Crypto Exchange Availability Checker

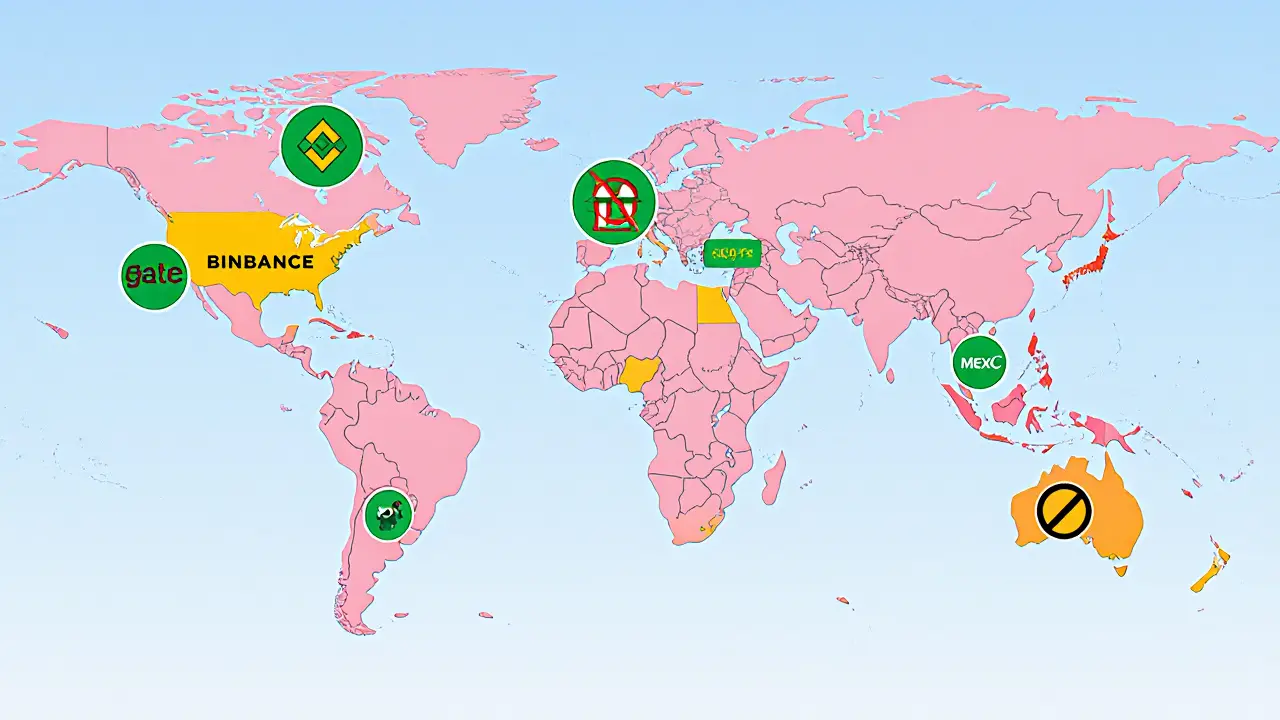

Major Exchanges by Region

Regional Regulatory Status Guide

Cryptocurrency exchange is a platform that lets users buy, sell, and trade digital assets such as Bitcoin and Ethereum. Availability varies wildly across the globe because every country applies its own mix of rules, demand, and tech infrastructure. In 2025 the market is worth $48.41billion and is expected to hit $122.63billion by 2032, but that growth won’t be even. Below you’ll find the biggest drivers, the leading players and a quick reference to where you can actually trade today.

TL;DR - Key Points at a Glance

- Binance holds ~38% of global market share but is barred from most U.S. states.

- Gate.io, Bitget and MEXC fill gaps left by regulatory pressure on larger players.

- Eastern Europe (Ukraine, Moldova, Georgia) shows the highest adoption scores, driving strong local exchange ecosystems.

- Clear, supportive regulation = more exchanges; hostile rules = exits or limited services.

