AST Unifarm Airdrop Eligibility Checker

Your Eligibility Status

This tool helps you assess your potential eligibility for the AST Unifarm airdrop based on common criteria from similar events. Check the boxes below to see your progress:

Potential Eligibility Status

Expected Airdrop Timeline

Based on past DeFi airdrop patterns, here's the likely sequence:

If AST.finance follows this pattern, the airdrop could land sometime in Q4 2025.

Frequently Asked Questions

No exact date has been published yet. Based on previous AST-related airdrops, expect an announcement in the next few weeks, followed by a 2-week claim window in Q4 2025.

The project has not confirmed KYC requirements. Some DeFi airdrops stay fully on-chain, while others add KYC for regulatory reasons. Keep an eye on the official blog for any updates.

Most airdrops require a non-custodial address you control. Using an exchange wallet often results in missed claims because the exchange holds the private keys.

AST Unifarm airdrop has been buzzing across crypto forums, but reliable details are scarce. Below we break down what is confirmed, where the gaps lie, and how you can stay informed while the official info rolls out.

Key Takeaways

- Official documentation on the AST Unifarm airdrop is currently missing.

- Check AST.finance channels regularly for announcements.

- Use proven eligibility patterns from similar airdrops (e.g., AsterDEX) as a checklist.

- Beware of scams that mimic the airdrop name.

- Keep your wallets secure and only interact with verified links.

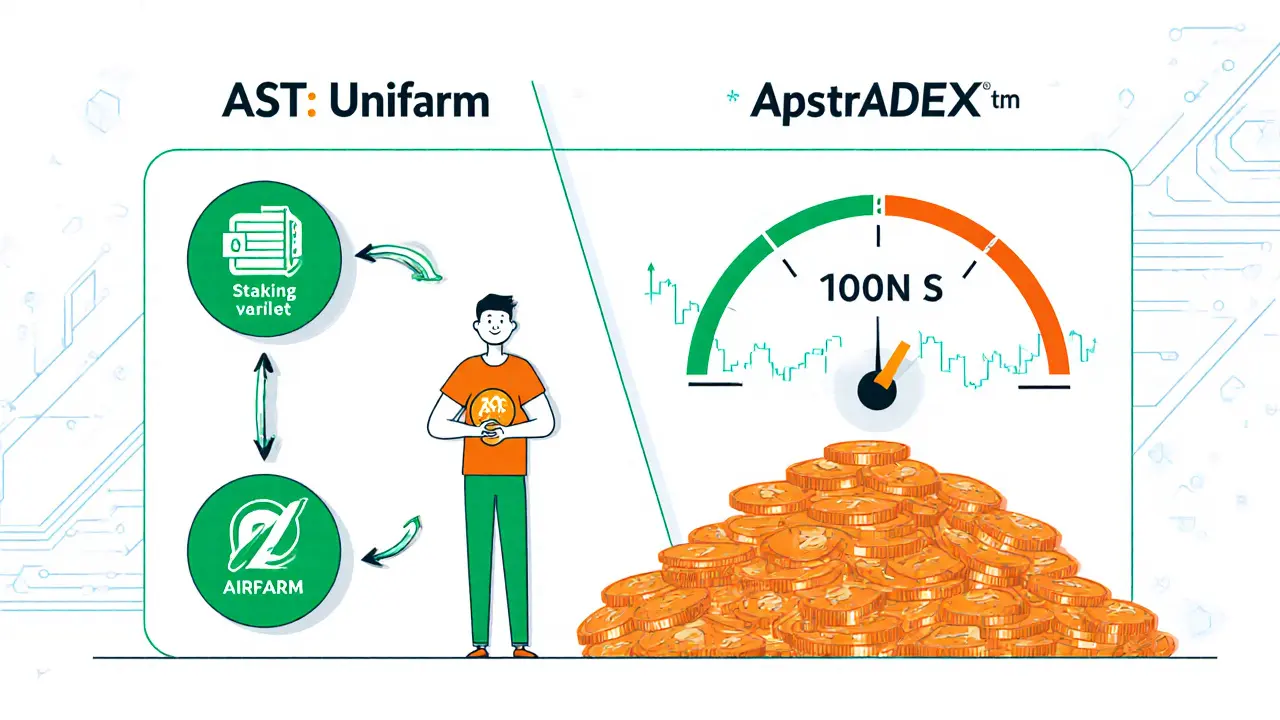

When we talk about the upcoming AST Unifarm airdrop a token distribution that would reward participants who engage with the Unifarm protocol through AST.finance, the first step is to understand the two core players.

