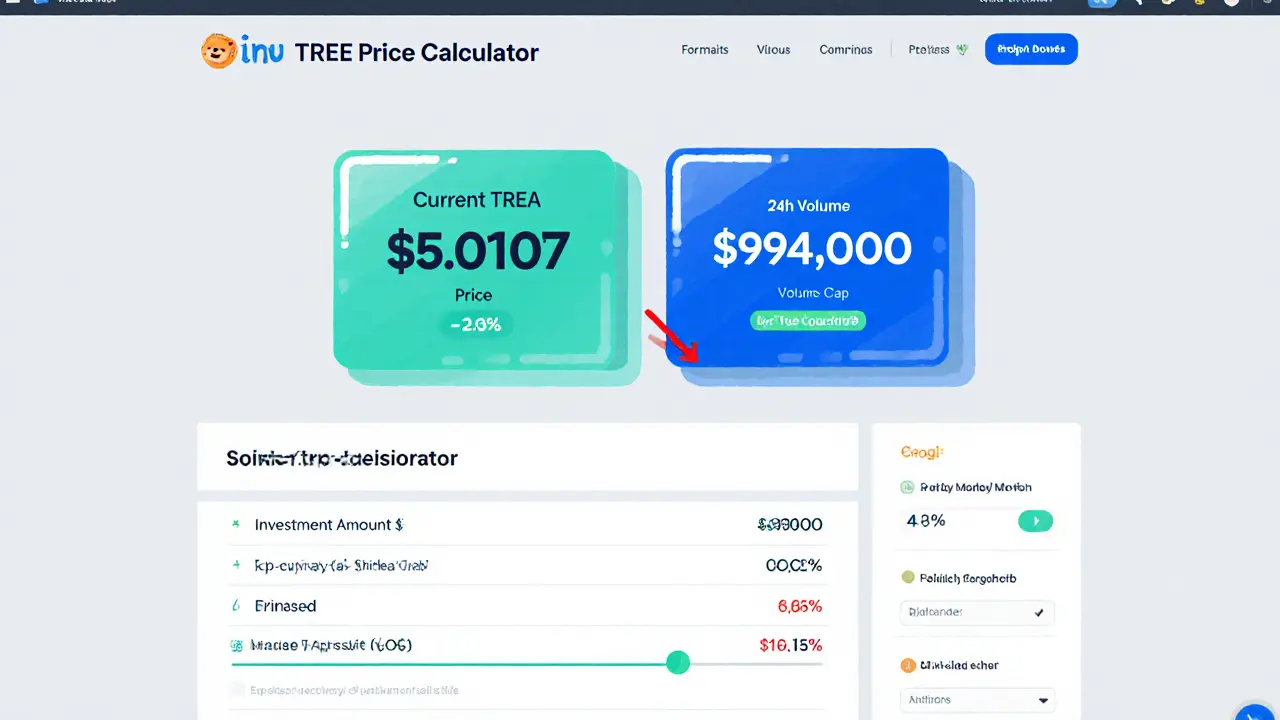

Shiba Inu TREAT Token Price Calculator

Current TREAT Price

$0.00107 (↓ 2.3%)

Market Cap: $939,100

24h Volume

$994,000

Volume-to-Market Cap Ratio: 42%

Investment Calculator

Token Comparison

| Attribute | Treat (3.33B) | Shiba Inu TREAT (10B) |

|---|---|---|

| Price (USD) | $0.0001701 | $0.001071 |

| Market Cap | $560,650 | $939,100 |

| Total Supply | 3.33 billion | 10 billion |

| Circulating Supply | ≈3 billion | 910 million |

| Transaction Fee | 0.5% | 0.5% |

Important Notes

TREAT token values are highly volatile. Past performance is not indicative of future results. The actual price may vary significantly from projected values.

Key Takeaways

- Shiba Inu TREAT (TREAT) is a utility token inside the Shiba Inu ecosystem, not just a meme coin.

- Two versions exist: the "Treat" token and the "Shiba Inu TREAT" token, each with different supply and price.

- Current price (Oct2025) sits around $0.00107 with a market cap under $1million.

- Utility includes liquidity for the SHI stablecoin, rewards on ShibSwap, and upcoming Metaverse and card‑game incentives.

- Volatility is high; short‑term outlook is bearish, while long‑term projections are modestly positive.