- Spot trading dominates (≈61% of volume) and is the most widely available product type.

Market Landscape in 2025

The global exchange market is dominated by a handful of centralized platforms. Binance processes about $23.97billion in 24‑hour trading volume, giving it a 38% share. Gate.io ranks second with a 9% share and $113.7billion spot volume. Bitget follows at 7.2%, while MEXC holds 8.6%.

The top‑10 exchanges together command roughly 46% of global volume, leaving the rest to a mix of regional specialists and emerging DeFi platforms. Spot trading still accounts for the lion’s share of activity - about 61.3% - because it’s simple, liquid and regulator‑friendly.

How Regulation Shapes Availability

Regulatory frameworks are the single biggest factor that determines whether an exchange can operate in a given jurisdiction.

- United States: A patchwork of SEC, CFTC, FinCEN and state‑level rules means most major exchanges create separate entities (e.g., Binance.US) or withdraw entirely. Binance’s $4billion settlement in 2023 forced a phased exit from the U.S. market.

- European Union: MiCA (Markets in Crypto‑Assets) is still rolling out, but most EU states allow full‑service exchanges with KYC/AML checks.

- Asia: HongKong, Singapore and SouthKorea have clear licensing pathways, attracting both global and local platforms.

- Emerging economies: Countries like Yemen, Venezuela and Jordan see high adoption because traditional banking is weak, yet many lack formal crypto regulations, creating a gray‑area market.

Where regulators are transparent and supportive, you’ll see multiple exchanges competing for users. Where rules are vague or hostile, you often get a single local player or a complete withdrawal.

Top Exchanges and Their Regional Footprint

| Exchange | Global Market Share | Primary Regions Served | Regulatory Status |

|---|---|---|---|

| Binance | 38% | Europe, Asia, Latin America, Middle East (excludes U.S.) | Operates local entities (e.g., Binance.US, Binance.TR) to meet jurisdictional rules |

| Gate.io | 9% | Eastern Europe, Southeast Asia, Africa | Registered in the Cayman Islands; complies with KYC/AML in most served countries |

| Bitget | 7.2% | SouthAmerica, SouthEast Asia, Middle East | Licensed in Singapore and Malta, uses local subsidiaries where required |

| MEXC | 8.6% | Asia‑Pacific, Africa | Operates under a HongKong licence; limited access in U.S. and Europe |

| Koinbay | ~2% | Europe (UK, Germany, France) | Fully FCA‑registered in the UK, compliant with EU MiCA draft |

Notice how each platform splits its services across different legal entities. That split is a direct response to the regulatory environment in each region.

Regional Adoption Hotspots

The 2025 Global Crypto Adoption Index puts three Eastern European nations at the top: Ukraine, Moldova and Georgia. High retail demand there pushes local exchanges to offer a full suite of spot pairs, fiat on‑ramps and even emerging DeFi bridges.

In Asia, HongKong SAR ranks fifth and Singapore sits at fifteenth. Both cities have clear licensing pathways, so you’ll find a dense cluster of both global and home‑grown platforms.

Countries with economic instability - Yemen (12th), Jordan (4th) and Venezuela (9th) - also rank high. Users in these markets gravitate to crypto as a hedge, but many rely on peer‑to‑peer (P2P) services when formal exchanges are blocked.

Decentralized Finance (DeFi) and Its Regional Impact

DeFi platforms sidestep many regulatory hurdles because they operate on‑chain without a central entity. However, they still face regional restrictions: some nations block access to known DeFi bridges or require users to pass KYC on third‑party aggregators.

Even so, DeFi’s growth is nudging traditional exchanges to add features like liquidity mining, staking and cross‑chain swaps - especially in regions where regulators are still catching up.

Future Outlook - What to Expect by 2030

Projected market size of $122.63billion by 2032 suggests continued expansion, but the geography of that growth will be shaped by three trends:

- Regulatory convergence: Nations that publish clear crypto‑friendly frameworks (e.g., Singapore, EU members adopting MiCA) will attract more exchange licences and thus more user choice.