AST.finance a decentralized finance platform that focuses on yield optimization and cross‑chain liquidity aims to boost its native AST token the utility token used for staking, governance, and fee discounts on the platform. Meanwhile, the Unifarm protocol an automated farming service that lets users earn yields by providing liquidity to multiple chains has partnered with AST.finance to incentivize early adopters.

What We Know So Far

As of October42025, the only public statements come from brief tweets and Discord teasers. No whitepaper, no airdrop schedule, and no eligibility rules have been released. The teasers do hint at two possible distribution methods:

- Rewarding users who have already staked AST on AST.finance.

- Granting tokens to wallets that have interacted with Unifarm - either by providing liquidity or by claiming farming rewards.

Both approaches mirror the mechanics used by the AsterDEX a perpetual exchange that ran a large AST token airdrop in 2023. That prior airdrop allocated 704million AST tokens based on a points system called Spectra Stage a tiered reward program that tracked trading volume and staking activity. While the AST Unifarm airdrop is a different event, the precedent gives us a useful template.

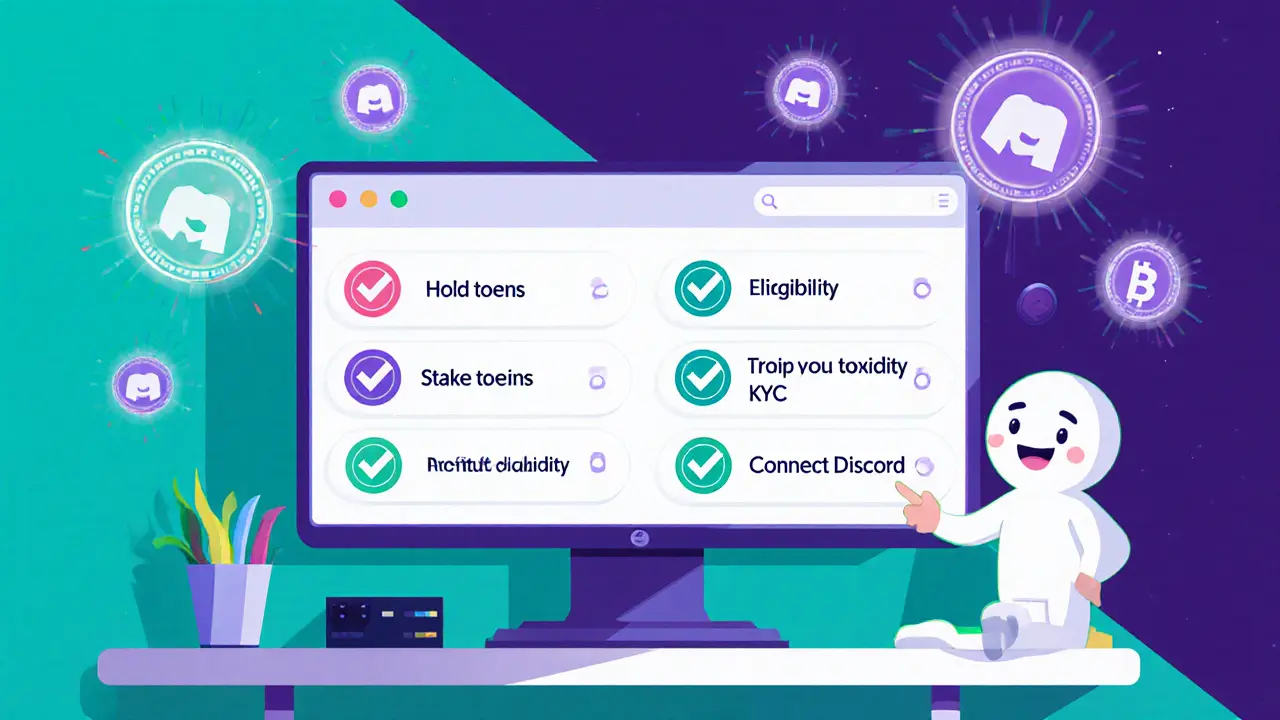

Typical Eligibility Checklist (Based on Similar Airdrops)

- Hold a minimum of 100AST tokens in a non‑custodial wallet.

