Pakistan Crypto Mining Power Calculator

Mining Parameters

Estimated Results

Annual BTC Production: 0 BTC

Annual Revenue: PKR 0

Annual Cost: PKR 0

Profit Margin: 0%

Power Utilization: 0%

Efficiency Factor: 0 J/TH

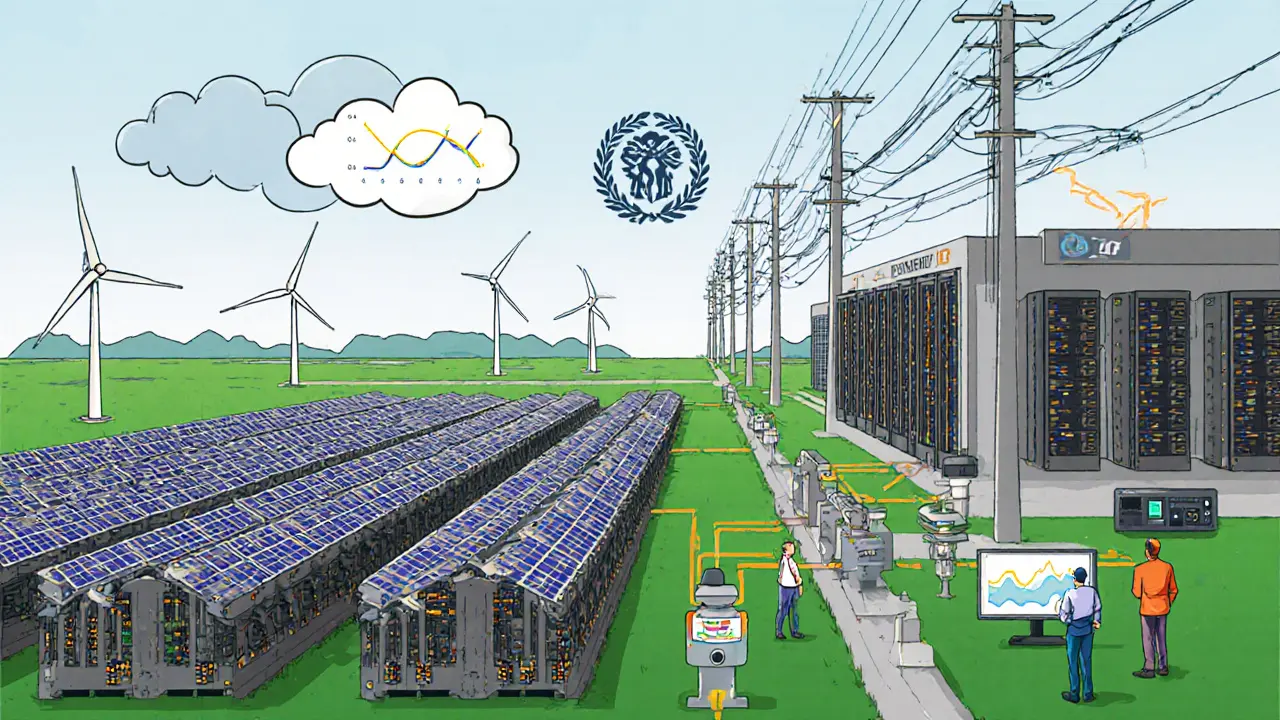

When the Pakistan government announced a 2,000MW power grant for cryptocurrency mining in May2025, the move sent shockwaves through the global mining community. The plan ties together surplus electricity, a fledgling regulatory framework, and big‑name advisers to create what could become one of the world’s largest state‑backed mining operations.

Why Pakistan Is Turning Surplus Power into Bitcoin

Pakistan currently sits on about 7,000MW of idle generation capacity, most of it coal‑fired plants running at a fraction of their design output. Pakistan Crypto Council a government‑created body under the Ministry of Finance that coordinates crypto‑related projects sees this under‑utilisation as a revenue opportunity. By allocating 2,000MW-roughly 28.5% of the surplus-to Bitcoin mining and AI data centers, officials hope to turn “dead‑weight” electricity into billions of rupees of foreign exchange.

Key Players and Their Roles

The initiative is spearheaded by Finance Minister Muhammad Aurangzeb the senior cabinet member who championed the power‑allocation bill. Beside him, Bilal Bin Saqib Special Assistant to the Prime Minister on Blockchain and Crypto, responsible for policy rollout handles the regulatory side. Internationally, Changpeng Zhao co‑founder of Binance and strategic adviser to the Pakistan Crypto Council brings market credibility and technical know‑how.

