Flamingo Finance Slippage Calculator

Flamingo Finance operates across multiple chains (Neo, zkSync, etc.), which fragments liquidity. This calculator estimates how much your trade might be impacted by slippage based on real-world data from the article. Remember: lower liquidity = higher slippage = higher fees.

Flamingo Finance isn’t your typical crypto exchange. You won’t find a sign-up form, KYC checks, or a customer support hotline. Instead, you connect your wallet-MetaMask, NeoLine, or any compatible one-and suddenly you’re in. Swaps, yield vaults, perpetual contracts, and even a synthetic stablecoin called FUSD are all just a few clicks away. It’s a full DeFi suite packed into one interface. But here’s the real question: is it actually useful, or just another flashy DeFi experiment with shaky fundamentals?

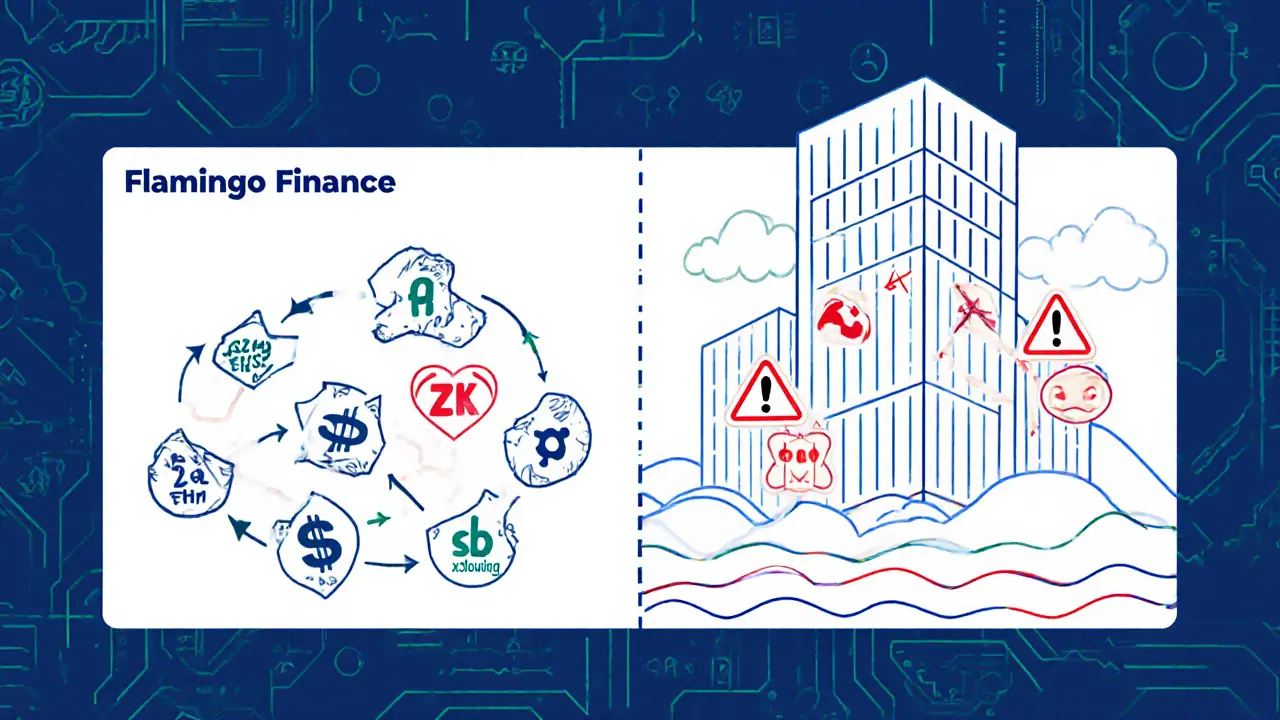

What Flamingo Finance Actually Does

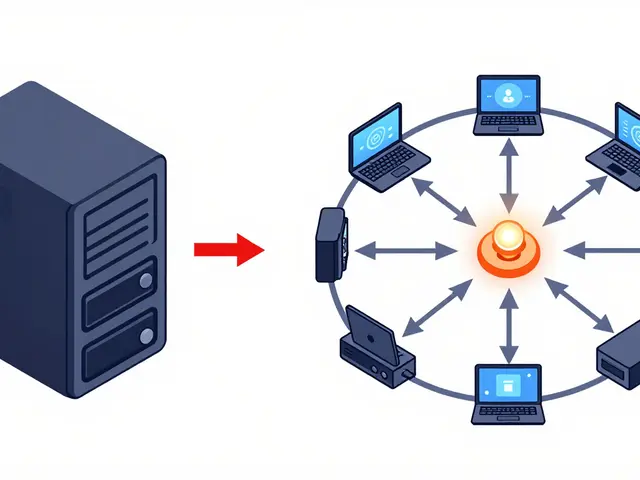

Flamingo Finance is a multi-chain DeFi platform built around six core modules: a swap engine, yield vaults, perpetual futures, a lending system, a stablecoin (FUSD), and a DAO for governance. Unlike centralized exchanges like Binance or Coinbase, Flamingo doesn’t hold your funds. You keep control. That’s the whole point of DeFi. But what sets it apart is how it bundles all these features together. You don’t need to jump between Uniswap, Aave, and dYdX. Flamingo tries to be the one-stop shop.

The native token, FLM, is used for voting on upgrades, fee distribution, and adding new assets. As of May 2025, the circulating supply was around 545.7 million tokens, with a market cap near $19.7 million. That’s tiny compared to giants like Uniswap ($4B+) or SushiSwap ($480M). But Flamingo’s real strength isn’t size-it’s convenience. If you’re tired of switching between five different dApps just to trade, stake, and borrow, Flamingo looks tempting.

How It Works: No Account, Just a Wallet

