Sakai Vault (SAKAI) is a decentralized exchange (DEX) with a native cryptocurrency token called SAKAI. It promises fast, low-cost trading with AI-powered strategies and zero price impact trades - but the reality is far more complicated. As of late 2025, SAKAI is a low-liquidity, high-risk token with unproven technology and questionable user adoption. If you’re considering buying or using it, you need to understand what’s actually working - and what’s just marketing.

What SAKAI Actually Does

Sakai Vault isn’t just a coin. It’s a platform built to compete with Uniswap and PancakeSwap, offering spot trading, perpetual futures, and AI-driven trading tools. The SAKAI token powers everything: paying fees, staking, and accessing premium features. The project claims its multi-asset pool design eliminates slippage - meaning you can trade large amounts without the price moving against you. That’s a big deal in DeFi, where slippage often eats into profits.

But here’s the catch: no major independent study has verified that claim. Bitget’s August 2025 analysis called the architecture "novel," but admitted there’s no real-world data proving it outperforms Uniswap’s constant product model. Meanwhile, users on Reddit report that even $300 trades cause massive slippage. If the core feature doesn’t work as advertised, the rest doesn’t matter.

Token Supply and Economics

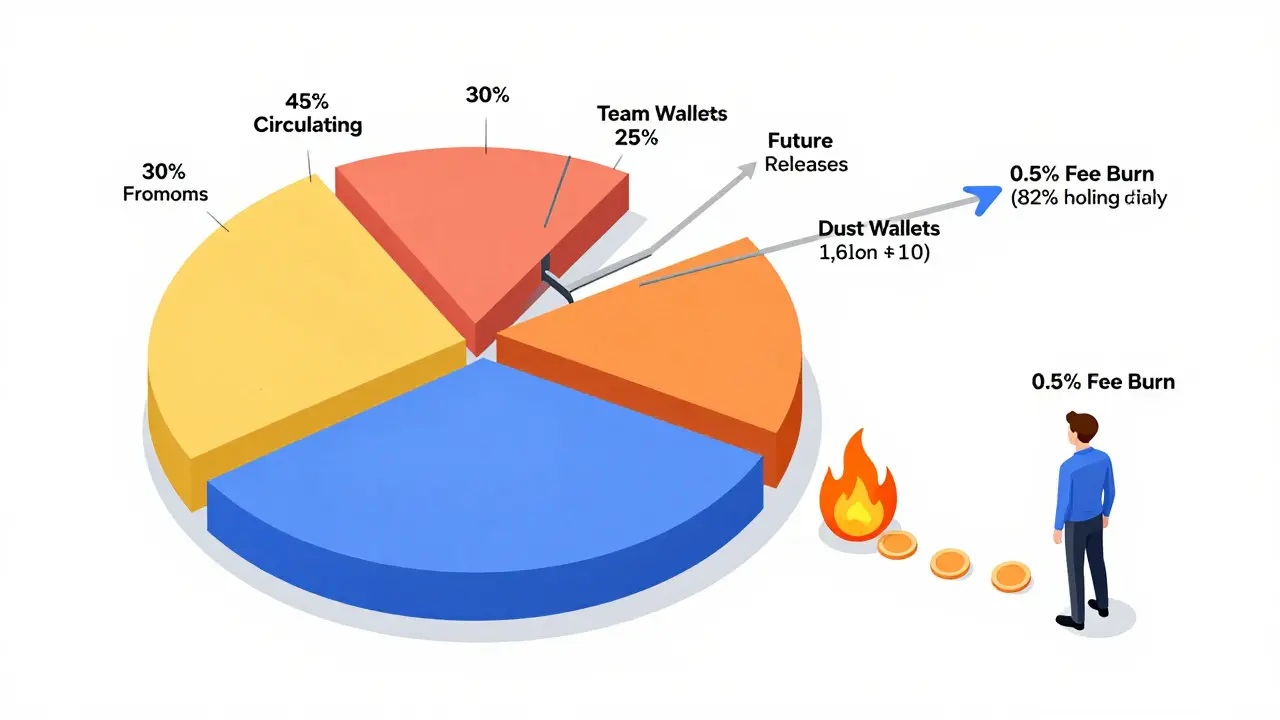

SAKAI has a fixed supply of 8 million tokens. No more can be created. That sounds good - scarcity drives value. But 45% of those tokens (3.6 million) are already in circulation, according to CoinGecko. The rest are locked in team wallets, liquidity pools, or future releases. That’s not unusual, but the real problem is how the token is being burned.

