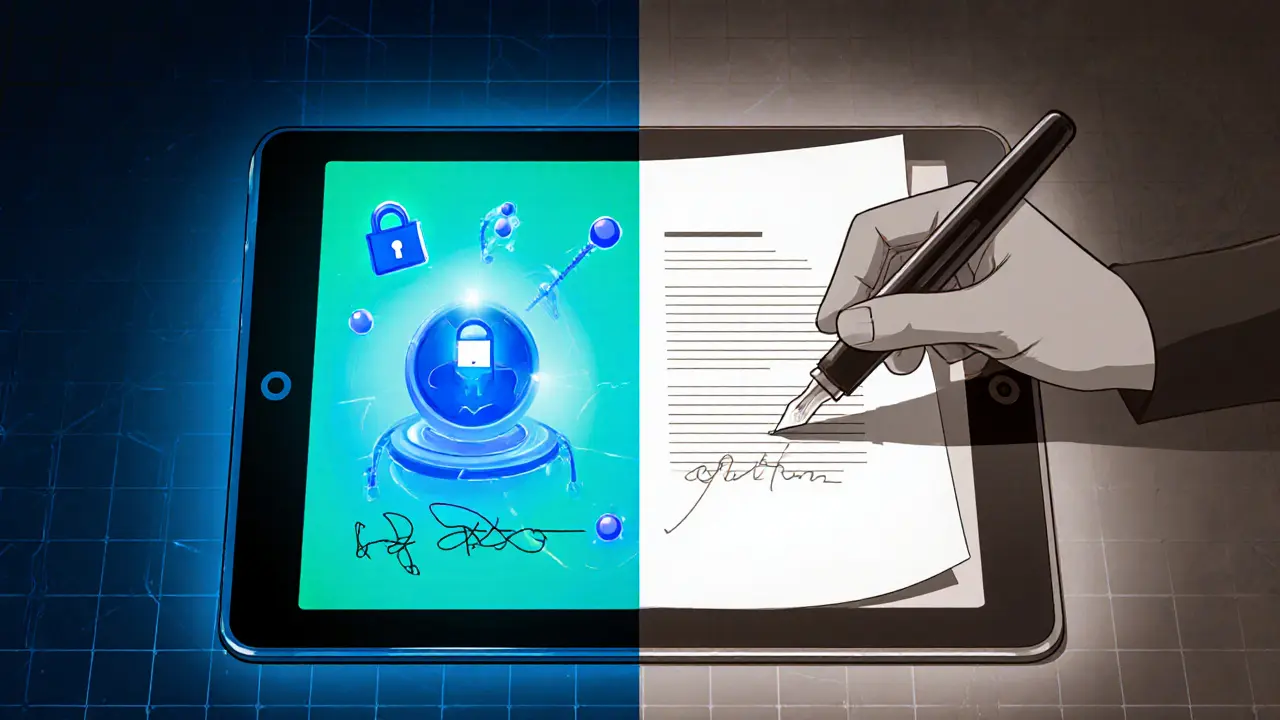

Digital vs Traditional Signatures Comparison Tool

Cryptographic proofs generated using asymmetric cryptography. Used in Bitcoin, Ethereum, and other blockchain networks.

- Security: Mathematically proven, resistant to forgery

- Verification: Automated, machine-readable

- Scalability: Handles millions of transactions

- Non-repudiation: Immutable proof of authorship

- Use Cases: Multi-sig, smart contracts, signature aggregation

Physical marks made with pen on paper, relying on visual inspection for authenticity.

- Security: Subjective, vulnerable to skilled forgery

- Verification: Manual, human-based

- Scalability: Limited by human capacity

- Non-repudiation: Can be contested in court

- Use Cases: Legal documents, deeds, off-chain agreements

ECDSA

Elliptic Curve Digital Signature Algorithm

Used in Bitcoin, Ethereum

Schnorr

Linear signatures

Enables key aggregation

BLS

Aggregate signatures

Reduces block size

| Criteria | Digital Signatures | Traditional Signatures |

|---|---|---|

| Security | Cryptographic, resistant to forgery | Subjective, vulnerable to skilled forgery |

| Scalability | Automated verification of millions | Manual verification limits throughput |

| Non-repudiation | Mathematical proof of authorship | Can be contested, requires expert testimony |

| Implementation Cost | Initial PKI setup, software development | Low upfront cost, high labor cost at scale |

| Legal Acceptance | Recognized in many jurisdictions | Universally accepted for paper contracts |

Conclusion

In cryptocurrency and blockchain applications, digital signatures are essential for security, scalability, and automation. They provide cryptographic proof that is impossible to forge, unlike traditional signatures which are subjective and manually verifiable. While traditional signatures remain important for legal documents outside the blockchain, digital signatures dominate high-volume, high-security environments.

