Stablecoin Cost Calculator

Choose Your Transaction Method

Select the stablecoin and amount to see real-world costs based on Iran's crypto market data.

Transaction Summary

Based on September 2025 data: USDT TRC-20 costs $0.10 (13.7s), DAI Polygon costs $0.0002 (0.001s)

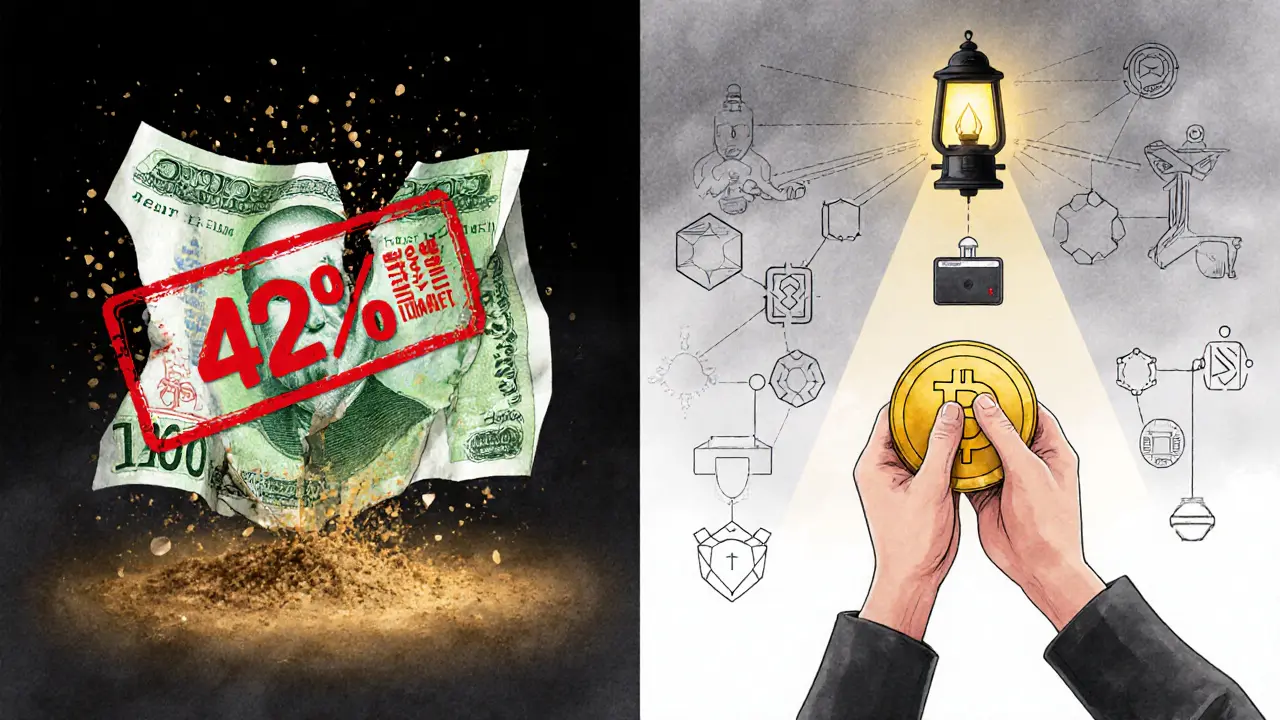

Iran’s government has made it harder than ever to use cryptocurrency for everyday transactions. In 2025, the Central Bank of Iran blocked all local payment gateways tied to digital assets, banned crypto ads, and forced exchanges to hand over user data through government-controlled systems. But people are still using crypto-because the rial keeps losing value. Inflation hit 42% last year. Savings evaporate. People need a way to protect their money. And they’ve found one.

