When you're looking for a crypto exchange in Japan, you don't just want another platform that says it’s secure. You need one that’s BICC Exchange - regulated, reliable, and built for the local market. BICC Exchange has been operating since 2018 under Japan’s Financial Services Agency (FSA), which means it follows strict rules designed to protect users after the Mt. Gox collapse. That’s not something every exchange can claim. But does that make it a good choice for you? Let’s break it down.

Regulation and Safety First

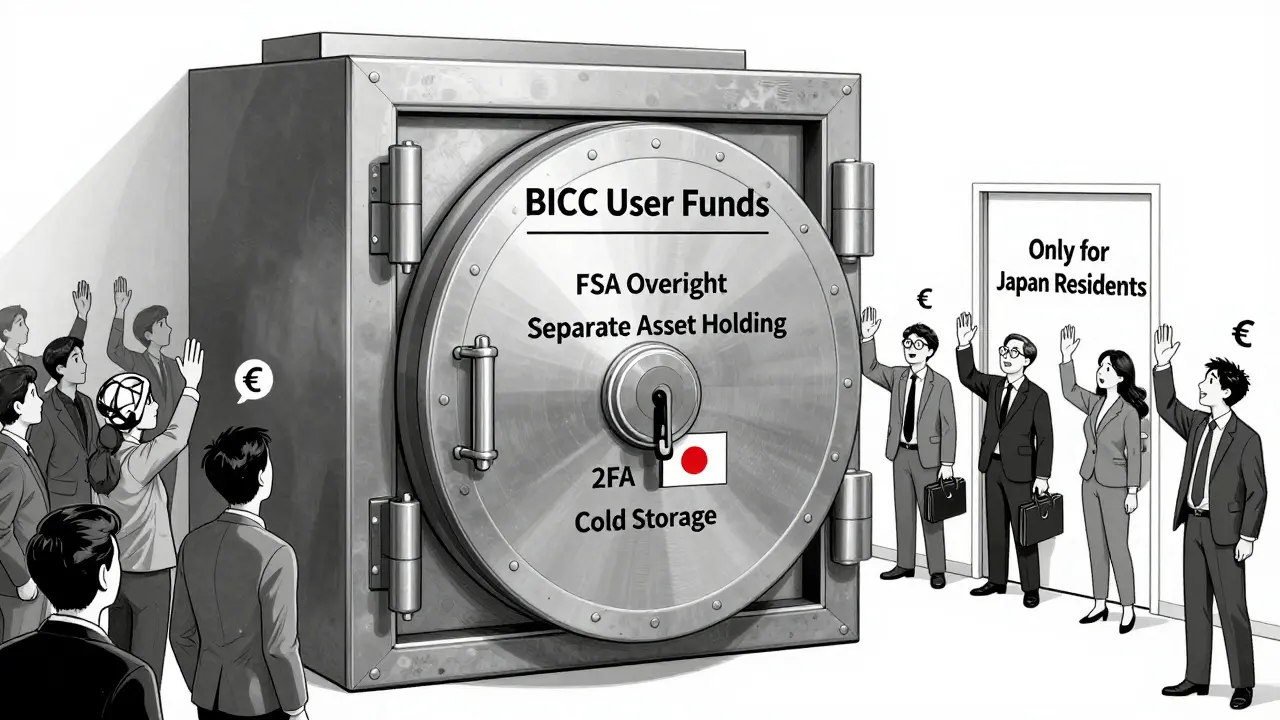

BICC Exchange is one of the few crypto platforms in Japan that’s officially licensed by the FSA. This isn’t a small detail - it’s the biggest reason to consider it. Japan’s financial regulators require exchanges to keep user funds separate from company money, run regular audits, and enforce strict KYC (Know Your Customer) checks. BICC does all of this. You’ll need to upload a government-issued ID, verify your email, and turn on two-factor authentication before you can trade. No shortcuts. No exceptions.

Compare that to unregulated platforms that vanish overnight or demand extra fees to "unlock" your account. BICC doesn’t do that. According to California’s DFPI Crypto Scam Tracker, which lists over 100 fraudulent crypto sites, BICC isn’t on it. That’s a strong sign it’s not a scam. But regulation alone doesn’t mean it’s perfect. You still need to know what you’re getting.

What You Can Trade

BICC supports over 50 cryptocurrencies, including the big names: Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. That’s more than many Japanese exchanges offer. For example, BitFlyer USA only lists 11 coins. If you want to diversify beyond BTC and ETH, BICC gives you options. You can trade spot markets and also access contract trading - meaning you can go long or short on assets without owning them.

But here’s the catch: while the selection is decent, it’s not as wide as global giants like Binance or OKX. If you’re into lesser-known altcoins or new DeFi tokens, you might find gaps. BICC focuses on stable, high-demand assets that fit Japan’s regulatory comfort zone. That’s a trade-off: fewer risky coins, but more confidence in what’s listed.

How to Deposit and Withdraw

BICC supports two main ways to move money: crypto transfers and Japanese bank transfers. If you already own Bitcoin or Ethereum, you can send it directly to your BICC wallet using common networks like Bitcoin (BTC) or Ethereum (ETH). Withdrawals are processed quickly, usually within a few hours.

