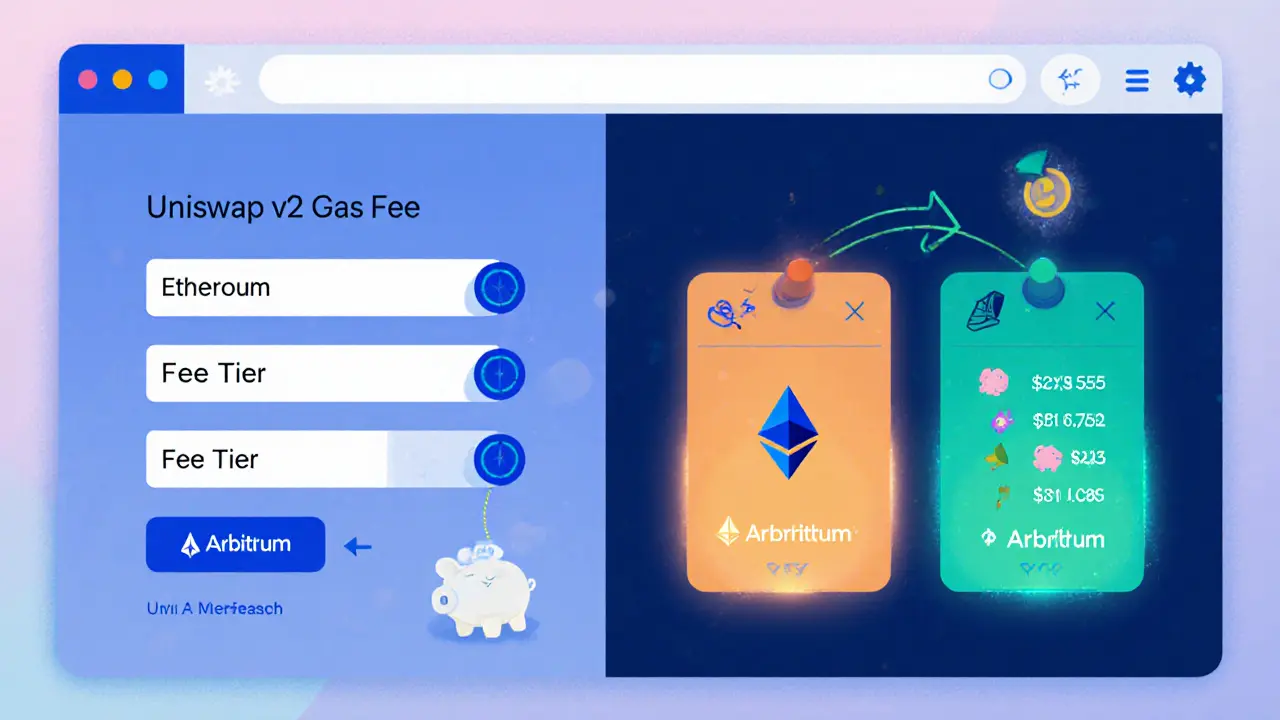

Uniswap v2 Gas Fee Calculator

Gas Fee: $15.00

Protocol Fee: $0.30

Total Cost: $15.30

Gas Fee: $0.005

Protocol Fee: $0.30

Total Cost: $0.305

Fee Breakdown

On Arbitrum, gas fees are typically under $0.01 for a standard swap, compared to $10-$20 on congested Ethereum. Protocol fees remain consistent at 0.01%-1.00% across chains.

Quick Takeaways

- Uniswap v2 on Arbitrum offers sub‑$0.01 gas fees for most swaps.

- Tiered fee model ranges from 0.01% to 1% depending on pair stability.

- TVL on Arbitrum sits above $4billion, keeping pools deep and slippage low.

- MetaMask and other Web3 wallets integrate seamlessly, but price‑feed latency can still bite.

- Security is solid - the protocol inherits Ethereum’s audit‑tested contracts, yet layer‑2 risk remains.

What is Uniswap v2 on Arbitrum?

When you hear Uniswap v2 (Arbitrum) is a decentralized exchange (DEX) that runs the second version of Uniswap’s automated market maker on the Arbitrum Layer‑2 network. It lets anyone swap ERC‑20 tokens without a middle‑man, while leveraging Arbitrum’s Optimistic Rollup tech to cut gas costs dramatically.

