AMM Liquidity Pool Calculator

Estimated Results

Based on inputs provided:

Click "Calculate Potential Returns" to see your estimated impermanent loss and fee income.

Want to earn passive income while keeping the crypto market flowing? Supplying capital to Automated Market Maker (AMM) pools is the backbone of decentralized exchanges, letting anyone become a market maker without an order book.

TL;DR - Quick Takeaways

- Deposit equal‑value token pairs into an AMM pool to earn a share of trading fees.

- Watch out for impermanent loss - the most common profit‑killer.

- Uniswap V3’s concentrated liquidity can boost capital efficiency by 2‑5×.

- Pick pools with low volatility or correlated assets for higher net returns.

- Use dashboards, algorithmic bots, or manual range tweaks to stay ahead of market moves.

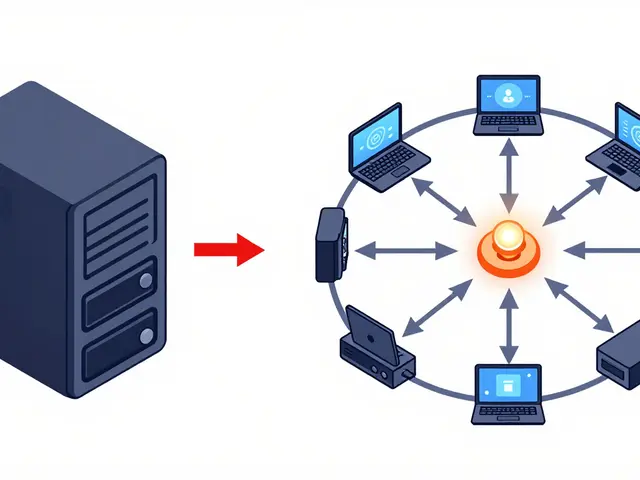

What an AMM Pool Actually Is

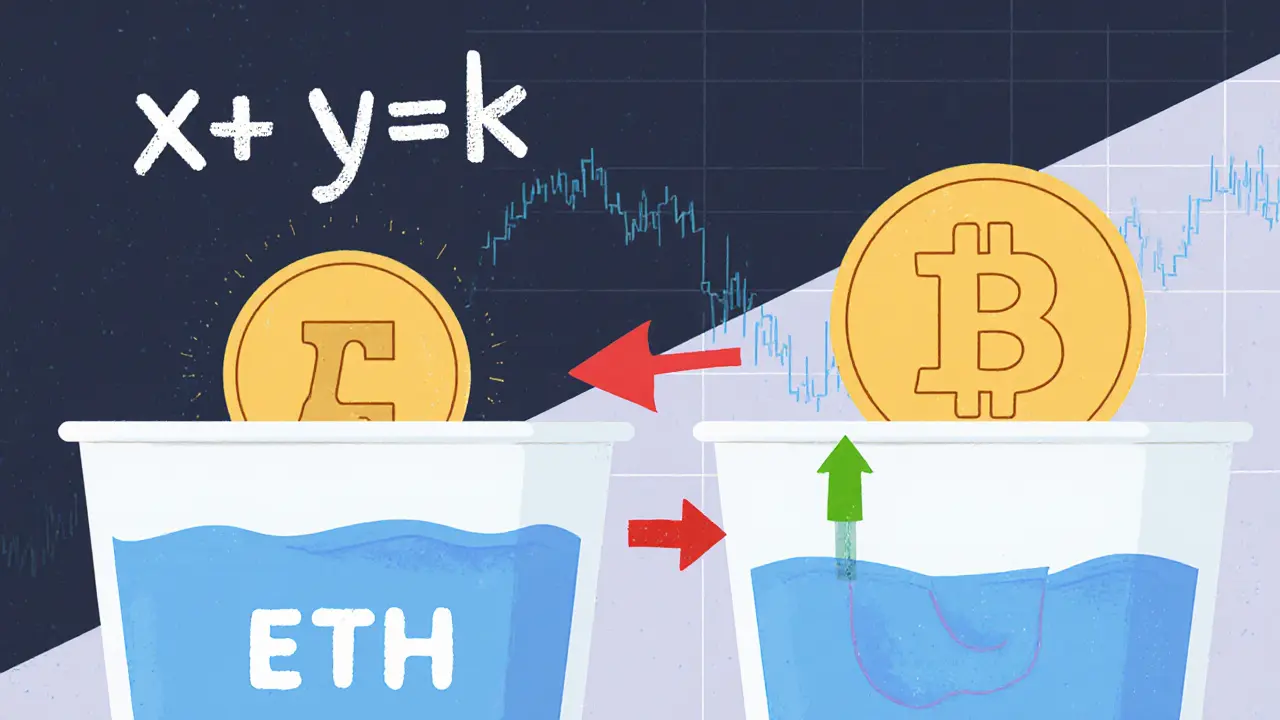

At its core, an Automated Market Maker (AMM) pool is a smart contract that holds two (or more) tokens in a fixed ratio. The classic formulax*y=k, introduced by Uniswap, lets the contract automatically price swaps based on the current reserves. When you add liquidity, you receive LP tokens that represent your slice of the pool and entitle you to a proportion of the fees collected on each trade.

Key Risks: Impermanent Loss Explained

Imagine you lock 1ETH and 2500USDC into a pool when ETH is $2500. If ETH jumps to $3000, the pool rebalances, leaving you with less ETH than if you had simply held the assets. That difference is called impermanent loss. Recent 2025 research shows the average realized loss hovers around 3.8% compared with a buy‑and‑hold approach, so you need fee income or extra rewards to offset it.

Choosing the Right Pool - A Mini‑Comparison

| Platform | Typical Fee | Specialty | Impermanent Loss Risk | Best For |

|---|---|---|---|---|

| Uniswap V3 | 0.05% - 1% | Concentrated liquidity, dynamic fees | Medium‑high (depends on range) | Active LPs who can manage price ranges |