Shiba Inu TREAT has become a buzzword among crypto fans who follow the broader Shiba Inu family. When you first see the ticker “TREAT” you might wonder if it’s another meme token or something with real purpose. Below we break down what the token actually is, how it works, where it trades, and what risks you should weigh before buying.

Shiba Inu TREAT is a cryptocurrency token built on Ethereum that serves specific roles within the Shiba Inu ecosystem. It was launched by Ryoshi, the anonymous founder of Shiba Inu, to complement the core tokens SHIB, LEASH, BONE, and the upcoming stablecoin SHI.

What is Shiba Inu TREAT (TREAT)?

In simple terms, TREAT is an ERC‑20 token that aims to provide liquidity for the SHI stablecoin and act as the reward currency on ShibSwap, the decentralized exchange (DEX) built for the Shiba Inu community. It also powers future rewards in the Shiba Inu Metaverse and the blockchain version of the Shiba Inu Collectible Card Game.

Two contracts currently exist on Ethereum:

- Contract A (0xa02C49Da76A085e4E1EE60A6b920dDbC8db599F4) - listed on platforms as "Shiba Inu TREAT" with a total supply of 10billion tokens.

- Contract B - listed as "Treat" with a total supply of 3.33billion tokens.

How does TREAT fit into the Shiba Inu ecosystem?

The Shiba Inu ecosystem is often described as a four‑layer stack:

- Core meme token: SHIB provides brand recognition and community size.

- Utility tokens: LEASH (store of value) and BONE (governance for ShibaSwap) enable DeFi functions.

- Stablecoin: SHI is slated to be the ecosystem’s peg‑to‑USD token.

- Infrastructure token: TREAT supplies liquidity for SHI and replaces BONE as the reward token on ShibSwap.

By anchoring the SHI stablecoin’s liquidity pool, TREAT becomes a critical piece of the ecosystem’s financial infrastructure. If SHI launches successfully, demand for TREAT could increase as traders need to provide or withdraw liquidity.

Technical specifications & token economics

Below is a side‑by‑side view of the two token versions currently circulating.

| Attribute | Treat (3.33B supply) | Shiba Inu TREAT (10B supply) |

|---|---|---|

| Contract address | Varies (different from 0xa02…) | 0xa02C49Da76A085e4E1EE60A6b920dDbC8db599F4 |

| Current price (USD) | $0.0001701 | $0.001071 |

| Market cap | $560,650 | $939,100 |

| Total supply | 3.33billion | 10billion |

| Circulating supply | ≈3billion | 910million |

| 24‑h volume | $397,730 | $994,000 |

| Volume‑to‑market cap ratio | 71% | 42% |

Both versions have a built‑in 0.5% transaction fee on most DEXs that support them. The fee is used to fund ecosystem initiatives and to burn a portion of the token, which creates a mild deflationary pressure.

Market performance & price history

From its launch until October2025, TREAT has shown classic meme‑coin volatility mixed with utility‑driven price spikes. The all‑time high hit $0.01717 on 15January2025, followed by a sharp dip to $0.01034 the next day - a 39% swing in 24hours.

Since then, the price has settled into a tighter range around $0.0010‑$0.0012. According to CoinMarketCap, the token’s 24‑hour price change is about +11.7% on days of heightened trading, while the 24‑hour volume hovers near $1million.

Analyst platforms such as 3commas recommend a “Sell” stance for the short term, projecting a modest average price of $0.00152 through 2025. Long‑term models from TradingBeasts and Wallet Investor suggest potential gains of up to 86% by 2030 if the broader Shiba ecosystem delivers on its roadmap.

Trading & liquidity considerations

Most of TREAT’s activity lives on decentralized exchanges - primarily Uniswap V3 and SushiSwap. Centralized exchanges have yet to list the token, which means new investors often need to bridge fiat via a larger exchange (e.g., Binance for ETH) and then swap for TREAT on a DEX.

Because liquidity pools are relatively shallow, large trades can cause noticeable price slippage. The 0.5% fee slightly cushions this effect, but you should still expect a few percent slippage on orders larger than $10,000.

Transaction confirmation times are generally under 15minutes on Ethereum’s mainnet, but during network congestion gas fees can spike, making small‑scale trades pricey. Some users add the token to “layer‑2” bridges (Arbitrum, Optimism) where fees are lower, but the contracts are not yet fully audited on those layers.

Future outlook & potential use cases

The token’s long‑term value is tightly bound to three upcoming milestones:

- SHI stablecoin launch - TREAT will provide the bulk of the liquidity pool. Successful deployment would create ongoing demand for TREAT as users deposit and withdraw SHI.

