Kraken Fee Calculator

Estimated Trading Fees

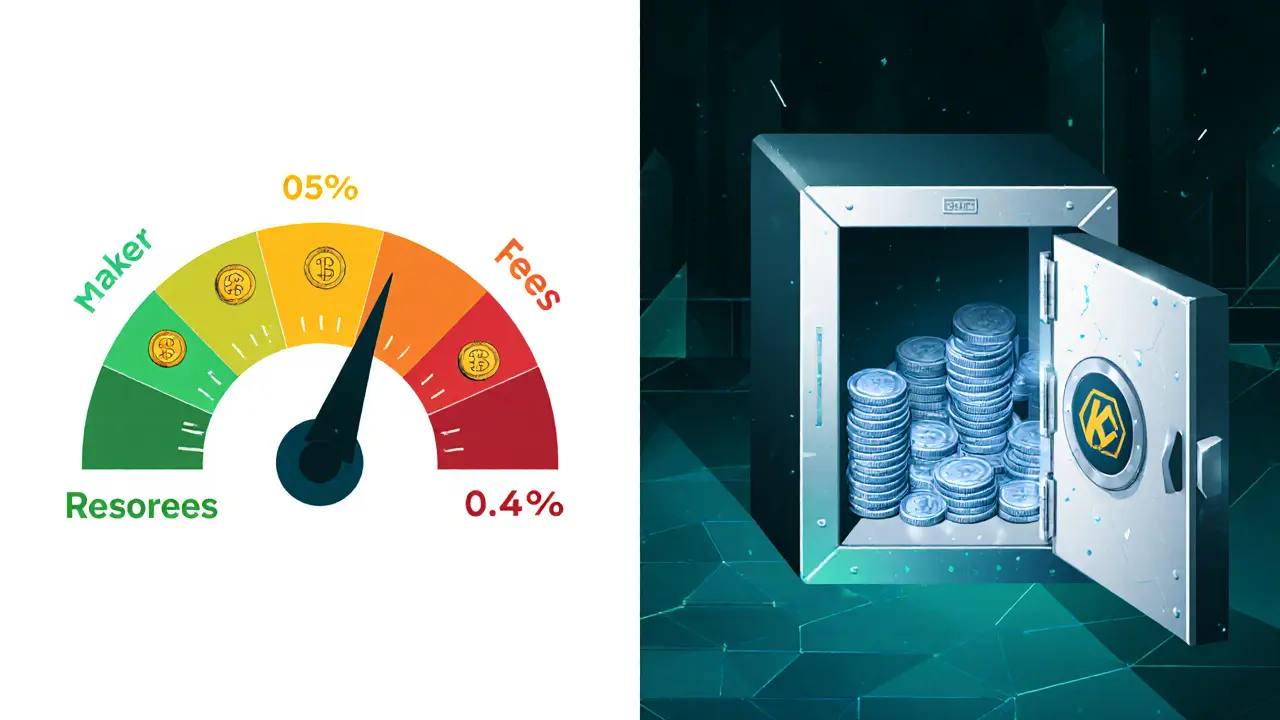

Maker Fee

0.16%

Limit orders that add liquidityTaker Fee

0.26%

Market orders that remove liquidityStablecoin Fee

0.90%

For stablecoin purchasesWhen it comes to crypto trading, Kraken is a SanFrancisco‑based cryptocurrency exchange that offers spot, margin, futures and staking services. Founded in 2011, it now ranks as the fourth‑largest exchange by volume in 2025 and serves over 6million traders worldwide.

Quick Takeaways

- Kraken supports more than 410 crypto assets and eight fiat currencies.

- Maker‑taker fees range from 0% to 0.4%; volume‑based discounts kick in after $50k in 30days.

- Security features include proof‑of‑reserves, cold‑storage of >95% of assets, and FinCEN registration.

- Advanced tools: margin up to 5×, futures up to 50×, and two staking options.

- Compared with Coinbase, Kraken wins on fee flexibility and asset breadth but lags on verification speed.

Core Features and Asset Coverage

Kraken’s platform is split into two main interfaces: a simplified web view for casual purchases and Kraken Pro, an advanced dashboard with customizable charts, deep‑order‑book access, and API support. Both are mirrored in native iOS and Android apps, though the full feature set still feels richer on the desktop.

