Tothemoon Crypto Exchange Feature Checker

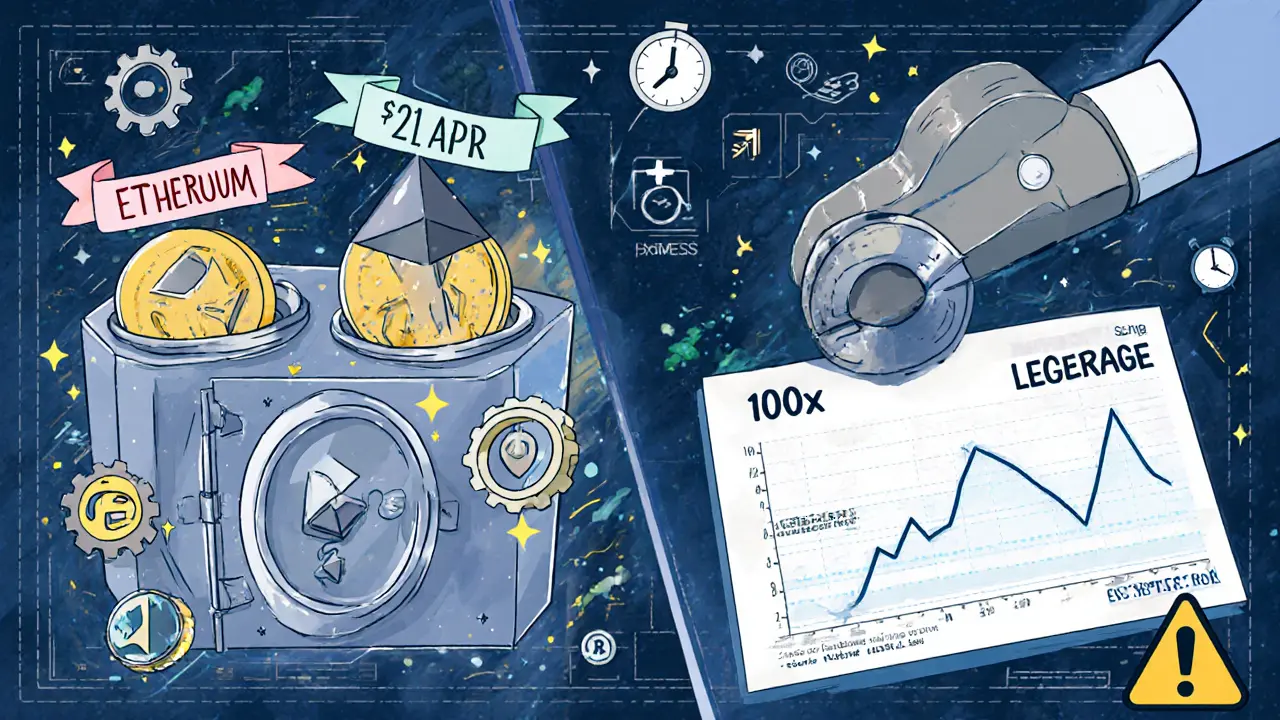

Staking APR

Tothemoon offers up to 21% APR on selected PoS tokens like ETH and DOT.

Leverage

Up to 100x leverage available for futures trading.

Trading Pairs

Only 29 trading pairs available, limiting diversification.

Debit Card

Mastercard with €15,000 daily limit and low fees.

