Privacy Coin Price Impact Calculator

How Delistings Affect Privacy Coin Prices

Based on the 2025 delisting wave, privacy coins saw a 71.6% price surge despite removal from major exchanges. This calculator estimates the potential impact on prices based on supply and demand dynamics.

Why privacy coins are disappearing from crypto exchanges

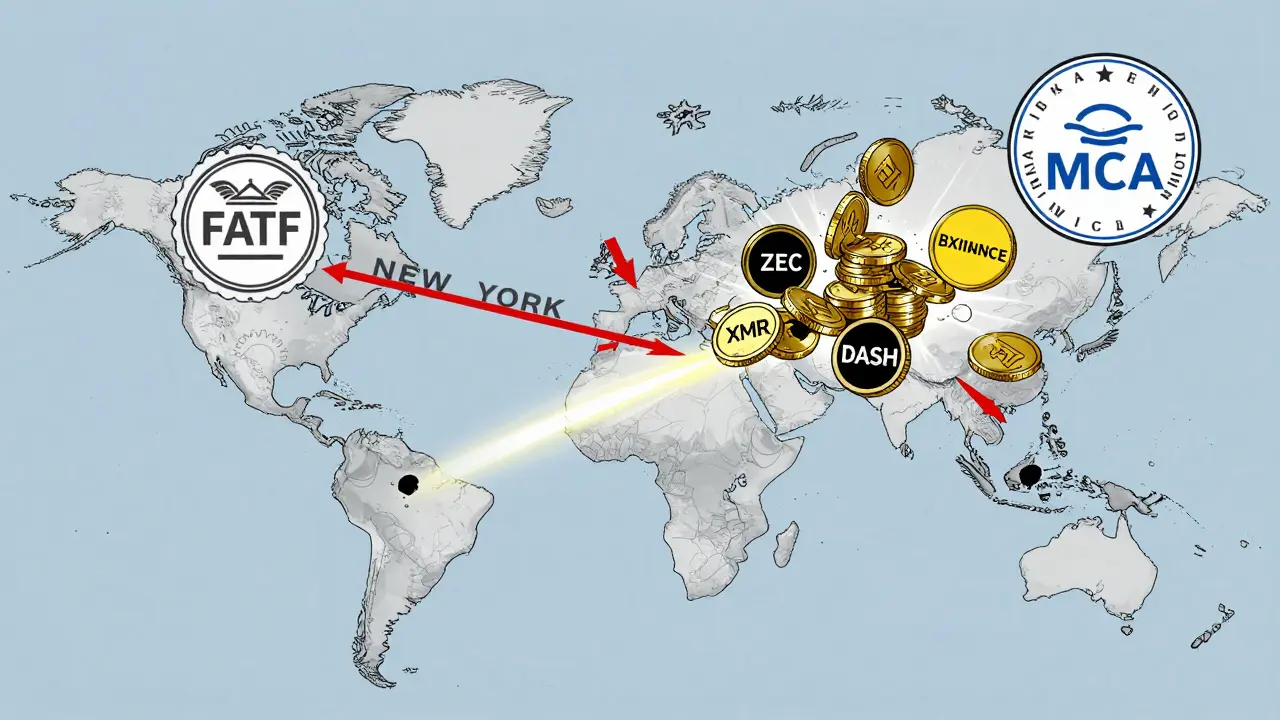

Back in 2023, you could still trade Monero, Zcash, and Dash on most major crypto exchanges. Today? Not so much. By early 2025, 73 exchanges worldwide had removed privacy coins from their platforms - up from just 51 in 2023. That’s not a random cleanup. It’s a coordinated global retreat, driven by regulators who say these coins make it too easy to hide illegal money. And the exchanges? They’re choosing compliance over convenience.

Monero (XMR), Zcash (ZEC), and Dash (DASH) aren’t just obscure altcoins. Together, they handled over $250 billion in transactions in 2025. That’s 11.4% of all crypto activity. But here’s the problem: unlike Bitcoin or Ethereum, where every transaction is visible on a public ledger, privacy coins are designed to hide who sent what, to whom, and how much. That’s not a bug - it’s the whole point. But regulators see it as a red flag.