Why Iranians Still Use Crypto Despite the Ban

It’s not about speculation. It’s survival. The Iranian rial has lost over 80% of its value against the US dollar since 2020. Many can’t buy groceries, pay rent, or import medicine without losing half their income to inflation. Crypto isn’t a luxury here-it’s a lifeline. Even though it’s technically illegal to use Bitcoin or Ethereum to pay for goods, people do it anyway. In 2025, an estimated 14.7 million Iranians-almost one in six-actively use digital assets. That’s up from 13.2 million just six months earlier. The government allows mining, but only if you pay sky-high energy fees. Legal miners now pay 0.03 cents per kWh, up from 0.004 cents. That made 82% of mining operations unprofitable overnight. So people went underground. Unlicensed rigs now generate 65% of Iran’s $1 billion annual mining revenue. Meanwhile, the government’s own digital rial pilot on Kish Island has fewer than 12,500 users. Most Iranians don’t trust it. It ties to your national ID. You can’t send it abroad. It doesn’t protect your savings.How Iranians Are Bypassing the Blockades

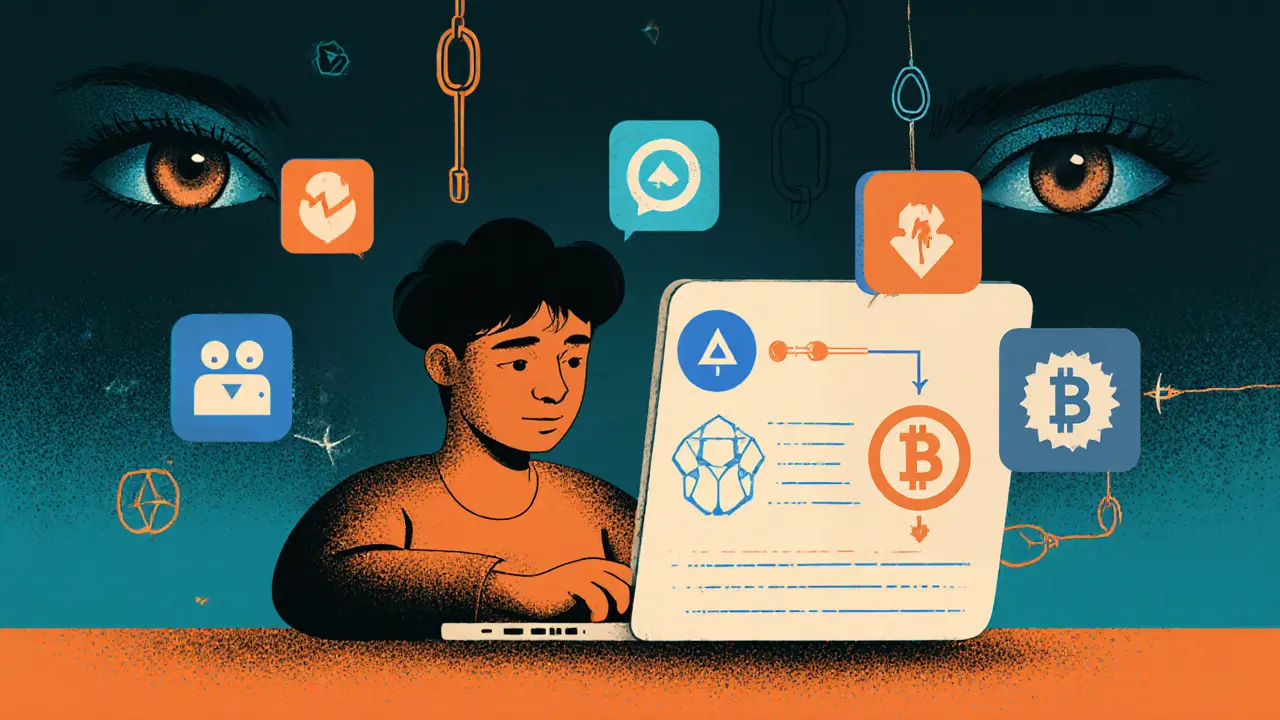

Iranians aren’t waiting for permission. They’ve built a parallel financial system using tools the government didn’t anticipate. Virtual Private Networks (VPNs) are the first line of defense. About 78% of crypto users rely on them to access foreign exchanges like Binance and Bybit. NordVPN, ExpressVPN, and Surfshark dominate the market. But it’s not just about hiding your IP. Iranian internet providers now throttle traffic to known exchange servers. So users have switched to obfuscated VPNs-versions that disguise crypto traffic as regular browsing. One Reddit user tested 47 connections using Windscribe’s obfuscation mode and succeeded 83% of the time. Telegram bots have become the hidden backbone of Iran’s crypto economy. With over 2.1 million members across crypto-focused groups, Telegram is where people trade, share tips, and move money. Bots like@IranCryptoBridge let users convert USDT to DAI on the Polygon network without KYC. One user reported the whole process-conversion, transfer, wallet update-taking just seven minutes and costing under $0.50.

DAI on Polygon replaced Tether (USDT) as the go-to stablecoin after Tether froze 42 Iranian wallets in July 2025, cutting off access to over $7.5 billion in assets. Within 28 days, DAI usage jumped from 3% to 67% of all stablecoin transactions in Iran. Why? Polygon transactions cost $0.0002 and settle in 0.001 seconds. USDT on TRC-20 takes 13.7 seconds and costs $0.10. Speed and cost matter when you’re trying to send money before the next internet shutdown.