| Curve | 0.04% - 0.15% | Stablecoin & similar‑asset pairs | Low (high correlation) | Risk‑averse users wanting low IL |

| PancakeSwap | 0.25% - 0.5% | BNB‑chain, low gas | Medium | Yield hunters on BSC |

| Balancer | 0.10% - 0.3% | Multi‑asset weighted pools | Varies (depends on token mix) | Portfolio diversifiers |

| Raydium | 0.025% - 0.15% | Solana speed, Serum order‑book link | Low‑medium | Fast‑trading on Solana |

Four Proven Strategies to Boost Returns

- Correlated token pairs: Pair assets that move together (e.g., USDC/USDT, DAI/USDC). Low price divergence reduces impermanent loss.

- Wider price ranges on concentrated liquidity positions can capture more swaps, especially on volatile markets.

- Longer position durations on low‑fee pools that generate steady volume (e.g., Curve stablecoin pools) let fee earnings compound.

- Match strategy to network elasticity: On Layer‑2s like Base where TVL positively correlates with volume, allocating more capital often yields higher fees.

Step‑by‑Step: Adding Liquidity on Uniswap V3

Below is a practical walk‑through for a beginner who wants to earn fees on a 0.3% fee tier ETH/USDC pool.

- Connect your wallet (MetaMask, Ledger, etc.) to the Uniswap interface.

- Navigate to the Pool tab and click “Add Liquidity”.

- Select the token pair (ETH & USDC) and the fee tier (0.3%).

- Enter the amount of each token. Uniswap will auto‑calculate the required ratio (usually 1:price of ETH in USDC).

- Choose a price range. For a passive approach, set the range wide enough to stay in‑range for weeks-e.g., 95% to 105% of the current market price.

- Approve each token’s smart contract (this costs a one‑time gas fee).

- Confirm the transaction. After mining, you receive LP tokens that you can later redeem.

Keep an eye on the “position in range” indicator. If the market moves out of your range, fees stop accruing until you rebalance.

