The Central Bank of Jordan used to say crypto was off-limits. Period. Back in 2014, they issued a blunt warning: banks couldn't touch Bitcoin. No trading, no exchanges, no payments. For over a decade, that was the rule. People still traded - mostly through peer-to-peer apps and informal networks - but it was all in the shadows. Then, in 2025, everything changed.

From Ban to License: The 2025 Law That Rewrote the Rules

On September 14, 2025, Law No. 14 of 2025 - the Virtual Assets Transactions Regulation Law - went into effect. This wasn’t just a tweak. It was a full overhaul. The Central Bank of Jordan didn’t just soften its stance; it handed control to a new regulator: the Jordan Securities Commission (JSC). Now, if you want to run a crypto exchange, wallet service, or any kind of virtual asset business in Jordan, you need a license. No exceptions. Even if you’re based overseas but market to Jordanians, you’re still covered by this law.

The penalties for breaking it are serious. Operating without a license can land you in prison for at least one year and cost you up to $141,000 in fines. That’s not a warning - it’s a deterrent. The law also makes it clear: anything involving digital assets - whether it’s Bitcoin, Ethereum, or a new token - falls under this rule. The only exceptions? Central Bank Digital Currencies (CBDCs) and digitized securities. Those stay under the Central Bank and JSC’s direct control, respectively.

