Isolated vs Cross Margin Decision Helper

Trading Style Assessment

Answer these questions to determine which margin mode suits your trading approach best.

Your Recommendation

Margin Mode Comparison

| Feature | Isolated Margin | Cross Margin |

|---|---|---|

| Risk Cap | Limited to allocated amount | Potentially whole account |

| Capital Efficiency | Lower - unused funds sit idle | Higher - all equity works as collateral |

| Management Style | Active - manual margin adjustments | Passive - system auto-adjusts |

| Best For | High conviction, high leverage trades | Multi-position portfolios, hedged strategies |

| Liquidation Risk | Immediate once allocated margin depleted | Delayed, but can wipe out entire balance |

| Learning Curve | Steeper - monitor each position | Gentler - focus on overall equity |

When you start trading crypto derivatives, the first decision you’ll face is whether to use isolated margin vs cross margin. Both methods let you trade on leverage, but they handle risk very differently. Picking the wrong one can turn a small loss into a wipe‑out, while the right choice can keep your capital intact and let you focus on strategy instead of constant margin math.

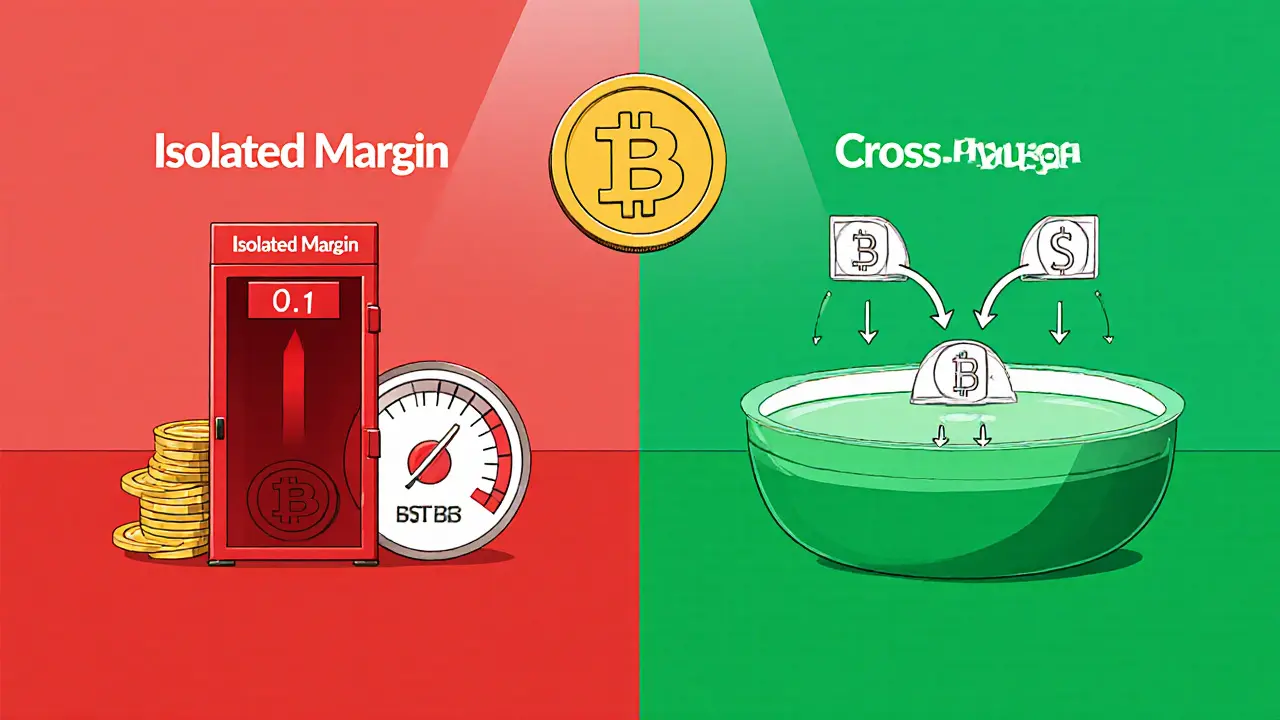

What Exactly Are Isolated and Cross Margin?

