Minswap V2 Fee Calculator

Calculate Your Swap Fees

Estimate your Minswap V2 swap fees for Cardano transactions compared to Ethereum.

Your Estimated Fees

Minswap V2 fees range from $0.01 to $0.05 per swap depending on network congestion. Ethereum fees can be $5-$15 during peak times. The difference is due to Cardano's low-cost infrastructure.

Why Are Minswap Fees So Low?

Minswap V2 uses Aiken, a leaner smart contract language, with contracts 70% smaller than V1. This results in faster execution and near-zero fees. No more $1.50 swaps!

- ✓ 70% smaller smart contracts

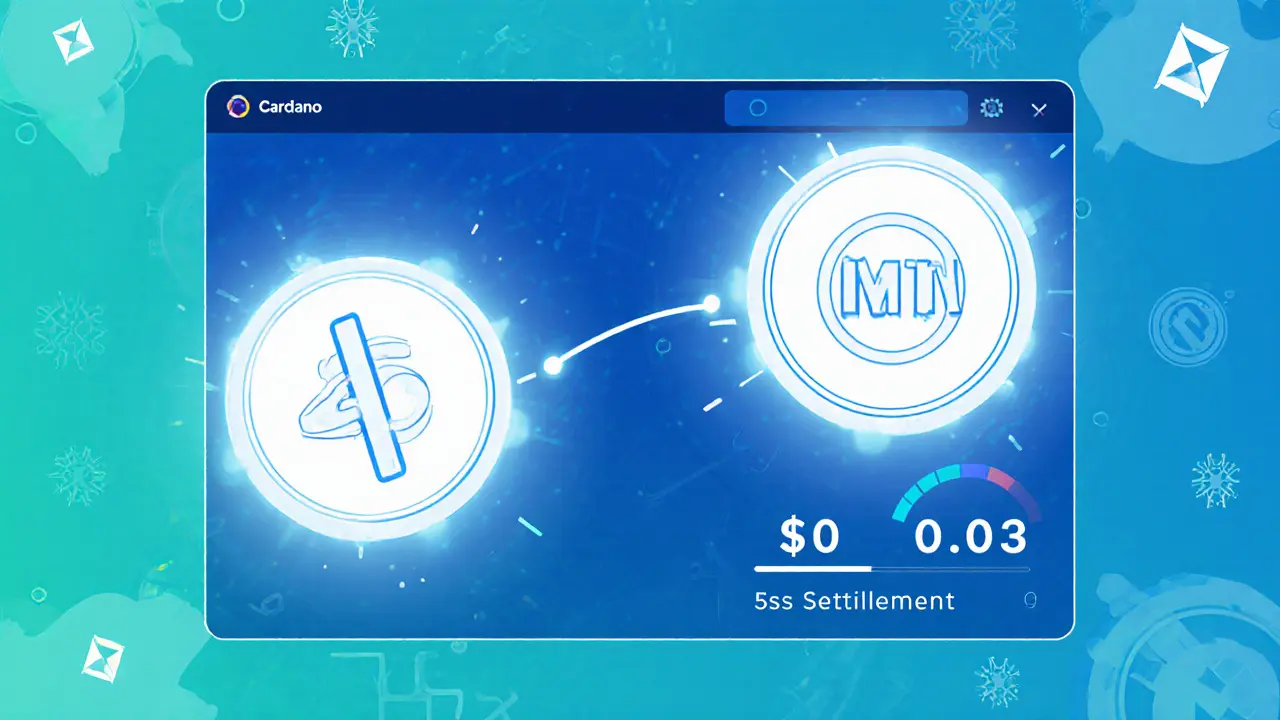

- ✓ 5-20 second settlement

- ✓ Always under $0.05

Most crypto traders on Cardano don’t need another exchange. They need a better one. That’s where Minswap V2 comes in. It’s not just an update-it’s a complete rebuild. If you’ve ever waited 30 seconds for a swap, paid $2 in fees, or got lost in a clunky interface, you already know why this matters. Minswap V2 fixes all of that. And it does it without sacrificing decentralization.

What Minswap V2 Actually Does Differently

Minswap V2 isn’t a tweak. It’s a rewrite. The original version used Plutus, Cardano’s smart contract language, but it was bloated. Contracts were large, slow, and expensive to run. V2 switched to Aiken, a newer, leaner language built specifically for Cardano. The result? Contracts are 70% smaller. That means faster execution and near-zero fees.You’re not paying $1.50 to swap MIN for ADA anymore. You’re paying $0.03. Sometimes $0.01. That’s not a discount. That’s a revolution. On Ethereum, a simple trade can cost $5-$15 during busy hours. On Minswap V2, even during peak traffic, you’re still under $0.05. That’s why retail traders-people buying small amounts of tokens daily-are switching in droves.

