ACMD Token Value Estimator

Airdrop Value Calculator

Estimate the potential value of your ACMD airdrop tokens based on current market conditions and tokenomics.

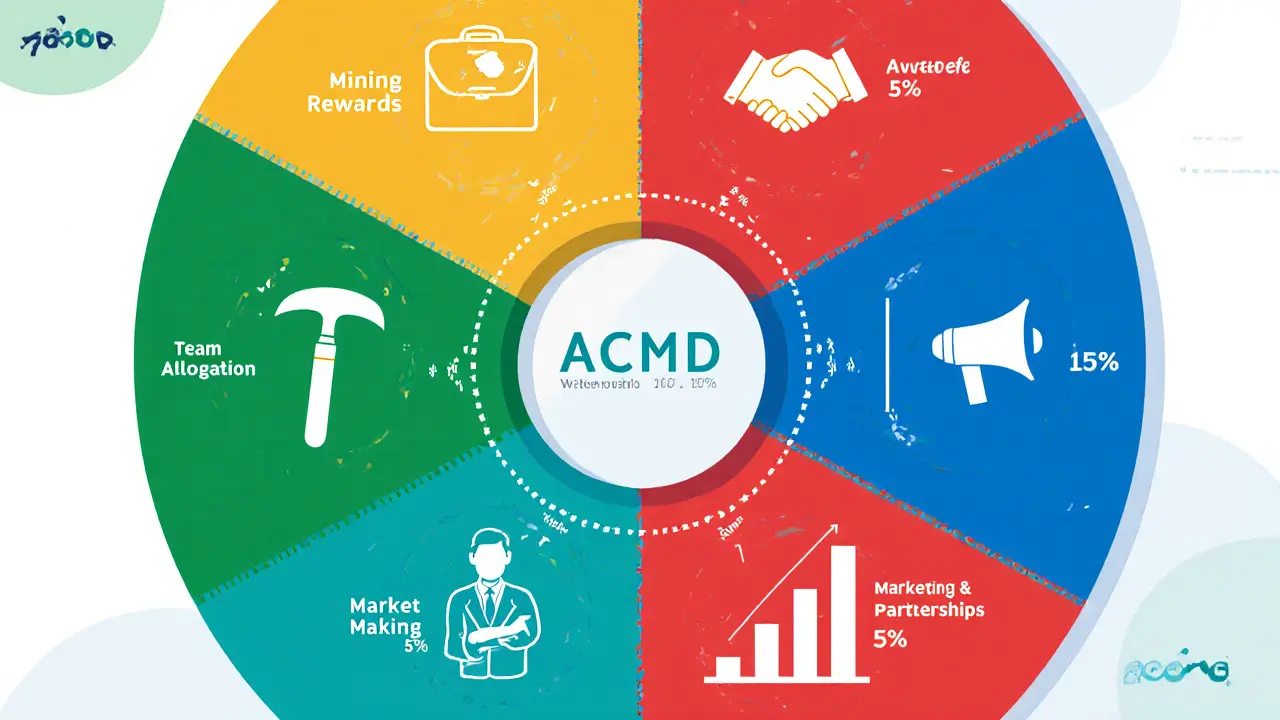

ACMD Tokenomics Overview

- Total Supply: 1 billion ACMD (official documentation)

- Mining Rewards: 65% of total supply over 3 years + 1 month

- Team Allocation: 15%

- Early Investors: 10%

- Market Making: 5%

- Marketing & Partnerships: 5%

Key Risk Factors

- Inconsistent price data across exchanges

- Low liquidity on major exchanges

- Contract address verification needed

- Vesting schedule affects long-term value

- Competition from established DeFi protocols

How the Airdrop Works

- Participants follow Archimedes on Twitter

- Join Telegram community

- Submit wallet address via Google Form

- Random lottery determines winners

- Winners receive tokens directly to wallet

Quick Take

- Participate by following Archimedes on Twitter, joining Telegram and submitting a Google Form.

- The airdrop handed out $20,000 worth of ACMD tokens via a random lottery.

- ACMD tokenomics allocate 65% to mining rewards, with a three‑year+one‑month release schedule.

- Price data is inconsistent - check the official contract before swapping.

- Long‑term success hinges on Archimedes’ cross‑chain lending rollout.