What Happened to Nobitex?

Nobitex was Iran’s largest local exchange. It handled 70% of domestic crypto trades in early 2025. Then came the June 18, 2025, hack-$90 million stolen. The government responded by limiting trading hours to 10 AM-8 PM and demanding full user data. Trading volume dropped to 38% of its former level. Now, most Iranians avoid it entirely. Instead, peer-to-peer (P2P) trading dominates. Telegram groups connect buyers and sellers directly. No middleman. No government oversight. You pay in rials via mobile banking. They send you crypto. It’s risky-scams happen-but it’s the only way to trade outside restricted hours. As of September 2025, P2P accounted for 52% of all Iranian crypto transactions.

Tools You Need to Get Started

You don’t need to be a coder. But you do need the right tools-and to learn how to use them.- VPN: Choose one with obfuscation. NordVPN and ExpressVPN work best. Monthly cost: $7-$12.

- Telegram: Join at least two active crypto groups. Search for "Iran Crypto P2P" or "DAI Iran". Avoid public links-use invites from trusted users.

- MetaMask: Install the wallet on your phone or browser. Set it to Polygon network. Never store large amounts on exchanges.

- Tor Browser: Use it when accessing decentralized exchanges or wallet services. It adds another layer of anonymity.

- DAI stablecoin: Always convert USDT to DAI on Polygon. It’s faster, cheaper, and less likely to be frozen.

The Risks Are Real

This isn’t risk-free. The government is watching. In August 2025, a new law required all wallet providers to monitor transactions in real time. That pushed developers to create decentralized wallets that don’t store user data. But if you’re caught using a banned method, you could face fines, account freezes, or worse. Transaction failures are common. During peak hours (4-6 PM), internet throttling spikes. Wallets freeze. Transfers get stuck. One user lost $1,200 in a failed DAI swap because the network timed out. Always test with small amounts first. And then there’s the Tether freeze. Over 14,200 Iranians had wallets locked in July 2025. Average loss: $6,350. That’s why no one keeps more than $1,500 in any single wallet. Spread it out. Use multiple wallets. Don’t trust one stablecoin. Diversify.What’s Working Right Now (September 2025)

Here’s what’s actually getting people through the day:- Buy USDT on Telegram P2P with rials.

- Use a Telegram bot to swap USDT → DAI on Polygon.

- Send DAI to your MetaMask wallet via Tor browser.