Electricity Pricing - The Subsidy Debate

The government pushed a subsidised rate of 23‑24PKR per kWh (≈$0.08) for mining farms. That price sits comfortably between the global low of $0.03 in ultra‑cheap hydro regions and the high end of $0.15 in oil‑dependent markets. To illustrate the competitive edge, see the table below.

| Country / Region | Typical Rate | Key Energy Source |

|---|---|---|

| Pakistan (proposed) | $0.08 | Coal + Solar Mix |

| China (pre‑ban) | $0.04 | Hydropower |

| Kazakhstan | $0.06 | Coal |

| United States (Texas) | $0.12 | Natural Gas |

| Canada (Québec) | $0.03 | Hydro |

Projected Output and Economic Impact

Bitcoin mining researcher DanielBatten estimates the 2,000MW allocation could generate 17,000BTC per year-about $1.8billion at October2025 spot prices. Even a modest 10% utilisation would still net roughly $180million annually, enough to offset the idle‑plant losses that cost Pakistan around 2.8trillion PKR each year.

Beyond direct revenue, the plan aims to create thousands of high‑skill jobs in hardware maintenance, data‑center management, and AI research. Existing data‑center operators-PTCL Pakistan Telecommunication Company Limited, a leading telecom and data‑center provider, Multinet, Chapal, Supernet, Cybernet, Vision Telecom-are already positioned to host mining rigs alongside AI workloads.

Regulatory Landscape and IMF Concerns

The International Monetary Fund (IMF) has flagged the subsidy structure as a potential market distortion. International Monetary Fund global watchdog that monitors macro‑economic policies, currently in talks with Pakistan over the mining subsidy worries about the ability to phase out subsidies without hurting investors. IMF staff have asked how the government plans to transition to market‑based rates once the pilot proves profitable.

Pakistani officials counter that the subsidy is temporary-designed to attract capital while the power sector stabilises. Both sides remain in “informational discussions”, according to public statements in July2025.

Technical Challenges and Grid Management

Running 2,000MW of mining hardware 24/7 puts pressure on transmission lines already stretched by residential demand spikes. The power‑division must ensure that mining farms do not jeopardise grid stability. Key technical tasks include:

- Integrating real‑time load‑balancing software that can throttle mining rigs during peak demand.

- Deploying on‑site renewable generators (solar or wind) to offset the carbon footprint of coal‑based mining.

- Upgrading substations in Lahore, Karachi, and Islamabad to handle the extra load.

Training programs are being set up for engineers to understand blockchain‑specific power consumption patterns, a skill set that traditionally does not feature in utility curricula.

Comparing Pakistan’s Model to Other Mining Hubs

China’s 2021 ban forced miners to relocate, creating a vacuum that countries like Kazakhstan, Russia, and the United States filled. Pakistan’s approach differs in two ways:

- State‑backed subsidy rather than purely market‑driven incentives.

- Co‑location of AI data centres, aiming to create a “digital bridge” between Asia, Europe, and the Middle East.

While Kenya and Ethiopia are experimenting with renewable‑only mining, Pakistan relies on a mixed coal‑solar portfolio, giving it flexibility but also exposing it to environmental scrutiny.

What This Means for Investors

Foreign mining operators view the offer as a low‑cost entry point, especially given the $0.08/kWh rate and the possibility of tax holidays. However, they must weigh the IMF‑related regulatory risk. The presence of Binance co‑founder Changpeng Zhao as adviser signals strong industry backing, potentially smoothing over financing hurdles.

For venture capitalists, the broader ecosystem-AI data centres, telecom partners, and a nascent crypto regulatory framework-offers a diversified exposure beyond pure mining revenue.

Next Steps and Timeline

The rollout is divided into three phases:

- Phase1 (Q42025 - Q22026): Commission 500MW of mining capacity, test grid‑stability protocols, and finalize subsidy unwind plan.

- Phase2 (2026‑2027): Scale to the full 2,000MW, integrate AI workloads, and attract at least three major international operators.

- Phase3 (2028+): Review performance, negotiate permanent electricity pricing, and consider expanding to renewable‑only mining farms.

Stakeholders are advised to monitor IMF statements and the Pakistan Crypto Council’s monthly updates for any shifts in policy or pricing.

Frequently Asked Questions

How much Bitcoin can 2,000MW actually produce?

At current network difficulty, 2,000MW of efficient ASICs can mine roughly 17,000BTC per year, translating to about $1.8billion at October2025 prices.

What is the proposed electricity rate for miners?