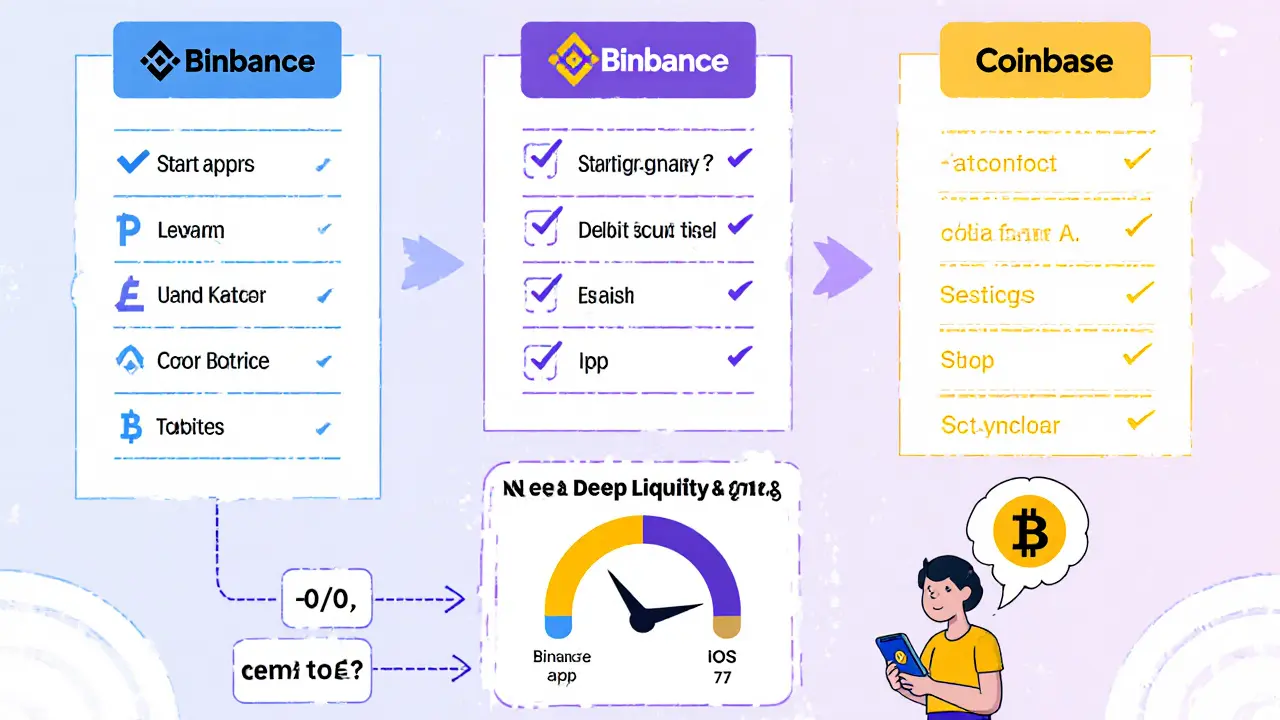

Compare With Major Exchanges

| Feature | Tothemoon | Binance | Coinbase |

|---|---|---|---|

| Supported Assets | 200+ | 600+ | 250+ |

| Trading Pairs | 29 | 400+ | 120+ |

| Leverage | Up to 100× | Up to 125× | None (margin only on US) |

| Staking APR | Up to 21% | Up to 18% | Up to 10% |

| Crypto Debit Card | Mastercard, €15k limit | Visa, $10k limit | Visa, $5k limit |

| Mobile App (iOS) | No | Yes | Yes |

| Expert Rating (CoinGecko) | 3/10 | 8/10 | 7/10 |

Key Pros

- High staking APR (up to 21%)

- 100× leverage option

- Low-fee crypto debit card

- SEPA Instant support

- 24/7 live-chat support

Key Cons

- Only 29 trading pairs

- No iOS app

- Weaker liquidity

- Low expert rating (3/10)

- Limited regulation scope

Recommendation

Tothemoon is ideal for users seeking high staking returns and a low-fee crypto debit card. However, power traders requiring deep liquidity and full mobile support may prefer Binance or Coinbase.

Looking for a quick verdict on the Tothemoon platform? You’ve probably seen the bold claim that it’s the “fastest growing crypto exchange in the world,” but the reality is a mix of solid features and some glaring gaps. This review breaks down the most important aspects - from fees and security to the crypto debit card - so you can decide if Tothemoon fits your trading style.

Quick Take (TL;DR)

- Centralized exchange founded in 2018, based in Lithuania and licensed by the Lithuanian Financial Crimes Investigation Service (FCIS).

- Offers spot trading for >200 assets but only 29 trading pairs, which limits diversification.

- Futures up to 100× leverage match industry leaders, yet liquidity is weaker than major rivals.

- Staking APR reaches 21% on select PoS tokens - a clear upside for passive income.

- Crypto debit card (Mastercard) provides €15,000 daily limit, low fees, but no iOS app restricts iPhone users.

Who Is Tothemoon?

Tothemoon is a centralized cryptocurrency exchange launched in 2018, headquartered in Lithuania and regulated by the Lithuanian Financial Crimes Investigation Service (FCIS). The platform markets itself as a one‑stop shop for buying, selling, and earning on digital assets. While it has a modern look and a handy Android app, the absence of an iOS version remains a major pain point for many traders.

Core Trading Features

The exchange supports over 200 crypto assets, including the big names like Bitcoin (BTC), Ethereum (ETH), Polygon (MATIC), and Solana (SOL). Despite this broad catalog, the exchange limits users to 29 trading pairs, so you won’t find every cross‑asset combo you’d expect on larger platforms.

For chart lovers, the web interface embeds TradingView widgets, allowing advanced technical analysis without leaving the site. Spot trading fees start at 0.15% and decrease with higher 30‑day volume, a standard tiered structure.

