Traditional Signatures: From Pen to Protocol

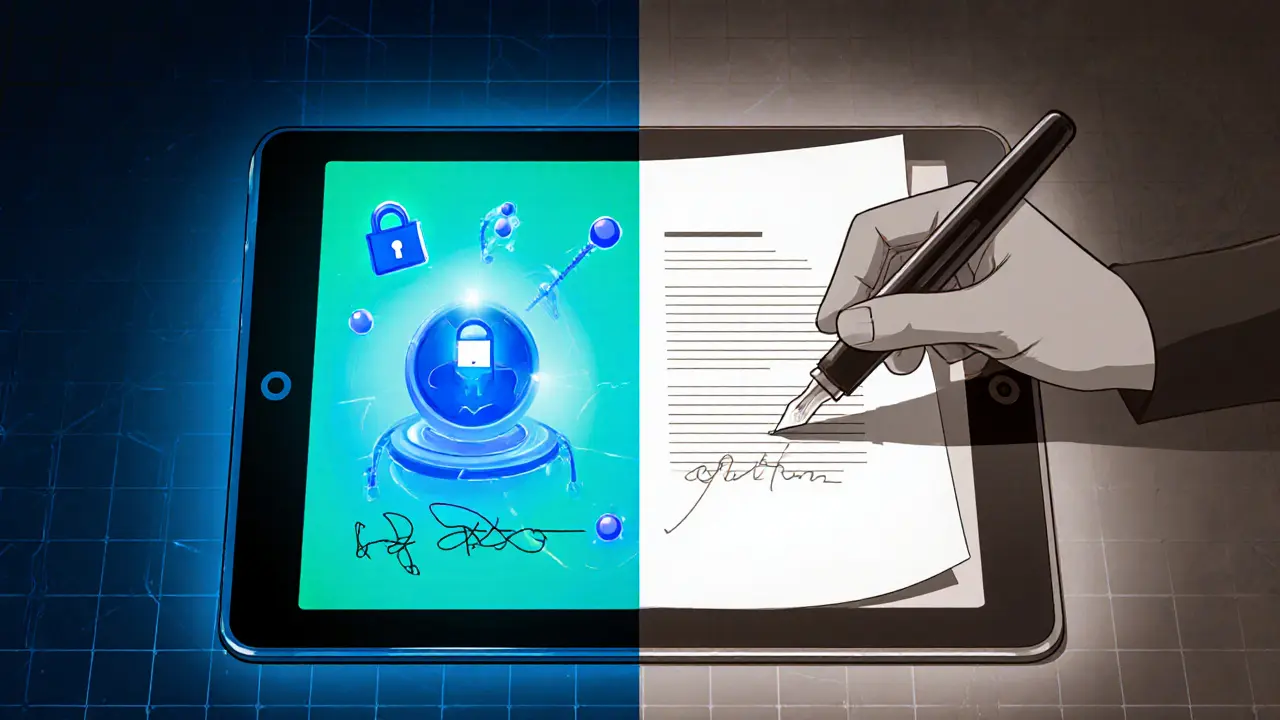

When working with traditional signatures, the handwritten marks that prove a person’s intent on paper. Also known as wet signatures, they have been the cornerstone of contracts, checks, and identity verification for centuries. In the digital age they still set the baseline for what we consider a valid assent, even as crypto projects replace ink with math.

Why signatures matter in crypto

Enter digital signatures, cryptographic proofs that a message came from a specific private key. These signatures borrow the trust model of traditional signatures but add mathematical guarantees. A digital signature requires a hash of the data, turning any document into a fixed‑size fingerprint. That fingerprint, paired with a private key, creates a proof anyone can verify using the public key. This relationship lets blockchain networks confirm transactions without ever seeing the original data, a leap from the physical world’s need for the actual document.

Another key player is the cryptographic hash function, an algorithm that maps data of any length to a unique short string. Hashes are the glue that binds signatures to content. When you sign a token airdrop eligibility list, the hash ensures the list can’t be altered without breaking the signature. This principle underpins many of the airdrop guides in our collection, where users learn to verify holdings before claiming rewards.

For larger data sets, Merkle trees, hash‑based structures that enable efficient verification of individual items within a batch become essential. A Merkle root summarizes thousands of entries, letting a single signature cover the whole batch. If a project announces an airdrop, the Merkle proof lets each participant prove they belong to the list without downloading the entire dataset. This technique mirrors the way traditional signatures once verified a whole contract page by page, but now it happens in milliseconds on chain.

Blockchain security leans on these three pillars: traditional concepts of assent, cryptographic hashes, and Merkle proofs. Together they create a trust chain that replaces paper trails with immutable logs. For traders eyeing new token drops—like the Base Reward Token or GoldMiner airdrops—understanding how signatures verify eligibility can prevent scams and save money. The same logic applies to exchange reviews, where platform security hinges on how well they implement signature verification for deposits and withdrawals.

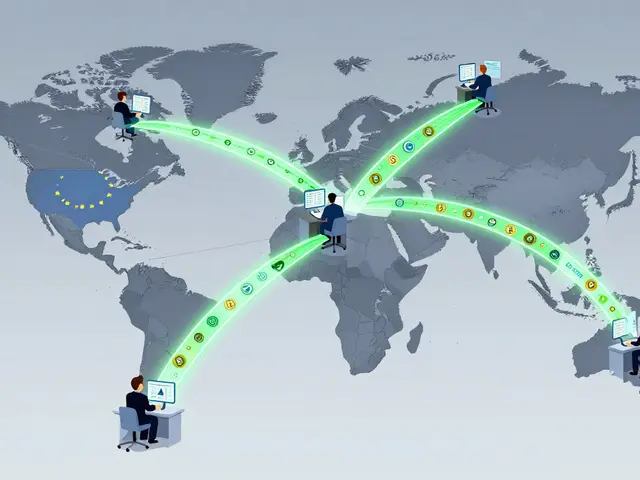

Regulatory articles in our feed, such as the China crypto ban or India’s 30% tax, often mention compliance checks based on digital signatures. Authorities require firms to prove the authenticity of transaction records, and they do it using the same cryptographic signatures that power DeFi protocols. So whether you’re reading about Malta’s blockchain strategy or Taiwan’s banking restrictions, the underlying theme is the shift from handwritten proof to cryptographic assurance.

Below you’ll find a curated list of posts that dive deeper into each of these areas—airdrop qualification guides, exchange security reviews, and regulatory breakdowns—all tied together by the role signatures play in today’s crypto ecosystem. Explore how the old world of ink meets the new world of code, and pick up practical tips to protect your assets.

Explore how digital signatures outshine handwritten ones in crypto. Learn about ECDSA, Schnorr, BLS, security benefits, and real‑world blockchain use cases.

Categories

Archives

Recent-posts

Automatic Exchange of Crypto Tax Information Between Countries: What You Need to Know in 2026

Jan, 2 2026

Finance

Finance