And it’s not just about cost. The routing system is smarter. Instead of needing a direct pool between two tokens, V2 finds the cheapest path. Want to swap GENs for STAKE? No direct pool? No problem. Minswap automatically routes through ADA or another bridge token. It’s like GPS for crypto trades-finding the fastest route even when the main road is closed.

The Interface That Actually Works

Most DEXes feel like they were designed by engineers who forgot users exist. Minswap V2 feels different. The UI is clean. No clutter. No 7-step processes. You connect your wallet (Nami, Eternl, or Flint), pick your tokens, enter the amount, and hit swap. That’s it. Three clicks. Five seconds.The market screen shows real-time liquidity, price impact, and APY for liquidity pools-all on one page. You don’t have to jump between tabs to see if a token is worth trading. You can see it immediately. Even new users report understanding how to trade after just one session. That’s rare in DeFi.

They also fixed the liquidity migration nightmare. In V1, moving your tokens to the new contract was risky. Impermanent loss could wipe out your gains. V2 has a dedicated portal that guides you through the process. It shows you exactly what you’ll lose or gain before you confirm. It doesn’t eliminate risk-but it makes it transparent.

How It Compares to Other Cardano DEXes

Cardano has more than a dozen DEXes. SundaeSwap was first. JellySwap uses order books. WingRiders is fast but ugly. So why does Minswap V2 lead?- Slippage: For trades over $500, Minswap averages 15-20% less slippage than SundaeSwap. That’s because it pulls liquidity from multiple pools at once, not just one pair.

- Speed: Settlement takes 5-20 seconds. On JellySwap, it’s often 30+ seconds because of order book matching delays.

- Fees: All Cardano DEXes have low fees, but Minswap’s are consistently the lowest. Users report 90% of swaps under $0.03.

- UX: No other Cardano DEX comes close to Minswap’s polish. Even WingRiders, which is technically solid, feels outdated.

It’s not perfect. Minswap doesn’t support Ethereum, Solana, or BSC tokens. If you want to trade Bitcoin or USDT directly, you can’t. You need to bridge them to Cardano first. That’s a limitation-but it’s intentional. Minswap is focused on being the best Cardano-native DEX, not a cross-chain aggregator like Thorchain.

Liquidity Mining and Earnings

If you’re a liquidity provider, Minswap V2 is one of the best places to earn on Cardano. APYs vary wildly depending on the token pair:- Stablecoin pools (e.g., ADA/USDT): 8-12% APY

- Newer tokens (e.g., MIN/ADA, GEN/ADA): 15-25% APY

- High-risk new launches: Up to 40%-but watch for rug pulls

These aren’t guaranteed. They change daily based on trading volume and token demand. But they’re consistently higher than most centralized exchanges’ staking rewards. And you’re not locking up your coins-you can withdraw anytime.

Just remember: impermanent loss is real. If the price of one token in your pair moves sharply, you’ll lose value compared to just holding. Minswap’s migration tool helps, but it doesn’t eliminate risk. Only experienced DeFi users should put large amounts in high-yield pools.

Security, Regulation, and Risks

Minswap is decentralized. That means no one owns it. No CEO. No customer support hotline. No one to call when you send funds to the wrong address.Smart contracts have been audited, but the audit reports aren’t public. That’s a red flag for some. Most users trust the team because they’ve been transparent about updates, released code on GitHub, and don’t take VC money. Unlike PancakeSwap or Uniswap, Minswap is funded by community contributions and token sales. That’s a good sign-it means incentives are aligned.

But here’s the hard truth: Minswap is unregulated. No KYC. No AML. No legal recourse. If you get hacked, scammed, or make a mistake, you’re on your own. That’s fine for experienced users. It’s terrifying for beginners.

Transaction failures happen about 5-7% of the time during network congestion. The fix? Increase the fee slider by 10-20%. It’s not automatic, but it’s simple. Most users learn this after one failed swap.

Who Should Use Minswap V2?