Leverage and Futures

If you’re into high‑risk positions, Tothemoon offers futures contracts with up to 100× leverage - on par with industry giants. However, the platform’s order book depth is shallower than that of Binance or Coinbase, which can lead to slippage during volatile moves. New users should test the waters with smaller positions before committing large capital.

Staking and Passive Income

One of the platform’s standout perks is the staking program. Proof‑of‑Stake tokens like Ethereum (ETH) and Polkadot (DOT) deliver up to 21% annual percentage rate (APR). This beats many competing exchanges, making Tothemoon an attractive option for investors who prefer “set‑and‑forget” earnings.

Banking Integration: SEPA and Card Payments

Deposits can be made via bank cards or SEPA Instant transfers, while withdrawals are processed through SEPA (for EUR) and standard bank wires. The SEPA support is a clear advantage for European users, offering quick, low‑cost fiat movement.

Crypto Debit Card - Real‑World Spending

The exchange’s crypto debit card, powered by Mastercard, lets you spend crypto at any merchant that accepts Mastercard. Key specs:

- Daily spend limit: €15,000

- Base transaction fee: 0.15%

- Supports Apple Pay and Google Pay

- No issuance or maintenance fees for the virtual version

New cardholders receive a 5USDC bonus, which the platform promotes heavily on YouTube. The card’s low fees and high limit are competitive, but remember it’s only available on Android and web platforms - iPhone users are left out.

Security Measures

Tothemoon employs two‑factor authentication (2FA) for login protection and runs a bug bounty program that rewards up to $50,000 for discovered vulnerabilities. While these steps show a commitment to security, the exchange’s public security documentation is thin, and expert ratings flag potential gaps.

Expert and User Sentiment

On CoinGecko’s expert panel, Tothemoon scores 3 out of 10, labeled a “poor exchange.” The low score points to concerns around liquidity, regulatory robustness, and customer support. Trustpilot, by contrast, lists a 3.6‑out of‑5 rating from 120 reviews. Users commend the 24/7 live‑chat support and the instant card‑based buying flow, yet they also criticize the missing iOS app and occasional withdrawal delays.

Regulatory Landscape

The Lithuanian Financial Crimes Investigation Service (FCIS) license gives the platform a legal foothold in the EU, facilitating SEPA integration and EUR support. However, Lithuanian oversight is less stringent than regulators in the UK, US, or Germany, which can affect perceived safety among risk‑averse traders.

Feature Comparison with Major Exchanges

| Feature | Tothemoon | Binance | Coinbase |

|---|---|---|---|

| Founded | 2018 | 2017 | 2012 |

| Licensing | FCIS (Lithuania) | Multiple (including Malta, US) | UK FCA, US FinCEN |

| Supported Assets | 200+ | 600+ | 250+ |

| Trading Pairs | 29 | 400+ | 120+ |

| Leverage | Up to 100× | Up to 125× | None (margin only on US) |

| Staking APR (Top Tokens) | Up to 21% | Up to 18% | Up to 10% |

| Crypto Debit Card | Mastercard, €15k limit | Visa, $10k limit | Visa, $5k limit |

| Mobile App (iOS) | No | Yes | Yes |

| Expert Rating (CoinGecko) | 3/10 | 8/10 | 7/10 |

Pros and Cons Checklist

- Pros

- High staking APR on selected PoS tokens

- 100× leverage option for futures traders

- Low‑fee crypto debit card with high daily limit

- SEPA Instant support for fast EUR deposits

- 24/7 live‑chat support staffed by humans

- Cons

- Only 29 trading pairs - limited market depth

- No iOS app - iPhone users are excluded

- Liquidity weaker than major exchanges

- Expert rating of 3/10 signals reliability concerns

- Regulation limited to Lithuanian jurisdiction

How to Get Started on Tothemoon

- Visit the official website and click “Sign Up”.

- Enter your email, choose a strong password, and complete the KYC verification (passport or ID + proof of address).

- Enable two‑factor authentication (Google Authenticator or SMS).

- Deposit funds via SEPA Instant, credit/debit card, or transfer your existing crypto.

- Navigate to the “Spot” tab to trade BTC/ETH or go to “Futures” for leveraged positions.

- If you want passive income, go to the “Staking” section, select ETH or DOT, and lock your tokens for the advertised APR.

- Apply for the crypto debit card under the “Card” menu, wait for approval, and start spending.

Everything can be done from a browser or the Android app; just remember you’ll need a desktop or Android device for full functionality.