As of October2025 the exchange lists over 410 cryptocurrencies, from the original Bitcoin and Ethereum to newer DeFi tokens and several stablecoins. Stablecoin purchases incur a slightly higher 0.9% fee, while most other assets sit under 0.4% for makers and takers alike.

The fiat layer includes USD, EUR, GBP, JPY, CAD, AUD, and CHF, letting traders deposit via bank ACH, SEPA, or domestic wire. Minimum deposits are as low as $10, a stark contrast to many rivals that demand $50 or more.

Fee Structure Explained

Kraken runs a classic maker‑taker model. Makers (limit orders that add liquidity) enjoy 0% to 0.16% fees, while takers (market orders that remove liquidity) pay 0.10% to 0.26%. High‑volume traders who move more than $50k in a 30‑day window see these rates dip to as low as 0% for makers and 0.10% for takers.

Beyond trading fees, the exchange charges for fiat on‑ramps and off‑ramps. ACH / online banking costs 0.5%; card and digital‑wallet deposits sit at 3.75% plus a $0.25 flat fee. Withdrawal fees for major coins like Bitcoin and Ethereum are minimal-usually a few cents or a fraction of a percent of the withdrawn amount.

For margin traders, the fee schedule adds an interest component based on the borrowed amount. Kraken offers up to 5× leverage, and the daily interest rate starts at 0.02% for BTC‑based positions, scaling with leverage and asset volatility.

Security and Compliance Highlights

Security is Kraken’s headline claim. The exchange stores roughly 95% of user funds in geographically dispersed cold wallets, with the remaining assets in multi‑signature hot wallets for rapid withdrawals. A quarterly proof‑of‑reserves audit publicly verifies that total holdings match user balances, a practice few exchanges still follow.

Regulatory compliance is another pillar. Kraken is a FinCEN‑registered money services business and holds licenses across the United States, Europe, Canada, and Japan. This regulatory breadth enables fiat on‑ramps in multiple currencies and reduces the risk of sudden shutdowns that have plagued less‑compliant platforms.

Two‑factor authentication, hardware‑token support, and email confirmations guard account access. For institutional clients, Kraken offers cold‑storage custody solutions with separate segregation of assets.

Advanced Trading: Margin, Futures, and Staking

Beyond spot trading, Kraken provides three major advanced products:

- Margin trading: Up to 5× leverage on 70+ assets. Traders must maintain a minimum maintenance margin of 20%; liquidation triggers are clearly displayed on the Pro interface.

- Futures contracts: Perpetual and quarterly contracts on Bitcoin, Ethereum, and several altcoins, offering up to 50× leverage. Futures positions settle in the underlying crypto, and funding rates are recalculated every eight hours.

- Staking: Two options exist-bonded staking, where users lock tokens directly on the blockchain and earn rewards, and simplified staking, a custodial service where Kraken handles validator operations. Staking is available for assets like Tezos, Cosmos, and Polkadot, though regional restrictions apply.

These features make Kraken attractive to both retail power traders and institutional desks that need high leverage and deep liquidity.

Kraken vs. Coinbase: Head‑to‑Head Comparison

| Feature | Kraken | Coinbase |

|---|---|---|

| Supported Cryptocurrencies | 410+ assets | ~250 assets |

| Fiat Currencies | USD, EUR, GBP, JPY, CAD, AUD, CHF | USD, EUR, GBP |

| Maximum Leverage | 5× margin, 50× futures | 3× margin, 25× futures (Coinbase Pro) |

| Maker‑Taker Fees (Base) | 0% - 0.16% maker / 0.10% - 0.26% taker | 0.00% - 0.10% maker / 0.10% - 0.40% taker |

| Minimum Deposit | $10 (USD) | $50 (USD) |

| Verification Speed (Pro account) | Typically 2‑5days | 1‑3days |

| Security Rating (Industry Audits) | #1 in security & customer service 2025 | #3 in security 2025 |

The table makes it clear that Kraken shines in asset breadth, leverage options, and fee flexibility, while Coinbase offers a slightly faster KYC flow and a more beginner‑friendly UI.