Modern algorithms like Schnorr and BLS signatures offer even greater efficiency and scalability benefits for blockchain networks, making them the preferred choice for next-generation crypto applications.

Quick Take

- Digital signatures use asymmetric cryptography; traditional signatures rely on handwriting.

- In crypto, algorithms like ECDSA (Elliptic Curve Digital Signature Algorithm) provides short keys and fast verification dominate.

- Digital signatures guarantee non‑repudiation, tamper‑evidence, and automated verification, while traditional signatures are subjective and manual.

- Advanced schemes such as Schnorr Signatures enable key aggregation and multi‑signatures with linearity or BLS Signatures allow signature aggregation across many signers, cutting block size are reshaping blockchain scalability.

- Adoption is soaring: the global digital‑signature market hit $5.7B in 2023, and crypto networks process trillions of dollars annually using these algorithms.

What Is a Digital Signature?

When you see the term digital signatures in a crypto wallet or a smart contract, you’re looking at a piece of math that proves a transaction came from the holder of a private key. Digital Signatures are cryptographic proofs generated by applying a private key to a hash of the underlying data. The result is a unique string that can be verified by anyone who knows the corresponding public key.

The whole process hinges on asymmetric cryptography: the private key signs, the public key verifies. No secret ever leaves the signer’s device, which means the network never sees the private key itself. This design is what lets Bitcoin, Ethereum, and countless other blockchains run without a central authority.

How Do Traditional Handwritten Signatures Work?

Traditional Signatures are physical marks made with a pen that represent a person’s intent to approve a document. Their authenticity is judged by visual comparison-experts look at stroke pressure, slant, speed, and idiosyncrasies.

Because verification is human‑based, it’s inherently subjective. A skilled forger can mimic the visual style, and the signature can degrade over time or become illegible. Legal systems still accept them for many contracts, but they lack the mechanized traceability needed for high‑frequency, high‑value crypto transactions.

Technical Architecture: From Hashes to Public Keys

Creating a digital signature starts with a cryptographic hash (SHA‑256 is common). The hash compresses the entire document into a fixed‑size fingerprint. That fingerprint is then fed into a signing algorithm together with the signer’s private key.

Various algorithms exist, each with its own trade‑offs. ECDSA uses elliptic‑curve mathematics to achieve security comparable to RSA but with much shorter keys (e.g., a 256‑bit curve versus a 3072‑bit RSA key) is the workhorse for Bitcoin and Ethereum. It stems from the discrete‑log problem, making it resistant to known attacks while keeping computation light for mobile wallets.

Newer schemes such as Schnorr Signatures are provably secure, non‑malleable, and enable linear aggregation of multiple signers into a single compact signature were introduced to Bitcoin via the Taproot upgrade (BIP‑340). BLS Signatures provide deterministic, aggregate‑able signatures that can compress dozens of individual signatures into one, a feature useful for block‑level aggregation in proof‑of‑stake chains.

All these algorithms rely on a Public Key Infrastructure (PKI) that distributes and binds public keys to identities via digital certificates. In pure blockchain settings, the public key is often embedded directly in the transaction, eliminating the need for a central certificate authority.

Security, Non‑Repudiation, and Tamper Resistance

Digital signatures excel in three security dimensions:

- Authentication: Verification is a mathematical operation-if the public key matches, the signature is valid.

- Integrity: Any change to the signed data produces a different hash, instantly breaking the signature.

- Non‑repudiation: Because only the holder of the private key could have generated the signature, the signer cannot later deny involvement.

Traditional signatures lack these guarantees. A forger who reproduces the pen strokes can fool a visual examiner, and a signed paper can be altered without leaving a cryptographic trace.

In practice, crypto exchanges cite digital signatures as the reason they can settle billions of dollars daily without manual dispute resolution. The mathematical proof is indisputable and can be audited by anyone on the network.

