Cryptocurrency Mining Pakistan

When talking about cryptocurrency mining in Pakistan, the process of using computer hardware to validate blockchain transactions and earn crypto rewards within Pakistan's borders. Also known as crypto mining PK, it blends cutting‑edge tech with local market quirks. The activity hinges on three big ideas: the need for energy‑intensive Proof of Work, the selection of efficient mining hardware, and the impact of the country's regulatory environment, which can make or break a venture. Understanding how these pieces fit together helps anyone decide if they should start a rig, join a pool, or stay on the sidelines.

Key Factors Shaping Mining in Pakistan

The Proof of Work, the consensus method behind Bitcoin and many altcoins, requires miners to solve complex math puzzles. This method drives electricity consumption, so the next factor, electricity costs, becomes a decisive metric. Pakistan's grid rates vary widely by province and time‑of‑day, meaning a miner must calculate the cost‑per‑hash before buying equipment. Speaking of equipment, mining hardware ranges from consumer‑grade GPUs to industrial ASICs. Each offers a different hash‑rate‑to‑power‑ratio, and the choice often balances upfront expense against long‑term profitability. Finally, the regulatory environment in Pakistan is evolving; the government has hinted at tax frameworks for mining revenues and occasional restrictions on high‑energy activities. These rules shape where miners set up farms—some prefer remote locations with cheaper power, while others join centralized pools to spread risk. Together, these elements create a chain of cause and effect: Proof of Work pushes hardware demand, hardware choice influences electricity usage, and electricity costs intersect with regulations to determine overall returns.

For anyone eyeing a foothold, the practical steps start with a clear profit model. Begin by estimating daily earnings using a mining calculator, inputting your chosen hardware’s hash rate, local electricity price, and the current network difficulty. Next, factor in any applicable taxes or licensing fees dictated by the regulatory environment. If the numbers stay positive, consider scaling up or joining a local pool to smooth earnings. Keep an eye on policy updates—Pakistan’s stance on crypto can shift, and staying compliant protects you from sudden fines. Below you’ll find a curated set of articles that walk through everything from hardware reviews and cost‑analysis worksheets to the latest legal notices and community tips. Dive into the collection to sharpen your strategy, avoid common pitfalls, and make the most of cryptocurrency mining in Pakistan.

Pakistan’s 2,000MW power grant for crypto mining aims to turn idle electricity into billions, boost jobs, and attract global miners while navigating IMF concerns and grid challenges.

Categories

Archives

Recent-posts

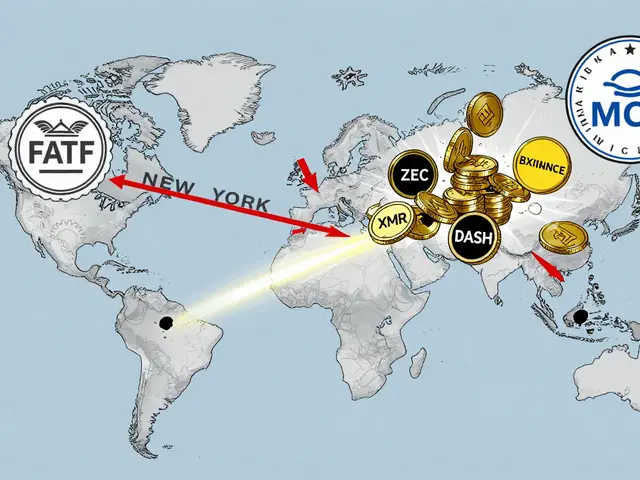

Privacy Coin Delisting Wave from Crypto Exchanges: Why Major Platforms Are Dropping XMR, ZEC, and DASH

Dec, 4 2025

Finance

Finance