ASIC Miner Performance Calculator

Mining Performance Summary

Efficiency:

Daily Earnings:

Monthly Earnings:

Annual Earnings:

Net Annual Profit:

ROI Period:

| Metric | ASIC (Antminer S19 Pro) | GPU (RTX 3080) | CPU (Intel i9-13900K) |

|---|---|---|---|

| Hash Rate | 110 TH/s | 0.5 TH/s | 0.02 TH/s |

| Power Consumption | 3,250 W | 320 W | 125 W |

| Joules per Terahash | 29 J/TH | 640 J/TH | 6,250 J/TH |

| Initial Cost (USD) | $5,200 | $1,200 | $500 |

When you hear the term ASIC miner is a specialized hardware device built solely to solve a particular cryptographic algorithm for a blockchain network, you might picture a humming box in a garage or a massive rack in a data centre. In reality, an ASIC miner is the workhorse that keeps Bitcoin and many other Proof‑of‑Work coins moving, delivering hash power that ordinary computers simply can’t match. If you’re curious about why these machines matter, how they differ from GPUs or CPUs, and what you need to consider before buying one, you’ve landed in the right spot.

Quick Take

- ASIC miners are purpose‑built chips that hash a single algorithm (e.g., SHA‑256 for Bitcoin) at extreme speed.

- They outperform GPUs and CPUs by 10‑100× in hash rate while using far less electricity per hash.

- Major manufacturers include Bitmain (Antminer series) and Canaan Creative (Avalon line).

- Upfront costs run from a few hundred dollars for entry‑level units to tens of thousands for industrial models.

- Profitability hinges on electricity rates, mining difficulty, and the price of the coin you mine.

What Exactly Is an ASIC Miner?

An ASIC (Application‑Specific Integrated Circuit) miner is a chip designed to execute ONE cryptographic function over and over. Unlike a CPU that can run a spreadsheet or a GPU that renders video games, an ASIC’s circuitry is hard‑wired for a single task-solving the hash puzzle for a specific blockchain.

Because the chip never has to switch contexts or run generic code, it can calculate hashes millions of times per second. For Bitcoin’s SHA‑256 algorithm, modern units like the Antminer S19 Pro push around 110TH/s (terahashes per second) while sipping roughly 3250W of power.

How ASIC Miners Work

Mining is the process of confirming transactions and adding new blocks to a blockchain. Here’s the simplified flow:

- The network broadcasts a block header that includes a list of pending transactions.

- Miners repeatedly hash the header plus a changing "nonce" value.

- When a hash output falls below the network’s target difficulty, the block is considered solved.

- The winning miner broadcasts the solution, earns the block reward (new coins + fees), and the block is appended.

ASIC miners excel at step 2 because they can churn through billions of hash attempts per second, giving them a much higher chance of being the first to hit the target.

Why ASICs Beat GPUs and CPUs

| Metric | ASIC (Antminer S19 Pro) | GPU (RTX 3080) | CPU (Intel i9‑13900K) |

|---|---|---|---|

| Hash Rate | 110TH/s | 0.5TH/s (approx.) | 0.02TH/s (approx.) |

| Power Consumption | 3250W | 320W | 125W |

| Joules per Terahash | 29J/TH | 640J/TH | 6250J/TH |

| Initial Cost (USD) | $5200 | $1200 | $500 |

The table makes it crystal clear: ASICs deliver the most hashes for the least electricity, which is why they dominate Bitcoin mining. GPUs still have a role in mining coins that use different algorithms, such as Ethereum’s former Ethash (now PoS) or Ravencoin’s KawPoW, but they’re a poor fit for SHA‑256.

Major Players and Popular Models

Two companies dominate the market:

- Bitmain - Best known for the Antminer series. The current flagship, Antminer S19 Pro, blends raw power with a relatively efficient 29J/TH.

- Canaan Creative - Introduced the Avalon line. The Avalon110 offers a slightly lower hash rate (73TH/s) but a comparable efficiency.

Other noteworthy manufacturers include MicroBT (M30S++) and Bitfury (B8). All these devices share three core components: a set of ASIC chips, an integrated power supply, and a cooling system (typically multiple high‑speed fans).