Use Cases in Cryptocurrency and Blockchain

Beyond simple value transfer, digital signatures unlock advanced capabilities:

- Multi‑signature wallets: Require two or more private keys to approve a transaction. Schnorr’s key aggregation hides the number of signers, making multi‑sig transactions look like ordinary ones.

- Smart contract triggers: Contracts can verify a user’s signature on‑chain and execute code automatically, removing any need for off‑chain approval.

- Signature aggregation: BLS signatures allow a block to contain a single aggregate signature for all transactions, reducing on‑chain data by up to 50%.

- Threshold signatures: DAOs can require a quorum of members to sign a proposal without exposing individual signatures, enhancing privacy.

These features simply aren’t possible with handwritten signatures, which would require manual processing for every approval-an impractical approach for a network handling millions of transactions per day.

Performance and Scalability Considerations

Real‑world benchmarks show ECDSA verification takes roughly 0.2ms on a modern CPU, while RSA verification can be 10‑20× slower due to larger key sizes. Schnorr adds a slight overhead but gains massive savings when aggregating signatures-Bitcoin’s Taproot upgrade can boost transaction capacity by 20‑40%.

Developers also appreciate deterministic signatures (e.g., EdDSA) because they remove nonce‑reuse vulnerabilities, a common source of private‑key leakage.

Implementation Complexity and Adoption

Deploying digital signatures demands a PKI‑style setup: generate key pairs, protect private keys (hardware wallets, HSMs), distribute public keys, and integrate verification code. Open‑source libraries like libsecp256k1, OpenSSL, and Bouncy Castle provide battle‑tested implementations, and community forums are full of step‑by‑step guides.

Traditional signatures need no software-just a pen and a piece of paper. However, scaling manual verification across thousands of contracts quickly becomes a bottleneck.

Regulatory bodies worldwide now recognize digital signatures as legally binding (U.S. ESIGN Act, EU eIDAS). This legal backing fuels enterprise adoption beyond crypto, into banking, insurance, and supply‑chain sectors.

Choosing the Right Signature Scheme

When picking a scheme for a new blockchain or a crypto‑related product, ask these questions:

| Criterion | Digital Signatures (ECDSA/Schnorr/BLS) | Traditional Signatures |

|---|---|---|

| Security | Cryptographic, resistant to forgery | Subjective, vulnerable to skilled forgery |

| Scalability | Automated verification of millions of signatures | Manual verification limits throughput |

| Non‑repudiation | Mathematical proof of authorship | Can be contested, requires expert testimony |

| Implementation Cost | Initial PKI setup, software development | Low upfront cost, high labor cost at scale |

| Legal Acceptance | Recognized in many jurisdictions | Universally accepted for paper contracts |

If your project handles high‑frequency transactions, needs programmable verification, or plans to use multi‑sig or threshold features, a modern digital scheme is the clear winner. For low‑volume, purely legal documents that must be physically signed (e.g., a deed), a traditional signature may still make sense.

Checklist for Deploying Digital Signatures in Crypto Projects

- Generate strong, unique private keys (use hardware wallets or secure enclaves).

- Choose an algorithm that matches your performance and security needs (ECDSA for legacy compatibility, Schnorr for aggregation, BLS for block‑level compression).

- Implement robust key‑management policies (rotate keys, revoke compromised keys, store backups securely).

- Integrate a well‑audited library (libsecp256k1, ed25519‑ref, BLS12‑381 implementations).

- Test verification across multiple platforms (desktop, mobile, hardware wallets).

- Confirm legal compliance with relevant e‑signature regulations (ESIGN, eIDAS).

Frequently Asked Questions

Can a digital signature be forged?

Only if an attacker obtains the signer’s private key or breaks the underlying cryptographic hardness assumption (e.g., solving the elliptic‑curve discrete‑log problem). With properly generated keys and up‑to‑date algorithms, forging is computationally infeasible.

Do traditional signatures have any place in crypto?

They’re useful for off‑chain legal agreements (e.g., partnership contracts) that later get referenced on‑chain. Inside the blockchain, they’re impractical because you can’t programmatically verify a handwritten mark.

What’s the main advantage of Schnorr over ECDSA?

Schnorr signatures are linear, allowing multiple public keys to be aggregated into a single signature. This reduces transaction size, hides the number of signers, and eliminates signature malleability issues present in ECDSA.

Are BLS signatures ready for production?