What the ACMD X CMC Airdrop Is

In August 2024 Archimedes Protocol teamed up with CoinMarketCap the leading crypto market‑data platform that tracks prices, volumes and rankings for thousands of tokens to run a joint token‑distribution event. The ACMD X CMC airdrop a lottery‑based giveaway of ACMD tokens worth roughly $20,000, designed to celebrate Archimedes’ launch on OKExchain was meant to spark community buzz and pull early users into the protocol’s DeFi suite.

How to Join the Airdrop (Step‑by‑Step)

- Head to the official Archimedes Protocol a cross‑chain leverage aggregator that combines loan mining, leveraged lending and liquidity mining Twitter handle @ArchiProtocol. Follow the account, retweet the pinned airdrop announcement and tag three friends in the retweet.

- Join the community Telegram channel at t.me/ArchimedesGlobal. This is where Archimedes posts updates, AMAs and technical posts.

- Fill out the Google Form linked in the tweet (or found on the airdrop landing page). You’ll need to paste a compatible wallet address - the airdrop supports the ERC‑20 version of ACMD on the OKExchain network.

After completing the three tasks, you’re entered into a random draw. Winners receive their ACMD tokens straight to the wallet address you submitted.

Tokenomics in Plain English

The native utility token, ACMD the governance and reward token powering the Archimedes ecosystem, has a disputed maximum supply - some sources list 10billion, while the protocol’s own docs say 1billion. Regardless of the exact cap, the allocation works like this:

| Category | Percentage | Purpose |

|---|---|---|

| Mining Rewards | 65% | Incentivize liquidity providers and leveragers over 3years+1month |

| Team | 15% | Cover development, operations and future upgrades |

| Early Investors | 10% | Reward initial capital providers |

| Market Making | 5% | Provide liquidity on exchanges |

| Marketing & Partnerships | 5% | Fuel growth campaigns like the ACMD X CMC airdrop |

The mining pool halves its daily output each year after the first month, mimicking Bitcoin’s halving model but on a much shorter schedule. This design is intended to keep reward inflation in check while still delivering attractive APYs early on.

Behind the Lottery: How Winners Were Picked

Archimedes collected all eligible wallet addresses in a Google Sheet, then fed the list into a random‑number generator. Each entry had an equal chance, regardless of how many friends you tagged. The protocol announced the winners via both the official Medium blog and a dedicated tweet thread. Tokens were sent directly to the provided addresses; no further claim steps were required.

Because the process was fully off‑chain, there’s no public on‑chain trace of exactly how many participants entered. Estimates from community chatter suggest a few thousand entries, with individual payouts ranging from $5 to $50 worth of ACMD, depending on the total pool size and winner count.

Price Confusion & Risk Checklist

One of the biggest red flags for a new token is inconsistent pricing. CoinMarketCap lists ACMD at $0 with zero 24‑hour volume, indicating either a data lag or no active markets while Crypto.com shows a price near $310. That discrepancy can stem from:

- Different contract addresses (multiple token versions on various chains)

- Delayed or missing market data feeds

- Possible wash‑trading or price manipulation on low‑liquidity pairs

Before you swap or stake ACMD, verify the contract address: 0x2f8e...1b2a57. Cross‑check it on a block explorer that supports OKExchain, and confirm that the token appears under the same symbol on the exchange you intend to use.

Risk checklist:

- Confirm contract authenticity on an official explorer.

- Check if there’s any liquidity pool on reputable DEXs (e.g., Uniswap V3 on OKExchain).

- Read the latest audit report - Archimedes claims a security review but the audit link is hidden behind a login.

- Consider the token’s vesting schedule - a large portion is locked for mining rewards, which could affect price stability.

- Stay updated on protocol milestones; a delayed launch could depress token value.

Technical Snapshot of Archimedes Protocol

Archimedes aims to be a “cross‑chain leverage aggregator.” In practice, that means a user can deposit collateral on one chain (e.g., Ethereum), borrow against it, and then lend that borrowed amount on another chain (e.g., Binance Smart Chain) to earn higher yields. The core modules include:

- Mortgage Lending: Collateralized loans with over‑collateralization ratios of 150%‑200%.

- Leveraged Lending: Users can amplify their exposure by borrowing against borrowed assets.

- Liquidity Mining Vaults: Automated strategies that shift capital to the highest APY pools across supported chains.

These features place Archimedes in direct competition with established players like Aave and Compound, but its cross‑chain focus is still relatively niche. The protocol’s smart‑contract suite is written in Solidity and leverages layer‑zero bridges to move assets safely.