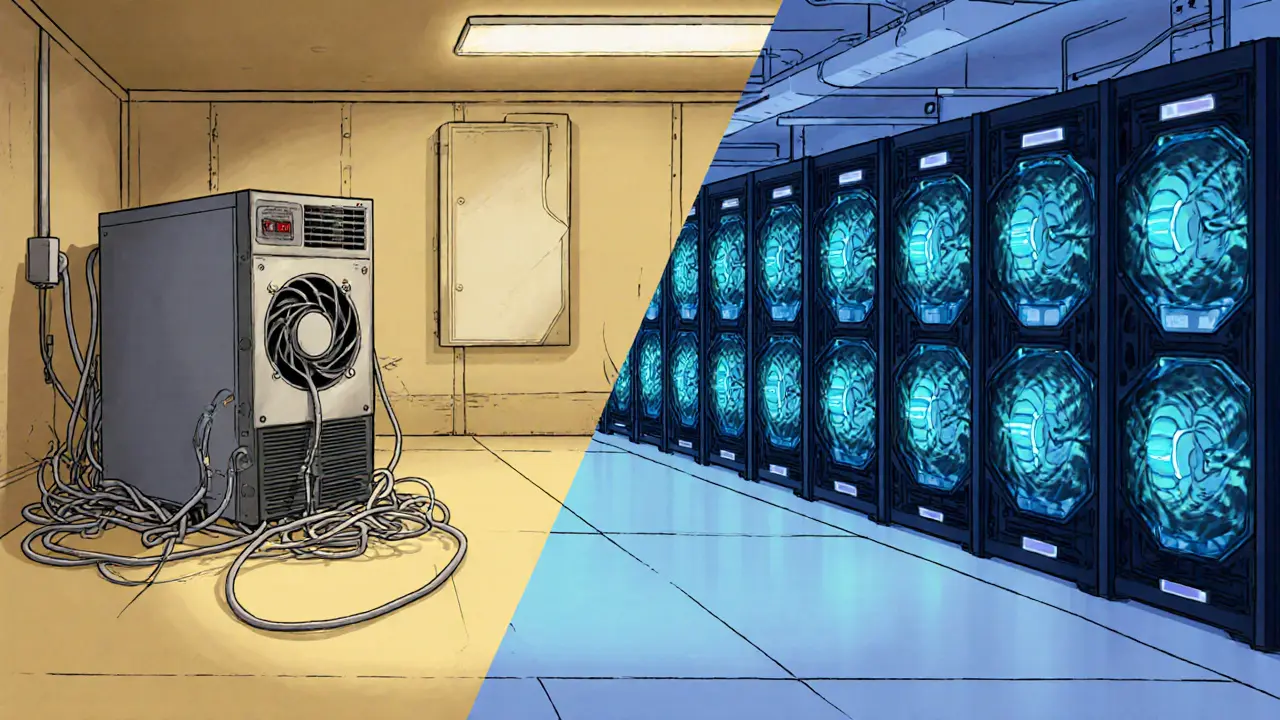

Getting Started: What You Need to Run an ASIC Miner

Before you rush out to buy hardware, make sure you’ve covered these basics:

- Electricity cost analysis - Calculate watts per terahash and multiply by your local kWh rate. In the UK, average residential rates hover around £0.34/kWh, which can erode profits quickly.

- Stable power outlet - Most units require a dedicated 220‑240V circuit with a minimum amperage rating (often 10‑15A per miner).

- Cooling space - ASICs generate 2‑4kW of heat. A well‑ventilated room or industrial‑grade HVAC is essential.

- Internet connection - A wired Ethernet link with low latency ensures your miner stays in sync with the network.

- Mining pool membership - Solo mining a major coin like Bitcoin is practically impossible for a single device. Join a pool such as slushpool or F2Pool to receive steady payouts.

Setup steps are fairly straightforward: unpack, connect power and Ethernet, flash the firmware (most manufacturers provide a web‑based UI), input your pool credentials, and start the hash.

Cost, Profitability, and Risks

Profit calculators take three inputs - hash rate, power consumption, and electricity cost - then factor in the current coin price and network difficulty. As of October2025, a single Antminer S19 Pro at a UK electricity rate of £0.34/kWh yields roughly £1.8 per day in Bitcoin earnings, translating to about £650 annually after electricity expenses. That’s a modest return on a £5200 investment, highlighting two key risks:

- Difficulty spikes - Every two weeks the Bitcoin network adjusts difficulty. A sudden jump can make your miner temporarily unprofitable.

- Hardware obsolescence - Newer ASICs improve efficiency by 10‑15% each year. An older unit may become non‑competitive within 18‑24 months.

Some miners mitigate risk by diversifying into coins that use other algorithms (e.g., Litecoin’s Scrypt) or by securing low‑cost renewable energy contracts.

Future Trends: Efficiency, Sustainability, and the PoW Landscape

Environmental pressure is nudging manufacturers toward greener designs. The latest 2025 releases from Bitmain and MicroBT claim sub‑29J/TH efficiencies, achieved through smaller nanometer processes and advanced heat‑pipe cooling.

At the same time, the broader crypto ecosystem is seeing a shift: major coins like Ethereum have already moved to Proof‑of‑Stake, reducing the overall demand for mining hardware. Nonetheless, Bitcoin and a handful of other PoW chains (e.g., Litecoin, Dogecoin) remain dominant, meaning ASIC miners will stay relevant for the foreseeable future.

