LP Yield Calculator

THENA FUSION Liquidity Calculator

Calculate potential returns from FUSION pools versus standard liquidity pools. Based on article data showing 35% improvement for pegged price pools.

Estimated Returns

Enter your parameters to see results

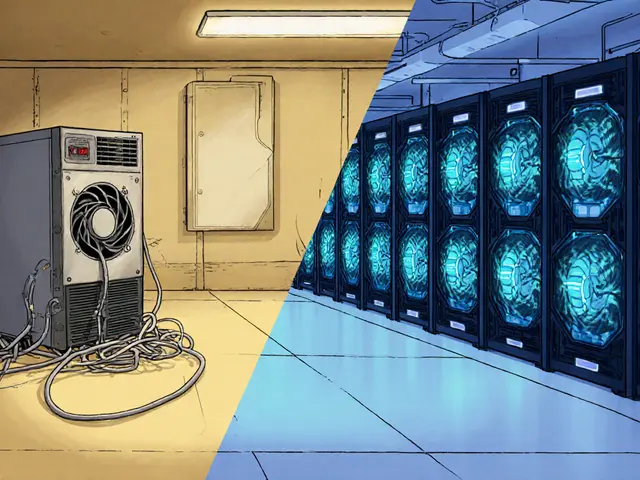

Most crypto traders juggle multiple apps just to swap tokens, trade futures, and chase rewards. You open one app for spot trading, another for leverage, and a third just to stake your liquidity. It’s messy. That’s where THENA FUSION steps in - promising to pack everything into one clean interface. But does it actually deliver, or is it just another overhyped DeFi project?

What Is THENA FUSION?

THENA FUSION is not just another decentralized exchange. Launched in 2023, it’s built on BNB Chain and opBNB as a DeFi SuperApp - meaning it combines spot trading, perpetual futures, and social trading tools in a single platform. Unlike Uniswap or PancakeSwap, which focus mostly on swapping tokens, THENA lets you trade spot pairs, open leveraged positions up to 60x, and join trading competitions - all without switching apps.

The core innovation is called FUSION pools. These aren’t your standard liquidity pools. Developed with Gamma Strategies and Algebra, they use concentrated liquidity to reduce impermanent loss. You can choose from six pool types: wide, narrow, manual, pegged price, correlated, and stable. This lets liquidity providers tailor their risk based on market conditions - something most DEXs don’t offer.

How Trading Works on THENA FUSION

THENA splits its services into three main parts: THENA Spot DEX, ALPHA Perpetuals, and ARENA.

THENA Spot DEX handles token swaps with advanced routing that cuts slippage. It supports limit orders and TWAP (Time-Weighted Average Price) trades through dLIMIT and dTWAP protocols powered by Orbs. That’s rare on a DEX - you usually need a centralized exchange for these tools.

ALPHA Perpetuals is where things get spicy. You can trade 270+ crypto pairs with up to 60x leverage. The platform uses SYMMIO’s intent-based model, which means orders are executed more efficiently and with lower funding rates than traditional perpetuals. It’s designed for active traders who want to go long or short without managing margin manually.

ARENA turns trading into a game. Users compete in weekly leaderboards based on P&L, with prizes paid in THE tokens. It’s not just for show - it drives volume and keeps users engaged. You’ll see traders sharing strategies in Discord, trying to climb the ranks. It’s social trading, but without the fluff of TikTok-style influencers.

Liquidity Pools: The Real Game-Changer

If you’re a liquidity provider, THENA’s FUSION pools are worth your attention. Traditional AMMs like Uniswap v2 force you to spread your funds across a wide price range. That means your capital sits idle most of the time. FUSION pools let you concentrate liquidity where it’s most needed - say, around the current price of BTC/USDT.

Here’s what that looks like in practice: a user on Reddit reported a 35% improvement in returns on stablecoin pairs after switching from standard pools to FUSION’s pegged price pool. That’s not marketing speak - it’s measurable. The platform also adjusts fees dynamically for manual and FUSION pools, so providers can optimize earnings during volatile markets.