- ShibSwap reward shift - Replacing BONE with TREAT as the primary incentive could drive higher staking volumes on the DEX.

- Metaverse & card‑game integration - Early prototypes promise TREAT‑based rewards for in‑game achievements and NFT purchases.

If any of these projects stall, the token could lose its utility edge and revert to pure speculation. Conversely, a smooth rollout could see modest but steady price appreciation, aligning with the 0.2% annual growth forecast from 3commas for 2025‑2026.

Risks and things to watch

Before you allocate capital, keep an eye on these red flags:

- High volatility: Price swings of 30‑40% within a single day are common.

- Limited exchange access: Mostly DEX‑only, which can deter institutional investors.

- Supply confusion: Two separate tokens with similar names lead to accidental purchases of the wrong contract.

- Regulatory uncertainty: Utility tokens can be re‑classified as securities depending on jurisdiction.

- Ecosystem dependency: TREAT’s fate rides on the success of SHI, ShibSwap, and the Metaverse project.

Monitoring community channels (Telegram, Discord) and development updates on GitHub provides early warnings of any roadmap delays.

Frequently Asked Questions

What is the main purpose of the TREAT token?

TREAT serves as liquidity for the upcoming SHI stablecoin, rewards users on ShibSwap, and will power future Metaverse and card‑game incentives within the Shiba Inu ecosystem.

How many TREAT tokens are in circulation?

The "Shiba Inu TREAT" version has about 910million tokens circulating, while the separate "Treat" token has roughly 3billion in circulation.

Where can I buy TREAT?

TREAT is mostly available on decentralized exchanges like Uniswap V3 and SushiSwap. You’ll need ETH or another ERC‑20 token to swap for TREAT.

Is TREAT a good long‑term investment?

The token’s long‑term prospects depend on the SHI stablecoin launch and ShibSwap’s reward switch. If those succeed, modest growth is possible; otherwise, it remains highly speculative.

What are the main risks of holding TREAT?

Key risks include extreme price volatility, limited exchange listings, confusion between two token contracts, and regulatory changes that could affect utility tokens.

How does the 0.5% transaction fee work?

Every swap involving TREAT on supported DEXs deducts 0.5% of the transaction value. Part of the fee is burned, reducing supply; the rest funds ecosystem initiatives.

Finance

Finance

Karl Livingston

July 17, 2025 AT 17:24I've been keeping an eye on the TREAT token lately, and the price dip definitely caught my attention. The 0.5% transaction fee is pretty modest compared to many other meme coins, which can be a bit of a relief. Still, the market cap under a million dollars makes it feel like a high‑risk playground.

Kyle Hidding

July 22, 2025 AT 19:51From a quantitative risk assessment perspective, TREAT exhibits an alarmingly elevated volatility coefficient, rendering its Sharpe ratio effectively negative. The liquidity depth is shallow, and the tokenomics lack any defensible utility beyond speculative hype.

Andrea Tan

July 27, 2025 AT 22:18Honestly, it’s kind of fun to see a new token pop up, especially when the community vibes are positive. If you’re just dabbling, the modest 0.5% fee won’t bite you hard. Just remember to only invest what you can afford to lose.

Gaurav Gautam

August 2, 2025 AT 00:44Exactly! Plus, the calculator they provided can help you map out potential returns, even if it’s based on optimistic growth rates. It’s a good habit to run those numbers before you jump in. Keep the optimism grounded, though, and you’ll avoid nasty surprises.

Robert Eliason

August 7, 2025 AT 03:11well i think ts still maybe undervalued? the market cap is low so big upside, nsure tho, might be some hidden value. just my two cents.

Cody Harrington

August 12, 2025 AT 05:38The 0.5% fee is indeed lower than many other tokens, which could make frequent trades a bit more bearable.

Chris Hayes

August 17, 2025 AT 08:04Looking at the supply numbers, the circulating supply is already close to 910 million, which leaves limited room for inflation. That said, the token’s affiliation with the Shiba ecosystem might provide some brand recognition.

Donald Barrett

August 22, 2025 AT 10:31Brand recognition? Please. That's just pig‑pig marketing fluff. The token is a meme on top of a meme, and the numbers prove nothing but a speculative bubble waiting to burst.

vipin kumar

August 27, 2025 AT 12:58What if the whole TREAT token is a front for a larger hidden agenda? The 0.5% fee could be a way to siphon funds into undisclosed wallets, and the low market cap makes it easy to manipulate.