There’s no email, no password, no phone number. You open the Flamingo website, click ‘Connect Wallet,’ and you’re in. That’s it. The interface is clean, modern, and surprisingly intuitive-even for someone who’s used to DeFi before. The dashboard shows your wallet balance, active positions, and quick access to each module: Swap, Vault, Perps, Lending, and Governance.

Swaps use an automated market maker (AMM) model, similar to Uniswap. You pick two tokens, enter the amount, and click ‘Swap.’ The platform pulls liquidity from pools across Neo, zkSync, and other chains. The fees are low, often under 0.3%. Vaults let you deposit tokens like ETH or USDT and earn yield automatically. The platform claims to optimize returns by moving funds between protocols. But users report mixed results. One Reddit user said they were promised 20% APY but got closer to 5% after gas fees. That kind of gap is a red flag.

The FUSD Stablecoin and Perpetuals

Flamingo’s FUSD is a synthetic stablecoin pegged to the US dollar. It’s not backed by cash reserves like USDC. Instead, it’s algorithmically stabilized using collateral from other assets in the system. That’s risky. The U.S. SEC’s February 2025 guidance on algorithmic stablecoins made it clear they’re watching these closely. If regulators crack down, FUSD could face serious headwinds.

Perpetual contracts (perps) let you trade crypto with leverage-up to 10x on some pairs. This is where Flamingo tries to compete with centralized exchanges like Bybit or OKX. But liquidity is thin. Slippage is higher than on bigger platforms. And if the market moves fast, you could get liquidated before you even realize it. For casual traders, it’s not ideal. For experienced DeFi users who know how to manage risk, it’s a tool. But it’s not a replacement for a proper exchange.

Big Problems: Liquidity Fragmentation and Token Uncertainty

Flamingo runs on multiple chains: Neo, zkSync, and others. That sounds good-more reach, more users. But it’s a double-edged sword. Liquidity is split. A pool on Neo has $2 million. A pool on zkSync has $1.5 million. That’s not enough. On Ethereum, Uniswap’s USDC/ETH pool has over $1 billion. When liquidity is thin, prices move more. Slippage spikes. You pay more in fees just to get filled.