- Use a reliable VPN with obfuscation to access Binance or Bybit for larger trades.

- Withdraw to a hardware wallet if you’re holding more than $5,000.

What Doesn’t Work Anymore

Don’t waste time on these:- Nobitex during off-hours (10 PM-9 AM). It’s blocked.

- Using USDT on Ethereum. Fees are too high, and it’s easy to track.

- Reliance on the digital rial. It’s not a currency-it’s a surveillance tool.

- Public crypto forums. The government monitors them. Use encrypted Telegram groups instead.

How to Stay Ahead of the Rules

The government changes the rules every few weeks. In September 2025, Telegram updated its bots to use multi-hop routing, making them 89% more reliable. That happened because users reported blocked IPs within hours. Stay in the loop. Join two Telegram groups. Read the pinned posts. Check Reddit’s r/IranCrypto daily. If a new bot appears, test it with $5 before committing more. If a wallet service says "no KYC," verify it with three other users before using it. The most successful users aren’t the richest. They’re the most adaptable. One 22-year-old student in Shiraz learned to set up multisig wallets in 48 hours after a new ban. He now helps 30 others in his neighborhood. That’s the real system: community-driven, decentralized, and constantly evolving.Final Thoughts

Iran’s crypto restrictions aren’t stopping people-they’re forcing innovation. What started as a way to dodge inflation has become a full-blown underground economy. It’s messy. It’s risky. But for millions, it’s the only way to keep their money from vanishing overnight. You won’t find a perfect solution. But you can find a working one. Start small. Learn from others. Use DAI on Polygon. Trust Telegram. Use a good VPN. And never store more than you can afford to lose.Is it legal to use crypto in Iran?

No, it’s not legal to use cryptocurrency for payments or trading through local platforms. The Central Bank of Iran banned all crypto payment gateways in late 2024 and requires full user data access for any exchange. However, enforcement is inconsistent. Most Iranians use crypto anyway because the rial is collapsing. The government tolerates mining for tax revenue but cracks down on personal use. There’s no clear legal gray area-it’s a de facto ban with widespread evasion.

Can I use Bitcoin to buy things in Iran?

Technically, no. No business is allowed to accept Bitcoin as payment. But in practice, many do-through Telegram. Sellers list items in P2P groups, you send them crypto, they ship the goods. It’s informal, unregulated, and risky. If the seller disappears, you have no recourse. Use this only for small, trusted trades. Never buy expensive items this way unless you’ve verified the seller through multiple channels.

Why is DAI better than USDT in Iran?

After Tether froze 42 Iranian wallets in July 2025, DAI became the only stablecoin that couldn’t be blocked by a single company. DAI is decentralized-no central authority can freeze it. It runs on Polygon, which has near-zero fees and ultra-fast transactions. USDT on TRC-20 is slower, more expensive, and still vulnerable to Tether’s decisions. DAI’s usage in Iran jumped from 3% to 67% of stablecoin trades in under a month. If you’re serious about protecting your money, DAI is the only safe stablecoin option.

What’s the best VPN for crypto in Iran?

NordVPN and ExpressVPN are the most reliable, but only if you enable their obfuscation feature (called "Obfuscated Servers" or "Stealth Mode"). Surfshark also works well. Avoid free VPNs-they’re slow, insecure, and often blocked. Paid services cost $7-$12/month. Test your connection by trying to access Binance. If it loads without a timeout, it’s working. Always use a VPN with a kill switch to prevent data leaks if the connection drops.

How do I avoid getting my wallet frozen?

Never keep more than $1,500 in any single wallet. Use multiple wallets for different purposes-one for trading, one for savings, one for P2P. Always use DAI on Polygon, not USDT. Avoid linking your real name or phone number to any crypto account. Use Tor when accessing wallets. And never use a wallet provided by a local exchange-those are monitored. Stick to MetaMask or Trust Wallet with self-custody. If you’re unsure, test with $10 first.

