When you think of Bitcoin, you might picture digital money or volatile prices. But beneath the surface, there’s a quiet, powerful engine keeping it all running: the Bitcoin network hash rate. This isn’t just tech jargon-it’s the real reason Bitcoin hasn’t been hacked, frozen, or taken over in over 15 years. And it’s growing stronger every day.

What Exactly Is Hash Rate?

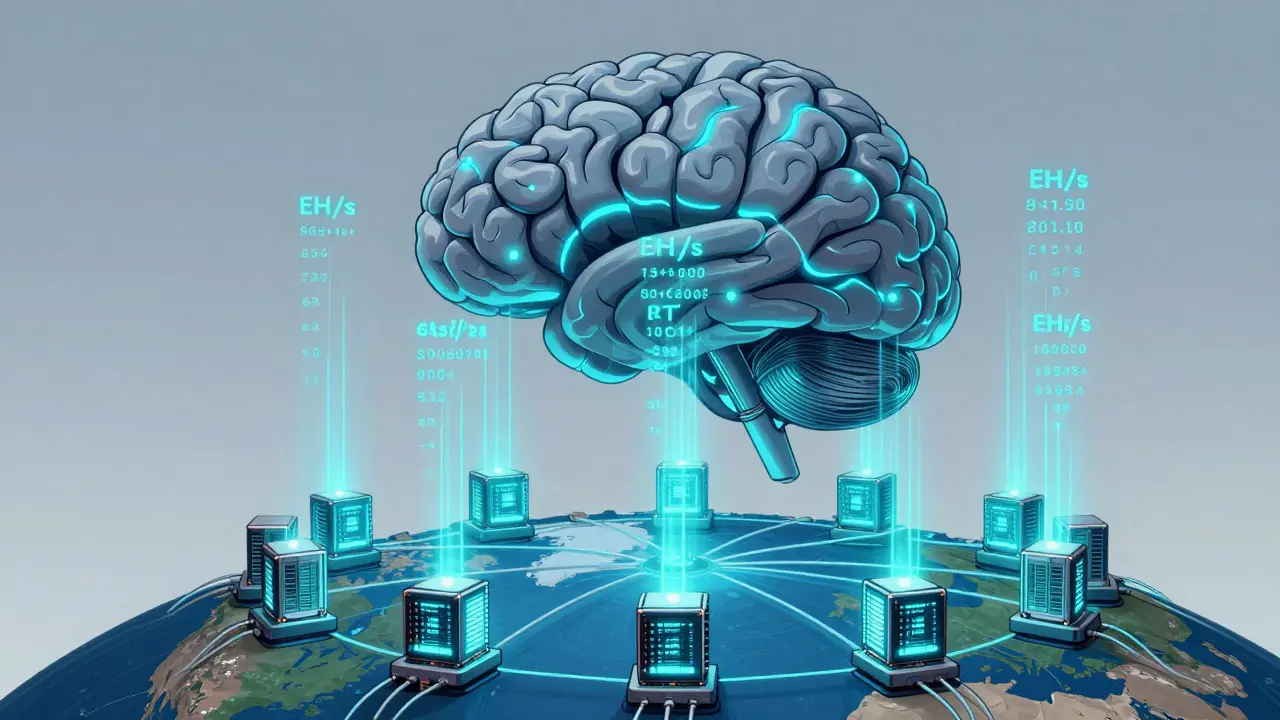

Hash rate is the total computing power being used by all Bitcoin miners around the world to process transactions and secure the network. Think of it like a giant, global supercomputer made up of thousands of machines, all racing to solve the same math puzzle. The faster they solve it, the higher the hash rate.