Community & Communication Channels

Keeping up with Archimedes is easiest via three main platforms:

- Twitter (@ArchiProtocol) - daily updates, meme drops, and airdrop announcements.

- Telegram (ArchimedesGlobal) - real‑time chat, dev AMAs, and support.

- Medium - deep‑dive technical posts, tokenomics breakdowns, and roadmap releases.

The “Global” tag signals the team’s aim to serve an international audience, with bilingual posts (English & Mandarin) appearing regularly.

Is the Airdrop Worth Your Time?

Short answer: if you already have a crypto wallet and are curious about DeFi, the effort is minimal and the upside-free tokens and early exposure-is decent. Long answer: the token’s market data is murky, and the protocol’s real‑world usage is still in beta. Treat the airdrop as a low‑risk experiment rather than a guaranteed profit source.

For seasoned DeFi users, the real value lies in testing Archimedes’ cross‑chain mechanisms. If the protocol delivers on its promise, early adopters could earn higher yields from leveraged lending and mining rewards. If it stalls, the ACMD tokens may remain largely illiquid.

Next Steps for Interested Participants

- Complete the three tasks listed above and double‑check your wallet address.

- Monitor the official Twitter and Telegram for winner announcements.

- After receiving ACMD, verify the token on an OKExchain explorer.

- Consider staking ACMD in the protocol’s mining vaults only after reading the latest risk disclaimer.

- Keep an eye on upcoming roadmap items: multi‑chain bridge upgrades slated for Q12026.

Frequently Asked Questions

What is the total supply of ACMD?

Official docs mention a 1billion cap, while some market sites list 10billion. The protocol’s latest whitepaper sticks with 1billion, so treat that as the authoritative figure.

Can I claim the airdrop after the deadline?

No. The lottery closed once the winner list was generated. If you missed the window, you can still earn ACMD through mining rewards or future community drops.

Is ACMD listed on any major exchanges?

As of October2025, only a few low‑volume DEXs on OKExchain show a pair with USDT. No major centralized exchange lists ACMD yet.

How does the mining reward halving work?

After the first month of launch, the daily ACMD emission is cut in half every 12 months. This continues until the 65% mining allocation is fully distributed over roughly three years.

What should I watch for to avoid scams?

Only use the official contract address (0x2f8e...1b2a57) and submit your wallet via the Google Form link posted on Archimedes’ verified Twitter. Beware of phishing sites that mimic the airdrop page.

Finance

Finance

Alie Thompson

April 1, 2025 AT 21:25When evaluating any airdrop, it is incumbent upon the community to consider the moral implications of participating in a venture whose tokenomics are, at best, opaque and, at worst, deliberately misleading; the discrepancy between a purported one‑billion supply and speculative reports of ten‑billion tokens should raise alarms about the project's commitment to transparency; furthermore, the allocation of sixty‑five percent to mining rewards suggests a pyramidal structure that rewards early participants at the expense of later entrants; the vesting schedule, spanning over three years plus an extra month, effectively locks a substantial portion of the circulating supply, creating a deferred inflationary pressure that could erode holder value; the low liquidity on major exchanges compounds this risk, making it difficult for users to exit positions without significant slippage; the reliance on a random lottery without on‑chain verification undermines trust, as there is no immutable record of fairness; the project's claim of cross‑chain leverage aggregation is ambitious, yet it directly competes with established, battle‑tested platforms such as Aave and Compound, raising questions about its technical viability; the marketing budget of merely five percent appears insufficient to sustain long‑term community growth in a saturated DeFi landscape; the presence of multiple contract addresses across chains adds a layer of complexity that the average user may not navigate safely; the lack of a publicly accessible audit report, despite assertions of a completed security review, signifies a gap in due diligence; participants should also be wary of wash‑trading possibilities on low‑volume DEX pairs, which can artificially inflate price signals; it is therefore advisable to treat the airdrop as a speculative experiment rather than a guaranteed investment; the ethical responsibility of the project team includes clear communication, accurate data, and demonstrable security measures, none of which are fully satisfied at this stage; before allocating any capital, consider the broader ecosystem implications of supporting projects that prioritize hype over substance; finally, always verify the contract address on an official block explorer to avoid phishing scams that exploit the airdrop's popularity.