- Stake or lock AST on AST.finance for at least 30days.

- Provide liquidity to any Unifarm pool and claim at least one reward.

- Connect your wallet to the official AST.finance Discord and verify your address.

- Complete KYC if the project decides to enforce regulatory compliance.

These points are speculative, but they reflect the most common requirements seen in DeFi airdrops. Adjust the list as official details emerge.

Comparison: AST Unifarm Airdrop vs. AsterDEX AST Airdrop

| Feature | AST Unifarm Airdrop (Planned) | AsterDEX AST Airdrop (2023) |

|---|---|---|

| Backing Project | AST.finance + Unifarm protocol | AsterDEX exchange |

| Total Tokens Distributed | Not disclosed | 704million AST |

| Eligibility Metric | Staking + liquidity provision | Spectra Stage points (trading + staking) |

| Distribution Method | Direct wallet airdrop (expected) | Direct wallet airdrop |

| Transparency Level | Low (info pending) | High (public dashboard) |

How to Verify Authentic Updates

Scams thrive on vague airdrop announcements. To avoid losing funds, follow these best‑practice steps:

- Only trust posts from the verified AST.finance Twitter handle the official account marked with a blue check and the official Unifarm Discord the community server linked from the AST.finance website.

- Check the AST.finance blog where detailed announcements are posted with hashes for verification for any airdrop‑related articles.

- Never share your private key or seed phrase; a legitimate airdrop never asks for them.

- If a claim portal appears, compare its URL with the one shared on the official channels.

- Use a hardware wallet for any claim transaction to add an extra layer of security.

Potential Timeline (Based on Past Patterns)

DeFi projects typically follow a three‑phase rollout:

- Announcement & registration: 1‑2weeks - project posts teaser, opens a registration form.

- Snapshot & eligibility calculation: 1week - wallets are frozen for snapshot, points are tallied.

- Distribution: 3‑5days - tokens are sent directly to eligible addresses.

If AST.finance sticks to this rhythm, the airdrop could land sometime in Q42025. Keep an eye on community pulse to confirm.

Next Steps for Interested Users

Even without full details, you can prepare now:

- Ensure you hold AST tokens in a non‑custodial wallet (e.g., MetaMask, Trust Wallet).

- Start staking on AST.finance to lock up the required amount.

- Provide liquidity to any Unifarm pool - the more pools you join, the higher the chance you meet “activity” thresholds.

- Join the official Discord, introduce yourself, and turn on announcement notifications.

- Bookmark the AST.finance blog page for future updates.

When the official announcement drops, you’ll already be in position to claim without scrambling.

Frequently Asked Questions

When will the AST Unifarm airdrop start?

No exact date has been published yet. Based on previous AST‑related airdrops, expect an announcement in the next few weeks, followed by a 2‑week claim window in Q42025.

Do I need to complete KYC?

The project has not confirmed KYC requirements. Some DeFi airdrops stay fully on‑chain, while others add KYC for regulatory reasons. Keep an eye on the official blog for any updates.

Can I claim the airdrop with a custodial exchange wallet?

Most airdrops require a non‑custodial address you control. Using an exchange wallet often results in missed claims because the exchange holds the private keys.

How does the AST Unifarm airdrop differ from the AsterDEX airdrop?

The AsterDEX airdrop distributed a fixed 704million AST based on a points system called Spectra Stage. The upcoming Unifarm airdrop is expected to reward staking and liquidity provision on two separate platforms, and its token amount and exact criteria remain undisclosed.

What are common scams associated with airdrop announcements?

Typical scams ask for private keys, request you to send a small amount of crypto to "verify" eligibility, or provide fake claim links that harvest your seed phrase. Always verify URLs and never share secret credentials.