Potential Pitfalls and How to Avoid Them

- Liquidity gaps: Stick to the most liquid pairs (BTC/USDT, ETH/USDT) to avoid slippage.

- Withdrawal delays: Plan withdrawals during EU banking hours; SEPA can take 1‑2 business days.

- Security concerns: Use a unique password, enable 2FA, and withdraw large holdings to a hardware wallet after trading.

- iOS limitation: If you’re an iPhone user, consider using the web interface on Safari or switch to a competitor with native iOS support.

Is Tothemoon Right for You?

If you value high staking returns, need a low‑fee crypto debit card, and are comfortable with a smaller trading ecosystem, Tothemoon can be a decent side‑tool. However, power traders who demand deep liquidity, a wide array of pairs, and a fully native mobile experience may find Binance or Coinbase more suitable.

Frequently Asked Questions

What is the minimum deposit on Tothemoon?

The platform allows deposits as low as €10 for card payments, while SEPA transfers have no strict minimum - just enough to cover the transaction fee.

Is Tothemoon’s crypto debit card available in the UK?

Yes, the Mastercard is issued to residents of the European Economic Area, including the UK. Shipping times vary, but most users receive the card within 7‑10 business days.

How does the staking APR compare to other exchanges?

Tothemoon offers up to 21% APR on tokens like ETH and DOT, which is higher than Binance (max ~18%) and Coinbase (max ~10%). The rate applies only when you stake directly through the exchange’s wallet.

Can I trade futures on the Android app?

Yes, the Android app includes a “Futures” tab where you can open leveraged positions up to 100×. The UI mirrors the web version but omits some advanced order‑type settings.

What security measures protect my account?

Tothemoon requires two‑factor authentication, encrypts data at rest, and runs a bug bounty program with rewards up to $50,000. Nonetheless, the platform’s public security documentation is limited, so using a hardware wallet for large holdings is advisable.

Finance

Finance

Vaishnavi Singh

October 17, 2024 AT 22:48Staking on Tothemoon promises a 21% APR, which on the surface sounds attractive, yet the limited trading pairs and weaker liquidity raise questions about the sustainability of such yields.

Peter Johansson

October 19, 2024 AT 16:28Sounds decent 😊

Cindy Hernandez

October 21, 2024 AT 10:08The platform’s 21% staking APR certainly catches the eye, especially when you compare it to the sub‑10% rates offered by many mainstream exchanges. However, the appeal of high yields should be weighed against the liquidity constraints inherent in a market with only 29 trading pairs. Low liquidity can amplify slippage, meaning that even modest trades might see execution at unfavorable prices. Moreover, the exchange’s expert rating of 3/10 on CoinGecko signals underlying issues that deserve scrutiny. Regulatory oversight limited to Lithuania may not provide the same consumer protections found in jurisdictions like the UK or the US. For European users, the SEPA Instant integration is a practical advantage, enabling quick fiat deposits and withdrawals. The crypto debit card, with its €15,000 daily limit and low fees, is competitive compared to Visa‑based cards on other platforms. Yet the absence of an iOS app excludes a sizable portion of mobile users, forcing them onto the web interface or Android app. From a security standpoint, two‑factor authentication and a bug bounty program are positive signs, but the thin public documentation leaves a knowledge gap. Users with substantial holdings should consider moving assets to a hardware wallet after trading to mitigate custodial risk. The futures offering of up to 100× leverage matches industry leaders, but the shallower order book heightens the risk of liquidation during volatile moves. If you’re a passive investor focused on staking, the higher APR may outweigh the drawbacks, provided you keep most of your capital on the platform only for the staking period. Active traders, however, will likely miss the deeper markets and broader pair selection found on Binance or Coinbase. In practice, many users report satisfactory live‑chat support, which can help resolve minor issues promptly. Withdrawal delays have been noted, especially outside EU banking hours, so plan your cash‑out schedule accordingly. Ultimately, the decision hinges on whether you prioritize high staking returns and a low‑fee card over deep liquidity and regulatory robustness.

Karl Livingston

October 23, 2024 AT 03:48The leverage options feel like a roller‑coaster for risk lovers – 100× can turn a tiny sip of capital into a tidal wave of profit or loss, and with the order book being a bit thin, you might find yourself caught in a slippage vortex that eats your margin in seconds.

Kyle Hidding

October 24, 2024 AT 21:28From a systemic risk perspective, the platform's low asset diversification index (29 pairs) combined with sub‑optimal market depth creates an exposure vector that is mathematically non‑optimal for high‑frequency arbitrage strategies, thus rendering the APR advantage largely superficial.