Every time someone trades, 0.5% of the fee is burned. Sounds deflationary, right? But with only $8,800 traded daily, you’re burning about $44 worth of SAKAI per day. At $0.028 per token, that’s less than 1,600 tokens destroyed daily. With over 3.6 million in circulation, that’s a drop in the ocean. Ethereum developer Micah Zoltu called this model "economically unsustainable" - burning tiny amounts in a low-volume ecosystem doesn’t create scarcity. It just wastes gas fees.

Price, Market Cap, and the Data Discrepancy

There’s no consensus on SAKAI’s value. CoinMarketCap says the price is $0.02866, with a market cap of $66,830. CoinGecko says it’s $0.040478 and $145,716. That’s a 118% difference. Why? Because they’re using different circulating supply numbers. CoinMarketCap counts 2.08 million tokens in circulation. CoinGecko counts 3.6 million. Neither is wrong - they just have different criteria for what counts as "circulating."

This isn’t just a data glitch. It’s a red flag. If two major trackers can’t agree on basic numbers, you can’t trust any price you see. TradingView shows a 4.73% drop in 24 hours. That’s normal for small coins - but it’s also a sign of high volatility and low buyer interest.

Where You Can Trade SAKAI

As of November 2025, SAKAI is listed on only three decentralized exchanges. None of the big names - Binance, Coinbase, Kraken - carry it. You can’t buy it with a credit card. You need crypto already, a wallet like MetaMask, and you must manually switch between Ethereum, Binance Smart Chain, and Polygon networks. Most new users spend over 20 minutes just getting set up.

That’s not user-friendly. It’s a barrier. And it explains why daily volume is so low. Uniswap trades over $5 billion per day. SAKAI trades $8,800. That’s 0.00018% of Uniswap’s volume. You can’t trade large amounts without moving the price. If you try to buy $1,000 worth, you’ll likely end up paying $1,200 by the time the trade executes.

The AI Trading Feature - Hype or Reality?

Sakai Vault markets its "AI-powered trading strategies" as a game-changer. But CryptoSlate’s September 2025 review found no machine learning at all. Instead, it’s a basic combo of moving averages and RSI indicators - the same tools you can get for free on TradingView. Users on Trustpilot and Reddit are calling it "non-functional" and "misleading."

One trader wrote: "I paid fees to use the AI bot. It made three trades in two weeks. Two lost. One barely broke even."

There’s no transparency. No backtesting data. No performance metrics. Just a button labeled "Start AI Strategy." That’s not AI. It’s a placebo.

User Experience: Frustration and Confusion

Trustpilot has 17 reviews. Average rating: 2.1 out of 5. The most common complaints? Slippage, broken AI tools, and support that takes 72 hours to reply. CryptoSlate’s usability team gave the documentation a 2.4 out of 5 - and found entire sections marked "Coming Soon."

On Reddit, 68% of 142 threads since January 2025 are complaints about being unable to execute trades. One user posted: "I tried to buy $500 of SAKAI. It took 17 minutes. The price moved 22% while I waited. I lost $110 before the trade even filled."

The Telegram group has 12,450 members. Only 387 are active daily. The Discord server has 8,920 members - but only 42 active in the last week. That’s not a community. That’s a graveyard of early buyers hoping for a rebound.

Who’s Holding SAKAI?

CoinMarketCap says 126,330 wallets hold SAKAI. But Nansen’s blockchain analysis shows 82% of those wallets hold less than $10 worth. That’s "dust" - small amounts bought during presales or giveaways. These aren’t investors. They’re bystanders. The real holders? A few early buyers who bought at $0.00012 and are sitting on 2,300% gains. They’re the only ones making money.

Future Plans - Promises or Pipe Dreams?

The roadmap looks ambitious: v2.0 with a better AI engine by Q1 2026, listing on two Tier-2 centralized exchanges by Q2, and a DAO by Q3. But CoinTelegraph’s November 2025 investigation found only 2 of 7 promised v1.0 features were fully built. That’s a 71% failure rate on deliverables.