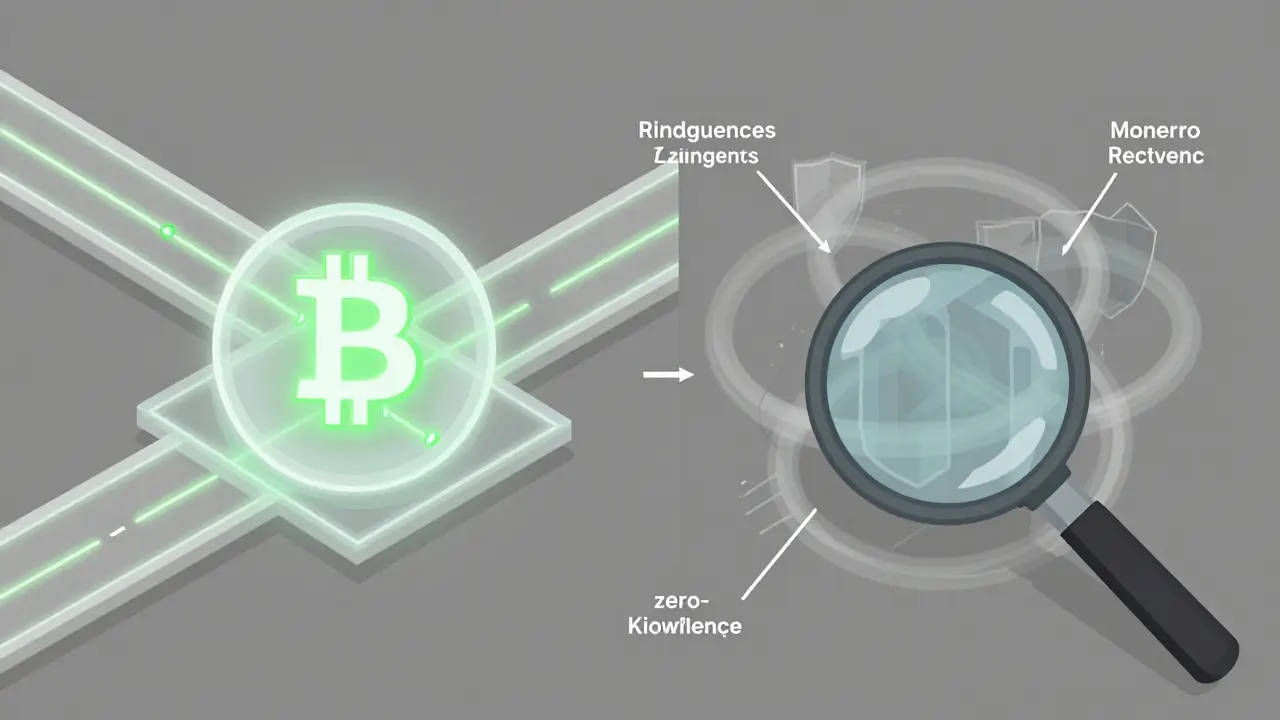

How privacy coins work - and why regulators hate them

Monero uses ring signatures, which mix your transaction with dozens of others, making it nearly impossible to trace the real sender. Zcash uses zero-knowledge proofs - a fancy term for proving a transaction is valid without showing any details. Dash has stealth addresses that generate a new one for every payment, so you can’t track who’s receiving funds. These aren’t theoretical features. They’re built into the code, and they work.

Compare that to Bitcoin. On Bitcoin, you can type any wallet address into a block explorer and see every single transaction ever made to or from it. That’s transparency. Privacy coins are the opposite. They’re the digital equivalent of cash in an envelope - no sender, no receiver, no paper trail.

The Financial Action Task Force (FATF), the global watchdog for money laundering, didn’t just warn exchanges about privacy coins in 2025 - they demanded action. Their updated Travel Rule now requires exchanges to collect and share customer data for transactions above $1,000. But privacy coins can’t do that. Their design makes it technically impossible. So exchanges had a choice: break the rules or drop the coins.