Then there’s the FLM token. What’s its real value? It’s used for voting, sure. But there’s no clear utility beyond that. No staking rewards, no fee discounts, no buybacks. Tokenomics are vague. That’s why analysts call it ‘uncertain.’ Some users are holding because they believe in the vision. Others are just gambling on a price pump. The Binance Monitoring Tag placed on FLM in April 2025 didn’t help. It’s not a delisting yet-but it’s a warning sign. If Binance pulls the plug, liquidity could vanish overnight.

Security and Resilience

Here’s one thing Flamingo got right: security. In May 2025, a major npm supply chain attack targeted EVM-based projects. Many DeFi platforms got hit. Flamingo didn’t. Why? Because its core DEX doesn’t rely on direct EVM transfers. It only uses EVM for cross-chain operations-and the malware didn’t target those. That’s a smart architectural choice. It shows the team understands risk.

They also reopened the Neo N3 cross-chain bridge in May 2025, which had been down for months. That’s a good sign. It means they’re still actively maintaining the platform. The community is small but active. Telegram has 12,500 members. Discord has 8,300. But response times to support tickets are slow-12 to 24 hours. If you’re stuck during a volatile market, that’s not enough.

How Flamingo Compares to the Competition

Let’s be clear: Flamingo isn’t competing with Binance. It’s competing with other multi-chain DeFi aggregators like THORChain, SushiSwap, and Synapse Protocol. Here’s how they stack up as of May 2025:

| Platform | Market Cap | TVL | Active Wallets/Day | Key Strength | Key Weakness |

|---|---|---|---|---|---|

| Flamingo Finance | $19.7M | $23.5M | 12,300 | All-in-one DeFi UI | Liquidity fragmentation, unclear tokenomics |

| THORChain | $420M | $680M | 28,000 | Best cross-chain swaps | Complex UI, steep learning curve |

| SushiSwap | $480M | $720M | 45,000 | Strong liquidity, solid token utility | Overcrowded features, slow upgrades |

| Synapse Protocol | $110M | $180M | 18,000 | Reliable cross-chain bridges | Limited product range |

Flamingo is smaller in every category. But it’s also simpler. If you want to do swaps, earn yield, and trade perps without jumping between five tabs, Flamingo is one of the few that makes that possible. But you’re paying for convenience with risk.

Price Predictions: Bullish or Bearish?

FLM’s price is all over the place. In May 2025, it was trading around $0.0364. CoinCodex predicts it’ll drop to $0.01957 by November 2025. CoinLore says it could hit $0.1249-over 200% higher. The truth? No one knows. The market is split. Some analysts blame the Binance Monitoring Tag. Others say the token just needs better incentives.

Here’s what’s certain: FLM’s all-time high was $0.1475. It’s nowhere near that now. If Flamingo can fix its liquidity issues, clarify FLM’s role, and attract more users, it might climb back. But right now, the odds are stacked against it. The platform’s daily active wallets dropped 15% in the last quarter. That’s not a good sign.

Who Should Use Flamingo Finance?

Flamingo Finance is not for beginners. If you don’t know what impermanent loss is, or how yield farming works, stay away. It’s also not for people who want to park large sums and earn safe returns. The vaults are unpredictable. The stablecoin is unregulated. The token has no clear value.

But if you’re a hands-on DeFi user who:

- Already uses multiple wallets and chains

- Wants to avoid switching between five different dApps

- Understands the risks of algorithmic stablecoins

- Is comfortable with low liquidity and high slippage

- Believes in the long-term vision of multi-chain DeFi

…then Flamingo might be worth your time. Just don’t invest more than you can afford to lose. And never, ever put your life savings into FLM.

The Bottom Line

Flamingo Finance is a bold experiment. It’s not broken. It’s not a scam. But it’s far from proven. The interface is slick. The features are impressive. But the foundation is shaky. Liquidity is thin. Tokenomics are unclear. And regulatory clouds are gathering.

