the whining. The regulators are doing their job, and if you don’t like the rules, get used to them. Banking involvement would only add unnecessary risk to a volatile market. The stable‑coin draft will finally give the system a controlled digital asset, which is exactly what’s needed. Stop complaining and start adjusting your strategies accordingly.

Carthach Ó Maonaigh

January 24, 2026 AT 22:52Yo, the whole thing feels like a circus – banks are benched while VASPs get the spotlight. The law’s language is as clear as mud, but the message is simple: keep crypto out of traditional finance. That’s a bold move, but it’s also a massive inconvenience for everyday users. Still, the community finds a way, as always.

Jenise Williams-Green

February 2, 2026 AT 12:59It is a moral imperative that we do not allow speculative digital assets to corrupt our banking system. The selective bans reflect a profound ethical stance against reckless profit‑driven behavior. By restricting banks, the authorities uphold a duty to protect the public from volatile market forces. The forthcoming stable‑coin legislation will further cement this principled approach. Let us commend the regulators for choosing integrity over convenience.

Jim Griffiths

February 11, 2026 AT 03:06If you’re setting up a crypto startup in Taiwan, be prepared for the NT$2‑5 million compliance cost. Register with the FSC early to avoid last‑minute delays. Use a vetted VASP for any fiat‑on‑ramp to stay within the law. That’s the most straightforward path to a compliant operation.

Twinkle Shop

February 19, 2026 AT 17:13From a cultural‑policy perspective, Taiwan’s regulatory architecture exemplifies a hybrid governance model that integrates fintech innovation within a tightly regulated financial ecosystem. The coexistence of the Financial Supervisory Commission’s stringent AML/KYC mandates with the nascent stable‑coin legislative framework creates a bifurcated market structure. This duality necessitates that market participants adopt a layered compliance strategy, leveraging both robust custodial segregation protocols and real‑time transaction monitoring APIs. Moreover, the forthcoming Central Bank Digital Currency pilot will likely introduce a tokenized settlement layer, further complicating the interoperability matrix between legacy banking infrastructure and distributed ledger technologies. Stakeholders must therefore invest in cross‑functional expertise, blending legal acumen with cryptographic engineering, to navigate the evolving compliance landscape efficiently. As the regulatory timeline progresses, we can anticipate a gradual convergence of policy incentives that may eventually lower entry barriers for smaller VASPs, fostering a more competitive and diversified digital asset market.