Who pulled the plug - and when

The biggest exchange in the world, Binance, announced in February 2025 that it was removing Monero, Zcash, and Dash from its European and U.S. platforms. That alone wiped out an estimated $600 million in monthly trading volume. Kraken followed in March, pulling privacy coins from its Canadian service because they couldn’t meet FINTRAC’s new reporting rules. In Japan, every licensed exchange stopped offering privacy coins - a ban that’s been in place since 2018, but got even stricter in 2025.

South Korea’s top five exchanges - including Upbit and Bithumb - removed six privacy coins by September 2025. Upbit gave users a 20-day notice, citing FATF guidelines directly. OKEx Korea did the same, cutting off five privacy coins by October 10. These weren’t isolated moves. They were part of a global pattern.

The European Union’s MiCA regulation, which came into full effect in 2025, forced exchanges to make all transaction data transparent. Privacy coins couldn’t comply. As a result, EU-based exchanges dropped them. And in July 2027, the EU plans to ban anonymous crypto accounts entirely - meaning even if you hold privacy coins, you won’t be able to trade them on regulated platforms.

What happened to the price? It went up

Here’s the twist: even as exchanges dumped privacy coins, their prices surged. In 2025, Monero, Zcash, and Dash collectively gained 71.6% - outperforming Bitcoin. Why? Because supply dropped. With fewer places to trade them, the coins that remained in circulation became scarcer. People who still believed in privacy weren’t selling. They were holding.

But not all privacy coins rose. Zcash saw an 8% drop in shielded transactions - the kind that hide details - because stricter KYC rules made users nervous. Some stopped using them altogether. Others moved to decentralized platforms where no one asks for ID.

Where can you still trade privacy coins?

If you’re looking to buy Monero or Zcash now, you won’t find them on Binance, Kraken, or Coinbase. But you can still trade them - just not where the mainstream crowd goes.

Peer-to-peer platforms like LocalMonero saw a 19% spike in activity after the delistings. Users are now trading directly with each other, using cash, bank transfers, or even gift cards. Decentralized exchanges (DEXs) like Uniswap and PancakeSwap still list privacy coins, but they don’t require KYC. That’s a double-edged sword: no identity checks mean more privacy, but also more risk. No one’s there to help if you get scammed.

Some countries still allow privacy coins under strict rules. Switzerland and Liechtenstein let exchanges offer them if they follow tight KYC and AML checks. Singapore allows them too, but with heavy monitoring. Dubai banned them in 2023. Australia restricts access. Japan and South Korea? Completely out.

The debate: security vs. freedom

Some experts say removing privacy coins is necessary. Australia’s IDAX found that 78% of its institutional clients supported the delistings because they wanted to avoid legal trouble. Banks and hedge funds don’t want to be flagged for handling “dirty” crypto. For them, compliance is cheaper than fines.

But privacy advocates argue this is a betrayal of crypto’s original promise. Monero wasn’t created to help drug dealers - it was built to protect journalists in authoritarian regimes, small businesses hiding supplier deals, and people in countries with hyperinflation who need to store value without government oversight. When exchanges remove these coins, they’re not just following rules - they’re choosing a side.

And the irony? The more exchanges ban privacy coins, the more they’re pushed into unregulated corners. That’s exactly what regulators say they want to avoid. But without legal pathways, users have no choice but to go underground.

What’s next for privacy coins?

Developers aren’t giving up. There’s a new wave of research focused on “compliant privacy.” Imagine a privacy coin that hides transaction details - but can reveal them to regulators under court order. That’s the holy grail. Some teams are working on zero-knowledge proofs that can prove a transaction is legal without showing the amount or parties involved. Think of it like a sealed envelope that only a judge can open.

74% of privacy coin developers say FATF rules are their biggest hurdle. But if they can build a version that satisfies regulators without sacrificing core privacy, they might get back on exchanges. Until then, the split grows wider: one world of regulated, traceable crypto - and another, quieter world where privacy still matters.