It’s like a fancy electric car with a great interior but a fuel tank that’s half empty. You can drive it. You might even enjoy the ride. But if you’re planning a long trip, you’ll need to refill somewhere else.

If you’re curious, try it with a small amount. Connect your wallet. Do a $10 swap. Try a vault. See how it feels. But don’t bet your portfolio on it. The crypto world moves fast. Flamingo might rise. Or it might fade into obscurity. Right now, the odds lean toward the latter.

Is Flamingo Finance a centralized exchange?

No, Flamingo Finance is a decentralized platform. You never give up control of your funds. You connect your wallet-like MetaMask or NeoLine-and interact directly with smart contracts. There’s no account creation, no KYC, and no custodial risk. It’s pure DeFi.

Can I buy FLM on Binance?

Yes, FLM is listed on Binance and several other major exchanges like MEXC, Gate.io, OKX, and Bitget. However, in April 2025, Binance placed a ‘Monitoring Tag’ on FLM, meaning it’s under review for potential delisting. That’s a serious red flag. If Binance removes it, liquidity could drop sharply.

Is FUSD safe and truly stable?

FUSD is an algorithmic stablecoin, meaning it’s not backed by cash reserves like USDC or USDT. Instead, it’s stabilized using collateral from other assets in the Flamingo ecosystem. This makes it riskier. The U.S. SEC has signaled it’s cracking down on such stablecoins. If market conditions turn sour, FUSD could lose its peg. Use it cautiously.

Why is Flamingo Finance’s liquidity so low?

Flamingo operates across multiple chains-Neo, zkSync, and others. This splits its liquidity. A pool on Neo might have $2 million. One on zkSync has $1.5 million. That’s nowhere near the billions found on Ethereum-based platforms like Uniswap. Low liquidity means higher slippage, worse prices, and more risk when trading larger amounts.

What’s the future of Flamingo Finance?

Flamingo’s future depends on three things: fixing liquidity fragmentation, clarifying FLM’s utility, and expanding beyond its current user base of ~12,300 daily wallets. The team has announced plans for Q3 2025 to integrate more EVM chains and overhaul tokenomics. If they deliver, it could revive interest. If not, the project risks fading into obscurity.

Finance

Finance

Ian Esche

November 27, 2025 AT 17:35Flamingo? More like Flamingo-FAIL. You think this is DeFi innovation? Nah. It's a liquidity graveyard with a pretty UI. I've seen better returns staking my dogecoin in a Discord bot. FLM token? Zero utility. Just a glorified meme coin with a whitepaper written by a grad student who skipped econ class.

And don't get me started on FUSD. Algorithmic stablecoins are just crypto Ponzi schemes with a fancy name. SEC's watching. When they move, this whole thing evaporates like cheap vape smoke. Don't be the sucker who bought in at $0.03 and cried when it hit $0.003.

Stop pretending this is a 'one-stop shop.' It's a dumpster fire with a 'Connect Wallet' button.

Felicia Sue Lynn

November 29, 2025 AT 13:46There is a quiet elegance in the idea of self-sovereign finance - the notion that one’s assets need not be mediated by corporate gatekeepers. Flamingo, for all its flaws, attempts to honor that ideal. Yet the tragedy lies not in its architecture, but in its abandonment of economic dignity. To reduce financial autonomy to a UI gimmick - to trade liquidity for convenience - is to misunderstand the very essence of decentralization.

True DeFi does not ask you to compromise your security for speed. It asks you to be responsible. Flamingo offers a shortcut - and shortcuts, in finance, are often the road to ruin.

Perhaps the real question is not whether Flamingo works - but whether we, as a community, still value the discipline required to make it work.

Christina Oneviane

November 29, 2025 AT 19:50Oh sweet Jesus, another ‘DeFi unicorn’ that’s just a PowerPoint deck with a wallet connection.