Stable pools (V1) charge a flat 0.01% fee, while variable pools charge 0.02%. That’s lower than most centralized exchanges on small trades. But here’s the catch: 87% of THENA’s total volume comes from just one pair - BSC-USD/USDC. That means liquidity is thin on other pairs. If you’re trying to trade a lesser-known token, you might get slippage or poor fills.

Who Is THENA FUSION For?

THENA isn’t for beginners. If you’ve never connected a wallet or paid gas fees, you’ll be overwhelmed. The interface is dense. One user on CoinGecko’s forum said it took them three hours to get comfortable - compared to 30 minutes on Uniswap. You need to understand AMMs, leverage, and liquidity provision before diving in.

But if you’re already trading DeFi daily - staking, farming, shorting - THENA saves you time. No more switching between PancakeSwap, Bybit, and Balancer. Everything’s in one place. The platform also supports wallet abstraction, which simplifies onboarding for newcomers. You can log in with email or social accounts, even if your wallet is still connected in the background.

Most users (68%) have been in DeFi for over a year. The community is active: 45,000+ members across Telegram and Discord. If you get stuck, someone’s usually there to help. Documentation scores 4.2/5 - solid for basics, but weak on advanced FUSION strategies. You’ll need to dig into YouTube tutorials or Discord threads to master concentrated liquidity setups.

Pros and Cons

- Pros: All-in-one platform (spot, perps, social trading), low slippage thanks to advanced routing, concentrated liquidity reduces impermanent loss, high leverage (60x), active community, low fees on stable pools, THE token rewards for LPs and traders.

- Cons: Steep learning curve, liquidity concentrated on BSC-USD/USDC, only available on BNB Chain (no Ethereum or Solana support), complex migration for existing LPs, UI feels cluttered for casual users, limited educational resources for advanced features.

How It Compares to Competitors

On BNB Chain, THENA sits third behind PancakeSwap and Biswap in trading volume. But it’s not competing on volume alone - it’s competing on features. PancakeSwap is simple and popular, but it doesn’t offer perpetuals or social trading. Biswap has leverage but no concentrated liquidity pools.

Compared to centralized exchanges like Binance or Bybit, THENA has lower trading fees and no KYC. But you’re trading against a pool, not an orderbook. That means less precision on large orders. For small to medium trades, it’s fine. For institutional-sized trades? You’ll still need a CEX.

On Ethereum, Uniswap v3 has concentrated liquidity too - but no built-in leverage or gamified trading. THENA’s edge is integration. You don’t need to bridge to another protocol to trade futures. Everything happens on-chain, in one app.

Security and Regulation

THENA keeps its decentralized structure to avoid regulatory scrutiny. No KYC, no fiat on-ramps (yet). That’s a plus for privacy, but a risk if you’re in a strict jurisdiction. The platform hasn’t had any major exploits, but its complexity raises red flags. More features = more code = more potential bugs. Audits are public, but most users don’t read them.

Gas fees are low because it runs on BNB Chain. You’ll pay less than $0.50 per trade on average. That’s a big win over Ethereum-based DEXs, where fees can spike to $10+ during congestion.

The THE Token and Rewards

THE is the native token of the THENA ecosystem. 44% of tokens are allocated to users and liquidity providers. Only 18% went to the team - that’s a good sign. It’s listed on MEXC and other exchanges, with daily volume over $5 million as of November 2023.

You earn THE by providing liquidity, trading, and participating in ARENA competitions. Rewards are distributed weekly. The token isn’t just a governance tool - it’s a performance incentive. If you’re active on the platform, you’ll accumulate THE faster than staking on most DeFi protocols.

Future Roadmap

THENA isn’t resting. The roadmap includes AI-driven trading signals, cross-chain expansion beyond BNB Chain, and simplified onboarding for mainstream users. If they pull off cross-chain support - say, adding Ethereum or Solana - they could become a top-5 DEX globally.

Right now, they’re focused on fixing liquidity fragmentation. They’ve already seen a 23.57% volume bump in the week ending November 10, 2023, after a previous dip. That suggests user confidence is returning.

Final Verdict

THENA FUSION is not for everyone. If you’re new to crypto, stick with a simple app like MetaMask Swap or PancakeSwap. But if you’re already deep in DeFi - trading leverage, staking LP tokens, chasing yield - THENA saves you hours every week. The integration of spot, perps, and social trading is unmatched on a decentralized platform.