This isn’t for everyone. But it’s perfect for:- Cardano holders who trade tokens daily

- Small traders who hate paying high fees

- Liquidity providers looking for decent yields without locking funds

- DeFi natives who value speed and control over customer service

It’s not for:

- Complete beginners who don’t know what a wallet is

- Large traders moving $50,000+-liquidity pools are too shallow

- People who want support when things go wrong

- Users who need cross-chain swaps (yet)

Cardano’s ecosystem is growing fast. Minswap V2 is leading it-not because it’s the biggest, but because it’s the most thoughtfully built. It doesn’t try to be everything. It just does one thing: swap Cardano tokens, faster, cheaper, and smoother than anyone else.

How to Get Started

1. Get a Cardano wallet-Nami, Eternl, or Flint. Install it on your browser or phone.You’ll be trading in under 5 minutes. No tutorials needed. No complicated steps. Just a clean interface and cheap trades.

Is Minswap V2 safe to use?

Minswap’s smart contracts have been audited, but the reports aren’t public. It’s non-custodial, so you control your keys. That’s safer than centralized exchanges-but you’re responsible for your own mistakes. No one can reverse a transaction. Use small amounts at first. Never send funds to unknown addresses.

Can I trade Bitcoin or Ethereum on Minswap V2?

No. Minswap V2 only supports Cardano-native tokens (ADA, MIN, GEN, etc.). To trade other coins, you need to bridge them to Cardano first using a service like Wormhole or cBridge. Minswap doesn’t handle cross-chain swaps yet, but it’s planned for future updates.

What’s the minimum amount I can swap?

You can swap as little as 0.001 ADA. The platform doesn’t enforce a minimum. But transaction fees are fixed at around $0.01-$0.05, so swapping tiny amounts isn’t cost-effective. Most users trade $5 or more to make sense of the fees.

Why is my transaction stuck or failing?

Cardano’s network can get congested during big token launches. If your transaction fails or takes longer than 30 seconds, increase the fee slider slightly in your wallet. Most users fix this by raising the fee by 10-20%. It’s not automatic, but it’s simple.

Does Minswap have a mobile app?

No official mobile app exists. But the website works perfectly on mobile browsers. Just use Nami or Eternl on your phone, connect to app.minswap.org, and trade like normal. No download needed.

What’s the MIN token used for?

MIN is Minswap’s governance token. Holders can vote on upgrades, fee structures, and new features. It’s not required to trade, but liquidity providers earn MIN as rewards. As of November 2025, MIN trades between $0.0142 and $0.0146. It’s not a speculative asset-it’s a utility token for platform decisions.

Is Minswap V2 better than Uniswap?

For Cardano users, yes. For Ethereum users, no. Minswap’s fees are 100x lower than Uniswap’s during normal traffic. Settlement is faster. But Uniswap supports thousands of tokens across chains. Minswap only supports Cardano. So it’s not better overall-it’s better for its specific use case.

If you’re already holding Cardano tokens, Minswap V2 is the easiest, cheapest, and fastest way to trade them. It doesn’t try to impress with flashy features. It just works. And in DeFi, that’s the most valuable thing of all.

Finance

Finance

alex bolduin

November 30, 2025 AT 04:50Cardano's real advantage isn't tech-it's this kind of user-first design.

Vidyut Arcot

November 30, 2025 AT 22:50Jay Weldy

December 2, 2025 AT 07:16Thank you to whoever built this.

Melinda Kiss

December 3, 2025 AT 06:58👏

Philip Mirchin

December 4, 2025 AT 06:48And yes, the fees are unreal. I’ve done 47 swaps this week. Total fees: $1.12.

Britney Power

December 5, 2025 AT 14:16Also, 'Cardano-native' is just a marketing term for 'not cross-chain.'

Maggie Harrison

December 6, 2025 AT 00:55Also, the UI is so smooth I cried a little. No one makes DeFi feel this human anymore.

Cardano’s quiet revolution is here. 🌱

Lawal Ayomide

December 7, 2025 AT 09:59justin allen

December 7, 2025 AT 11:23samuel goodge

December 8, 2025 AT 06:44Greer Dauphin

December 10, 2025 AT 02:22Shari Heglin

December 10, 2025 AT 08:43Reggie Herbert

December 11, 2025 AT 01:16Murray Dejarnette

December 12, 2025 AT 10:02Sarah Locke

December 12, 2025 AT 19:28Mani Kumar

December 14, 2025 AT 02:57Tatiana Rodriguez

December 15, 2025 AT 04:18ashi chopra

December 16, 2025 AT 20:38Darlene Johnson

December 17, 2025 AT 22:02