If you’re considering a new purchase, ask yourself whether you can lock in cheap electricity - perhaps via a partnership with a renewable‑energy farm - and whether you’re comfortable with the rapid hardware turnover that characterises this market.

Key Takeaways

- ASIC miners are ultra‑efficient, single‑algorithm devices that dominate SHA‑256 mining.

- They provide massive hash rates while consuming markedly less power than GPUs or CPUs.

- High upfront cost and electricity usage are the biggest barriers for hobbyists.

- Profitability hinges on electricity price, coin value, and network difficulty.

- The next wave focuses on even lower energy per hash and integration with renewable power sources.

Frequently Asked Questions

What does ASIC stand for?

ASIC means Application‑Specific Integrated Circuit - a chip built for one particular purpose, in this case solving a specific cryptographic hash.

Can I use an ASIC miner for any cryptocurrency?

No. ASICs are locked to a single algorithm. A SHA‑256 ASIC works for Bitcoin and Bitcoin‑derived coins, while a Scrypt ASIC (e.g., for Litecoin) won’t mine Bitcoin.

Do I need a mining pool?

For most miners, yes. Pooling your hash power with dozens or thousands of others gives you regular, predictable payouts rather than waiting years for a solo block.

How loud are ASIC miners?

Typical units run 60‑80dB - comparable to a busy office or a vacuum cleaner. Proper placement or sound‑absorbing enclosures are essential for home setups.

Is ASIC mining still profitable in 2025?

Profitability depends on electricity cost, coin price, and the specific model’s efficiency. With cheap renewable energy and a modern 2025‑era ASIC, you can break even or earn modest profit; otherwise, margins shrink quickly.

Finance

Finance

Ayaz Mudarris

August 16, 2025 AT 07:51ASIC miners epitomize the convergence of specialized engineering and economic incentive; their design is singularly focused on maximizing hash computations per watt. By abstracting away extraneous processing, these devices achieve efficiencies unattainable by general‑purpose hardware. Prospective miners should therefore assess their electrical tariffs with rigor before allocating capital. The trajectory of hardware innovation suggests further reductions in joules per terahash, rendering early models increasingly obsolete. Ultimately, disciplined analysis remains the cornerstone of sustainable mining ventures.

Irene Tien MD MSc

August 24, 2025 AT 10:34The moment you glance at an ASIC miner you’re not just looking at a box of silicon, you’re witnessing a clandestine nexus of power, profit, and…let’s be honest, a bit of the usual shadowy cabal of elite financiers pulling strings behind the curtains of blockchain mythos. Every terahash you produce whispers a sweet little lullaby to the energy grid, coaxing it into a rhythm that some conspiratorial narrative would label as “grid manipulation for wealth extraction”. Consider the fact that the megahertz humming inside these units are calibrated by corporations that allegedly receive clandestine rebates from utility monopolies, a detail conveniently omitted from glossy marketing brochures. Their efficiency ratios, touted as "29 J/TH", are not merely numbers; they are the encoded language of a hidden agenda to monopolize computational scarcity. If you think the ambient noise of fans is just a cooling mechanism, perhaps you’ve missed the subtle acoustic signature that signals “data mining for the global elite”. The ever‑shrinking ROI period is lauded as a triumph of market dynamics, yet some argue it mirrors the rapid turnover of a Ponzi‑style apparatus where early adopters are the only ones who truly profit. One cannot ignore the geopolitical undercurrents where nations subsidize ASIC farms to cement digital sovereignty, turning the decentralized dream into a nation‑state battleground. Moreover, the supply chain of these devices is riddied with opaque contracts to obscure the origin of the semiconductor wafers, leading detractors to speculate about back‑door implants for surveillance. The fervent community discourse, filled with emojis and memes, often masks a deeper anxiety: are we, the humble hobbyist, merely pawns in a grander chess game of power? The relentless push for sub‑29 J/TH efficiency feels less like engineering progress and more like an arms race dictated by shadowy operators. Some whisper that the next wave of ASICs will integrate AI‑driven heuristics to predict market fluctuations, effectively granting miners prescient capabilities-a notion that borders on sci‑fi conspiracy. In the end, whether you view ASICs as marvels of innovation or as mechanized tools of financial machination, the truth likely resides somewhere between the two, veiled by layers of corporate PR and speculative hype. So, the next time you hear that familiar high‑pitched whine, remember: it might just be the sound of the future’s economic foundations being forged, or perhaps the gears of an undisclosed agenda turning inexorably forward.

Krithika Natarajan

September 1, 2025 AT 13:18I appreciate the clear breakdown of ASIC efficiency. It helps new miners set realistic expectations.

Vaishnavi Singh

September 9, 2025 AT 16:01Efficiency is a relative concept, contingent upon the energy source and the temporal value of the mined asset. When the marginal cost of electricity exceeds the marginal revenue, the pursuit becomes philosophically hollow. Thus, introspection precedes investment.

