October 2024 Crypto Market Updates

When checking October 2024 Crypto Market Updates, the latest snapshots of digital coin prices, new token listings, and market‑wide analysis for the month. Also known as Oct 2024 crypto roundup, it helps traders and investors see what moved, why it moved, and where the next opportunity might hide.

One of the biggest draws for anyone watching the space is cryptocurrency price tracking, a real‑time feed that shows each coin’s market cap, volume, and 24‑hour change. This feed enables you to spot sudden spikes before they settle, compare performance against Bitcoin, and decide whether to swing in or out. In October, we saw Bitcoin bounce off the $67k level while Ethereum edged past $4.8k, and dozens of midsize altcoins broke key resistance points. The data also revealed that stablecoin inflows grew 12 % week over week, hinting that risk‑off sentiment was nudging some traders toward safety.

Another hot topic this month was blockchain airdrops, free token distributions that projects use to attract users and bootstrap network effects. October featured three verified airdrops that cleared the usual eligibility hurdles: a DeFi lending token rewarding early liquidity providers, a layer‑2 scaling solution handing out governance tokens to beta testers, and a gaming platform giving its native coin to players who hit a 10‑hour play threshold. Each airdrop required a simple on‑chain snapshot, and the follow‑up price action showed that early claimers could see up to 150 % gains within a week, proving that good airdrop research still pays off.

While price data and airdrops grabbed headlines, exchange comparison tools, platforms that rank crypto exchanges on fees, liquidity, and security features played a behind‑the‑scenes role. Our analysis in October highlighted that three exchanges cut taker fees by 0.02 % to stay competitive, while a fourth rolled out a new insurance fund that covers up to $5 million in user losses. For anyone swapping large volumes, these shifts matter because lower fees directly boost net returns. The comparison also showed that exchanges offering deep order books on emerging tokens tend to attract higher trade volume, which in turn improves price stability for those assets.

Finally, the month wasn’t just about crypto. stock market analysis, the practice of evaluating equities, indices, and macro trends alongside digital assets revealed a growing correlation between tech‑sector ETFs and major altcoins. When the Nasdaq 100 surged 3 % after earnings season, Bitcoin followed with a 4 % rise, suggesting that traditional risk appetite is spilling over into crypto. This crossover insight helps investors balance portfolios, hedge against sector‑specific shocks, and decide whether to diversify into stablecoins during equity pullbacks.

All these pieces—price tracking, airdrops, exchange tools, and stock cross‑analysis—fit together like a puzzle that forms the bigger picture of October’s market dynamics. Below, you’ll find the full collection of articles, charts, and quick guides that dive deeper into each theme, giving you the practical intel you need to act confidently in the fast‑moving world of digital finance.

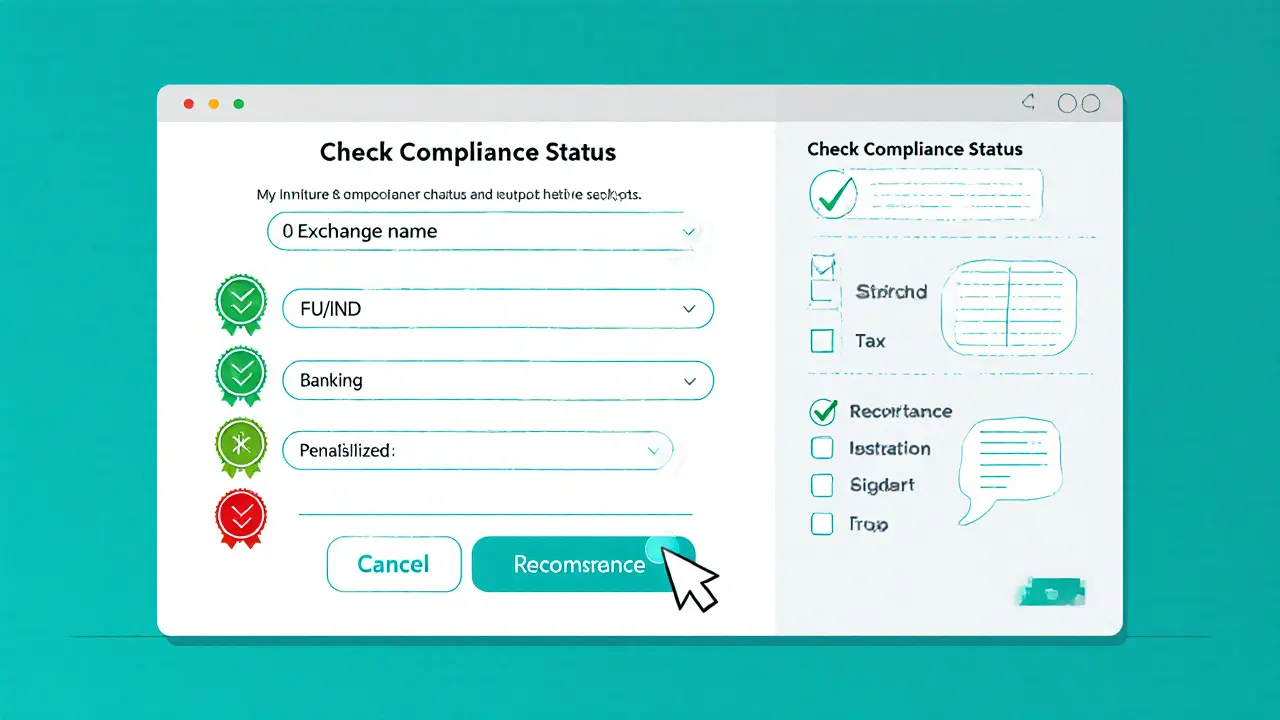

A 2025 guide to Taiwan's FSC crypto regulations for exchanges, covering registration, AML rules, security token limits, ETF access, compliance checklist, and upcoming law changes.

Cryptocurrency trading is pulling billions out of Nigeria's economy, devaluing the naira and reshaping remittances. This article explains the scale, drivers, regulatory shifts, and what it means for everyday Nigerians.

An in‑depth Tothemoon crypto exchange review covering fees, staking, leverage, debit card, security, user sentiment and a feature comparison with major rivals.

Learn which crypto exchanges Indian traders should avoid in 2025, why compliance matters, and how to pick safe platforms with practical checks and a handy checklist.

Finance

Finance