Several proof‑of‑stake networks (e.g., Ethereum 2.0’s upcoming phases) are already integrating BLS for committee signatures. The libraries are mature, but developers should still audit implementations for side‑channel risks.

How does quantum computing threaten current digital signatures?

Shor’s algorithm can solve the discrete‑log and integer‑factorization problems, breaking ECDSA, RSA, and related schemes. Post‑quantum candidates like CRYSTALS‑Dilithium and Falcon are being standardized to replace them before large‑scale quantum computers appear.

Finance

Finance

Karl Livingston

August 21, 2025 AT 00:58Digital signatures are the unsung heroes of modern crypto-quiet, relentless, and absolutely pivotal. They let us move value at the speed of light without ever needing a notary in the room. The math behind them is elegant, turning a simple hash into an ironclad proof. It’s fascinating how a few lines of code can replace centuries of paperwork.

Kyle Hidding

August 21, 2025 AT 20:25The post glosses over the inherent fragility of current ECDSA implementations, failing to address nonce reuse attacks that can jeopardize the entire ecosystem. Moreover, the reliance on elliptic‑curve hardness is a single point of failure in the advent of quantum breakthroughs. One must also consider side‑channel leakage in hardware wallets, which is often brushed aside as “implementation detail”.

Andrea Tan

August 22, 2025 AT 15:52Got the gist that digital signatures win on scalability, which is spot on. Traditional ink still has its niche, especially for court‑bound agreements. Nice breakdown of the pros and cons.

Gaurav Gautam

August 23, 2025 AT 11:18I love how the article highlighted Schnorr’s linearity-really opens doors for multi‑sig wallets that look like single‑sig transactions. The aggregation feature can shrink block sizes dramatically, which is a boon for low‑bandwidth nodes. Also, the comparison table makes the trade‑offs crystal clear for anyone deciding between ECDSA and newer schemes. Just a heads‑up: when you move to BLS, you need to watch out for pairing‑based computational overhead. Overall, the piece does a solid job balancing technical depth with accessibility.

Robert Eliason

August 24, 2025 AT 06:45i think trad signatures still matter for some legacy contracts but digital is clearly the future i guess

Cody Harrington

August 25, 2025 AT 02:12Great to see the practical checklist at the end-helps developers avoid the usual pitfalls. Keeping private keys secure is non‑negotiable; hardware wallets are the way to go. Also, testing across platforms early saves tons of headaches later.

Chris Hayes

August 25, 2025 AT 21:38The emphasis on non‑repudiation hits the nail on the head. A handwritten signature can always be contested, whereas a cryptographic proof is immutable. For high‑value transfers, that assurance is priceless.

Donald Barrett

August 26, 2025 AT 17:05Nice but the article skips the fact that many blockchains still use insecure curve parameters. That’s a massive oversight.

vipin kumar

August 27, 2025 AT 12:32The whole narrative about digital signatures being the ultimate answer feels a bit naive. Have you considered the hidden backdoors that could be embedded by state actors? Even the best‑crafted algorithms can be subverted at the implementation level, especially when open‑source libraries are compromised. Keep an eye on supply‑chain attacks.

Mark Briggs

August 28, 2025 AT 07:58Sure, that's a bold claim.

mannu kumar rajpoot

August 29, 2025 AT 03:25Interesting point, but you missed the edge cases where aggregation fails and you end up with larger data. Also, the security model changes when you combine keys.

Tilly Fluf

August 29, 2025 AT 22:52From a formal standpoint, the distinction between cryptographic proof and visual verification is well‑articulated. The systematic approach to assessing implementation cost is commendable. However, the article could benefit from citing specific regulatory frameworks, such as the U.S. ESIGN Act, to substantiate legal acceptance claims. Overall, the exposition maintains a high level of scholarly rigor.

Vaishnavi Singh

August 30, 2025 AT 18:18One might contemplate the epistemological implications of trusting a mathematical proof over a human eye. Yet, the practical necessities of blockchain demand such trust. The piece aligns well with that line of thought.

Peter Johansson

August 31, 2025 AT 13:45👍 Absolutely love how the article walks you through the whole lifecycle-from key generation to verification. First, you generate a strong private key, ideally stored on a hardware device, because exposing it to the internet is a recipe for disaster. Next, you hash your payload (usually with SHA‑256) which condenses the data into a fixed‑size fingerprint-this step is crucial for ensuring integrity. Then, that hash is fed into the signing algorithm, be it ECDSA, Schnorr, or BLS, together with your private key, resulting in a signature that anyone can verify with the corresponding public key.