The government has set a subsidised rate of 23‑24PKR per kWh, roughly $0.08, for the first three years of operation.

Will the IMF block the project?

The IMF has expressed concerns about the subsidy’s sustainability but has not issued a formal veto. Ongoing technical discussions aim to align the program with macro‑economic goals.

Can foreign miners set up operations without a local partner?

Regulations require a Pakistani entity to hold the mining licence. Most foreign firms are partnering with local telecom or data‑centre owners like PTCL.

What happens to the subsidy after Phase1?

The plan calls for a gradual transition to market‑based rates over a three‑year period, contingent on IMF approval and grid‑stability metrics.

Finance

Finance

Ayaz Mudarris

September 24, 2025 AT 05:03From an analytical standpoint, allocating 2,000 MW of otherwise idle generation capacity to cryptocurrency mining represents a notably efficient re-purposing of national assets. The projected revenue of approximately $1.8 billion annually could offset a substantial portion of the fiscal deficit incurred by underutilised coal plants. Moreover, the integration of AI data‑centre workloads alongside mining operations may diversify the technological ecosystem, fostering ancillary skill development. It is essential, however, to monitor grid stability metrics closely, ensuring that residential demand is not jeopardised. The gradual transition to market‑based electricity rates, as stipulated for Phase 1, should align with IMF recommendations to mitigate macro‑economic distortions.

Irene Tien MD MSc

September 27, 2025 AT 04:26Ah, the grand illusion of a government‑backed crypto utopia, where idling coal plants finally find purpose, or so the official narrative would have you believe. The dazzling promises of billions in foreign exchange? Just a glittering veneer masking the deeper realities – a massive subsidy that will inevitably become a fiscal blackhole, a potential environmental nightmare, and a geopolitical lever for the IMF to pull when the lights flicker.

One must ask, why does a nation rich in untapped solar potential choose a coal‑heavy mix, cozying up to the very industry that fuels climate change? The answer, dear reader, lies in the cozy dance between political elites and crypto magnates who whisper sweet nothings about “digital bridges” while the average citizen wonders when their electricity bill will finally make sense. And let’s not forget the uncanny resemblance to past schemes where state‑sponsored projects vanish into bureaucratic oblivion, leaving only phantom profits on paper.

In short, brace yourselves for a saga of subsidies, regulatory hair‑pulling, and a lot of wasted potential, all under the neon glow of Bitcoin’s volatile price chart.

Karl Livingston

September 30, 2025 AT 04:40I get the excitement about turning idle power into revenue, but I also worry about the human side. Thousands of jobs sound great, yet the skill gap is huge – many local engineers haven’t worked with ASICs before. The training programs mentioned are a step in the right direction, but they need real funding and time. Also, the environmental impact shouldn't be ignored; even with a coal‑solar mix, the carbon footprint could be significant. It would be wise to push for renewable‑only mining farms early on, rather than retrofitting later.

Kyle Hidding

September 30, 2025 AT 18:33From a systems‑engineering perspective, the integration of 2,000 MW of mining hardware imposes a non‑trivial load profile on the transmission network. Real‑time demand response mechanisms must be provisioned to curtail hash‑rate during peak residential consumption windows. Failure to implement such throttling could precipitate voltage sag events, compromising both grid reliability and miner profitability. Moreover, the proposed onsite renewable offsets, while conceptually sound, require rigorous capacity factor assessments to ensure they meaningfully reduce net emissions. In short, the technical scaffolding must match the economic aspirations.

Andrea Tan

October 3, 2025 AT 16:00Sounds like a solid plan if they can keep the power cheap and the grid stable. I’m curious how the local telecom firms will handle the extra heat and noise. Hopefully they’ve got good cooling solutions.

Gaurav Gautam

October 7, 2025 AT 03:20It’s encouraging to see a collaborative approach that blends crypto mining with AI workloads. If the government can keep the subsidy transparent and phase it out responsibly, this could be a win‑win for the economy and technological development. Let’s hope the regulators stay flexible and the IMF’s concerns are addressed without stifling innovation.

Robert Eliason

October 7, 2025 AT 17:13Yo, the whole "temporary" subsidy thing sounds like a classic bait‑and‑switch. They’ll probably keep the rates low forever and just blame the IMF when they can’t. Not buying the “phase‑out” hype.

Cody Harrington

October 10, 2025 AT 14:40I think the phased rollout makes sense; starting small lets them iron out issues before scaling to the full 2 GW. It’s a pragmatic approach.

Chris Hayes

October 12, 2025 AT 22:13The project's success hinges on disciplined execution. Too often, ambitious plans crumble under bureaucratic inertia. Keep an eye on actual utilization numbers; if they stay below 10 %, the whole thing is a misallocation of resources.

