Flamingo Finance review: What happened to this DeFi platform and is it still active?

When you hear Flamingo Finance, a decentralized finance platform built on the Fantom blockchain that let users earn rewards by providing liquidity and farming tokens. It was once one of the more popular DeFi projects on Fantom, offering high yields and a clean interface. Also known as Fantom’s top yield aggregator, it attracted traders looking for better returns than traditional exchanges could offer.

Flamingo Finance wasn’t just another DeFi platform—it was built to simplify liquidity pools, digital markets where users lock up crypto to help trade other tokens, and in return earn fees and rewards and yield farming, the practice of moving crypto between protocols to maximize returns. Users could stake FLAMINGO tokens, add liquidity to pairs like FTM/USDC, and earn extra tokens as incentives. At its peak, it had hundreds of millions locked in, and the team even partnered with big names in the space. But then, everything slowed. Updates stopped. The website went quiet. The Discord vanished. And today, the token trades for pennies—if it trades at all.

What happened to Flamingo Finance? It didn’t get hacked. It didn’t get shut down by regulators. It just faded. The team disappeared. No announcements. No explanations. That’s the quiet death many DeFi projects suffer—not from fraud, but from neglect. It’s a reminder that high APYs don’t mean safety. A slick website doesn’t mean sustainability. And a big name behind a project doesn’t guarantee it’ll last.

If you’re looking at Flamingo Finance now, you’re not checking for a comeback—you’re checking for a warning sign. The same patterns show up in dozens of other projects: too much hype, too little code, no clear roadmap after launch. That’s why the posts below cover similar cases—like Quoll Finance, Launchium, and CZF—projects that promised big returns and then vanished. You’ll also find guides on how to spot the red flags before you deposit your crypto. Because the next Flamingo Finance might already be live. And it won’t tell you it’s dying. You’ll have to figure it out yourself.

Flamingo Finance offers a unique all-in-one DeFi experience with swaps, vaults, and perps-all without KYC. But with low liquidity, unclear tokenomics, and a Binance monitoring tag, is it worth the risk?

Flamingo Finance is a multi-chain DeFi platform offering swaps, vaults, perps, and a synthetic stablecoin-all in one interface. But with low liquidity, uncertain tokenomics, and a Binance monitoring tag, is it worth using?

Categories

Archives

Recent-posts

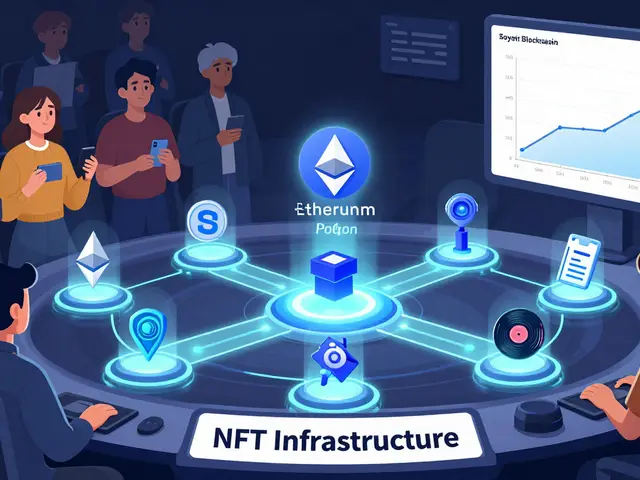

NFTs in the Creator Economy: How Digital Ownership Is Changing How Creators Earn in 2026

Feb, 18 2026

Finance

Finance