How the Licensing System Works

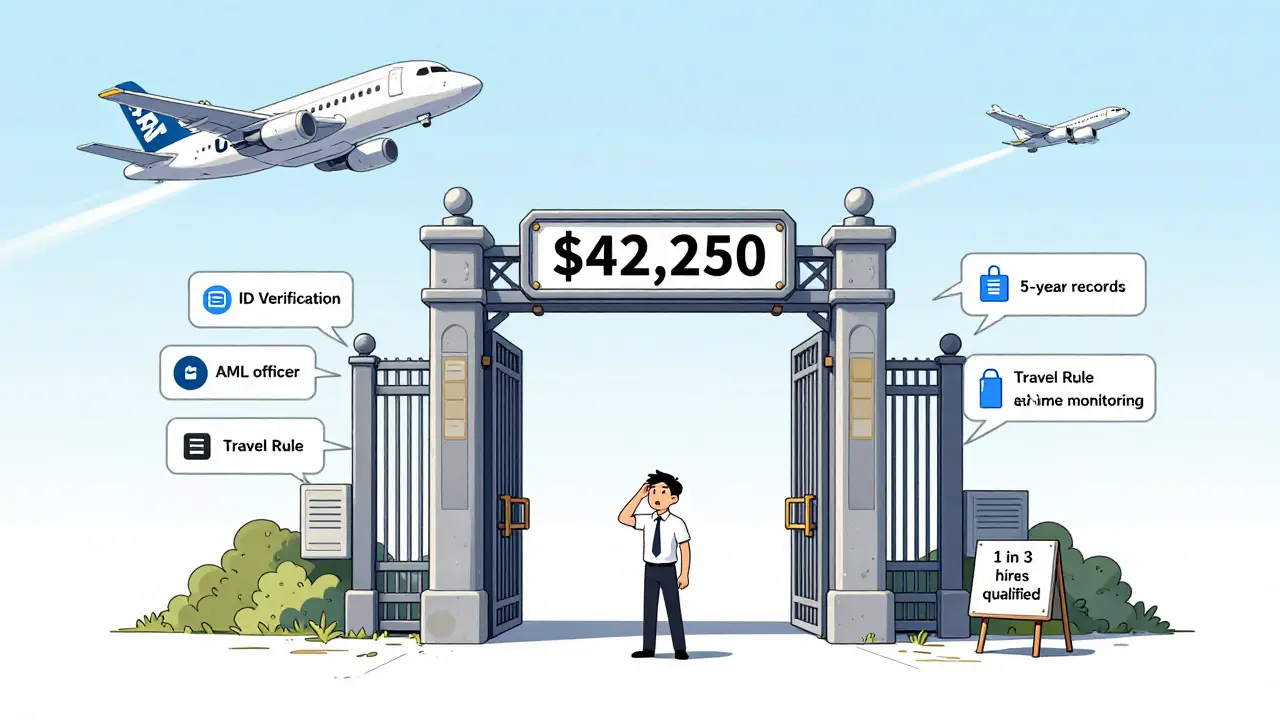

Getting licensed isn’t a formality. It’s a multi-step process with real costs. First, you submit a preliminary application - $7,000 just to start. Then, you submit detailed documentation on your compliance systems, ownership structure, and technical setup. That’s another $21,000 in processing fees. Finally, the JSC does an on-site operational review. That costs $14,000. Total? Around $42,250 before you even open your doors.

But the money isn’t the only hurdle. You need to prove you can handle anti-money laundering (AML) rules. That means:

- Verifying every customer’s identity (Customer Due Diligence)

- Extra checks for high-risk users like government officials (Enhanced Due Diligence)

- Monitoring every transaction over $14,000 (JOD 10,000)

- Reporting suspicious activity to the Anti-Money Laundering Unit

- Keeping records for five full years

- Appointing a full-time AML compliance officer

- Following the Travel Rule - sharing sender and receiver info on transfers above $3,000

And you need tech that can handle it. Most startups struggle with integrating real-time transaction monitoring tools. A survey by the Jordan Fintech Association found 73% of new entrants hit this wall. There’s also a shortage of qualified people. Only 1 in 3 fintech hires in Jordan right now has the right mix of blockchain knowledge and AML training.

Why Jordan Changed Its Mind

This wasn’t just about keeping up with global trends. Jordan got slapped on the FATF grey list in 2023. That’s the Financial Action Task Force - the global watchdog for money laundering and terror financing. Being on that list made it harder for Jordanian banks to do business internationally. It scared off investors. It damaged trust.

The 2025 law was Jordan’s way out. By creating a clear, rules-based system aligned with international standards, they aimed to get off the list. The IMF and World Bank both noted the framework is well-designed. But implementation? That’s the real test.

Right now, the JSC has just 12 staff members handling all virtual asset oversight. Compare that to the UAE, where hundreds of regulators manage a market ten times larger. Experts warn that without more resources, enforcement could be patchy. The first six to eight months after the law launched were full of confusion. Even licensed operators didn’t know exactly what was expected.

How It Compares to the Region

Jordan isn’t the first in the region to regulate crypto. The UAE has been doing it for years. Dubai and Abu Dhabi have full regulatory zones with licenses for everything from DeFi protocols to NFT marketplaces. Bahrain is also ahead, with a clear sandbox for startups. Egypt, Kuwait, and Iraq still ban crypto outright.

Jordan sits in the middle. It’s not as open as the UAE, but it’s not as closed as its neighbors. That gives it a chance - but also a challenge. The UAE has over 500,000 daily crypto traders. Jordan has about 1.2 million users, but almost all of them trade informally. The hope is that with legal platforms, that number will shift. Fitch Solutions predicts Jordan’s crypto market could grow from $150 million in 2024 to $750 million by 2027. That’s a 71% annual growth rate.

But here’s the catch: the big players aren’t coming yet. Most global exchanges still don’t list Jordan. Why? Because the licensing system is new, unclear in places, and expensive. Even local operators who’ve been running informal exchanges since 2020 say they’re stuck. They can’t afford the $42,250 fee - and they don’t know what capital requirements will be. The government hasn’t published those numbers yet.

What Users Are Saying

On Reddit’s r/CryptoJordan, reactions are split. One user, AmmanTrader87, said: “After years of P2P trading in the shadows, finally having a legal framework is reassuring - but the $141,000 fine seems excessive for small operators.” Another, BlockchainDevelopr_Jo, said: “The clarity will attract institutional investment we’ve been missing, but the 90-day window to comply was way too short.”