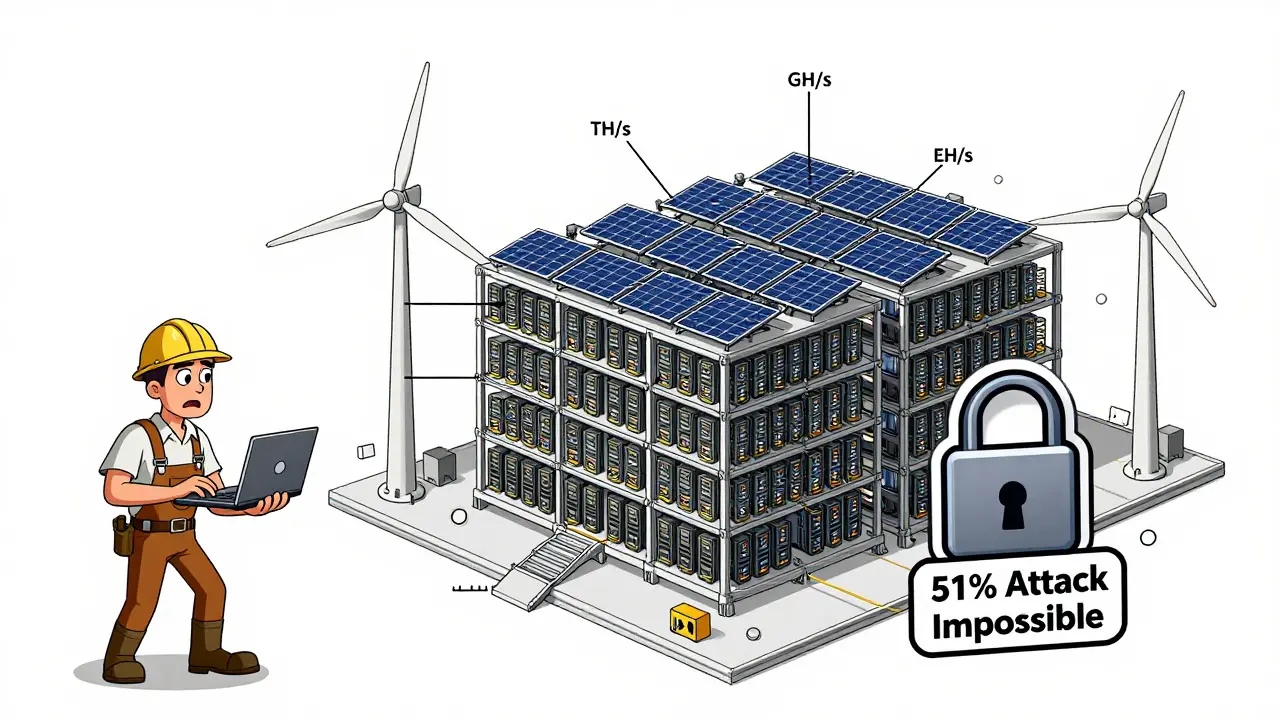

It’s measured in hashes per second. That’s how many guesses these machines make every second trying to find the right answer. Because the numbers are so huge, we use bigger units:

- 1 GH/s = 1 billion guesses per second

- 1 TH/s = 1 trillion guesses per second

- 1 EH/s = 1 quintillion guesses per second (that’s 1 followed by 18 zeros)

As of late 2025, Bitcoin’s hash rate sits above 800 EH/s. That means, right now, miners are making over 800 quintillion guesses every second. To put that in perspective, the entire internet doesn’t come close to matching that level of raw computational power.

Why Does Hash Rate Matter for Security?

Bitcoin doesn’t have banks, police, or CEOs to enforce rules. Instead, it relies on math and economics. The hash rate is the backbone of that system.

Every 10 minutes, a new block of transactions is added to the blockchain. To add it, a miner must solve a cryptographic puzzle. The first one to solve it gets rewarded in Bitcoin. But here’s the key: the puzzle is designed to be hard to solve but easy to verify. That’s where hash rate comes in.

The higher the hash rate, the harder it is for anyone to cheat. Why? Because of something called a 51% attack. If one person or group controlled more than half of the network’s total hash rate, they could theoretically reverse transactions, block others, or double-spend Bitcoin. Sounds scary, right?