Managing Positions - When to Rebalance?

Rebalancing isn’t a set‑it‑and‑forget job. Here’s a simple decision tree:

- If price exits your range and you expect it to stay out for >24hours → withdraw and redeposit a new range.

- If market volatility spikes (e.g., >5% price swing in 12hours) → consider narrowing the range for higher fee capture, but beware of higher IL.

- If fee APR drops below your target (e.g., < 5%) for two consecutive days → explore a different pool or move to a higher‑fee tier.

Tools like Zerion or Zapper provide real‑time analytics, gas‑cost calculators, and IL estimators.

Advanced Tactics - Algorithmic & Cross‑Chain Liquidity

Seasoned LPs often run bots that adjust ranges based on volatility indexes (e.g., 24‑hour price variance). Open‑source scripts on GitHub can pull price feeds from Chainlink and auto‑submit transactions via Flashbots to reduce front‑running risk.

Cross‑chain platforms like SushiSwap’s Trident or Balancer’s V2 let you allocate capital across multiple networks from a single dashboard, smoothing out network‑specific TVL elasticity. For example, you could keep 60% on Ethereum’s high‑fee pools, 30% on Optimism’s lower‑fee pools, and 10% on Base where TVL growth drives volume.

Risk Management - Insurance & Hedging

Insurance protocols such as Nexus Mutual now offer policies covering impermanent loss for selected pools. Premiums typically range from 0.2% to 0.5% of the locked value, payable annually.

Alternatively, hedge by shorting the underlying asset on a perpetuals platform (e.g., dYdX). If you provide ETH/USDC liquidity, a modest short on ETH can offset the loss if ETH drops sharply.

Regulatory Considerations

In the UK, HMRC treats LP token rewards as taxable income at the time of receipt, while realized impermanent loss may be considered a capital loss. Keep detailed transaction logs to simplify filing.

Summary Checklist Before You Commit Capital

- Identify the token pair and check correlation (correlation >0.8 is ideal).

- Pick a pool with dynamic fees or a fee tier that matches expected volatility.

- Calculate expected fee APR vs. projected impermanent loss using an IL calculator.

- Determine gas cost impact (Ethereum gas vs. Layer2 cheaper).

- Set a price range and plan a monitoring cadence (daily, or hourly for volatile pairs).

- Consider insurance or hedging if the position size exceeds your risk tolerance.

Frequently Asked Questions

What is the difference between standard and concentrated liquidity?

Standard AMMs like Uniswap V2 spread your capital across the entire price curve, meaning most of it sits idle when the market price is far from the extremes. Concentrated liquidity, introduced in Uniswap V3, lets you lock funds inside a chosen price band, so every dollar you commit is actively used for swaps, boosting fee earnings dramatically.

How can I estimate impermanent loss before adding liquidity?

Use an IL calculator (many DEX dashboards embed one). Input the current price, the price range you plan to set, and the expected price movement. The tool returns a percentage loss relative to simply holding the assets. Compare that figure against the projected fee APR to see if the trade‑off makes sense.

Is it worth providing liquidity on high‑gas networks like Ethereum?

Only if you target high‑volume pools where fee revenue can absorb the gas expense. Many LPs now shift a large share of capital to Layer‑2 solutions (Arbitrum, Optimism, Base) where fees are an order of magnitude lower, improving net returns.

Can I withdraw my liquidity at any time?

Yes. LP tokens are redeemable on demand. However, withdrawing during a period of high price divergence may crystallize impermanent loss, so timing matters.

What tools help me monitor multiple pools across chains?

Portfolio aggregators like Zapper, Zerion, or DeBank pull data from Ethereum, BSC, Polygon, and newer chains, showing TVL, fee APR, and estimated IL side‑by‑side. Some also let you rebalance with a single click.

liquidity provision can be rewarding, but only if you understand the mechanics, keep an eye on impermanent loss, and choose the right pool for your risk appetite. Start small, track results, and iterate - that’s how most successful LPs stay ahead of the curve.