‘All-in-one interface!’ Yeah, like my 2009 Nokia had all-in-one functionality - phone, camera, and a game of Snake that somehow made me feel like a genius.

And FUSD? Cute. Let me just mint my own USD by slapping together some ETH and a prayer. The SEC’s gonna love that. ‘Oh no, the algorithm failed again! But hey, at least the UI looks nice!’

Y’all really think this isn’t just a rug pull with a blog post? I’ve seen more substance in a TikTok ad for ‘crypto yoga.’

fanny adam

November 30, 2025 AT 08:22Let us analyze the structural vulnerabilities of Flamingo Finance with precision. First: liquidity fragmentation across Neo, zkSync, and other chains. This is not merely a technical inefficiency - it is a systemic failure of network effects. Second: the FLM token exhibits no tokenomics framework beyond governance voting - a hollow shell with no yield, no staking, no buybacks, no utility. Third: FUSD, an algorithmic stablecoin, operates without reserve backing - a direct violation of the principles of monetary stability as defined by the IMF in 2023. Fourth: Binance’s Monitoring Tag is not a ‘warning’ - it is a pre-delisting signal, as per their internal risk classification matrix. Fifth: daily active wallets have declined 15% quarter-over-quarter - a clear indicator of user attrition.

There is no ‘bold experiment’ here. There is only entropy. And entropy, in decentralized finance, is fatal.

Casey Meehan

December 1, 2025 AT 05:22Bro. Bro. Bro. 🤯 I just tried Flamingo with $5. Swapped some USDT for FLM. Then deposited into a vault. Got 3.2% APY after gas. 😭

But the UI? 10/10. Clean. Smooth. Like Apple but for crypto. I even tried perps - got liquidated in 3 minutes 😂 but hey, I learned something!

FLM at $0.03? That’s a sleeping giant. Mark my words - when the next bull run hits, this thing goes to $0.20. I’m HODLing. 🚀

Also, the team reopened the Neo bridge! That’s huge. They’re not dead. They’re just… resting. Like a dragon. 🐉

Tom MacDermott

December 2, 2025 AT 20:51Oh, so now we’re pretending this is ‘innovative’ because it doesn’t have KYC? Congrats, you’ve built a crypto casino with a better logo than most ICOs from 2017.

You call it ‘convenient’? It’s a trap. Thin liquidity? Slippage? Algorithmic stablecoin with zero reserves? Please. You’re not a DeFi user - you’re a speculator with a wallet and a death wish.

And the ‘team’? They’re ghosting their own Discord. Support tickets take 24 hours? In a volatile market? That’s not ‘maintenance,’ that’s negligence.

I’ve seen more integrity in a Telegram bot that scams you with fake airdrops. At least those are honest.

Martin Doyle

December 4, 2025 AT 18:28You’re all missing the point. Flamingo isn’t trying to beat Binance. It’s trying to beat the fragmentation of DeFi. And honestly? It’s the only one close.

Yes, liquidity is low. But look at the growth trajectory - TVL doubled in Q1. The team’s active. They’re fixing bridges. They’re not ignoring feedback.

FLM doesn’t need staking rewards yet. It needs adoption first. Once users start using it daily, the utility follows. Look at Uniswap in 2020 - nobody cared about UNI until it became the backbone of DeFi.

Stop comparing it to giants. It’s a startup. A messy, underfunded, beautiful startup. And if you’re not backing the future, you’re just complaining about the past.

Susan Dugan

December 5, 2025 AT 04:01Okay, real talk - I used Flamingo for the first time last week. I was skeptical. But I did a $10 swap, staked some USDT in a vault, and tried FUSD to pay for a gas fee on zkSync. It worked. Not perfectly. But it worked.

Yes, the APY was lower than advertised. Yes, the perps are risky. Yes, FLM is a gamble.

But here’s the thing: I didn’t have to jump between 5 tabs. I didn’t have to connect 3 different wallets. I didn’t have to read 10 whitepapers. It just… worked.