Both terms describe how an exchange allocates the funds in your account to cover a leveraged position. In Isolated Margin a risk‑management mode that limits the amount at risk to a specific, pre‑allocated pool for each individual trade, you set aside a fixed amount of margin for a single position. If that trade goes against you, the loss cannot exceed the amount you allocated, and the rest of your balance stays untouched.

In Cross Margin a mode that uses the entire available account balance as collateral for all open positions, the exchange automatically draws from any free equity or unrealized profits to keep every position above its liquidation level. One losing trade can pull funds from another winning trade, which can prevent an immediate liquidation but may also erode the whole account if several positions move together.

How Isolated Margin Works in Practice

Imagine you have 1BTC on BitMEX a leading crypto futures exchange that popularized isolated and cross margin modes. You decide to open a short Bitcoin futures contract with 10× leverage. With isolated margin, you specifically allocate 0.1BTC as the position margin. Even if the market spikes and your position would require 0.5BTC to stay afloat, the exchange will liquidate you once the allocated 0.1BTC is exhausted, leaving the remaining 0.9BTC safe.

This approach gives you crystal‑clear visibility: the maximum loss you can suffer on that trade is exactly the amount you set aside. If you later want to increase exposure, you must manually add more margin to that position, which updates the liquidation price in real time.

How Cross Margin Operates Behind the Scenes

Now consider the same 1BTC balance, but you enable cross margin on BitMEX. You open the identical 10× short position, but you don’t specify a separate margin amount. The exchange treats the entire 1BTC as collateral for all positions you hold. If the market moves against your short, the system automatically pulls funds from any unrealized gains in other contracts or from the free portion of the 1BTC to keep the short alive. Only when the total equity (balance+unrealized P&L) falls below the maintenance margin will the exchange trigger liquidation.

This automatic fund‑shuffling means you can sustain short‑term dips without immediate panic. However, a cascade of losses across several correlated positions can drain the whole account before you even notice the danger.

Pros and Cons: A Side‑by‑Side Look

| Feature | Isolated Margin | Cross Margin |

|---|---|---|

| Risk cap per trade | Limited to allocated amount | Potentially whole account |

| Capital efficiency | Lower - unused funds sit idle | Higher - all equity works as collateral |

| Management style | Active - you add/remove margin manually | Passive - system auto‑adjusts |

| Best for | High‑conviction, high‑leverage single trades | Multi‑position portfolios, hedged strategies |

| Liquidation risk | Immediate once allocated margin depleted | Delayed, but can wipe out entire balance |

| Learning curve | Steeper - need to monitor each position | Gentler - focus on overall equity |

Notice how the trade‑off is not about "better" or "worse" but about which set of trade‑offs aligns with your style.

When to Choose Isolated Margin

If you’re a speculative trader who wants to test a bold idea without endangering the rest of your stash, isolated margin is the natural fit. It shines in these scenarios:

- High‑leverage bets (e.g., 50× or 100×) where a small move can erase the stake.

- Back‑testing a new strategy on a sandbox account and allocating only a fraction of capital.

- Positions that are not correlated, so you don’t need the safety net of cross‑collateral.

Platforms like Binance one of the world’s largest crypto exchanges offering both isolated and cross margin modes and PrimeXBT a broker that provides isolated margin with instant leverage adjustment sliders give clear UI controls to set the exact amount you’re willing to risk.

When Cross Margin Makes Sense

Cross margin works best for traders who view their portfolio as a whole and want the system to automatically protect against short‑term squeezes. Ideal use‑cases include:

- Hedged positions where gains on one contract offset losses on another.

- Long‑term swing trades that sit alongside smaller day‑trade positions.

- Beginners who prefer not to juggle separate margin pools per trade.

Because the exchange pools all equity, a modest dip in one market can be smoothened by profits elsewhere, reducing the frequency of forced liquidations.

Practical Tips to Avoid Common Pitfalls

- Know your liquidation price. Both modes calculate liquidation differently. In isolated margin, it’s a static price based on the allocated margin. In cross margin, the price shifts as profits and losses from other contracts change your total equity.

- Monitor margin ratio. Most exchanges display a "margin ratio" (equity÷maintenance margin). Keep it comfortably above the minimum - a ratio of 200% or higher gives a buffer against sudden moves.