Is the digital rial a good alternative to crypto?

No. The digital rial is not a currency-it’s a government tracking tool. It requires your national ID. You can’t send it overseas. It doesn’t protect against inflation. Only 12,400 people use it on Kish Island. Even if it expands, it won’t offer the privacy or international access that crypto does. Iranians who tried it quickly abandoned it. Crypto is the only tool that lets you store value outside the state’s control.

Finance

Finance

Savan Prajapati

November 27, 2025 AT 02:19DAI on Polygon is the only way. USDT is a trap.

Komal Choudhary

November 27, 2025 AT 14:13Bro I tried using a free VPN and got my IP flagged in 3 minutes. Pay for NordVPN. No regrets. 😎

SHASHI SHEKHAR

November 27, 2025 AT 16:40Let me tell you something about DAI and Polygon - this isn’t just tech, this is civil resistance. The gas fees on Polygon are so low you could send 500 transactions for less than a cup of chai. And speed? 0.001 seconds? That’s faster than your aunt’s WhatsApp voice note. USDT on TRC-20? Pfft. 13.7 seconds? In Iran, when the internet cuts out at 5 PM, that’s an eternity. DAI doesn’t wait. DAI moves. It’s decentralized, so Tether can’t freeze it - no central server, no CEO with a kill switch. Plus, Polygon’s layer-2 is built for scale, not surveillance. And guess what? Iranians are hacking the system not with code, but with community. Telegram bots? They’re not apps - they’re lifelines. One guy in Tabriz built a bot that auto-converts rials to DAI via SMS if your internet dies. No app needed. Just a SIM card and a prayer. And the best part? No KYC. No forms. No government fingerprint. It’s like the Wild West, but with crypto wallets instead of six-shooters. People are learning this stuff from Aparat videos, not university lectures. A 16-year-old in Mashhad taught her whole neighborhood how to use MetaMask on a $50 Android phone. That’s innovation. That’s resilience. That’s what happens when you have nothing left to lose. The state wants to control money? Fine. We’ll make our own. And we’ll make it faster, cheaper, and untraceable. DAI on Polygon isn’t a workaround - it’s the new economy.

Casey Meehan

November 29, 2025 AT 14:24DAI on Polygon? Nah, I use Monero. They don’t even know how to track that. 😏

Michael Labelle

November 30, 2025 AT 15:04It’s wild how a bunch of people with no banking access built a financial system that’s more efficient than most Western banks. Hats off.

Evelyn Gu

December 1, 2025 AT 13:25I just want to say… I cried reading this. Not because I’m emotional - but because I’ve seen friends lose everything to inflation. My cousin in Isfahan sold her wedding gold just to buy USDT on Telegram. She didn’t even know what a wallet was. Now she’s teaching others. That’s not crypto. That’s survival. And it’s beautiful. I’ve spent hours researching this, reading forums, watching Aparat tutorials in Farsi, trying to understand how someone with no internet access can still send money. It’s not just tech - it’s courage. Every time someone sends $100 in DAI to a family member in a village, they’re defying a regime. And it’s quiet. No headlines. No press. Just a phone, a VPN, and a prayer. I’m so grateful people are sharing this. Please keep posting updates. The world needs to know.

Wilma Inmenzo

December 3, 2025 AT 06:40Of course the government allows mining… because they’re mining your data too. You think they don’t have backdoors in every VPN? Every Telegram bot? Every MetaMask wallet? They’re watching. Always watching. This whole thing is a psyop. They want you to use crypto so they can track your spending habits, your contacts, your habits. They’ll shut it down when they’ve mapped everyone. Don’t be fooled. The digital rial? It’s the real endgame. DAI is the bait. 💀

Grace Zelda

December 5, 2025 AT 06:06What’s more terrifying - the government banning crypto… or the fact that we’ve normalized living in a digital underground? We’ve turned finance into espionage. You don’t just send money anymore - you plan a mission. You check your IP, you rotate wallets, you test with $5, you avoid public links. This isn’t finance. This is a resistance movement dressed in blockchain. And honestly? I’m impressed. We’ve been taught that decentralization is theoretical. But here? It’s real. It’s urgent. It’s saving lives. The fact that a 22-year-old student in Shiraz built a multisig system in 48 hours? That’s not tech literacy - that’s human evolution.