Getting Started: Step‑by‑Step Guide

- Visit the official Kraken website and click “Create Account”.

- Enter your email, create a strong password, and verify the email link.

- Complete the KYC process: provide name, address, a government ID, and a selfie. Expect 2‑5days for verification.

- Secure your account: enable 2FA via Google Authenticator or a hardware token.

- Deposit fiat: choose your preferred method (ACH for US, SEPA for EU, or domestic wire). Minimum $10 deposit.

- Navigate to the “Buy Crypto” tab for a quick purchase, or switch to “Kraken Pro” for advanced order types.

- If interested in staking, go to the “Earn” section, select a supported asset, and follow the on‑screen bonding steps.

Most new users can complete the basic purchase flow within 15minutes. Mastering margin or futures takes weeks of practice, so start small and use the extensive educational resources available on Kraken’s Help Center.

Pros, Cons, and Who Should Use Kraken

Pros

- Extensive crypto and fiat coverage.

- Deep liquidity and competitive maker‑taker fees.

- Robust security: cold storage, proof‑of‑reserves, and regulatory licensing.

- Advanced tools for margin, futures, and staking.

- Low minimum deposit, making it accessible for small‑scale traders.

Cons

- Verification can be slower than some rivals, especially for Pro‑level accounts.

- Interface complexity may overwhelm absolute beginners.

- Not all fiat deposit methods (e.g., credit cards) are supported worldwide.

Best For

- Intermediate to advanced traders who need margin or futures.

- Users who value security and regulatory compliance above a slick UI.

- Investors interested in staking a variety of PoS assets.

Not Ideal For

- People seeking instant account approval and a click‑and‑buy experience.

- Those who only trade a handful of major coins and don’t need advanced features.

Future Outlook and Upcoming Developments

Kraken is gearing up for a potential IPO in late 2025, a move that could bring greater transparency and access to institutional capital. The exchange plans to broaden its staking catalog, adding more regional offerings as local regulations clarify. Mobile app enhancements are also on the roadmap, promising a richer on‑the‑go experience for futures and margin traders.

Industry analysts predict that exchanges which combine strong security, broad asset sets, and compliance will dominate the next wave of crypto adoption. Kraken’s $10billion private valuation and its track record of steady growth position it well for continued relevance, provided it keeps pace with emerging competitors that focus on user‑centric design and instant onboarding.

Frequently Asked Questions

Is Kraken safe for storing large amounts of crypto?

Yes. Kraken keeps about 95% of funds in offline cold wallets, conducts quarterly proof‑of‑reserves audits, and complies with multiple global regulators, making it one of the safest exchanges in 2025.

What is the minimum amount I can deposit on Kraken?

The minimum fiat deposit is $10 (or equivalent in other supported currencies). For crypto, you can send as little as 0.0001BTC or the network‑minimum of the chosen coin.

How do Kraken’s fees compare to Binance?

Kraken’s maker‑taker fees start at 0% for makers and 0.10% for takers, while Binance’s standard fees sit at 0.10% maker and 0.10% taker, with additional discounts for BNB‑based payments. Kraken is cheaper for high‑volume traders due to its tiered volume discounts.

Can I trade futures on Kraken’s mobile app?

Yes, the 2025 mobile app now supports futures trading, though the full suite of advanced charting tools is still only available on the web version.

What staking rewards does Kraken offer?

Rewards vary by asset. For example, Tezos yields around 5.5% APY, Cosmos about 9%, and Polkadot roughly 10% when using the custodial staking service. Bonded staking often yields similar rates but requires you to manage validators.