- Use stop‑loss orders. Even though isolated margin caps loss, a stop‑loss can close the position before it reaches the liquidation threshold, preserving your allocated margin for future trades.

- Don’t over‑leverage on cross margin. Because the system will pull from the entire balance, a high leverage on a single position can inadvertently expose all your other trades to risk.

- Regularly rebalance. If you’re on cross margin, periodically check that unrealized gains aren’t creating hidden exposure. Pull profits out or reduce position sizes to keep the risk profile where you want it.

Decision Tree: Which Mode Fits Your Strategy?

Answer these quick questions to land on a recommendation:

- Do you trade only a few high‑conviction positions?

Yes → Isolated Margin. - Do you run several correlated or hedged contracts?

Yes → Cross Margin. - Are you comfortable topping up margin manually when a trade moves against you?

Yes → Isolated Margin. - Do you prefer the platform to handle margin adjustments automatically?

Yes → Cross Margin.

Most traders end up using a hybrid approach: isolated margin for speculative, high‑risk bets and cross margin for the core portfolio that generates steady returns.

Frequently Asked Questions

Can I switch between isolated and cross margin on the same trade?

Yes. Most exchanges let you toggle the mode before the position is opened. After a trade is live, you typically need to close it and reopen with the desired margin type, because the margin allocation is baked into the contract at execution.

Does cross margin protect me from losing my entire account?

It reduces the chance of an immediate liquidation by auto‑borrowing from other positions, but if multiple contracts move against you simultaneously, the whole equity can still be wiped out.

Which margin type is more tax‑efficient?

Tax treatment depends on jurisdiction, not the margin mode. However, isolated margin makes it easier to isolate gains and losses for reporting because each position’s P&L is capped at the allocated amount.

Do decentralized exchanges (DEXs) offer isolated or cross margin?

Most DEXs use smart‑contract based collateral that behaves more like cross margin - the whole locked balance secures all open positions. Some newer protocols are experimenting with isolated vaults, but they’re not yet mainstream.

Is one mode better for beginners?

Cross margin is generally easier because the platform handles margin calls automatically. Beginners should start with low leverage and consider cross margin until they grasp how isolated margin allocation works.

Understanding the mechanics behind isolated and cross margin equips you to match the right tool with your risk appetite and trading plan. Whether you lock a precise amount for a high‑stakes bet or let the system pool all your equity for a diversified portfolio, the key is to stay aware of how liquidation thresholds are calculated and to monitor your margin ratio every day.

Ready to experiment? Open a demo account on your favorite exchange, try a small isolated position, then flip to cross margin for a multi‑contract setup. The experience will reveal which mode feels more comfortable for your style, and you’ll avoid costly surprises when the market gets volatile.

Finance

Finance

Mark Briggs

February 22, 2025 AT 09:47Nice deep dive, really needed the extra five paragraphs.

mannu kumar rajpoot

March 3, 2025 AT 16:00Honestly, the whole "isolated vs cross" narrative is just a smokescreen designed by the exchanges to keep us guessing, while they pull the strings behind the scenes.

Tilly Fluf

March 12, 2025 AT 22:14Thank you for sharing this comprehensive overview; it will undoubtedly assist many traders in making an informed decision.

Darren R.

March 22, 2025 AT 04:27Behold, the grand theater of margin selection, where every misguided soul must choose between the shackles of isolation and the abyss of cross‑collateral, a decision fraught with peril, yet gloriously dramatic, for those who dare to gamble their digital fortunes!; Yet, let us not be fooled by the seductive allure of "higher capital efficiency," for it merely masks the lurking specter of total account wipe‑out, a fate that haunts the reckless.

Hardik Kanzariya

March 31, 2025 AT 11:40Exactly, keep your risk profile in mind and remember you can always start small. If things go south, you’ll still have room to learn.