Finance

Finance

Cathy Ruff

October 4, 2025 AT 08:05Don't think you can just sign up and print money, these airdrops are a circus and most people get left holding nothing

Miranda Co

October 9, 2025 AT 01:59I get the skepticism but if you already meet the basic criteria it's a low‑effort way to boost your position

Just make sure your wallet is non‑custodial and you’ve staked the tokens for the required period

Jenise Williams-Green

October 13, 2025 AT 19:52The Unifarm airdrop follows a pattern we've seen across multiple DeFi projects. Eligibility typically hinges on three pillars: token ownership, active participation, and community engagement. Holding at least 100 AST in a non‑custodial wallet proves you have skin in the game. Staking or locking the token for a month signals commitment and helps the protocol's security. Providing liquidity to any Unifarm pool not only earns you fees but also qualifies you for reward tracking. Connecting your wallet to the official Discord verifies you are a real person, not a bot. Some projects add a KYC layer, but AST has not confirmed this yet, so keep an eye on announcements. The snapshot will likely occur a week after registration closes, freezing balances for calculation. Points are usually awarded proportionally, so larger stakes translate to larger airdrop slices. Distribution tends to happen within a few days after the snapshot, directly to your address. If you miss any of these steps, you risk being excluded from the final payout. Remember that using an exchange‑controlled wallet will almost certainly disqualify you. The safest approach is to keep all activity in wallets where you control the private keys. Also, stay active in community channels; occasional bonus allocations are sometimes handed out to early contributors. In short, if you tick all the boxes now, you’ll be in a good position when the tokens finally land.

Kortney Williams

October 18, 2025 AT 13:45Sounds reasonable, I think the community vibe matters a lot too

Being present in the Discord can sometimes give you early heads‑up on tweaks

Laurie Kathiari

October 23, 2025 AT 07:39Honestly, most of these airdrops are just a marketing gimmick designed to lure naïve investors into locking up their tokens for the project's benefit. The colorful promises often mask the reality that only a fraction of participants receive any meaningful amount. If you’re not prepared to lose the opportunity cost of staking your capital elsewhere, you might regret the effort. Moreover, the KYC requirement, if it shows up, could expose personal data to questionable data‑handling practices. Keep your expectations in check and remember that the biggest reward is the experience you gain navigating these ecosystems.

Jim Griffiths

October 28, 2025 AT 00:32Make sure you’ve actually checked the “provide liquidity” box, otherwise the eligibility calculator will mark you incomplete.

Cynthia Rice

November 1, 2025 AT 18:25Liquidity pools are the heart of DeFi, so contributing there is practically a prerequisite for any real airdrop.

Promise Usoh

November 6, 2025 AT 12:19From a philosophical standpoint, the act of participating in an airdrop reflects a trust in decentralized governance, yet the practical execution often suffers from unclear guidelines. It's important to cross‑verify official channels for any updates, especially regarding the KYC status. Typos in the official docs have caused confusion before, so stay vigilant. Lastly, keep your private keys safe; any compromise nullifies all the effort you put into meeting eligibility.

Tyrone Tubero

November 11, 2025 AT 06:12Honestly, the whole thing feels like a prestige contest for the elite, but if you already hold the tokens, why not try?

Taylor Gibbs

November 16, 2025 AT 00:05Inclusivity matters, so make sure you’re also helping newcomers understand the steps; a friendly guide can go a long way in building a strong community.

Rob Watts

November 20, 2025 AT 17:59Stay active and keep those positions safe

Bhagwat Sen

November 25, 2025 AT 11:52Look, the mechanics are simple: hold, stake, provide liquidity, join Discord and you’re in the game. No need to overthink it, just follow the checklist and you’ll be set. If you skip any step you’ll probably get nothing. The timeline is tight, so act fast.

mukesh chy

November 30, 2025 AT 05:45Sure, the airdrop is coming, but most people will just chase the hype and forget about the fundamentals of tokenomics.

Marc Addington

December 4, 2025 AT 23:39Patriotic to the DAO, I say we all rally behind AST and make sure our wallets are ready. Anything less is a betrayal of the community’s spirit.