One of the biggest advantages of Schnorr is its linearity, which allows multiple signers to combine their public keys into a single aggregate public key. This means a multi‑sig transaction looks exactly like a regular transaction on the blockchain, preserving privacy and saving space. BLS takes this a step further by enabling dozens or even hundreds of signatures to collapse into one, dramatically reducing block size and improving throughput for proof‑of‑stake networks.

But remember, the security of all these schemes hinges on protecting the private key. Hardware wallets, secure enclaves, or even offline cold storage are essential. If an attacker extracts your key, the whole system collapses, irrespective of the algorithm’s mathematical strength.

From a compliance perspective, it’s worth noting that many jurisdictions have embraced e‑signatures under legislation like the EU’s eIDAS and the U.S. ESIGN Act. This legal backing makes digital signatures not just technically robust but also legally enforceable, which is a key consideration for enterprises.

Finally, the article’s checklist is spot‑on: generate strong keys, pick the right algorithm for your use‑case, implement robust key‑management policies, and test verification across all targeted platforms. Following these steps will set you up for a secure, scalable, and future‑proof crypto project. 🚀

Cindy Hernandez

September 1, 2025 AT 09:12The practical checklist really ties everything together nicely. Remember to rotate keys periodically-cryptographic hygiene matters. Also, double‑check that your library versions are up‑to‑date to avoid known CVEs.

victor white

September 2, 2025 AT 04:38One cannot overlook the aesthetic elegance of elliptic‑curve mathematics; it is a triumph of abstract algebra manifesting in concrete security. The discourse, however, would benefit from a more nuanced critique of legacy RSA deployments that stubbornly persist in certain ecosystems. Still, the comparative matrix serves as a lucid guide for practitioners.

Angela Yeager

September 3, 2025 AT 00:05Well‑written summary, especially the part about legal acceptance across jurisdictions. It’s reassuring to see the technology aligning with regulatory frameworks. Nice work!

Darren R.

September 3, 2025 AT 19:32Oh my gosh!!! The sheer drama of this whole digital‑signature saga is just *exquisite*!!!; It's like watching a Shakespearean tragedy where the villain is quantum computing and the hero is…well, us!; But seriously, we must act now!!!; Upgrade, audit, and pray!!!; The stakes could not be higher!!!

Hardik Kanzariya

September 4, 2025 AT 14:58Great to see the emphasis on key‑management-can't stress enough how vital it is. Hardware wallets are a must, and rotating keys regularly keeps the attack surface low.

Shanthan Jogavajjala

September 5, 2025 AT 10:25When you talk about aggregation, remember that the underlying math requires pairing‑based cryptography, which can be CPU‑intensive. Also, proper validation of aggregated signatures is essential to avoid subtle replay attacks.

Millsaps Delaine

September 6, 2025 AT 05:52The article does a commendable job illuminating the nuances of modern signature schemes. Yet, one must not forget that the very notion of trust, even in a mathematically sound system, is a social construct that we embed into code. When we champion Schnorr for its linearity, we also tacitly endorse a reduction in transparency; the aggregated signature tells us nothing about the individual contributors, which could be problematic in regulated environments demanding auditability. Moreover, the shift toward BLS for massive aggregation introduces pairing‑based operations, whose computational cost may offset the apparent gains in bandwidth, especially for low‑power IoT nodes. It is also noteworthy that while the post mentions quantum threats humorously, the urgency of migrating to post‑quantum schemes cannot be overstated-CRYSTALS‑Dilithium and Falcon are already finalists in the NIST standardization process. In practice, a hybrid approach-maintaining legacy ECDSA signatures while gradually introducing post‑quantum signatures-might provide a pragmatic pathway. Finally, the legal acceptance section, though accurate regarding ESIGN and eIDAS, omits the nuanced variations in enforcement across jurisdictions; for instance, some European nations still require a qualified electronic signature for certain public‑law contracts. All in all, a solid foundation, but the devil resides in the implementation details, governance policies, and future‑proofing strategies.

Jack Fans

September 7, 2025 AT 01:18Good overview, but don’t forget to test edge‑cases like malformed signatures; they can cause unexpected crashes. Also, keep an eye on library updates-security patches roll out frequently.