Crypto Trading Cardano: How to Trade ADA Wisely and Avoid Common Mistakes

When you trade Cardano, a proof-of-stake blockchain built for scalability and smart contracts. Also known as ADA, it's one of the top crypto assets used for daily trading, DeFi staking, and long-term holding. But trading Cardano isn’t just about buying low and selling high. Most people lose money because they use risky exchanges, ignore liquidity, or chase fake airdrops pretending to be tied to Cardano projects. You need to know what’s real and what’s a trap.

Cardano trading often connects to DeFi platforms, decentralized apps where you can swap tokens, earn yields, or trade derivatives. Also known as DeFi trading, it’s popular on networks like BNB Chain and Solana—but many of these platforms, like Flamingo Finance or THENA FUSION, have low liquidity, unclear tokenomics, or are flagged by big exchanges like Binance. Just because a platform says it supports Cardano doesn’t mean it’s safe. Some even mimic Cardano’s branding to trick users into depositing funds on fake sites. Then there’s the issue of crypto exchanges, platforms where you buy, sell, or store digital assets. Also known as crypto trading platforms, many—like BiKing, CBX, or GCOX—are unregulated, have no insurance, and have been hacked or vanished entirely. These aren’t just risky; they’re dangerous for anyone serious about trading Cardano. You don’t need 60x leverage or a gamified interface to profit. You need a reliable exchange, clear charts, and discipline.

Cardano’s value doesn’t come from hype. It comes from its tech, its community, and how it’s used in real applications. But if you’re trading it on a platform with three trading pairs and no users—like GCOX—or if you’re chasing a fake Cardano airdrop that doesn’t exist, you’re already behind. The posts below show you exactly what went wrong for others: scams disguised as DeFi tools, exchanges that disappeared overnight, and tokens that dropped 99% after a splashy launch. You’ll see how people got burned by unregulated platforms, confused names (like Cronus Finance instead of Crypto.com), and fake rewards. This isn’t theory. It’s what happened. And if you’re trading Cardano, you need to know how to avoid the same fate.

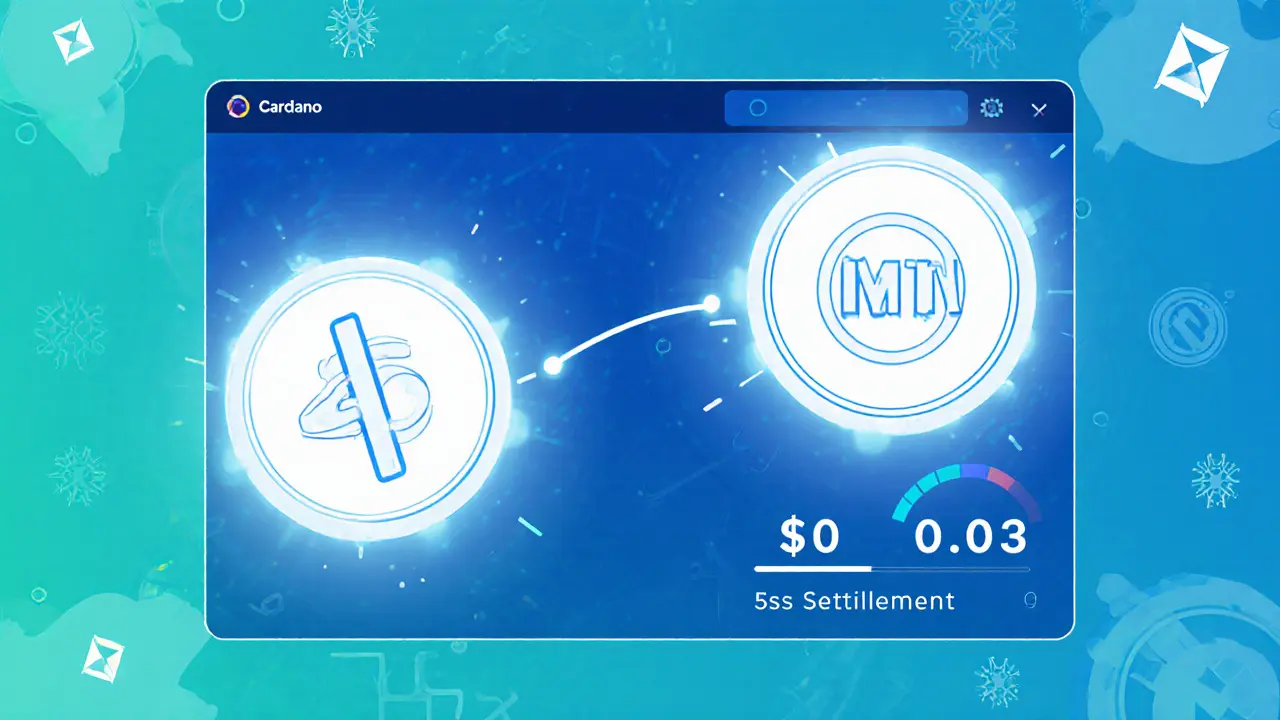

Minswap V2 is the fastest, cheapest DEX on Cardano with near-zero fees, smart routing, and a clean interface. Perfect for traders who want speed and control without the bloat of other platforms.

Finance

Finance