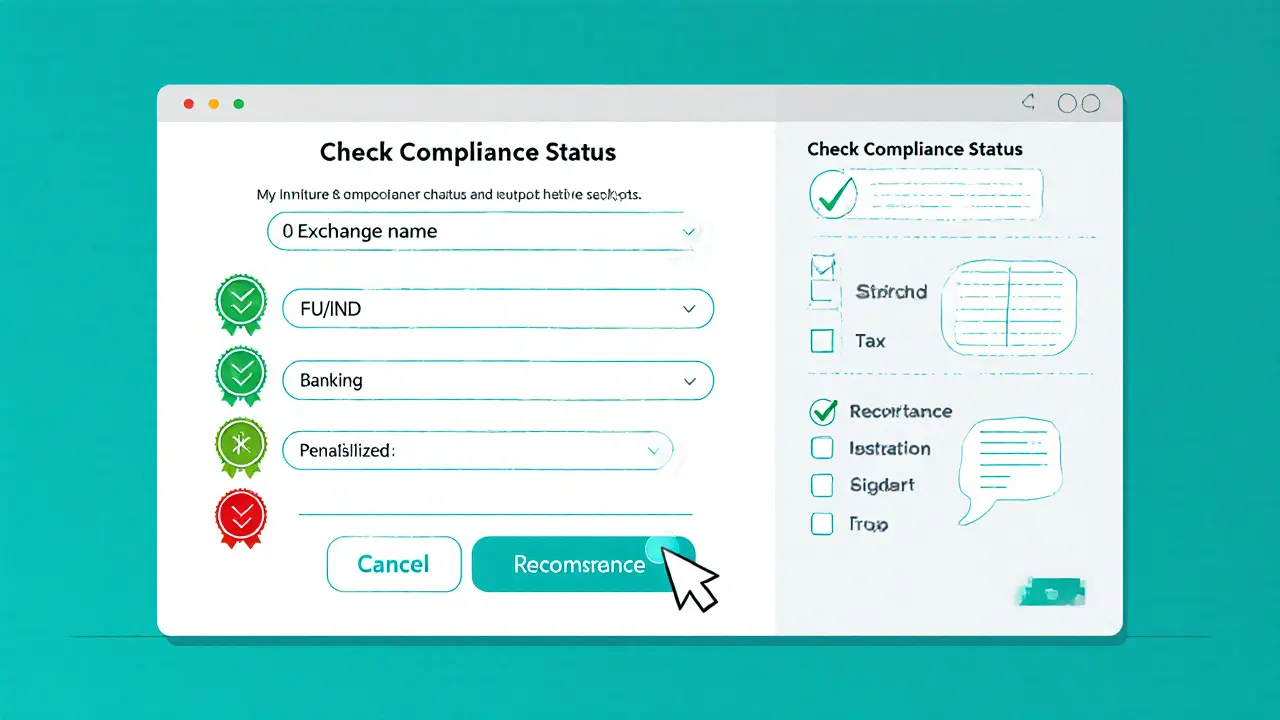

Indian Crypto Exchange Compliance Checker

Compliance Analysis Results

Key Compliance Factors

- FIU-IND Compliance

- Banking Partnerships

- Security Audits

- Tax Reporting Tools

Recommendation

Safety Checklist

- Verify FIU-IND compliance status

- Confirm INR banking or payment-gateway partnerships

- Ensure the platform provides a detailed tax-summary report

- Check for recent third-party security audits

- Read user reviews for grievance handling speed

When you trade crypto in India, you’re juggling a fast‑moving market and a patchwork of rules. Picking the wrong exchange can cost you money, tax headaches, or even legal trouble. Below you’ll find the exchanges that have raised red flags, why they’re risky, and what to look for before you deposit any rupees.

Quick Summary

- Binance and Bybit have been penalised by the FIU‑IND for non‑compliance.

- WazirX suffered a $230million hack and still holds user funds.

- Non‑FIU‑compliant platforms struggle with bank links, tax reports, and consumer protection.

- Verify FIU compliance, banking partnerships, security audits, and tax‑reporting tools before signing up.