Andrea Tan

October 26, 2024 AT 15:08Appreciate the deep dive; I’d add that the card’s 0.15% transaction fee is actually lower than many competitors, making everyday spending more cost‑effective.

Gaurav Gautam

October 28, 2024 AT 07:48True, the leverage can be a double‑edged sword, so I always advise newbies to start below 10× and keep a tight stop‑loss, especially on thin pairs.

Robert Eliason

October 30, 2024 AT 01:28yeah the risk is high but the high apr can make up for it if you only stake and dont trade alot.

Cody Harrington

October 31, 2024 AT 19:08Limited pair selection can stifle portfolio diversification, which is a key factor for risk management.

Chris Hayes

November 2, 2024 AT 12:48Balancing the pros and cons really comes down to your personal trading style and risk tolerance.

Donald Barrett

November 4, 2024 AT 06:28Honestly, anyone who ignores the liquidity nightmare on Tothemoon is just begging for a margin call; the platform’s thin order books are a ticking time bomb for leverage fans.

Angela Yeager

November 6, 2024 AT 00:08For European users, the SEPA Instant feature does streamline fiat on‑ramps, but the overall ecosystem still feels incomplete without a robust mobile app.

vipin kumar

November 7, 2024 AT 17:48It’s suspicious how the exchange touts a “fastest growing” claim while the regulatory footprint remains confined to a small Baltic jurisdiction.

Mark Briggs

November 9, 2024 AT 11:28Looks like hype.

mannu kumar rajpoot

November 11, 2024 AT 05:08Sure, but the lack of transparency makes you wonder who’s really pulling the strings behind the scenes.

Tilly Fluf

November 12, 2024 AT 22:48While the high staking APR is an alluring proposition, prudent investors must also consider the platform’s limited asset coverage and the absence of an iOS application, which may affect accessibility for a segment of the market.

kishan kumar

November 14, 2024 AT 16:28Indeed, the juxtaposition of impressive yield figures with a modest regulatory regime engenders a nuanced risk profile that warrants meticulous due diligence.

Anthony R

November 16, 2024 AT 10:08Therefore, potential users should, without hesitation, evaluate the trade‑off between high returns and regulatory security; the balance is crucial.

victor white

November 18, 2024 AT 03:48The platform’s niche focus might appeal to a specific cohort, yet the broader market demands more comprehensive tools.

Darren R.

November 19, 2024 AT 21:28Wow, the drama of a tiny exchange trying to play with the big boys is something you just can’t ignore-watch them slip!

Hardik Kanzariya

November 21, 2024 AT 15:08Let’s give them a chance to grow; if they improve liquidity and roll out an iOS app, they could become a solid alternative.

Shanthan Jogavajjala

November 23, 2024 AT 08:48Honestly, the whole “low‑fee card” gimmick is just a distraction from the fact that the exchange’s order book is practically empty on most pairs.

Millsaps Delaine

November 25, 2024 AT 02:28The allure of a cheap debit card often masks deeper structural deficiencies that most casual users overlook. When you examine the depth charts for the majority of the 29 available pairs, you’ll notice that even modest volume orders cause noticeable price impact. This thin liquidity is a breeding ground for slippage, especially during periods of heightened market volatility. Moreover, the absence of an iOS app removes an entire swath of potential traders who rely exclusively on Apple devices for their daily trading activities. While the platform does provide a 0.15% transaction fee on card purchases, the savings are quickly eroded if you have to constantly re‑balance due to unexpected price movements. The 21% staking APR, though impressive on paper, is contingent upon keeping assets locked, which may not align with the strategies of more active investors. Security measures such as two‑factor authentication are baseline expectations these days, and the limited public documentation does little to inspire confidence. The regulatory oversight by Lithuania’s FCIS, while providing a legal foothold, does not carry the same clout as comprehensive frameworks found in the UK or US. Users have reported occasional withdrawal delays, an issue that can be particularly problematic for those needing rapid access to fiat. On the upside, the live‑chat support is staffed by real humans, which can be a breath of fresh air compared to the automated bots prevalent on larger exchanges. Nonetheless, the combination of limited pair selection, thin order books, and regulatory modesty creates a risk profile that is not suitable for everyone. If you can tolerate these trade‑offs, the high‑yield staking and low‑fee card might fit a niche strategy. Otherwise, you may be better served by more established platforms with deeper markets. In the end, thorough personal research is indispensable before committing significant capital. The market will reward those who balance ambition with caution.

Jack Fans

November 26, 2024 AT 20:08Sounds good, but watch for the hidden fees; they’ll bite you later, especially if you’re not careful, and remember, the fine print matters, always.