But here’s the catch: controlling 51% of Bitcoin’s current hash rate would cost billions of dollars in hardware and electricity. You’d need to buy and run more mining machines than the rest of the world combined. And even then, you’d be fighting against the network’s automatic difficulty adjustments-more hash rate means the puzzle gets harder, making your attack even more expensive.

That’s why Bitcoin’s security isn’t about encryption or passwords. It’s about cost. The network is secure because it’s cheaper to mine Bitcoin honestly than to try to break it.

How Hash Rate Keeps the Network Running

Bitcoin doesn’t just rely on hash rate for security-it uses it to keep time.

Every 2,016 blocks (roughly every two weeks), the network automatically adjusts how hard the puzzle is based on how fast blocks have been found. If miners are solving blocks too quickly (because more hash power joined), the difficulty goes up. If miners leave (maybe because Bitcoin’s price dropped), the difficulty goes down.

This system ensures that, no matter how many miners are online or how powerful their machines are, a new block is added to the blockchain every 10 minutes on average. It’s like a self-correcting clock that never needs winding.

This adjustment is why hash rate and Bitcoin price don’t move in perfect sync. When Bitcoin’s price spikes, miners rush to buy new equipment. But it takes months to build factories, ship hardware, and set up power lines. So the hash rate rises slowly after a price surge-and falls slowly when prices drop. That lag is built into the system on purpose.

Who Runs the Hash Rate? Miners and Pools

Bitcoin mining isn’t done on your laptop. It’s done on specialized machines called ASICs-Application-Specific Integrated Circuits. These are custom-built silicon chips that only do one thing: mine Bitcoin. They’re expensive, power-hungry, and noisy. But they’re also incredibly efficient at solving the hash puzzle.

Because the odds of one miner finding a block alone are tiny, most miners join mining pools. These are groups of miners who combine their hash power. When one of them finds a block, the reward is split based on how much computing power each contributed.

Geographically, mining has become more spread out than ever. A few years ago, most mining was in China. Today, it’s scattered across the U.S. (especially Texas and Georgia), Canada, Kazakhstan, Russia, and parts of Europe. This decentralization makes the network more resilient. If one country shuts down mining, the rest keep going.

What Happens When Hash Rate Drops?

Hash rate doesn’t just measure power-it’s a warning signal.

If the hash rate suddenly drops by 20% or more in a few days, exchanges and wallet providers start paying attention. Why? Because a sharp decline means fewer miners are active. That could be due to a price crash, power outages, or government crackdowns.

A lower hash rate makes a 51% attack cheaper. If the network’s total computing power falls from 800 EH/s to 200 EH/s, an attacker might only need $50 million instead of $200 million to take control. That’s still a lot-but it’s within reach for well-funded bad actors.

That’s why platforms like Coinbase and Kraken monitor hash rate in real time. If they see a steep drop, they may temporarily pause deposits or withdrawals to protect users. It’s not panic-it’s precaution.

Hash Rate and Bitcoin’s Future

The trend is clear: Bitcoin’s hash rate keeps setting new all-time highs, even during price dips. Why? Because mining is becoming more professional. Big companies, institutional investors, and even energy firms are getting involved.

Many new mining operations now use stranded or wasted energy-like flare gas from oil fields or excess hydroelectric power. This isn’t just good for the environment; it’s good for Bitcoin. It makes mining cheaper and more sustainable, which encourages more participation.

As hardware improves, we’ll see more efficient ASICs that use less electricity per hash. That means the same amount of hash power will cost less to run. That, in turn, makes Bitcoin even more secure without needing higher prices.

Long-term, Bitcoin’s value and its hash rate are locked in a feedback loop. More people use Bitcoin → more miners join → higher hash rate → stronger security → more trust → more adoption. It’s a cycle that keeps getting stronger.

Why You Should Care About Hash Rate

You don’t need to own a mining rig to understand hash rate. But if you hold Bitcoin, you should care.