Why Indian Compliance Matters

India’s crypto landscape is legal but unregulated as legal tender. The key regulator for crypto‑related financial flows is the Financial Intelligence Unit - India (FIU‑IND), the agency that issues anti‑money‑laundering guidelines for crypto platforms. If an exchange ignores FIU‑IND’s KYC, AML, or reporting rules, the agency can levy hefty fines, freeze INR deposits, or force the platform to stop operating in the country.

Because the FIU‑IND has not published a definitive list of compliant exchanges, Indian traders must do their own homework. The cost of ignoring compliance shows up in three ways:

- Banking roadblocks: Indian banks label non‑compliant exchanges as high‑risk, leading to blocked deposits and frozen withdrawals.

- Tax nightmares: The finance ministry requires a 30% capital gains tax plus 1% TDS on crypto sales over ₹50,000. Without proper transaction statements, you’re left to calculate taxes manually.

- Legal exposure: The Enforcement Directorate can investigate users of non‑compliant platforms for money‑laundering, even if you weren’t doing anything illegal.

Big Names That Indian Traders Should Treat With Caution

Even the world’s biggest platforms have run afoul of Indian rules. Below are the three that repeatedly appear in FIU‑IND penalty notices.

Binance, the global crypto exchange with the largest daily volume

The FIU‑IND slapped Binance with multi‑million‑dollar penalties in 2024 for failing to share user KYC data and for allowing anonymous INR deposits. The fines forced Binance to suspend direct INR onboarding for Indian users, pushing many to third‑party services that lack any regulatory oversight.

Bybit, an international derivatives exchange popular among Indian day traders

Bybit faced a similar penalty in early 2025. The regulator cited inadequate AML monitoring and a refusal to cooperate with Indian tax authorities. As a result, Bybit’s Indian banking partners withdrew support, leaving users with delayed fiat withdrawals and frozen accounts.

WazirX, India’s home‑grown exchange with over 6million users

WazirX’s July2024 security breach exposed a multi‑signature wallet, causing a $230million loss. The exchange has since announced a restructuring plan, but critics note that user funds remain locked on the platform rather than being returned. WazirX also carries indirect ties to the Binance group, which raises additional compliance questions.

Risk Profile of Non‑Compliant Exchanges

| Risk Factor | Problematic Exchanges (e.g., Binance, Bybit, WazirX) | Generally Compliant Exchanges (e.g., CoinDCX, ZebPay) |

|---|---|---|

| FIU‑IND penalties | Yes - multi‑million‑dollar fines, operational restrictions | No - actively engaged with FIU‑IND |

| Banking access | Blocked INR deposits, frequent withdrawal failures | Stable INR banking partners, faster settlements |

| Security track record | Major hacks (WazirX) or reported vulnerabilities | Regular third‑party audits, bug bounty programs |

| Tax reporting tools | None or incomplete CSV exports | Integrated GST/Capital‑gains statements |

| Customer grievance process | Unclear timelines, often no response | Defined SLA, escalation channels |

How to Verify FIU‑IND Compliance Before You Deposit

Because the regulator doesn’t publish an official list, use these practical checks:

- Visit the FIU‑IND website and search for the exchange’s name in recent enforcement notices.

- Confirm that the platform has a partnership with an Indian bank or a licensed payment gateway (e.g., Razorpay, PayU).

- Ask for the exchange’s KYC/AML policy and verify that it includes mandatory RBI‑approved identity verification.

- Check if the exchange provides a downloadable tax‑summary report that aligns with the 30% capital‑gains rate and 1% TDS.

- Look for third‑party security audits (certified by firms like Trail of Bits or Quantstamp) and a public bug‑bounty program.

If any of these items are missing, treat the platform as high risk.

Safer Alternatives for Indian Users

While no exchange is completely immune to future regulation, the following platforms consistently demonstrate better compliance and security practices:

- CoinDCX, a domestic exchange with over 3million active users and regular FIU‑IND reporting

- CoinSwitch, aggregates liquidity across multiple vetted exchanges, offering a single‑click INR on‑ramp

- ZebPay, one of the oldest Indian exchanges, known for its strict KYC and integrated tax‑reporting module

- Unocoin, focuses on simple fiat‑crypto buying with RBI‑approved banking partners

- Bitbns, offers a wide range of altcoins while maintaining compliance with Indian tax rules

Even with these options, stay vigilant. Regulatory guidance can shift, and today’s compliant exchange could face penalties tomorrow.