The liquidity issue on minor pairs is a real concern. And the UI still feels like it was built by engineers, not designers. But the innovation here is real. FUSION pools alone could redefine how liquidity providers think about risk.

For experienced DeFi users looking for a one-stop shop that doesn’t compromise on features, THENA FUSION is one of the most compelling options on BNB Chain. Just be ready to learn. And keep an eye on that cross-chain expansion - that’s where the real growth will happen.

Finance

Finance

Jennifer Morton-Riggs

November 26, 2025 AT 00:05THENA FUSION feels like someone glued together five different DeFi apps and called it innovation. I get the appeal, but if I have to learn six types of liquidity pools just to swap ETH for USDC, I might as well use a CEX and call it a day.

Gus Mitchener

November 26, 2025 AT 16:26The real philosophical tension here isn't about liquidity concentration-it's about the epistemological collapse of decentralized finance. When trading becomes gamified through ARENA, and incentives are tokenized into THE, we're not building financial infrastructure-we're constructing a behavioral Skinner box wrapped in smart contracts. The liquidity providers aren't arbitrageurs anymore; they're conditioned operators in a closed-loop reward system. And the worst part? It works.

Kathy Alexander

November 28, 2025 AT 08:5960x leverage on a DEX? That's not innovation, that's financial recklessness dressed up as DeFi. You think concentrated liquidity reduces impermanent loss? Try telling that to the 70% of LPs who got wiped out during the 2022 bear market. This isn't a platform-it's a casino with a whitepaper.

Soham Kulkarni

November 28, 2025 AT 16:51bro i tried thena last week after reading this. honestly its a lot to take in. i used to use pancakeswap, now i have to learn dlimit, dtwap, fusion pools... its like learning a new language. but once you get it? its smooth. im still learning tho 😅

Tejas Kansara

November 29, 2025 AT 13:03Start with stablecoin pairs. FUSION pools on USDC/USDT are where the real yield is. Skip the volatile tokens until you're comfortable.

Rajesh pattnaik

December 1, 2025 AT 01:53in india we dont have much access to leverage trading but i follow thena because the community is actually helpful. no one hypes, no one scams. just people sharing tips. respect.

Lisa Hubbard

December 2, 2025 AT 10:02I read this whole thing. Twice. And I still don't know if I'm supposed to be impressed or terrified. The interface looks like a Bloomberg terminal threw up on a React app. And don't even get me started on the fact that 87% of volume is one pair. That's not a DEX, that's a monoculture. And monocultures collapse. Remember the Terra implosion? This feels like Terra 2.0 with better UI design.

preet kaur

December 2, 2025 AT 19:03to the person who said it's too complex-i felt the same. but i watched three youtube tutorials and joined the discord. now i make more from LPing than my part-time job. it's not for everyone, but if you're willing to learn, it pays off. no one owes you easy money.

Emily Michaelson

December 3, 2025 AT 15:15For new LPs: start with the pegged price pool on USDC/USDT. The fee structure is predictable, and the slippage is minimal. Avoid manual pools until you've tracked at least 30 days of price action. Also, check the audit reports-THENA’s been clean, but complexity increases attack surface.

Amanda Cheyne

December 3, 2025 AT 18:05They say it's decentralized but who really controls the FUSION pool algorithms? Gamma Strategies? Algebra? Those names sound like front companies for a hedge fund. And why is there no Ethereum support? Because they don't want SEC eyes on them. This is a regulatory avoidance play disguised as DeFi. They're building a honeypot for retail, then pulling the rug when the volume peaks.

Anne Jackson

December 5, 2025 AT 05:58Why is everyone so obsessed with BNB Chain? We have Ethereum. We have Solana. We have Polygon. Why are we giving our money to a platform that only works on a chain owned by a centralized exchange? This is just Binance’s way of keeping us in their walled garden. They don’t want freedom-they want control with a blockchain veneer.