Finance

Finance

Ayaz Mudarris

March 2, 2025 AT 12:34When diving into AMM liquidity, consider the fundamentals of price range selection and fee tier alignment. A tight range on a volatile pair can boost fee capture, but it also raises impermanent loss risk. Calculating the projected fee APR against the estimated IL is essential before committing capital. Ensure you monitor gas costs, especially on Ethereum, as they can erode returns dramatically.

Krithika Natarajan

March 7, 2025 AT 17:39Choosing a pair with high correlation keeps IL low. Look for stablecoins or assets that move together. Keep the range narrow enough to stay active.

Peter Johansson

March 12, 2025 AT 22:44Start small, watch the fees roll in, and adjust as needed. 😊 If the gas on Ethereum hurts you, hop onto a Layer‑2 like Arbitrum. Consistency beats chasing the highest APR.

Cindy Hernandez

March 18, 2025 AT 03:48The guide rightly flags the importance of dynamic fees. For example, Uniswap V3 allows you to switch tiers as volatility shifts. Pair that with a reliable analytics tool to see real‑time fee APR. That way you avoid surprises when the market spikes.

Irene Tien MD MSc

March 23, 2025 AT 08:53Oh, sure, because nothing says “smart investing” like tossing your hard‑earned crypto into a black box that pretends to be a market maker. The way the article paints concentrated liquidity as a silver bullet is almost as whimsical as believing the moon is made of cheese. Yet, if you enjoy watching your capital dance on a price curve while a fee‑tier hamster spins, go ahead – the IL calculator will be your new bedtime story. Just remember, the only thing more volatile than the assets you’re providing is the emotional roller‑coaster of watching fee percentages fluctuate like a toddler on a sugar rush.

victor white

March 28, 2025 AT 13:58One must acknowledge that the intricacies of impermanent loss demand a rigorous quantitative approach. Merely eyeballing fee percentages without stochastic modeling is academically negligent. The synthesis of on‑chain analytics with off‑chain risk models yields a more robust strategy. In short, precision trumps sentiment.

Rebecca Stowe

April 2, 2025 AT 20:02Liquidity provision can be a steady side hustle if you keep expectations realistic. Small, consistent fee earnings add up over time. Patience is your best ally.

Aditya Raj Gontia

April 8, 2025 AT 01:07From a DeFi engineering perspective, the slippage elasticity factor directly impacts LP token valuation. Leveraging zero‑knowledge rollups reduces L1 gas overhead, thereby improving net APR. Integrate a multi‑chain aggregator to diversify exposure across EVM‑compatible networks.

Kailey Shelton

April 13, 2025 AT 06:12Just keep an eye on the gas fees.

Angela Yeager

April 18, 2025 AT 11:16It's wise to document each deposit and withdrawal for tax purposes, especially in jurisdictions like the UK. A simple spreadsheet can track LP token receipts and realized impermanent loss. This habit will save you headaches when filing. Also, consider using a tax‑friendly wallet to simplify reporting.

Darren R.

April 23, 2025 AT 16:21Ah, the ever‑glorious saga of liquidity provision, a tale replete with promise, peril, and-let us not forget-the inevitable drama of gas fees, that relentless specter haunting every transaction, every hopeful LP, every earnest dreamer! One must, with solemn reverence, pore over fee APR charts, dissect IL curves, and-dare I say-pay homage to the gods of on‑chain analytics, lest the abyss of loss swallow one's modest gains! Remember, dear reader, that the only constant in this cryptic ballet is change, and change, as we all know, loves a good plot twist.

Millsaps Delaine

April 28, 2025 AT 21:26When one peruses the labyrinthine corridors of decentralized finance, it becomes abundantly clear that the author’s exposition, while verbose, scarcely scratches the surface of the nuanced interplay between fee tier selection and volatility forecasting. The narrative, cloaked in florid prose, attempts to masquerade complexity as profundity, yet the seasoned practitioner discerns the underlying truth: concentration of liquidity demands continual vigilance. To truly master the art, one must embrace algorithmic rebalancing, harness chain‑link price feeds, and remain ever‑mindful of front‑running vectors that lurk in the shadows of every transaction. In sum, the path to sustainable yields is paved not with idle speculation but with disciplined, data‑driven iteration.

