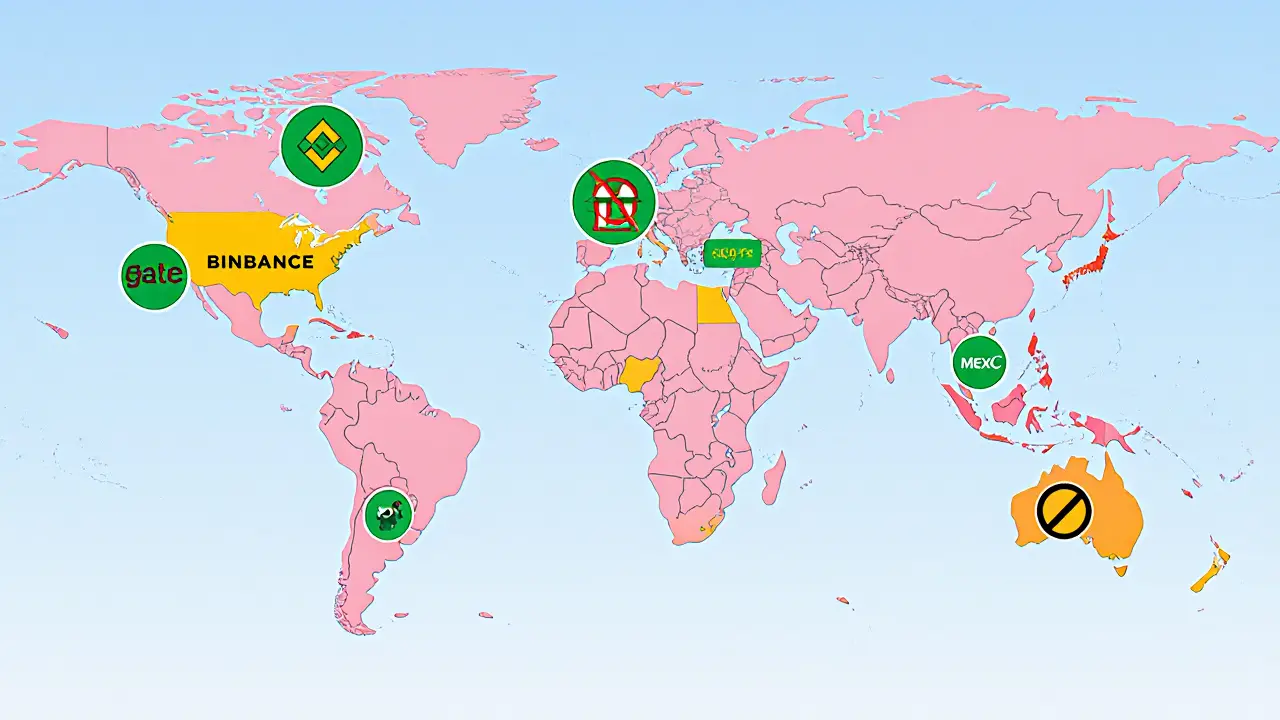

Crypto Exchange Availability

When talking about crypto exchange availability, the range of cryptocurrency platforms you can actually use in a given country or region. Also known as exchange access, it depends on local laws, supported assets and technical compatibility. Understanding this helps you pick a platform that works for you without legal surprises.

One of the biggest drivers behind exchange regulations, government rules that dictate which crypto services may operate locally is compliance. If a regulator bans certain tokens, the exchange either blocks them or shuts down entirely, directly shaping availability. In practice, a trader in India checks the FIU guidelines, while a user in Taiwan looks at FSC licensing requirements. Both scenarios show how regulation influences what you can see on your dashboard.

Fees are another practical filter. exchange fees, the costs attached to deposits, withdrawals, trading and margin use vary wildly – some platforms charge 0.1% per trade, others add hidden network fees. High fees can make an otherwise available exchange feel out of reach, especially for small‑cap traders. By comparing fee structures across OpenSwap, SuperEx and Coinext, you get a clear picture of whether the platform’s cost aligns with your budget.

Security cannot be ignored when assessing availability. exchange security, features like two‑factor authentication, cold storage and audit trails determines if a platform is worth using even if it’s legally accessible. A well‑secured exchange can survive hacks and keep your assets safe, while a lax one might expose you to loss despite being on the regulatory whitelist. Real‑world incidents on WoofSwap and Azurswap illustrate how security status can shift a platform from available to risky overnight.

How Availability Shapes Your Trading Strategy

Availability isn’t just a static list – it shapes the strategies you can employ. If your region only permits spot trading, you’ll miss out on futures or margin products offered elsewhere. Conversely, a jurisdiction that embraces DeFi might let you tap into launchpads like Raydium LaunchLab or Pangea Swap without extra hurdles. Knowing which services are open lets you align your plan with the tools you actually have, whether you’re hunting airdrops, staking rewards, or low‑fee arbitrage.

These dynamics create a web of relationships: crypto exchange availability encompasses the platforms you can log into, exchange regulations influence which platforms stay open, exchange fees affect how often you trade, and exchange security decides whether you trust the platform with large positions. When one piece changes – say a new tax rule in Brazil – the whole availability picture shifts, prompting you to re‑evaluate your choices.

Below you’ll find a curated set of articles that dive deeper into each of these angles. Expect detailed reviews of OpenSwap, SuperEx, and Coinext, breakdowns of regional regulation impacts, fee comparison tables, and security audits. Use them to map out which exchanges fit your needs, stay compliant, keep costs low, and protect your assets as the landscape evolves.

Explore how crypto exchange availability varies worldwide, what regulations shape access, and which platforms serve each region in 2025.

Categories

Archives

Recent-posts

Healthcare Blockchain Implementation Examples: Real-World Use Cases and Lessons Learned

Jan, 14 2026

Finance

Finance