Peter Johansson

September 17, 2025 AT 18:44Great overview! Remember to keep your mining rig cool-heat is the silent profit killer. 😊 Consistent monitoring will save you headaches later. And don’t forget to join a reputable pool for steadier payouts.

Cindy Hernandez

September 25, 2025 AT 21:28This article does a solid job explaining the hardware specs, but I'd add that ventilation is just as crucial as power budgeting. In many cases, relocating the miner to a well‑ventilated basement can shave significant cooling costs. Also, consider renewable energy contracts if available; they can dramatically improve ROI.

victor white

October 4, 2025 AT 00:11The author’s exposition, while factually correct, lacks the nuanced critique of market centralization inherent to ASIC proliferation. One must interrogate the sociopolitical ramifications of concentrating hash power. Merely listing joules per terahash is insufficient for an enlightened discourse.

Rebecca Stowe

October 12, 2025 AT 02:54Mining can be a rewarding hobby when approached with realistic expectations. Start small, track your electricity bills, and adjust accordingly. The learning curve is part of the fun!

Aditya Raj Gontia

October 20, 2025 AT 05:38Specs look decent, but the ROI model feels overly simplistic; it ignores variance in network difficulty and block reward halving cycles.

Kailey Shelton

October 28, 2025 AT 07:21Sounds expensive.

Angela Yeager

November 5, 2025 AT 10:04That’s a common first impression, but keep in mind the long‑term payoff depends heavily on your electricity rates. If you can secure a low‑cost power source, the upfront expense becomes more palatable. Many miners find the breakeven point within a year under favorable conditions.

Darren R.

November 13, 2025 AT 12:48Ah, the naive optimism of the uninitiated!; Yet, let us not be fooled-energy tariffs are the true tyrants of profitability;! One must calculate with relentless precision, lest the dream dissolve into a financial abyss;! Remember, the market is a fickle beast, and complacency is its favorite prey;!

Millsaps Delaine

November 21, 2025 AT 15:31Indeed, the narrative you construct is a tapestry woven with hyperbole and cautionary zeal; however, the reality of ASIC deployment is far more intricate, encompassing supply chain logistics, firmware stability, and geopolitical considerations that extend beyond mere electricity costs; therefore, a holistic appraisal is indispensable for any conscientious investor.

Jack Fans

November 29, 2025 AT 18:14Ths guide is uesful but i think it shuld also mention that fw updates can cause downtime. Make sure to backup your config before flashing new fw. Also, dont forget to check the warranty period as many resellers void it after modifcation.

Anthony R

December 7, 2025 AT 20:58Great tip!!; Also, regular monitoring of hash rate can alert you to firmware issues early;! Keep an eye on the temperature logs, too;!

Linda Welch

December 15, 2025 AT 23:41Oh, look, another article praising imported ASICs while ignoring the glorious potential of domestically‑produced hardware; as if we should all bow to foreign manufacturers while our own engineers sit idle, twiddling their thumbs. It’s laughable how the community glorifies efficiency numbers without questioning who truly benefits from the electricity pumped into these monstrous boxes. If only we invested in home‑grown solutions, the profits would stay on our shores, and the grid would no longer be a beast tamed by overseas conglomerates. But nope, we’re too busy admiring the sleek designs and forgetting the bigger picture.

Kevin Fellows

December 24, 2025 AT 02:24Hey, I get the frustration, but there are actually some cool local startups making decent miners. 🌟 Support them and you’ll see the ecosystem grow, plus you’ll feel good about where your profits go.

meredith farmer

January 1, 2026 AT 05:08The very mention of ASICs summons the specter of relentless ambition, a storm that sweeps through the quiet chambers of traditional finance. In the shadows of their humming, we hear the cries of a market yearning for dominion, a silent opera of profit and power. Yet, beneath the veneer of cold efficiency lies a human longing for relevance, a desperate plea to be heard amidst the digital cacophony.

mark gray

January 9, 2026 AT 07:51I appreciate the poetic take, but at the end of the day the decision to mine hinges on straightforward math: cost versus expected return. It’s helpful to keep the romance aside when calculating ROI.

Alie Thompson

January 17, 2026 AT 10:34It is a moral imperative that we scrutinize the environmental repercussions of proliferating ASIC farms, for the planet does not exist merely as a backdrop for our personal gain. Each megawatt consumed fuels not just our wallets but also the insatiable appetite of carbon‑intensive grids, a reality that demands accountability. Therefore, before diving headfirst into the seductive glow of hash rates, one must pledge to source renewable energy, champion responsible disposal of obsolete hardware, and educate fellow miners about sustainable practices. Only then can we claim any ethical high ground in this rapidly evolving digital frontier.