What this means for you

If you own privacy coins, you’re not stuck. But you need to adapt. Stop relying on centralized exchanges. Learn how to use a non-custodial wallet like Monero’s official GUI or Zcash’s zecwallet. Explore peer-to-peer trading. Understand atomic swaps - technology that lets you exchange coins directly without an intermediary.

If you’re new to crypto and care about privacy, know this: the days of buying Monero on Coinbase are over. The future of privacy crypto is decentralized. And that’s not necessarily bad - just different. The same tools that make privacy coins hard for regulators to control also make them harder for exchanges to manage. That’s the trade-off.

The delisting wave isn’t the end of privacy coins. It’s a turning point. The question now isn’t whether privacy matters - it’s whether the system can find a way to protect it without breaking the rules.

Why are privacy coins being removed from exchanges?

Privacy coins like Monero and Zcash are being delisted because they make it impossible for exchanges to comply with global anti-money laundering rules, especially the FATF’s 2025 Travel Rule. These rules require exchanges to track and report customer data for transactions over $1,000 - something privacy coins’ encryption features prevent by design.

Which privacy coins were most affected by delistings?

Monero (XMR), Zcash (ZEC), and Dash (DASH) were the most widely delisted. These three accounted for over 90% of all privacy coin trading volume before the wave. Other coins like PIVX, Haven (XHV), and BitTube (TUBE) were also removed, but with less market impact.

Can I still buy Monero or Zcash in 2025?

Yes, but not on major centralized exchanges like Binance or Kraken. You can still buy them on peer-to-peer platforms like LocalMonero, decentralized exchanges (DEXs) like Uniswap, or through atomic swaps. These methods don’t require identity verification, but they come with higher risk and less customer support.

Why did privacy coin prices go up even as they were being delisted?

Fewer places to trade means less supply on major platforms. People who still believe in privacy stopped selling and held onto their coins. At the same time, demand didn’t disappear - it just moved to decentralized and peer-to-peer markets. This supply squeeze drove prices up 71.6% in 2025, even as exchanges pulled support.

Is there a future for privacy coins in regulated markets?

The future depends on technology. Developers are working on privacy solutions that can prove a transaction is valid without revealing details - and still allow regulators to access data under legal orders. If they succeed, privacy coins might return to exchanges under strict conditions. If not, they’ll remain in the unregulated shadows.

Finance

Finance

Ankit Varshney

December 5, 2025 AT 19:00Exchanges are scared of fines, but they're ignoring the real threat: a world where your every financial move is tracked, analyzed, and monetized.

Ziv Kruger

December 6, 2025 AT 04:23This isn't progress. It's surrender.

Heather Hartman

December 6, 2025 AT 18:45Catherine Williams

December 7, 2025 AT 22:59When exchanges drop privacy coins, they're choosing corporate safety over human dignity.

Mohamed Haybe

December 9, 2025 AT 13:48Marsha Enright

December 9, 2025 AT 14:04Andrew Brady

December 10, 2025 AT 22:09Sharmishtha Sohoni

December 12, 2025 AT 08:45Althea Gwen

December 14, 2025 AT 05:18Durgesh Mehta

December 15, 2025 AT 16:34Sarah Roberge

December 17, 2025 AT 13:16Jess Bothun-Berg

December 19, 2025 AT 00:02Joe B.

December 20, 2025 AT 00:51Meanwhile, the developers working on compliant ZKPs? They’re getting funded by venture capital firms who are already negotiating with FINCEN. This isn’t a battle between freedom and control. It’s a transition from unregulated chaos to regulated compliance-with a premium on privacy-as-a-service. The next phase isn’t about hiding transactions. It’s about selectively revealing them. And the people who built privacy coins? They’re being bought out. The revolution isn’t coming. It’s being acquired.

Rod Filoteo

December 21, 2025 AT 21:59Layla Hu

December 23, 2025 AT 04:01Nora Colombie

December 25, 2025 AT 03:46Greer Dauphin

December 26, 2025 AT 19:33