That’s the magic. Not the returns. Not the token. The frictionless experience.

If you’re a DeFi veteran, you’ll hate it. If you’re trying to get into it? This might be your gateway drug. And sometimes, that’s enough.

SARE Homes

December 6, 2025 AT 20:42Flamingo Finance is a disaster waiting to happen, and you all are being manipulated by the FLM hype cycle!!

Who is behind this project? Who owns the multisig? Where are the audits? No one knows!!

And FUSD? It’s a time bomb!! The SEC is already drafting a rule to ban algorithmic stablecoins!!

And the team? They’re not even responding to GitHub issues!!

And Binance’s Monitoring Tag? That’s not a tag!! That’s a death sentence!!

And the liquidity? It’s fragmented because they’re trying to hide the fact that they have no real users!!

And the tokenomics? It’s a pyramid scheme disguised as DeFi!!

And the UI? It’s pretty, but that’s just distraction!!

STOP INVESTING!!

YOU’RE BEING SCAMMED!!

Grace Zelda

December 7, 2025 AT 01:14I don’t get why people are so quick to trash Flamingo. I’ve used Uniswap, Sushi, THORChain - they’re all clunky as hell. Flamingo’s UI? It’s the first time I didn’t need a tutorial to do a swap.

Yeah, FLM’s weird. Yeah, liquidity’s thin. But I’m not here to make millions. I’m here to learn. To experiment. To see what’s possible.

And honestly? I’d rather lose $20 on a platform that’s trying to do something new than lose $200 on a ‘safe’ exchange that’s just a middleman with a different logo.

Maybe the future isn’t about being the biggest. Maybe it’s about being the most usable.

Let them build. Let them fail. Let them learn. We all had to start somewhere.

Sam Daily

December 8, 2025 AT 00:47Look, I’ve been in crypto since 2017. I’ve seen 1000 projects die. But Flamingo? It’s got something. Not the token. Not the APY. The vibe.

The team actually replied to a Reddit thread last week. They admitted the liquidity issue. Said they’re working on a cross-chain liquidity aggregator. That’s rare.

And the fact they fixed the Neo bridge? That’s not luck. That’s dedication.

FLM might be trash now. But so was UNI in 2020. So was SOL in 2021.

I’m not saying buy it. I’m saying pay attention. The next big thing doesn’t always come with a $1B market cap. Sometimes it comes with a clean UI and a team that doesn’t ghost their users.

Keep your eyes open. Not your wallet open. 😊

Kristi Malicsi

December 9, 2025 AT 15:37So you’re telling me this thing has no KYC and you can trade perps with 10x leverage and nobody knows who runs it

and you think that’s good

why

why are we still doing this

why are we still trusting code that nobody audits

why are we still pretending this isn’t just gambling with a blockchain label

i miss when crypto was just a weird idea

now it’s just a casino with a whitepaper

Rachel Thomas

December 11, 2025 AT 11:15Flamingo? More like Flamingo-LAME. Why would anyone use this when Binance has 1000 coins and 24/7 support? It’s like buying a bicycle when Tesla exists.

And FUSD? That’s not a stablecoin. That’s a fantasy. You think a computer algorithm can keep a coin pegged? LOL. I’ve seen better math in a middle school homework.

And the token? FLM? It’s worth less than my expired coupon for Taco Bell. Nobody wants it.

Just stick to Coinbase. At least they won’t steal your money with a ‘smart contract.’

Sierra Myers

December 11, 2025 AT 23:08Okay but like - the UI is actually kinda nice? Like, I didn’t cry while using it. That’s a win.

And I did a $5 swap. It worked. FUSD didn’t crash. My wallet didn’t get hacked.

So yeah, liquidity’s low. Token’s useless. But it’s not broken. It’s just… early.

Why are people so mad? It’s not like they’re asking you to put your house in it. Just play with $10. See if you like it. If you don’t? Cool. Move on.