Mark Briggs

September 1, 2025 AT 15:24Wow, deep thoughts.

mannu kumar rajpoot

September 6, 2025 AT 17:51yeah, but the reality is that many of these projects are just smoke screens for pump‑and‑dump schemes. you can see the patterns if you look at the transaction histories.

Tilly Fluf

September 11, 2025 AT 20:18Thank you for sharing this detailed overview. It is essential for potential investors to be fully aware of both the opportunities and inherent risks associated with emerging tokens such as TREAT.

Vaishnavi Singh

September 16, 2025 AT 22:44Indeed, the transient nature of market sentiment underscores the impermanence of value in such digital assets; one must contemplate the broader implications of speculative finance.

Peter Johansson

September 22, 2025 AT 01:11Great breakdown! Remember, the crypto market moves fast, so keep tracking the volume‑to‑market‑cap ratio. It’s a solid indicator of liquidity health 😊.

Cindy Hernandez

September 27, 2025 AT 03:38Exactly, and diversifying across multiple tokens can mitigate some of the volatility you highlighted. Always set stop‑loss orders if you decide to trade TREAT.

victor white

October 2, 2025 AT 06:04One must question the very ontology of a token named “TREAT.” Is it merely a financial instrument, or does it aspire to a meme‑driven cultural paradigm? The semantics are as puzzling as the market data.

Angela Yeager

October 7, 2025 AT 08:31I appreciate the nuanced perspective. While the naming may be whimsical, it doesn’t preclude a serious evaluation of its utility and risk profile.

Darren R.

October 12, 2025 AT 10:58!!!Listen up!!! The crypto arena is a battlefield where only the most vigilant survive!!! TREAT is merely a fleeting spark in an ocean of digital hype!!!

Hardik Kanzariya

October 17, 2025 AT 13:24True that, but even fleeting sparks can ignite larger fires if the community rallies behind them. It’s all about momentum and collective belief.

Shanthan Jogavajjala

October 22, 2025 AT 15:51From an implementation standpoint, TREAT’s smart‑contract code appears to follow the standard ERC‑20 pattern with a modest transaction tax, which is fairly straightforward.

Millsaps Delaine

October 27, 2025 AT 17:18It is a most intriguing exercise to deconstruct the epistemological foundations upon which the so‑called TREAT token is erected, for one must first acknowledge the inherent absurdity that pervades much of contemporary meme‑coin discourse. The token’s nominal price of $0.00107, while ostensibly negligible, belies a deeper sociocultural phenomenon wherein participants willingly ascribe value to an abstract construct devoid of intrinsic utility. Moreover, the 0.5% transaction fee, though modest in isolation, operates as a subtle mechanism for continual wealth extraction, a fact that is often obfuscated by the glossy veneer of promotional material. One cannot overlook the market cap, a paltry $939,100, which betrays a precarious liquidity environment susceptible to manipulation by even modest capital influxes. The circulating supply of 910 million further exacerbates the dilution risk, rendering any prospective appreciation infinitesimally incremental absent a catalytic event. While proponents may invoke the brand affiliation with the Shiba ecosystem as a legitimizing factor, such associative branding remains a tenuous justification at best. The volatility index, implicitly suggested by the price decline of 2.3%, underscores a stochastic behavior pattern that would make even seasoned risk‑averse investors wince. In addition, the volume‑to‑market‑cap ratio of 42% indicates a relatively active trading scene, yet this activity may simply reflect speculative churn rather than genuine adoption. It is also worth mentioning the psychological allure of the “TREAT” moniker, which subtly taps into reward‑based conditioning, thereby fostering a herd mentality that can be easily exploited. Ultimately, the token’s future hinges on a fragile blend of community sentiment, speculative momentum, and the ever‑present specter of regulatory intervention. Should any of these variables shift unfavorably, the token’s valuation could collapse with alarming rapidity. Consequently, any prudent investor would do well to contextualize TREAT within the broader tapestry of meme‑driven financial instruments, recognizing its potential as both a cautionary tale and a fleeting opportunity. In sum, the TREAT token epitomizes the paradoxical interplay between frivolous novelty and genuine financial risk, demanding a measured yet skeptical appraisal.

Jack Fans

November 1, 2025 AT 19:44Overall, the token’s modest fees and community tools make it accessible, but the underlying volatility warrants caution.

Adetoyese Oluyomi-Deji Olugunna

November 6, 2025 AT 16:24Sounds legit.