Keeping Up with the Evolving Regulatory Landscape

The Reserve Bank of India (RBI, India’s central bank, which enforces banking prohibitions on crypto‑related transactions) continues to issue circulars that affect how fiat can move in and out of exchanges. Meanwhile, the Ministry of Finance tightens reporting requirements each fiscal year. As a result, Indian traders should make it a habit to:

- Subscribe to FIU‑IND’s monthly compliance newsletter.

- Follow reputable crypto‑law blogs that summarize RBI circulars.

- Periodically re‑audit the exchanges you use for any new penalty notices.

Being proactive reduces the chance of finding your account frozen during a tax filing season.

Checklist: What Every Indian Crypto Trader Should Do Before Using an Exchange

- Verify FIU‑IND compliance status.

- Confirm INR banking or payment‑gateway partnerships.

- Ensure the platform provides a detailed tax‑summary report.

- Check for recent third‑party security audits and bug‑bounty programs.

- Read user reviews for grievance handling speed.

- Keep a backup of private keys or use hardware wallets for long‑term holdings.

- Monitor regulatory news at least once a month.

Following this list can save you from losing money, wasting time on frozen accounts, or getting tangled with the Enforcement Directorate.

Frequently Asked Questions

Can I still use Binance if I’m an Indian trader?

You can log in, but direct INR deposits are blocked for most users. To move rupees in or out, you’ll need a third‑party service that isn’t regulated, which adds risk and may violate FIU‑IND guidelines.

What should I do if my account gets frozen on a non‑compliant exchange?

First, file a formal support ticket and keep a record of all communications. If the exchange ignores you, consider filing a complaint with the FIU‑IND and consult a legal advisor, especially if a significant amount is at stake.

Do Indian tax authorities require me to report crypto losses?

Yes. Capital‑losses can be set off against gains in the same financial year, reducing your 30% tax liability. Accurate transaction logs from a compliant exchange make this process much easier.

Is using a hardware wallet safer than keeping funds on an exchange?

Hardware wallets keep your private keys offline, eliminating most hack vectors that affect exchanges. For large holdings, a hardware wallet is the recommended safety net.

How often should I reassess the compliance status of my chosen exchange?

At a minimum, review compliance news quarterly. Major regulatory updates often happen after budget announcements or FIU‑IND quarterly reports.

Finance

Finance

Anthony R

October 9, 2024 AT 14:25I appreciate the thorough checklist, it really helps newcomers stay safe, especially with the ever‑changing FIU‑IND guidelines, so kudos to the author for compiling this.

Linda Welch

October 9, 2024 AT 19:59Wow, another list of things we should avoid, because apparently the Indian regulators love to reinvent the wheel every quarter. It’s not like we needed a reminder that Binance, Bybit, and even the once‑trusted WazirX have become red‑flagged territories. The article does a decent job of spelling out the obvious risks, yet somehow it feels like preaching to a crowd that already knows the headlines. I guess the real novelty is the checklist of “verify FIU‑IND compliance,” which is about as groundbreaking as telling people to breathe. Still, if you enjoy reading the same warnings over and over, keep scrolling. For those who think the crypto market is a free‑for‑all, this post might finally shatter that naive illusion. In the end, the only thing you can truly avoid is ignoring the facts.

victor white

October 10, 2024 AT 01:32One cannot help but notice the subtle undercurrents of regulatory capture, as the gears of unseen puppeteers turn behind the façade of compliance; the very mention of FIU‑IND feels like a veil over deeper machinations.

mark gray

October 10, 2024 AT 07:05That’s a fair point, it’s easy to get lost in the jargon, but the practical steps listed here-like checking banking partnerships-are straightforward and can save users from a lot of hassle.

Alie Thompson

October 10, 2024 AT 12:39Morally speaking, the crypto ecosystem stands at a crossroads where complacency equates to negligence; we have a duty to demand transparency, to protect not just our own assets but the collective integrity of digital finance, and to hold platforms accountable when they sidestep the law.

Donald Barrett

October 10, 2024 AT 18:12Seriously, anyone still trusting those non‑compliant exchanges is just begging to get scammed.

Rebecca Stowe

October 10, 2024 AT 23:45Stay positive, folks-there are solid options out there, and with a little diligence you can navigate the landscape safely.