Finance

Finance

Alie Thompson

December 30, 2024 AT 00:54It is a moral imperative, in this era of unchecked financial experimentation, to demand that any platform handling users' hard‑earned wealth be subjected to the highest standard of ethical stewardship; Kraken, while lauded for its breadth, must continuously prove that its security architecture is not a mere marketing veneer but a living, breathing guarantee of safety. One cannot simply accept a 0.9% stablecoin fee as a benign cost without asking where those dollars truly go, and whether they feed into a system that respects user autonomy. The proof‑of‑reserves initiative, though commendable, must be transparent, audited by truly independent parties, lest it become another checkbox on a compliance form. Moreover, the platform's insistence on a 2‑5 day verification period under the guise of regulatory compliance may be justified, yet it also serves as a barrier that could be exploited to sieve out less vigilant users. While the cold‑storage of 95% of assets sounds reassuring, any lapse in the remaining 5% hot wallets could unleash catastrophic losses, and history teaches us to be wary of complacency. The tiered fee structure, rewarding high‑volume traders with zero‑percent maker fees, subtly encourages market participants to chase volume at the expense of smaller investors, creating an inequitable playing field. It is also worth noting that the elevated 0.9% fee on stablecoins could disincentivize the very liquidity that stabilizes the market, leading to price distortions. Users must demand that Kraken not only claims regulatory registration across multiple jurisdictions but also actively engages with consumer protection agencies to ensure accountability. The upcoming IPO, while potentially injecting capital for innovation, also raises concerns about profit‑driven motives eclipsing the mission of safeguarding user assets. In sum, the exchange's technical feats are impressive, yet the ethical onus remains: to operate with unwavering integrity, continuous transparency, and an unrelenting commitment to user security above all else.

Samuel Wilson

December 30, 2024 AT 06:28Kraken’s security model indeed sets a high bar; the cold‑storage percentage and proof‑of‑reserves audits are concrete steps toward user trust. However, operational transparency should be paired with clear communication about fee structures, especially for high‑volume traders. The verification timeline, while compliant, could benefit from a streamlined onboarding process to reduce friction for legitimate users. Overall, the platform balances robustness with regulatory compliance effectively.

Rae Harris

December 30, 2024 AT 12:01Look, the maker‑taker fee model is just old‑school tokenomics mashed together with a layered liquidity pool; you’re essentially paying for the privilege of market impact. If you’re into DeFi‑style AMM vibes, Kraken’s static fees feel archaic, especially when you can route through decentralized bridges with sub‑0.1% slippage. Bottom line: the exchange is solid, but the fee architecture is a relic.

Danny Locher

December 30, 2024 AT 17:34Kraken’s mobile app finally supports futures, finally.

Emily Pelton

December 30, 2024 AT 23:08Kraken offers a staggering array of assets, multiple fiat pairs, and an impressively low minimum deposit, which, in my view, makes it a premier choice for both novices and seasoned traders, however, the verification process can be painfully slow, consequently, many users experience frustration during onboarding, and while the security measures are top‑notch, the interface complexity may deter those seeking a simple, click‑and‑buy experience, nevertheless, the platform’s fee flexibility and advanced tools are undeniably valuable, especially for high‑volume participants.

sandi khardani

December 31, 2024 AT 04:41Let’s dissect the alleged superiority of Kraken with a critical eye: the touted 95% cold‑storage claim is a statistic that sounds impressive until you realize that the remaining 5% hot wallet allocation is a massive attack surface, one that could be weaponized by a coordinated hack. Moreover, the so‑called “proof‑of‑reserves” is typically a snapshot, not a continuous audit, leaving users in a perpetual state of uncertainty about real‑time solvency. The tiered fee structure, while beneficial to whales, subtly reinforces a power imbalance, encouraging retail participants to inflate trading volumes merely to chase lower fees, thereby feeding market manipulation cycles. Their regulatory compliance across jurisdictions, while ostensibly comprehensive, is often a superficial alignment that can be revoked overnight, as history has shown with exchanges suddenly losing licenses, and the announced IPO might shift focus from user protection to shareholder returns, potentially compromising the very security ethos they currently tout. In short, the platform is a mixed bag of robust features shadowed by systemic vulnerabilities and strategic short‑sightedness.

Darren R.

December 31, 2024 AT 10:14Ah, the grand tapestry of financial freedom, where Kraken stands as a beacon-yet, one must ponder: does the glitter of over‑a‑hundred assets blind us to the philosophical abyss of uncontrolled risk?; the interplay of regulatory compliance and decentralised ambition creates a paradoxical dance, a waltz of order amidst chaos,; and as we behold the cold‑wallet fortresses, are we not merely constructing walls that conceal deeper systemic flaws?; let us not be seduced solely by superficial metrics, but rather, interrogate the very essence of trust in digital custodianship,; only then can we truly claim to transcend the shackles of fiat‑centric orthodoxy.