Why Arbitrum matters for a DEX

Arbitrum is a Layer‑2 scaling solution built on Optimistic Rollup architecture. Launched in 2021 by Offchain Labs, it bundles many Ethereum transactions into a single batch, posts a proof to the main chain, and only resolves disputes when needed. The result? Throughput jumps from ~15tps on Ethereum to >2,000tps, and fees drop from $15‑$30 per transaction to a few cents.

How Uniswap v2 works on a Layer‑2

The core AMM logic is unchanged from Ethereum: liquidity providers deposit equal values of two tokens into a pool, receiving LP tokens that represent their share. Swappers interact with the pool via the swap() function, which automatically adjusts prices according to the constant‑product formula (x·y=k). On Arbitrum, the same contract code lives on a different chain ID, but the state is still settled on Ethereum, giving users the security of the mainnet while enjoying fast finality on the rollup.

Fee structure and real‑world cost savings

Uniswap v2 uses a tiered fee schedule:

- 0.01% - ultra‑stable pairs (e.g., USDC/USDT)

- 0.05% - stable pairs (e.g., USDC/DAI)

- 0.30% - most ERC‑20 pairs

- 1.00% - exotic or low‑liquidity pairs

Those percentages are the same on every chain, but on Arbitrum the gas fees are typically under $0.01 for a standard swap, compared to $10‑$20 on congested Ethereum. For a $1,000 trade on a 0.30% pool, you’d pay $3 in protocol fees plus under a cent in gas - a total that’s barely noticeable.

Liquidity depth and TVL on Arbitrum

As of August2025, Uniswap’s Arbitrum deployment holds roughly TVL (Total Value Locked) of $4.2billion. The biggest pools - WETH/USDC and WETH/USDT - each command over $250million, keeping price impact under 0.2% for trades up to $50,000.

Because Uniswap v2 pools are “flat” (each liquidity provider shares the same price curve), they tend to be more evenly distributed than v3’s concentrated liquidity. This makes it easier for casual users to find sufficient depth without hunting for specific price ranges.

User experience & wallet integration

The UI mirrors the Ethereum version: you connect a Web3 wallet, select the token pair, enter an amount, and click “Swap”. Under the hood, the interface reads your wallet balances via the MetaMask browser extension that injects an Ethereum provider into the page. Once you confirm, MetaMask signs the transaction and broadcasts it to Arbitrum.

Most users report a smooth experience, but price‑feed latency can still cause slippage. The UI shows a “price impact” warning; if the market moves while the transaction is being signed, you may end up with a slightly worse rate. A common mitigation is to use the “max slippage” setting (often defaulted to 0.5%).

Security & risk profile

Uniswap’s contracts have undergone multiple audits and are considered battle‑tested. Running on Arbitrum adds a layer‑2 risk: if the rollup’s fraud proof window (currently 7‑days) is exploited, assets could be frozen temporarily. However, the Arbitrum DAO has a strong track record of prompt dispute resolution, and the risk is orders of magnitude lower than trusting a centralized exchange.

Another consideration is “impermanent loss” for LPs-especially in volatile pairs. Since v2 pools are not concentrated, LPs face the classic x·y=k exposure, meaning the loss is proportional to the price divergence between the two tokens.

Uniswap v2 vs. v3 on Arbitrum

While this review focuses on v2, many traders also experiment with Uniswap v3, which introduced concentrated liquidity and multiple fee tiers. Below is a quick side‑by‑side comparison:

| Aspect | Uniswap v2 | Uniswap v3 |

|---|---|---|

| Liquidity model | Flat pools - every LP shares the same price curve | Concentrated pools - LPs choose price ranges |

| Fee tiers | Single tier per pair (0.01‑1%) | Multiple tiers (0.05%, 0.30%, 1%) plus custom ranges |

| Capital efficiency | Lower - requires more liquidity for same depth | Higher - LPs can target narrow price windows |

| Complexity | Beginner‑friendly | Requires understanding of price range selection |

| Typical gas cost (per swap) | ≈$0.008 | ≈$0.010 (slightly higher due to extra calculations) |

For most casual traders on Arbitrum, v2’s simplicity outweighs the extra capital efficiency of v3. Power users may gravitate to v3 for niche pairs where liquidity is scarce.