For fiat, you can deposit or withdraw Japanese Yen using bank transfers. This is huge for local users - no need to juggle third-party payment processors. But if you’re outside Japan, this becomes a dead end. BICC doesn’t accept USD, EUR, or other currencies. It’s built for Japanese residents. If you’re not in Japan, you’ll likely run into roadblocks during KYC or bank verification.

Interface and Usability

Users describe BICC’s platform as "dynamic and user-friendly." The layout is clean, with real-time charts, order book depth, and simple buy/sell buttons. It’s not as flashy as Coinbase or as packed with features as Bybit, but it doesn’t overwhelm you either. The mobile app works smoothly on both iOS and Android, which is a plus. You can check prices, place orders, and monitor your portfolio without needing a desktop.

One thing missing? Detailed analytics. There’s no advanced charting tools like Fibonacci retracements or volume profile indicators. If you’re a day trader who needs technical analysis layers, you’ll want to pair BICC with a separate charting tool like TradingView. For casual traders or beginners, it’s more than enough.

Fees and Costs

BICC doesn’t advertise its fee structure clearly on its homepage. That’s a red flag for many users. From available data, trading fees appear to be around 0.1% to 0.2% per trade, which is average for a mid-sized exchange. Deposit fees for crypto are free, but withdrawal fees vary by coin - for example, withdrawing Bitcoin costs about 0.0005 BTC. Fiat withdrawals via bank transfer likely carry a small fee, though exact numbers aren’t published.

There are no deposit bonuses. No referral programs. No staking rewards. That’s unusual in 2026, when most exchanges use incentives to grab attention. BICC doesn’t play that game. It’s focused on compliance, not marketing. If you’re looking for free money or high-yield rewards, look elsewhere. If you want steady, transparent trading, BICC fits.

Why It’s Not on CoinGecko or CoinMarketCap

This is the big question: Why isn’t BICC ranked on CoinGecko or CoinMarketCap? Both platforms list exchanges based on trading volume, liquidity, and trust scores. BICC doesn’t meet their thresholds. As of late 2025, CoinGecko requires at least $43 million in daily volume to make the top 100. BICC’s volume is likely under $10 million - possibly much lower.

That doesn’t mean it’s broken. It means it’s small. BICC serves a niche: Japanese users who want a regulated, no-frills platform. It doesn’t chase global users. It doesn’t run ads on YouTube. It doesn’t sponsor crypto conferences. It just operates quietly under FSA oversight. That’s why it’s absent from rankings - not because it’s unsafe, but because it’s not trying to be big.

Who Is BICC Exchange For?

BICC isn’t for everyone. Here’s who it works best for:

- Japanese residents who want a fully regulated exchange with bank integration.

- Beginners who value simplicity and safety over flashy features.

- Long-term holders who want to store and trade major coins without risk.

It’s not for:

- International users - the platform is locked to Japan.

- Active traders who need low fees, advanced tools, or hundreds of altcoins.

- Investors chasing rewards - no staking, no bonuses, no airdrops.

The Bottom Line

BICC Exchange isn’t the biggest or the loudest crypto platform in Japan. But it’s one of the safest. Its FSA license gives it legal backing that most exchanges can’t match. It’s transparent about KYC, doesn’t hide fees, and avoids the hype cycles that trap new users. If you’re in Japan and want to trade crypto without worrying about scams or sudden shutdowns, BICC is a solid option.

Just don’t expect to find it on every top 10 list. It’s not trying to be that. It’s trying to be reliable.

Is BICC Exchange regulated?

Yes. BICC Exchange is licensed and regulated by Japan’s Financial Services Agency (FSA), which requires strict compliance with anti-money laundering rules, capital requirements, and user fund protection. This makes it one of the few legally recognized crypto platforms in Japan.

Can I use BICC Exchange if I’m not in Japan?

Technically, no. BICC Exchange requires a Japanese bank account and government-issued ID for KYC. While you might be able to sign up from abroad, you won’t be able to complete verification or deposit/withdraw Japanese Yen. The platform is designed exclusively for Japanese residents.

Does BICC Exchange have a mobile app?

Yes. BICC offers official mobile apps for both iOS and Android. The apps support trading, portfolio tracking, and notifications. They’re simple but functional, with the same security features as the desktop version, including 2FA and biometric login.

What cryptocurrencies does BICC support?

BICC supports over 50 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), and others. It focuses on major, high-liquidity assets rather than obscure or new tokens. This aligns with Japan’s regulatory approach to minimizing risk.

Why isn’t BICC listed on CoinGecko or CoinMarketCap?

BICC doesn’t meet the minimum trading volume or trust score thresholds required by CoinGecko and CoinMarketCap. These platforms rank exchanges based on global activity, and BICC serves a small, localized market. Its absence doesn’t mean it’s unsafe - it just means it’s not targeting international users or high-volume trading.

Are there any hidden fees on BICC Exchange?

BICC doesn’t hide fees, but it doesn’t list them prominently either. Trading fees are around 0.1%-0.2%. Crypto withdrawals have small network fees (e.g., 0.0005 BTC for Bitcoin). Fiat withdrawals via bank transfer may carry a small fee, though exact amounts aren’t published. Always check the fee details before making a transaction.

Is BICC Exchange safe from hacks?

There have been no public reports of hacks or security breaches involving BICC Exchange. Its FSA regulation requires cold storage for most user funds, regular audits, and strong cybersecurity protocols. While no exchange is 100% hack-proof, BICC’s compliance framework makes it one of the safer options in Japan.

Finance

Finance