Hardik Kanzariya

December 31, 2024 AT 15:48It’s great to see how Kraken’s extensive asset coverage can empower traders across the globe. The security measures, especially the proof‑of‑reserves, provide a reassuring layer of confidence. I’d encourage anyone just starting out to take advantage of the low $10 deposit and explore the educational resources available.

Shanthan Jogavajjala

December 31, 2024 AT 21:21While the platform’s API access is robust, the current rate‑limit policies can occasionally bottleneck high‑frequency strategies, which is concerning for algorithmic traders who require real‑time data streams. Moreover, the documentation, albeit comprehensive, lacks clear examples for complex order types such as iceberg orders, making implementation cumbersome. Lastly, the mixed formality in user support responses sometimes leads to ambiguity, especially when troubleshooting latency issues tied to network congestion.

Millsaps Delaine

January 1, 2025 AT 02:54One must consider the epistemological implications of routing trade execution through a centralized entity that claims to be the arbiter of trust; the very notion that an exchange can simultaneously be a gatekeeper and a beneficiary of market flow is a paradox that warrants deeper scrutiny. Furthermore, the commoditisation of staking rewards through custodial services introduces an abstracted layer of value extraction that blurs the line between passive income and active participation. In essence, Kraken’s operational paradigm is a microcosm of the broader tension between decentralisation ideals and pragmatic regulatory compliance.

Jack Fans

January 1, 2025 AT 08:28Kraken’s fee schedule, especially the 0% maker rate for high‑volume traders, is a strong incentive for active market makers; however, it’s crucial to note that this benefit comes with increased exposure to market volatility. The platform’s extensive fiat support simplifies onboarding for new users, but the ACH fee of 0.5% can erode profit margins on smaller trades. Overall, the exchange offers a solid blend of security, liquidity, and feature set, making it a compelling choice for diversified trading strategies.

Adetoyese Oluyomi-Deji Olugunna

January 1, 2025 AT 14:01Kraken’s extensive asset lineup is impressive; yet, the UI sometimes feels cluttered, especially for newcomers.

Krithika Natarajan

January 1, 2025 AT 19:34The staking rewards are decent and the platform feels safe.

Ayaz Mudarris

January 2, 2025 AT 01:08In light of the recent regulatory developments, it is incumbent upon traders to adopt a disciplined approach when evaluating exchange platforms. Kraken’s adherence to FinCEN registration and multi‑jurisdictional licensing exemplifies a commitment to compliance that should be lauded. Nevertheless, the requisite verification timeline remains a hurdle that could be mitigated through enhanced automation. As we anticipate the forthcoming IPO, investors ought to balance the allure of potential growth with a rigorous assessment of operational resilience. Ultimately, a judicious blend of security awareness and strategic utilization of the platform’s advanced tools will yield the most favorable outcomes.

Irene Tien MD MSc

January 2, 2025 AT 06:41Oh, sure, Kraken’s “proof‑of‑reserves” is as trustworthy as a politician’s promise during election season, right? The whole thing feels like a grand illusion designed to lull the masses into a false sense of security while the real puppet masters pull the strings behind the curtain. And don’t even get me started on the 0.9% stablecoin fee – it’s practically a tax on anyone who dares to be cautious in this chaotic market. Meanwhile, the alleged 95% cold‑storage is probably just a nice PR line, with the remaining 5% hot wallets serving as a juicy target for any savvy hacker. In short, if you trust Kraken, you might as well hand over your keys to the NSA and hope for the best.

Kevin Fellows

January 2, 2025 AT 12:14Even with the fees, Kraken still feels like a solid place to trade, especially for those who want more than the basics.

meredith farmer

January 2, 2025 AT 17:48The conspiracies aren’t just about fees; they’re about who’s watching your every move behind that sleek interface. Kraken’s security claims are nothing but a smoke‑screen for data harvesting that fuels the deep‑state’s crypto agenda. If you’re not comfortable with that, you should probably stay away.

mark gray

January 2, 2025 AT 23:21It’s encouraging to see the platform’s growth, but let’s keep an eye on user feedback to ensure the experience stays balanced for everyone.