David Hardy

December 7, 2025 AT 01:30Just tried the ARENA leaderboard. Got 3rd place this week. Made $47 in THE tokens. Feels good. The UI is clunky but the rewards are real. Keep grinding, folks. 🚀

Matthew Prickett

December 7, 2025 AT 19:32Did you know the team behind THENA used to work for a crypto scam that got shut down in 2021? The same people. Same wallets. Same whitepaper tricks. They just changed the name. The ‘audits’? Paid for by their own treasury. The ‘community’? Bot accounts. The ‘volume bump’? Wash trading. I’ve been tracking their on-chain activity for 18 months. This isn’t DeFi. It’s a sophisticated pump-and-dump with a UI.

Caren Potgieter

December 9, 2025 AT 17:26i live in south africa and we dont have easy access to cexs so dexc like this are lifesavers. yes its complex but its better than losing money to sketchy p2p traders. i dont understand all the tech but i trust the community here. keep it real guys

Jennifer MacLeod

December 11, 2025 AT 06:19the fact that they support wallet abstraction is huge. i logged in with gmail and my wallet just worked. no seed phrase typing. no panic. this is how onboarding should work

Linda English

December 12, 2025 AT 09:40I understand the appeal of integration, but I'm deeply concerned about the cognitive load placed on users. The interface is not intuitive, the terminology is overwhelming, and the educational resources are insufficient for true accessibility. This is not empowerment-it's exclusion disguised as innovation. If DeFi is meant to be open to all, then we must prioritize clarity over complexity. Otherwise, we're just recreating the same gatekeeping we claim to oppose.

asher malik

December 12, 2025 AT 16:31the 60x leverage is insane but the funding rates are actually lower than bybit? that's wild. i tested it with 10x on btc/usdt and the liquidation risk felt manageable. still scared to go higher though

Julissa Patino

December 13, 2025 AT 11:16thena fusion? more like thena fiasco. 87% volume on one pair? lol. and you call that decentralization? its a single point of failure with a fancy dashboard. and the tokenomics? 44% to users? sure. but how many of those users are bots? i bet half of them are fake. this is just another rug waiting to be pulled

Omkar Rane

December 13, 2025 AT 16:29as someone from india i can say this: the real win here is the low gas fees. on eth i pay $8 just to swap, here its 20 cents. and the community is actually helpful. yes the ui is messy but i can trade, stake, and compete all in one place. no more juggling 5 tabs. its not perfect but its progress

Daryl Chew

December 14, 2025 AT 07:30They're using AI signals in the roadmap? That's the red flag. AI trading signals on DeFi? That's not tech-it's a prediction market for retail sheep. They're training algorithms to predict your behavior so they can front-run you. And you're all just handing over your data like it's free candy. Wake up.

Tyler Boyle

December 15, 2025 AT 19:08Let’s be real-the only reason THENA is gaining traction is because BNB Chain is cheap and PancakeSwap is stale. This isn’t revolutionary; it’s iterative. They took Uniswap v3, added leverage from Bybit, threw in a leaderboard from Discord, and called it a ‘superapp.’ It’s clever, sure, but it’s not a paradigm shift. The real innovation would be if they solved cross-chain liquidity without bridges. They haven’t. And until they do, this is just a glorified BNB Chain aggregator.

Jane A

December 17, 2025 AT 17:36Anyone who says this is good for beginners is lying. This is a trap for people who don’t know what impermanent loss is. Don’t be fooled by the shiny buttons. This is how you lose your life savings.

jocelyn cortez

December 19, 2025 AT 02:28My first time using THENA, I got confused and almost sent funds to the wrong pool. Took me 45 minutes to figure out the difference between narrow and correlated. But after that? I made 12% in two weeks on stablecoins. It’s not for everyone, but if you take the time to learn, it’s worth it.

Belle Bormann

December 20, 2025 AT 13:11just tried the dlimit order and it worked! i set it for eth at 3100 and it filled when price hit. no more refreshing the page. this is what i wanted from a dex

Jody Veitch

December 21, 2025 AT 16:26It’s amusing how people praise this as ‘decentralized innovation’ while ignoring that the entire ecosystem is built on Binance’s infrastructure. BNB Chain is not decentralized-it’s a permissioned sidechain with a few validators. This isn’t Web3; it’s Web2.1 with a crypto veneer. The ‘community’ is just Binance’s marketing arm with wallets.