A social media analysis of 1,247 posts in Arabic and English showed 62% of users welcomed the law - but 78% worried it would crush small businesses. That’s a red flag. If only big companies can afford to play, the market won’t grow. It’ll just consolidate.

What’s Next? CBDCs, DeFi, and Sharia Finance

The Central Bank of Jordan isn’t stopping at crypto. They’ve signaled plans to launch a Central Bank Digital Currency (CBDC) by late 2026. This won’t compete with Bitcoin - it’ll be Jordan’s own digital version of the Jordanian Dinar. Think of it like a digital wallet backed by the state.

Also on the horizon: regulations for decentralized finance (DeFi). A ministerial committee is working on rules for lending platforms, yield farms, and automated protocols. If done right, this could make Jordan a hub for Sharia-compliant crypto - something no other country in the region is seriously pursuing. With 42 Islamic banks already operating here, there’s a real opportunity.

But risks remain. Users might just move to the UAE or Bahrain if Jordan’s rules get too tight. And if the JSC can’t train enough staff or build reliable systems, enforcement will collapse. That’s what happened in some African countries - they passed laws, then couldn’t enforce them. The market went dark again.

Bottom Line: A New Era, Not a Quick Fix

The Central Bank of Jordan didn’t just change its mind about crypto. It rebuilt the entire system. The 2025 law is a bold, well-designed step toward legitimacy. It aligns with global standards. It addresses FATF concerns. It opens the door for innovation.

But it’s not a magic fix. The high costs, lack of skilled workers, unclear capital rules, and under-resourced regulator mean progress will be slow. For now, the real winners are the big players who can afford the license. The small traders? They’re still waiting.

If you’re a business in Jordan and you want to operate legally - start now. Don’t wait for the rules to get easier. They won’t. The window to apply is open, but it’s narrow. And if you’re a user? Be careful. Stick to licensed platforms. Avoid P2P deals with strangers. The law protects you - but only if you play by its rules.

Is cryptocurrency legal in Jordan in 2026?

Yes, but only if you’re licensed. The Virtual Assets Transactions Regulation Law (No. 14 of 2025) made it illegal to operate any crypto service without approval from the Jordan Securities Commission. Personal ownership and holding of crypto is not banned - but trading, exchanging, or offering services requires a license.

Who regulates crypto in Jordan now?

The Jordan Securities Commission (JSC) is the main regulator. The Central Bank of Jordan no longer handles crypto oversight directly. The JSC issues licenses, enforces AML rules, and monitors compliance. The Central Bank still controls Central Bank Digital Currencies (CBDCs) and digitized securities.

How much does a crypto license cost in Jordan?

The total application cost is approximately JOD 30,000 (around $42,250 USD). This includes a JOD 5,000 preliminary application fee, a JOD 15,000 documentation review fee, and a JOD 10,000 operational assessment fee. Additional costs for compliance systems, staff training, and software are not included.

What happens if I trade crypto without a license in Jordan?

Operating a crypto service without a license is a criminal offense. Penalties include a minimum one-year prison sentence and fines up to JOD 100,000 ($141,000 USD). Even foreign platforms that market to Jordanians can be prosecuted under this law. Personal trading (P2P) is not targeted, but running a business is.

Is a Central Bank Digital Currency (CBDC) coming to Jordan?

Yes. The Central Bank of Jordan has confirmed plans to launch a pilot CBDC in Q3 2026. This will be a digital version of the Jordanian Dinar, issued and controlled by the central bank. It’s separate from the crypto regulatory framework and is meant for everyday payments, not investment.

Why is Jordan’s crypto law considered a step forward?

It was a direct response to Jordan being placed on the FATF grey list in 2023 due to weak oversight of virtual assets. The law brings Jordan into compliance with global AML/CFT standards, improves financial transparency, and opens the door for legal investment. It also aligns with Jordan’s broader National Blockchain Strategy to modernize public services.

Finance

Finance

Maggie House

February 21, 2026 AT 10:22Dana Sikand

February 21, 2026 AT 12:58Cameron Pearce Macfarlane

February 21, 2026 AT 22:52