Samuel Wilson

October 15, 2025 AT 05:46From a coaching perspective, it is essential to establish clear performance metrics for both the mining farms and the grid operators. Regular audits will ensure that the intended economic benefits materialise while mitigating risk to the broader power system.

Rae Harris

October 17, 2025 AT 13:20Honestly, the whole thing smells like a grand experiment in market distortion. They’re basically handing out cheap electricity to a speculative industry – classic economics 101: subsidies lead to inefficiency.

Danny Locher

October 19, 2025 AT 20:53It’s exciting to see a country embrace new tech while trying to keep the lights on for everyone. Let’s hope the renewable side of the mix grows fast.

Emily Pelton

October 22, 2025 AT 04:26Listen up, folks! This initiative is a double‑edged sword; on one side, it promises economic growth, job creation, and technological advancement, but on the other side lurks the danger of creating a dependency on artificial subsidies that could cripple the national budget if not carefully phased out!; We must demand transparency, rigorous oversight, and a clear exit strategy for the subsidy regime; otherwise, we risk a fiscal nightmare that will echo for generations!

sandi khardani

October 24, 2025 AT 12:00The proposal is fundamentally flawed because it relies on an artificial price floor that does not reflect true market dynamics; by artificially depressing electricity costs, the government is effectively socialising the risk while privatizing the reward; this asymmetry will inevitably lead to rent‑seeking behaviour, inflated capital expenditures, and a misallocation of scarce resources that could have been directed toward genuinely productive sectors; the lack of a clear timeline for subsidy removal further exacerbates the problem, creating an environment ripe for regulatory capture and policy inertia; in short, without structural reforms, this scheme is a textbook case of fiscal irresponsibility.

Donald Barrett

October 26, 2025 AT 18:33Seriously, giving away cheap power to crypto miners is the most obtuse policy move I've seen. It's like handing a kid the keys to a sports car and expecting no crashes. Wake up!

Lara Cocchetti

October 29, 2025 AT 02:06There’s a hidden agenda here: by subsidising crypto mining, the state is indirectly funding a system that fuels illicit activities and evades regulation. This isn't just about economics; it's about national security and moral responsibility.

meredith farmer

October 31, 2025 AT 09:40Drama aside, this whole thing feels like a plot from a dystopian novel-government, big tech, secretive advisors, and a nation’s power grid turned into a mining rig. If the narrative were any more theatrical, we'd be watching a movie.

mark gray

November 2, 2025 AT 17:13While the initiative has potential, it's crucial to maintain clear boundaries between state support and private profit. Transparent reporting and stakeholder engagement will help balance these interests.

Alie Thompson

November 5, 2025 AT 00:46It is unsettling that a government would prioritize a volatile, speculative industry over tangible public services. The moral implication of diverting essential resources to a market that thrives on anonymity and can be used for illicit financing cannot be ignored. Moreover, the long‑term environmental consequences of scaling coal‑based mining operations present a stark contradiction to any claims of sustainable development. Policymakers must weigh the fleeting allure of cryptocurrency profits against the enduring duty to protect public welfare and ecological integrity. In this context, the ethical justification for such subsidies becomes increasingly tenuous, demanding a thorough public discourse and rigorous accountability mechanisms.

Christina Norberto

November 7, 2025 AT 08:20From a philosophically analytical perspective, the subsidised electricity scheme can be interpreted as a manifestation of state‑induced market externalities that contravene the principle of Pareto efficiency. By artificially lowering the marginal cost of production for cryptographic hashing, the government distorts the allocation of scarce resources, thereby generating a deadweight loss that reverberates through the broader economy. Furthermore, the epistemic risk associated with volatile crypto asset valuation introduces systemic uncertainty that could impair macro‑economic stability, especially if the anticipated foreign exchange inflows fail to materialise.

In essence, unless robust mitigation strategies are instituted-including transparent subsidy timelines, rigorous emissions accounting, and diversified revenue streams-the policy risks becoming an unsustainable fiscal burden.

Fiona Chow

November 9, 2025 AT 15:53It's fascinating how the plan tries to blend cutting‑edge AI data centres with traditional mining rigs. If executed well, this hybrid model could create a resilient tech hub in the region, attracting talent and investment beyond just crypto.

Shanthan Jogavajjala

November 11, 2025 AT 23:26Not to be intrusive, but have we considered the potential for local communities to be displaced by large‑scale mining farms? Proper stakeholder consultation is essential.