Jack Fans

May 4, 2025 AT 02:30Yo, dont forget to check the pool's total value locked (TVL) before you dive in. Higher TVL usually means better fee potential but also more competition for rewards. Also, watch out for gas spikes- they can eat your profit quick.

Christina Norberto

May 9, 2025 AT 07:35From a regulatory compliance standpoint, the failure to recognize the taxable nature of LP rewards constitutes a grievous oversight. Moreover, the article neglects to address the potential for anti‑money‑laundering violations inherent in anonymous pool participation. Such omissions are indicative of a broader negligence within the DeFi discourse. It is imperative that contributors rectify these gaps forthwith.

Fiona Chow

May 14, 2025 AT 12:40Sure, because nothing says “peaceful community” like a heated debate over fee percentages, right? Let’s all just agree that diversified liquidity across chains is the holy grail, and move on. After all, we’re all here to learn, not to argue.

Adetoyese Oluyomi-Deji Olugunna

May 19, 2025 AT 17:44One must, perphaps, ruminate upon the inherent elegance of a well‑structured liquidity pool, where each token dances in harmonious synchrony.

kishan kumar

May 24, 2025 AT 22:49In accordance with prevailing best practices, it is advisable to perform periodic rebalancing of your positions. 📈 Such rebalancing mitigates exposure to adverse price movements and enhances fee capture. Additionally, integrating on‑chain oracle feeds can provide more granular price insights. Formal compliance with these protocols is recommended.

Anthony R

May 30, 2025 AT 03:54Proper record‑keeping, especially of LP token minting events, is essential; likewise, noting gas expenditure per transaction assists in net‑return calculations; furthermore, maintaining a log of fee APR fluctuations enables strategic adjustments.

Linda Welch

June 4, 2025 AT 08:58Isn't it just adorable when folks from overseas claim they know more about our beloved crypto than we do? The article's innocent optimism about cross‑chain liquidity feels like a thinly veiled invitation for foreign capital to infiltrate our markets. We should be wary of relinquishing control to external protocols that may not share our values. Remember, a sovereign financial ecosystem thrives on home‑grown innovation, not on the whims of distant developers. Keep the capital close, and the fees will follow.

Vaishnavi Singh

June 9, 2025 AT 14:03The act of providing liquidity can be viewed as a microcosm of the broader exchange between certainty and uncertainty.

Each token placed within a price band represents a pledge to the market's ebb and flow.

When the price drifts outside the selected range, the impermanent loss manifests as a reminder of our limited foresight.

Conversely, the accrual of fees serves as a quiet affirmation that participation yields modest compensation for bearing risk.

From a philosophical standpoint, this dynamic mirrors the ancient wager between stability and change.

It compels the provider to confront the paradox of seeking profit while embracing potential loss.

The mathematical models, such as the IL calculator, become tools for translating abstract risk into tangible metrics.

Yet, beyond the equations lies a softer, almost contemplative awareness of one’s position within the ecosystem.

Choosing a narrow range is akin to focusing one's gaze, sharpening the view of immediate returns.

Choosing a wide range broadens the horizon, sacrificing short‑term gains for resilience against volatility.

In practice, the decision must balance personal risk tolerance with the observable market conditions.

The guide's emphasis on monitoring gas costs resonates with the idea that external frictions shape the net outcome.

Moreover, periodic rebalancing reflects an ongoing dialogue between the LP and the market, rather than a static contract.

This iterative process suggests that liquidity provision is not a singular act but a continuous practice.

Ultimately, the value derived hinges on the discipline to measure, adjust, and accept the inevitable imperfections.

Therefore, the prudent LP cultivates both analytical rigor and a measured humility before the ever‑shifting tides of price.