Future outlook for Uniswap on Arbitrum

Arbitrum’s upcoming Stylus upgrade adds support for WebAssembly‑based smart contracts, enabling languages like Rust and C++ could broaden the developer pool and bring new token projects to the DEX. More competition from other L2 DEXes (e.g., TraderJoe) is expected, but Uniswap’s brand recognition and deep liquidity give it a durable moat.

In short, if you want a fast, cheap, and secure way to swap ERC‑20 tokens without navigating centralized KYC, Uniswap v2 on Arbitrum remains one of the strongest choices in 2025.

Frequently Asked Questions

Do I need to bridge assets to use Uniswap v2 on Arbitrum?

Yes. Tokens must reside on Arbitrum. You can bridge from Ethereum using the official Arbitrum Bridge or a third‑party bridge like Hop. Once on Arbitrum, the assets appear in your wallet and are ready for swapping.

How do gas fees on Arbitrum compare to Ethereum’s mainnet?

Arbitrum’s gas is typically a hundredth of Ethereum’s. A simple swap that costs $15‑$30 on mainnet will cost under $0.01 on Arbitrum, assuming normal network conditions.

Can I provide liquidity on Uniswap v2 without staking my tokens?

Liquidity provision always locks your tokens in the pool until you withdraw them. There’s no separate staking contract for v2 - you simply add tokens to a pool and receive LP tokens that represent your share.

What’s the biggest risk when using Uniswap v2 on Arbitrum?

Beyond standard smart‑contract risk, the primary Layer‑2 risk is a potential delay in fraud‑proof finality. If a rollup dispute occurs, assets could be frozen for up to a week while the proof is resolved.

Should I use Uniswap v2 or v3 on Arbitrum?

For everyday swaps and beginners, v2’s flat pools are simpler and require less capital management. Advanced traders who want to maximize fee earnings on low‑volume pairs may prefer v3’s concentrated liquidity.

Finance

Finance

mark gray

November 11, 2024 AT 07:45Uniswap v2 on Arbitrum really cuts down the gas fees, which is great for anyone who wants to trade without paying a fortune. The interface is familiar, so you don’t have to learn a new system.

Adetoyese Oluyomi-Deji Olugunna

November 11, 2024 AT 18:51While the low‑fee model is undeniably exemplary, one must also consider the latent complexities that arise when bridging assets-those subtle nuances are oft‑overlooked.

Lara Cocchetti

November 12, 2024 AT 05:58Sure, the numbers look good, but have you thought about who controls the roll‑up sequencer? Every time a new upgrade lands, there’s a hidden vector for surveillance. It’s not just about cheap swaps; it’s about what data they could be mining behind the scenes.

kishan kumar

November 12, 2024 AT 17:05One might argue that the philosophical elegance of a constant‑product market‑maker mirrors the ancient notion of equilibrium in nature. Yet, the modern implementation on an Optimistic Rollup invites (😊) contemplation of trust versus efficiency – a duality that is both timeless and technologically novel.

Anthony R

November 13, 2024 AT 04:11In my experience, the combination of sub‑cent gas fees and consistent protocol fees makes Uniswap v2 on Arbitrum a practical choice, especially for smaller traders who need reliable liquidity without exorbitant costs.

Linda Welch

November 13, 2024 AT 15:18Wow, look at this miracle of modern finance-another DEX promising to save us from the tyranny of high gas fees. You’d think after years of hype, we’d have learned something about the hidden costs. But nope, here we are, still swapping tokens like it’s 2020. The so‑called “layer‑2 magic” is just a marketing gimmick wrapped in a shiny UI. Everyone’s buzzing about sub‑cent gas, yet nobody mentions the fact that your assets are still subject to a 7‑day fraud‑proof window. That’s a week of potential freeze while a smart contract dispute simmers. And let’s not forget the bridge-each time you move funds, you open a new attack vector, and the community pretends it’s “just a minor inconvenience.” Meanwhile, the developers keep patting themselves on the back for achieving “$4.2 billion TVL.” TVL doesn’t equal safety; it just means more money could be lost if a single exploit occurs. The “price impact under 0.2 %” claim sounds impressive until you realize it only applies to ultra‑large pools; the rest of the market suffers slippage like never before. If you rely on the MetaMask integration, you’re trusting a centralized extension that could be compromised at any time. And the “flat pools” model? It’s the simplest, yes, but also the least efficient-LPs are forced to provide massive capital for minimal returns. So, sure, swap that $10 token for $9.99, celebrate the savings, and ignore the systemic risks that still loom over the entire ecosystem. In short, cheap gas doesn’t make a bad system good.