Samuel Wilson

April 4, 2025 AT 18:52When analysing the ACMD airdrop, it is essential to adopt a measured perspective; the step‑by‑step guide provides clear instructions, which reduces entry barriers for newcomers; however, users must verify the official contract address to mitigate phishing risks; the token's liquidity constraints mean that any immediate trading could incur substantial slippage; therefore, a prudent approach is to hold the tokens until a reputable exchange lists them, thereby ensuring price stability and market depth.

Rae Harris

April 7, 2025 AT 16:19From a contrarian standpoint, the ACMD tokenomics look like a classic DeFi meme‑coin stratagem; the 65% mining reward allocation resembles a mining pool that will dump tokens once the halving schedule kicks in; the inconsistent price feeds across CMC and Crypto.com indicate data latency or low volume manipulation; plus, the cross‑chain leverage ambitions are more hype than substance at this point.

Danny Locher

April 10, 2025 AT 13:45That perspective highlights valid concerns, yet many early adopters find value in simply testing the cross‑chain mechanisms for educational purposes.

Emily Pelton

April 13, 2025 AT 11:12When addressing community members, it is crucial to emphasize that the airdrop participation process is straightforward, yet the underlying risks demand rigorous due diligence; ensure you are using the correct wallet format, double‑check the contract address, and be mindful of the low liquidity environment; remember, the token's vesting schedule will affect long‑term price dynamics, so patience is advisable; finally, engage with the official channels to stay updated on protocol milestones.

sandi khardani

April 16, 2025 AT 08:39When scrutinizing the project's architecture, one must note that the absence of a publicly posted audit report is a glaring omission; the reliance on a Google Sheet for winner selection bypasses any on‑chain transparency, which is antithetical to the ethos of decentralisation; further, the low‑volume DEX pairs create an environment ripe for price manipulation, where a single whale can shift the market dramatically; the token's emission curve, halving annually after the first month, suggests a built‑in inflationary shock that could devastate holder positions once the initial reward pool is exhausted; moreover, the cross‑chain bridge technology employed has historically been a vector for exploits, as evidenced by numerous incidents across the ecosystem; participants should therefore allocate capital only after a comprehensive risk assessment, factoring in smart contract vulnerabilities, market depth, and the project's ability to deliver on its roadmap; in short, the airdrop is a high‑risk proposition that may not justify the potential upside.

mark gray

April 19, 2025 AT 06:05When you look at the basics, just double‑check the contract address before you do anything.

Darren R.

April 22, 2025 AT 03:32When contemplating the moral fabric of the venture, one cannot ignore the contradictory supply figures; this inconsistency, coupled with the gratuitous use of buzzwords, betrays a superficial commitment to transparency; the airdrop, though well‑intentioned, may serve primarily as a publicity stunt rather than a genuine ecosystem catalyst.

Hardik Kanzariya

April 25, 2025 AT 00:59When supporting newcomers, it helps to remind them that patience and verification are key; keep an eye on the official channels for updates, and only interact with the verified contract address to stay safe.

Shanthan Jogavajjala

April 27, 2025 AT 22:25When dissecting the liquidity concerns, the paucity of robust market makers on major exchanges exacerbates slippage risks; consequently, any immediate arbitrage attempts are likely to be thwarted by insufficient depth.

Millsaps Delaine

April 30, 2025 AT 19:52When engaging in a discourse about token distribution, one must appreciate the nuanced interplay between governance incentives and market perception; the allocation of five percent to marketing underscores a strategic intent to cultivate brand awareness, yet the absence of a clear roadmap rendering these efforts somewhat nebulous; furthermore, the duality of reported total supply figures invites speculation regarding the project's candor; a sophisticated investor will weigh the theoretical utility of cross‑chain leverage aggregation against the pragmatic challenges of liquidity provision; the halving schedule, reminiscent of Bitcoin's emission model, aims to temper inflation but may inadvertently suppress early yield opportunities; in the broader DeFi panorama, ACMD's positioning is precarious, sandwiched between established protocols and emergent innovators; therefore, a measured, data‑driven approach is advisable for any participant seeking sustainable returns.

Jack Fans

May 3, 2025 AT 17:19When offering guidance, it is helpful to reference the project's official Medium posts for deeper technical insights, and to verify that the wallet address matches the OKExchain ERC‑20 format before submitting any forms.

Adetoyese Oluyomi-Deji Olugunna

May 6, 2025 AT 14:45When in doubt, avoid the airdrop.