The only real hope is a partnership with Ondo Finance, announced in November 2025, to bring institutional liquidity. If that happens, SAKAI could gain traction. But Ondo has no track record of rescuing failed DeFi projects. And even if they do, it’s not guaranteed to work.

Expert Opinions: Is SAKAI a Dead End?

Analysts are split - but leaning heavily negative. CoinGecko’s senior analyst called it "over-engineered" and "unnecessary." The DeFi Research Group gave it top 14 for innovation potential - but only because the concept is interesting, not because it works. Professional analysts surveyed by The Block gave SAKAI a 30% or lower chance of surviving two years.

Even the most optimistic price forecast - from CoinCodex - predicts only a 32% rise to $0.038 by December 2026. That’s barely above inflation. Meanwhile, the broader DeFi sector is projected to grow 150% in the same period.

Should You Buy SAKAI?

If you’re looking for a long-term investment - no. SAKAI has no liquidity, no real adoption, no proven tech, and a team with a poor track record on delivery.

If you’re a speculator with money you can lose - maybe. But only if you treat it like a lottery ticket. Buy small. Set a hard sell limit. Don’t hold it for more than a few weeks. And never invest more than you’re willing to lose completely.

The biggest risk isn’t price collapse. It’s that the platform quietly shuts down. No announcement. No warning. Just a dead website. That’s happened to hundreds of DeFi projects before. SAKAI is one of them waiting to happen.

Final Verdict

Sakai Vault (SAKAI) is not a crypto coin you should hold. It’s a high-risk experiment with no clear path to success. The tech sounds impressive on paper. In practice, it’s slow, confusing, and underperforming. The tokenomics don’t create value. The community is fading. The features don’t work as promised.

If you’re new to crypto, avoid it. If you’re experienced and want to gamble on a long shot, go in with eyes wide open. But don’t expect it to be anything more than a speculative gamble with a 70% chance of ending in total loss.

Is Sakai Vault (SAKAI) a good investment?

No, not as a long-term investment. SAKAI has extremely low liquidity, unverified technology, and poor user adoption. Most analysts believe it has less than a 30% chance of surviving two years. It’s only worth considering for speculative traders who can afford to lose their entire stake.

Can I buy SAKAI on Coinbase or Binance?

No. As of late 2025, SAKAI is not listed on any major centralized exchange. You can only trade it on three small decentralized exchanges, which means you need a crypto wallet like MetaMask and must connect to Ethereum, BSC, or Polygon networks manually.

Why is there such a big difference in SAKAI’s price between CoinMarketCap and CoinGecko?

The difference comes from how each site calculates circulating supply. CoinMarketCap counts 2.08 million tokens in circulation, while CoinGecko counts 3.6 million. Since price is multiplied by circulating supply to get market cap, the numbers diverge. Neither is necessarily wrong - but the inconsistency shows a lack of transparency in reporting.

Does the AI trading feature on Sakai Vault actually work?

No, not as advertised. Independent reviews found it uses basic technical indicators like RSI and moving averages - not machine learning or AI. Users report it makes few trades, often loses money, and provides no performance data. It’s a marketing feature with no real functionality.

What’s the biggest risk of holding SAKAI?

The biggest risk is abandonment. With low volume, few active users, and unfulfilled roadmap promises, the platform could shut down without warning. Many small DeFi projects disappear overnight. If that happens, your SAKAI tokens become worthless.

How much of SAKAI is actually in circulation?

There’s no clear answer. CoinMarketCap says 2.08 million (26% of total supply). CoinGecko says 3.6 million (45%). The total supply is fixed at 8 million. The discrepancy suggests unclear token distribution or inconsistent data collection - a major red flag for any crypto project.

Is SAKAI’s deflationary model effective?

No. Burning 0.5% of every trade fee sounds good, but with only $8,800 traded daily, you’re burning less than $50 worth of SAKAI per day. That’s 1,600 tokens out of 3.6 million. It has zero impact on scarcity. Experts say it’s just wasting gas fees without creating real value.

Why do so many people own SAKAI if it’s so unpopular?

Most holders got SAKAI during the presale or as airdrops. Nansen data shows 82% of wallets hold less than $10. These are "dust" accounts - not serious investors. The real buyers are early adopters who made huge profits and are now holding onto their gains.

Finance

Finance