Natalie Rawley

December 9, 2025 AT 17:32Drama aside, the real question is whether you’ve actually connected your wallet to the Discord server yet.

Scott McReynolds

December 14, 2025 AT 11:25When we look at the broader landscape of DeFi incentives, the Unifarm airdrop serves as both a reward mechanism and a strategic alignment tool for early adopters. Participants who have already integrated AST into their portfolios will find the required actions-holding, staking, providing liquidity-naturally align with their existing strategies. This reduces friction and increases the likelihood of a successful distribution. Moreover, community engagement through Discord not only verifies identity but also fosters a sense of belonging that can translate into future governance participation. The snapshot, typically set shortly after the registration window, captures a static view of holdings, ensuring fairness in the allocation process. By weighting points based on the amount staked and the duration of liquidity provision, the protocol incentivizes deeper commitment rather than one‑off token grabs. Distribution, when it occurs, will be automated via smart contracts, minimizing manual overhead and potential errors. However, users must be vigilant about gas costs during the claim phase, as network congestion can erode the net value of the airdrop. Security remains paramount; always double‑check contract addresses and avoid phishing links, especially when prompted to connect wallets. In the event that KYC becomes mandatory, participants should be prepared to provide verifiable information without compromising privacy. Finally, the long‑term value of the received tokens will hinge on Unifarm’s future product roadmap and market adoption, so consider how the airdrop fits into your overall investment thesis.

Alex Gatti

December 19, 2025 AT 05:19Check the eligibility list and make sure you’ve met every condition before the snapshot hits. Missing a single checkbox could cost you the entire airdrop.

John Corey Turner

December 23, 2025 AT 23:12From a philosophical angle, participating in such a distribution is a micro‑experiment in collective finance. Your actions ripple through the network, influencing liquidity depth and token velocity. It's fascinating to watch how coordinated staking can shift market dynamics.

Kimberly Kempken

December 28, 2025 AT 17:05Everyone’s cheering the airdrop but forget the hidden fees and potential rug‑pulls lurking beneath the hype.

Eva Lee

January 2, 2026 AT 10:59Technical jargon aside, the core requirement remains simple: you need to be an active participant in the ecosystem, not just a passive holder. Ensure your liquidity position is properly recorded on the blockchain before the snapshot.

stephanie lauman

January 7, 2026 AT 04:52Official channels have hinted at a possible KYC requirement, which raises concerns about data security. Stay vigilant and verify any requests through the official AST website to avoid phishing scams. 😊

Twinkle Shop

January 11, 2026 AT 22:45The strategic importance of the AST Unifarm airdrop cannot be overstated in the context of broader DeFi interoperability. By incentivizing token holders to engage across multiple layers-staking, liquidity provision, and community participation-the protocol fosters a robust network effect that can enhance market depth and price stability. Moreover, the requirement to connect a non‑custodial wallet to the official Discord serves a dual purpose: it filters out bots and ensures that only verified participants receive the distribution, thereby reducing the risk of fraudulent claims. From a compliance perspective, the potential introduction of KYC measures aligns with emerging regulatory frameworks, though it also introduces privacy considerations that participants must weigh carefully. The snapshot methodology, typically captured at a single block height, provides an immutable record of eligibility, ensuring transparency and fairness in token allocation. Effective distribution mechanisms, powered by smart contracts, minimize human error and expedite the delivery of tokens to eligible addresses. Users should remain cognizant of gas price volatility during the claim phase, as excessive fees can erode the net benefit of the airdrop. Security best practices-such as double‑checking contract addresses and avoiding phishing links-remain paramount throughout the process. Finally, the long‑term utility and valuation of the airdropped AST will hinge on Unifarm’s product roadmap, governance participation, and overall market adoption, making it essential for participants to integrate these tokens into a broader investment strategy.

Greer Pitts

January 16, 2026 AT 16:39Nice rundown, hope everyone gets their tokens without any hassle.

Lurline Wiese

January 21, 2026 AT 10:32The drama of airdrops is real, but the real work is just ticking the boxes and staying on top of announcements.

Adarsh Menon

January 26, 2026 AT 04:25U sure u r doing it right if u forget to join the discord