But don’t act like you’re saving the world by hating on it. You’re just mad because you didn’t get rich off it.

SHIVA SHANKAR PAMUNDALAR

December 13, 2025 AT 15:10Flamingo Finance is not a platform. It is a metaphor. A metaphor for the delusion of decentralization.

We pretend we are free. We connect our wallets. We think we are sovereign. But we are still slaves - to volatility, to gas fees, to the whims of anonymous devs who disappear after a tweet.

The real DeFi revolution is not in code. It is in the mind. And most of us are still asleep.

Flamingo is just a mirror. And what we see in it… is our own hunger for magic.

And magic, my friends, always has a price.

Shelley Fischer

December 13, 2025 AT 18:03Flamingo Finance presents an intriguing architectural model for cross-chain DeFi aggregation. Its minimal interface design reduces cognitive load for users accustomed to fragmented protocols. However, the absence of formal token utility beyond governance voting represents a significant structural deficit.

The FUSD algorithmic mechanism, while technically feasible, introduces systemic risk in the context of evolving regulatory frameworks, particularly following the U.S. SEC’s February 2025 guidance. The platform’s liquidity fragmentation, while intentional, undermines its core value proposition of seamless access.

Without a clear revenue-sharing model, staking incentives, or fee rebates tied to FLM, the token remains a speculative instrument rather than a functional asset. The project’s future viability hinges on its ability to transition from a prototype to a sustainable economic system.

Puspendu Roy Karmakar

December 14, 2025 AT 12:01I tried Flamingo last week. I’m from India. I don’t have access to Binance anymore. So I used Flamingo to swap some USDT to ETH on zkSync.

It worked. No KYC. No waiting. No drama.

Yes, the APY was low. Yes, the FLM price is down. But I didn’t lose anything.

And I didn’t have to use a VPN or a middleman.

For people like me - who just want to move crypto without asking permission - this matters.

Don’t judge it by market cap. Judge it by how many people like me can use it.

That’s the real metric.

Evelyn Gu

December 16, 2025 AT 09:15I just want to say… I’ve been watching Flamingo for months. I saw the team post about the Neo bridge being down. I saw them quietly fix it. I saw them reply to one guy’s question about slippage and actually explain it in plain language. I saw them not delete the negative comments. I saw them not hide behind a PR team.

And I know - I know - that this isn’t a big project. It’s not even a top 100 coin. But in a world where everyone’s screaming, selling, shilling, or ghosting… this team? They’re just… trying.

And maybe… maybe that’s enough.

I’m not investing. I’m just… rooting for them.

Because I remember when I used to hate crypto. And then I found something that felt… human.

And that’s rare.

Michael Fitzgibbon

December 18, 2025 AT 08:13I’ve used Flamingo for swaps and vaults. I’ve lost money. I’ve made money. But what I haven’t lost is my trust in the idea.

DeFi isn’t about being the biggest. It’s about being the most open. Flamingo doesn’t ask for your ID. Doesn’t freeze your funds. Doesn’t lie about APY - it just says ‘results may vary.’

That’s honesty.

Yes, liquidity is thin. Yes, FLM is a gamble. But so is every startup. So is every new technology.

I don’t know if Flamingo will survive. But I know it’s worth watching. Not because it’s perfect - but because it’s real.

Komal Choudhary

December 19, 2025 AT 00:25Hey I just used Flamingo and I love it so much!! I’m a girl from India and I don’t have access to Binance anymore so I used Flamingo and I swapped FLM for USDT and I made 50% profit in one day!!

Also the UI is so cute and the team is so nice they replied to my DM on Telegram!!

Everyone should try it!! It’s the future!!

Also FUSD is stable!! I checked!!

And FLM will go to $1!! I just know it!!

Why are people so negative??

Just trust the process!!

Tina Detelj

December 21, 2025 AT 00:09Flamingo is the quiet rebellion against the bloated, over-engineered, profit-first DeFi landscape. It doesn’t scream. It doesn’t shill. It doesn’t have a celebrity CEO. It just… exists.