It’s the invisible shield protecting your coins. A rising hash rate means the network is getting more secure. A falling one means you should pay attention. It’s not a price indicator-it’s a safety indicator.

Think of it like the number of guards around a vault. You don’t need to count them every day. But if they suddenly drop by half, you’d want to know why. Same with Bitcoin.

Hash rate is the proof that Bitcoin is still alive, growing, and more secure than ever. It’s not flashy. It doesn’t trend on Twitter. But without it, Bitcoin wouldn’t exist at all.

What is a good Bitcoin hash rate?

There’s no "good" or "bad" hash rate-it’s always growing. As of late 2025, Bitcoin’s hash rate exceeds 800 EH/s, which is the highest in its history. Higher is better because it means more security. Even during price corrections, the hash rate rarely drops for long because mining is a long-term investment. If it falls sharply, it’s a red flag.

Can Bitcoin’s hash rate be manipulated?

Not really. Hash rate is the sum of all mining power across thousands of independent operators worldwide. You can’t fake it. You can’t buy fake hashes. The only way to increase it is by deploying real hardware and paying for electricity. Any attempt to artificially inflate it would require massive resources and would be immediately visible to the network. The system is designed to resist manipulation.

Does hash rate affect Bitcoin’s price?

It’s the other way around. Bitcoin’s price influences hash rate, not the other way around. When the price rises, miners invest in more equipment, increasing hash rate. When the price falls, weaker miners shut down, and hash rate drops-usually with a delay. So while hash rate doesn’t drive price, it’s a lagging indicator of miner confidence and network health.

How often does Bitcoin’s mining difficulty change?

Every 2,016 blocks, which happens roughly every two weeks. The network looks at how long it took to mine the last 2,016 blocks. If it was faster than 10 minutes per block, difficulty increases. If slower, difficulty decreases. This keeps the block time stable no matter how much hash power is added or removed.

Can I check Bitcoin’s current hash rate?

Yes. You can view real-time hash rate data on sites like Blockchain.com, BitInfoCharts, or CoinWarz. These platforms update the number every few minutes. Watching the trend over weeks or months gives you a better sense of network health than checking a single number.

What’s Next for Hash Rate?

The future of Bitcoin’s hash rate is tied to three things: efficiency, energy, and decentralization.

ASIC manufacturers are already building chips that do more hashes per watt. That means less electricity for the same power. That’s good for miners-and good for the planet.

More mining is moving to places with cheap, renewable energy. Iceland, Canada, and parts of the U.S. are becoming hubs not just because of low costs, but because they offer clean power. This shift could make Bitcoin mining less controversial and more sustainable.

And as long as people keep using Bitcoin, the hash rate will keep climbing. It’s not just a number. It’s proof that the network is alive, growing, and more secure than any centralized system ever could be.

Finance

Finance

Rishav Ranjan

December 22, 2025 AT 22:04Mmathapelo Ndlovu

December 23, 2025 AT 04:11chris yusunas

December 24, 2025 AT 00:21Brian Martitsch

December 25, 2025 AT 02:57Sophia Wade

December 25, 2025 AT 23:08Zavier McGuire

December 27, 2025 AT 17:21Aaron Heaps

December 29, 2025 AT 13:21Steve B

December 31, 2025 AT 07:12Jake Mepham

January 1, 2026 AT 18:46Tristan Bertles

January 3, 2026 AT 13:48Jacob Lawrenson

January 4, 2026 AT 18:33Tyler Porter

January 5, 2026 AT 03:19Vyas Koduvayur

January 7, 2026 AT 02:48Jordan Renaud

January 8, 2026 AT 00:59Collin Crawford

January 8, 2026 AT 01:35Lloyd Yang

January 8, 2026 AT 17:08Craig Fraser

January 10, 2026 AT 05:45Helen Pieracacos

January 12, 2026 AT 00:13Janet Combs

January 13, 2026 AT 23:35Ellen Sales

January 14, 2026 AT 22:31SHEFFIN ANTONY

January 16, 2026 AT 19:05