Kevin Fellows

November 14, 2024 AT 02:25Nice walkthrough, thanks!

meredith farmer

November 14, 2024 AT 13:31Hold on, do you really think the de‑risking is that simple? I’ve seen roll‑up disputes cause massive panic. People panic, liquidity drains, and the whole thing spirals.

Alie Thompson

November 15, 2024 AT 00:38From an ethical standpoint, it’s crucial to recognize that while Uniswap v2 on Arbitrum offers undeniable cost benefits, users must also consider the broader implications of decentralization. The ease of access can inadvertently encourage speculative behavior, which may destabilize markets. Moreover, the transparency of blockchain transactions, while empowering, also raises privacy concerns for participants. It is our responsibility as members of this ecosystem to promote education around security best practices. By doing so, we safeguard not only individual assets but also the integrity of the network as a whole. Balancing convenience with vigilance is the hallmark of a mature user base.

Samuel Wilson

November 15, 2024 AT 11:45To maximize the benefits of Uniswap v2 on Arbitrum, I recommend setting a reasonable slippage tolerance-typically around 0.5 %-and confirming the transaction promptly to avoid price feed latency. Additionally, regularly monitor the bridge status for any announcements regarding maintenance, as this can affect transaction finality.

Rae Harris

November 15, 2024 AT 22:51Honestly, the jargon is overwhelming: Optimistic Rollup, TVL, impermanent loss-people just throw these terms around like buzzwords. If you can’t parse the acronyms, you’re probably not ready for real DeFi.

Danny Locher

November 16, 2024 AT 09:58I hear you, the tech can be dense, but the core idea is simple: you swap tokens faster and cheaper. Take it step by step, and you’ll get the hang of the rest.

Emily Pelton

November 16, 2024 AT 21:05Listen up, newcomers: always double‑check the contract address before you approve any token-phishing scams love to mimic legitimate DEX contracts. If you’re unsure, use a reputable source or the official Uniswap site to verify.

sandi khardani

November 17, 2024 AT 08:11The so‑called “sub‑cent gas fees” are merely a veneer that masks the underlying fragility of the entire Layer‑2 architecture. While users enjoy the illusion of cheap transactions, they remain blissfully ignorant of the fact that any dispute in the fraud‑proof window could lock their assets for days, if not longer. Moreover, the reliance on bridges introduces a single point of failure, and the community’s complacency towards these bridges is alarming. Each bridge transaction is a gamble, and the risk of exploiting the bridge’s code has been demonstrated repeatedly across the ecosystem. The TVL metric is being weaponized as a marketing tool, suggesting safety where there is none. Liquidity providers, in particular, should be wary of the impermanent loss that continues to plague flat‑pool models, despite the lure of higher returns. In summary, the narrative of cost savings should not eclipse the systemic risks embedded in the current design.

Christina Norberto

November 17, 2024 AT 19:18It would be remiss not to acknowledge the covert machinations of the central entities orchestrating the roll‑up consensus. Their undisclosed influence permeates the transaction validation process, thereby compromising the purported decentralization. Such clandestine control is antithetical to the very ethos of blockchain autonomy.

Fiona Chow

November 18, 2024 AT 06:25Obviously, the hype around Uniswap v2 on Arbitrum is just a clever PR stunt-nothing more, nothing less. Yet, people keep buying into the narrative like it’s gospel.

Rebecca Stowe

November 18, 2024 AT 17:31It’s encouraging to see more users exploring these low‑fee options; the ecosystem only gets stronger with broader participation.

Aditya Raj Gontia

November 19, 2024 AT 04:38From a technical standpoint, the integration of WASM via the Stylus upgrade could unlock new composability pathways, though the industry consensus on its impact remains mixed.

Kailey Shelton

November 19, 2024 AT 15:45Overall, the review covers the essentials, but it could benefit from a deeper dive into the upcoming competition from other L2 DEXes.

Krithika Natarajan

November 20, 2024 AT 02:51Appreciate the thorough breakdown; it helps demystify the process for newcomers.