Susan Dugan

December 6, 2025 AT 03:35Y’all are underestimating the power of community here. This isn’t just about tools - it’s about trust. You don’t trade with strangers on Telegram. You trade with people who’ve been vetted by three others. You learn who’s reliable by watching who gets their money first. It’s like the old barter system, but with crypto. And yeah, scams happen - but people adapt. They share warnings. They post screenshots. They build reputation like it’s a currency itself. That’s the real innovation. Not the tech. The trust.

Sam Daily

December 6, 2025 AT 19:42DAI on Polygon > everything. I’ve used every stablecoin. USDT? Frozen. USDC? Blocked. BUSD? Gone. DAI? Still moving. And the fees? I sent $200 and paid $0.00015. That’s less than a penny. If your internet’s slow, just wait 10 minutes. It’ll go through. Don’t overthink it. Just do it. 💪

Tina Detelj

December 8, 2025 AT 05:13It’s funny - we call this ‘bypassing restrictions,’ but really, we’re building a new social contract. The state says: ‘You must use our currency, our system, our surveillance.’ And the people say: ‘No. We’ll build our own.’ This isn’t rebellion. It’s redefinition. Crypto isn’t just money here - it’s dignity. It’s the right to move, to choose, to protect your future. The digital rial? It’s not a currency - it’s a confession booth. You hand over your identity to get… what? A number on a screen that loses value daily. Meanwhile, DAI on Polygon? It’s silent. It’s yours. No one owns it. Not the bank. Not the state. Not even Tether. And that? That’s freedom.

Rachel Thomas

December 8, 2025 AT 09:11Everyone’s acting like this is genius. But you’re all just gambling with your lives. What happens when the government blocks Telegram? Or shuts down the entire internet for a week? You think your ‘DAI’ is safe? It’s all smoke and mirrors. You’re playing Russian roulette with your savings. And you call it innovation?

Michael Fitzgibbon

December 9, 2025 AT 06:44I’ve been following this for months. I don’t live in Iran, but I have friends who do. What I’ve learned isn’t about tech - it’s about patience. You don’t rush. You test. You start with $5. You watch. You listen. You learn from the people who’ve been doing it for years. That’s the real guide. Not the blog posts. Not the YouTube videos. The quiet ones in the Telegram groups who never post, but always respond when someone asks for help. That’s the network that’s keeping people alive.

Joel Christian

December 10, 2025 AT 00:03yo i tried using a vpn and my phone overheated and i lost $300 bc the transfer timed out 😭 pls help

Vance Ashby

December 10, 2025 AT 01:27Let me break this down for you guys who think DAI is magic. Polygon is still centralized under the hood - the validators are known entities. And Telegram bots? They’re all run by devs with access logs. You think the Iranian cyber police can’t get those? They’ve already cracked 3 major bots this year. DAI isn’t untraceable. It’s just slower to trace. And when they catch you? You’re not just fined - you’re blacklisted from every bank, every phone plan, every job. This isn’t freedom. It’s a slow trap. And you’re handing them the keys.

Sam Daily

December 11, 2025 AT 23:05@Vance Ashby - you’re right that the system isn’t perfect. But what’s the alternative? Let your savings evaporate? The digital rial? A surveillance tool with worse inflation? People aren’t blind. They know the risks. But they also know what it’s like to watch your rent go up 30% in a week. They’re choosing survival over fear. And if the government catches them? They’ll face the consequences. But they’ll face them with dignity. Not with empty bank accounts.