Millsaps Delaine

April 9, 2025 AT 17:54Allow me to elucidate the profound philosophical ramifications inherent in the dichotomy between isolated and cross margin, for it is not merely a mechanical choice but an existential one that reflects the trader's very conception of control and surrender. In the realm of isolated margin, the practitioner asserts dominion over a discrete parcel of capital, thereby embracing a micro‑cosmic governance wherein each position is encased within its own protective chrysalis. This encapsulation furnishes a crystalline clarity: the maximum loss is mathematically bounded, and the psychological comfort derived therefrom is reminiscent of a well‑structured sonnet, each line meticulously measured. Conversely, cross margin epitomizes a holistic paradigm, a macrocosm where the entirety of one's equity is interwoven into a single tapestry of collateral. Here, the trader relinquishes granular oversight in exchange for a fluid, adaptive allocation that can immunize individual positions against transient market tremors. However, this very fluidity harbors a latent peril; in the event of simultaneous adverse moves across multiple contracts, the collective exposure can cascade, leading to a catastrophic diminution of capital, an event akin to a symphonic crescendo that culminates in dissonance. The decision, therefore, hinges upon an intricate calculus of risk appetite, strategic horizon, and psychological disposition. If one's disposition aligns with precision, risk compartmentalization, and the desire for discrete accountability, isolated margin emerges as the logical conduit. Should one favor an aggregated risk framework, wherein the system's auto‑balancing mechanisms are trusted to smooth volatility, cross margin becomes the appropriate vessel. Moreover, the trader must also contemplate operational efficiency: isolated positions demand continual monitoring, manual margin top‑ups, and vigilant liquidation price tracking-an intellectual exercise that can become onerous for those with limited temporal resources. Cross margin, by contrast, offers a more laissez‑faire approach, albeit at the expense of heightened vigilance over portfolio‑wide equity ratios. In summation, the choice between isolated and cross margin transcends mere technical specifications; it is a reflection of one's ontological stance toward risk, control, and the ever‑present specter of market entropy.

Jack Fans

April 19, 2025 AT 00:07Indeed, the granular control that isolated margin offers can be a double‑edged sword; it's like having a scalpel-precise but requiring a steady hand, while cross margin feels more like a broad brush, covering everything in one sweep, yet sometimes obscuring the finer details!!! Also, watch out for the occasional typo that slips in-its a purrfect reminder that even experts make missteps.

Adetoyese Oluyomi-Deji Olugunna

April 28, 2025 AT 06:20One must also consider the sociocultural implication of margin selection; it reflects not only strategic acumen but also a certain intellectual pedigree, albeit occasionally marred by typographical oversights-such as 'excellant' versus 'excellent', which betray the veneer of refinement.

Krithika Natarajan

May 7, 2025 AT 12:34I appreciate the balanced view presented here; it is helpful for newcomers. The guidance on monitoring margin ratio is particularly valuable.

kishan kumar

May 16, 2025 AT 18:47From a philosophical perspective, the interplay between isolated and cross modalities can be interpreted as a dialectic between autonomy and interdependence; one must weigh the merits carefully :)

Kevin Fellows

May 26, 2025 AT 01:00Super helpful, thanks for breaking it down in plain English!

Peter Johansson

June 4, 2025 AT 07:14Great advice! Remember, a solid stop‑loss is like a safety net-essential for any trader :)

Cindy Hernandez

June 13, 2025 AT 13:27This guide offers a clear roadmap for margin decisions. It’s a valuable resource for both beginners and seasoned traders.

victor white

June 22, 2025 AT 19:40One cannot help but notice how the narrative subtly nudges you toward a particular paradigm, a gentle coaxing that feels almost conspiratorial in its elegance; the hues of language paint a picture that is simultaneously alluring and disquieting.

Christina Norberto

July 2, 2025 AT 01:54The exposition above, while ostensibly thorough, appears to be a veneer masking an underlying agenda to perpetuate systemic risk, thereby endangering the very fabric of market integrity.

Fiona Chow

July 11, 2025 AT 08:07Oh, because nothing says “smart trading” like reading a 10‑page essay before you place a single trade, right?

Angela Yeager

July 20, 2025 AT 14:20Thanks for the friendly reminder to keep an eye on liquidation thresholds. It’s a solid tip for all of us.

vipin kumar

July 29, 2025 AT 20:34Remember, the exchange’s algorithm isn’t neutral; it’s designed to funnel profits to the insiders, so stay vigilant and diversify across platforms.

Shanthan Jogavajjala

August 8, 2025 AT 02:47From a systems‑engineering standpoint, the choice between isolated and cross margin maps directly onto resource allocation strategies: isolated = static partitioning, cross = dynamic pooling; each has trade‑offs in latency, throughput, and fault tolerance.