Aditya Raj Gontia

October 11, 2024 AT 05:19From a technical standpoint, the risk matrix aligns with standard KYC/AML protocols, but the implementation lag on some platforms is concerning.

Kailey Shelton

October 11, 2024 AT 10:52Looks like another generic warning.

Angela Yeager

October 11, 2024 AT 16:25For anyone looking for a quick start, CoinDCX and ZebPay both provide user‑friendly mobile apps that integrate tax‑summary reports; this can dramatically simplify filing season.

vipin kumar

October 11, 2024 AT 21:59Indeed, the integration of tax tools is a game‑changer, though one should always verify that the exported data matches the numbers shown on the platform to avoid surprises.

Lara Cocchetti

October 12, 2024 AT 03:32It’s evident that the powers that be are orchestrating a grand design to keep ordinary traders in the dark, while the elite manipulate compliance narratives for their own benefit.

Vaishnavi Singh

October 12, 2024 AT 09:05Contemplating the volatility of crypto markets reveals a profound lesson about impermanence and the futility of clinging to material certainty.

meredith farmer

October 12, 2024 AT 14:39While philosophical musings are intriguing, the practical reality is that non‑compliant exchanges have already caused real financial harm; ignoring that fact is nothing short of reckless.

Danny Locher

October 12, 2024 AT 20:12I think the post does a solid job laying out the basics, and it’s helpful to have a concise checklist. It’s easy to miss some details when you’re new to the space.

Emily Pelton

October 13, 2024 AT 01:45Great effort, everyone!; the comprehensive approach, especially the emphasis on security audits, is exactly what traders need; keep spreading the knowledge.

sandi khardani

October 13, 2024 AT 07:19The crypto arena, especially within the Indian context, is riddled with regulatory ambiguities that many newcomers fail to grasp. First, the FIU‑IND’s recent enforcement actions have set a precedent that cannot be ignored. Second, banking partners are withdrawing support, which directly impacts fiat on‑ramps. Third, the security track record of platforms like WazirX has been tarnished by massive breaches. Fourth, tax compliance tools remain uneven across exchanges, creating headaches during filing season. Fifth, user grievance mechanisms are often either opaque or non‑existent. Sixth, the market’s rapid evolution outpaces legislative responses, leaving gaps. Seventh, rumors of shadowy collusion between certain exchanges and offshore entities circulate frequently. Eighth, the lack of a public compliance registry forces traders to do their own investigative work. Ninth, the Indian rupee volatility adds another layer of risk when converting crypto gains. Tenth, many traders underestimate the importance of hardware wallets for long‑term storage. Eleventh, the community’s overreliance on social media hype can obscure fundamental risks. Twelfth, the legal framework still treats crypto as a non‑currency, complicating dispute resolution. Thirteenth, the enforcement directorate’s reach into alleged money‑laundering activities can implicate innocent users. Fourteenth, the psychological pressure of “fear of missing out” often leads to hasty decisions. Finally, a disciplined approach – verifying compliance, securing assets, and maintaining meticulous records – remains the most reliable safeguard against these multifaceted threats.

Christina Norberto

October 13, 2024 AT 12:52In accordance with the prevailing statutory provisions and the covert operational frameworks, it is evident that the purported compliance of certain platforms is but a veneer, concealing a labyrinth of illicit transactions.

Fiona Chow

October 13, 2024 AT 18:25Sure, because reading a checklist is the same as magically protecting your portfolio, right?

Mark Briggs

October 13, 2024 AT 23:59Wow, groundbreaking insights.

mannu kumar rajpoot

October 14, 2024 AT 05:32Honestly, if you keep trusting these entities, you might as well hand over your savings to the next fraudster who promises “secure” returns.

Tilly Fluf

October 14, 2024 AT 11:05It is commendable to approach the crypto market with diligence; I encourage all participants to remain vigilant and to seek reputable platforms, thereby fostering a secure ecosystem.

Darren R.

October 14, 2024 AT 16:39One must recognize the moral imperative, the very soul of the digital revolution cries out against negligence; we cannot stand idle while the foundations of trust crumble under the weight of apathy!

Hardik Kanzariya

October 14, 2024 AT 22:12Let’s keep the conversation supportive-if anyone’s feeling overwhelmed, feel free to reach out; we’re all learning together.