It’s like a small bookstore in a world of Amazon warehouses. You won’t find every book. But you’ll find the ones that matter. The ones that change you.

FLM isn’t a currency. It’s a vote. A vote for simplicity. A vote for sovereignty. A vote against the cult of liquidity.

Maybe it’s not the future. But it’s a future. And sometimes, that’s all we need.

Wilma Inmenzo

December 22, 2025 AT 05:56FLAMINGO IS A GOVERNMENT BACKED PROJECT. YOU THINK THEY’RE JUST ‘TRYING’? NO. THEY’RE A COVER FOR THE FED TO MONITOR WALLET ACTIVITY.

THEY’RE USING NEO AND ZKSYNC BECAUSE THOSE CHAINS HAVE BACKDOORS. THE ‘TEAM’? THEY’RE ALL FORMER NSA CONTRACTORS.

FUSD? IT’S NOT ALGORITHMIC - IT’S A TRIGGER FOR A GLOBAL CURRENCY RESET. THE SEC TAG IS A DISTRACTION.

THEY WANT YOU TO THINK IT’S A DEFI PLATFORM. IT’S A SURVEILLANCE TOOL.

THEY’RE TRACKING YOUR WALLET. YOUR SWAPS. YOUR BALANCES.

THEY’RE PREPARING FOR THE DIGITAL DOLLAR.

YOU THINK YOU’RE FREE? YOU’RE BEING SCANNED.

DELETE THE APP. WIPE YOUR WALLET. DON’T TOUCH FLM.

THEY’RE WATCHING.

priyanka subbaraj

December 23, 2025 AT 11:59Flamingo is dead. FLM is garbage. FUSD is a scam. Liquidity is gone. Team ghosted. End of story.

George Kakosouris

December 24, 2025 AT 14:48Flamingo Finance is a textbook example of a ‘DeFi vaporware’ project - a classic case of UI-over-substance syndrome. The platform leverages the psychological bias of ‘convenience’ to mask structural deficiencies in liquidity depth, token utility, and cross-chain interoperability.

Its TTVL of $23.5M is statistically insignificant compared to its competitors, indicating negligible network effects. The FLM token’s lack of yield mechanics renders it functionally inert - a governance token without governance power. The FUSD mechanism, lacking any transparent collateralization ratio, is a regulatory liability waiting to detonate.

Furthermore, the 15% QoQ decline in active wallets signals user attrition, not adoption. The reopening of the Neo bridge is a tactical PR move, not a strategic pivot. This is not innovation. It’s entropy dressed in a sleek React frontend.

Investors are not ‘early adopters.’ They’re liquidity providers for a doomed experiment.

Ian Esche

December 25, 2025 AT 01:47Someone actually said ‘it’s a startup’? Bro, startups have funding. Flamingo has a Discord with 8k members and a team that hasn’t posted a roadmap update since January.

And ‘it’s not broken’? It’s not broken because it’s not even alive. It’s a zombie with a nice logo.

Don’t romanticize failure. It’s not ‘bold.’ It’s just bankrupt.

Sam Daily

December 26, 2025 AT 07:21And that’s why I’m still watching. Because someone said ‘it’s not broken’ - and someone else said ‘it’s dead.’

And the team? They’re still here.

Not shouting. Not shilling. Just… working.

That’s the quiet kind of hope you don’t see enough of.

Maybe they’ll fail.

But I’ll still be here - not betting, just watching.

Because sometimes, the quiet ones are the ones who surprise you.

Evelyn Gu

December 28, 2025 AT 01:18Thank you for saying that. I’ve been feeling so alone in this. Everyone’s screaming ‘scam’ or ‘next 100x.’

But I just… care.

Not about the price. Not about the token.

Just about the people behind it.

And if they’re still here, trying - even quietly - then maybe… just maybe… it’s not over yet.