- Infrastructure upgrades: 5G rollout and improved internet access in Africa and Latin America will lower barriers for mobile‑first exchanges.

- Institutional entry: As banks and asset managers gain crypto licences, we’ll see hybrid platforms that blend traditional finance compliance with exchange liquidity, often starting in well‑regulated hubs.

For traders, the practical takeaway is simple: check the regulatory status of the exchange in your country before depositing large amounts. A platform that’s fully licensed in your jurisdiction offers better consumer protections and typically smoother fiat on‑ramps.

Quick Checklist - Is an Exchange Available in Your Region?

- Verify the exchange’s local licence (e.g., FCA in the UK, MAS in Singapore).

- Confirm KYC/AML requirements match your country’s data‑privacy laws.

- Look for dedicated regional domains (e.g., binance.com/tr for Turkey).

- Check if the exchange offers a fiat gateway for your currency.

- Read recent news for any regulatory actions that might affect service continuity.

Frequently Asked Questions

Which crypto exchange has the widest global coverage?

Binance holds the largest market share and operates the most regional subsidiaries (e.g., Binance.US, Binance.TR, Binance.KR), giving it the broadest de‑facto coverage, though it is restricted in the United States.

Can I trade on a global exchange if I live in a regulatory gray area?

Often you’ll need to use a local P2P service or a regional exchange that has adapted to the gray‑area rules. Many major platforms block IPs from high‑risk jurisdictions.

Is spot trading really available everywhere?

Spot trading is the most universally permitted product because it involves direct asset exchange without leveraged contracts. However, some countries still restrict even spot purchases of certain tokens.

How do regulatory changes affect exchange fees?

When an exchange must implement stricter AML/KYC processes or obtain additional licences, operational costs rise and fees may increase. Conversely, competition in a friendly jurisdiction can drive fees down.

What’s the best way to stay updated on regional exchange availability?

Follow official exchange blogs, regulator press releases, and reputable crypto news sites. Signing up for email alerts from the exchange’s compliance team also helps.

Understanding where exchanges can legally operate is just as important as knowing which coins are hot. By keeping an eye on regulatory trends and the regional strengths of each platform, you’ll be able to trade safely and take advantage of the market’s rapid growth.

Finance

Finance

Christina Norberto

July 26, 2025 AT 12:29In light of the data presented, one must acknowledge that the apparent proliferation of exchange services is nothing more than a veneer orchestrated by shadowy conglomerates to entrench financial control. The regulatory frameworks cited appear deliberately ambiguous, serving as a smokescreen for covert manipulation. Moreover, the selective licensing highlighted suggests a concerted effort to funnel liquidity toward entities amenable to undisclosed governance structures. Consequently, any superficial optimism regarding market accessibility is fundamentally misplaced.

Fiona Chow

August 8, 2025 AT 14:29Wow, a nifty interactive map that tells you which exchange you can use – because we’ve all been living under a rock and had no clue. Sure, the TL;DR sums it up nicely, but who needs actual deep analysis when you have such a glossy overview? Still, I guess it’s handy for the “I just want to know if I can buy Bitcoin today” crowd.

Rebecca Stowe

August 21, 2025 AT 16:29Great job compiling all this regional info – makes navigating the crypto jungle a lot less scary. Keep the updates coming, the community really appreciates it!

Aditya Raj Gontia

September 3, 2025 AT 18:29Liquidity fragmentation across jurisdictions is a classic case of market inefficiency with suboptimal order routing.

Kailey Shelton

September 16, 2025 AT 20:29Seems like another data dump that could have been a quick table.

Angela Yeager

September 29, 2025 AT 22:29For anyone unsure where to start, check the exchange’s local licensing details – for example, Binance operates under separate entities in the EU, Singapore, and the UAE to comply with respective regulations. Also, verify that the platform supports fiat on‑ramps for your currency, as many restrict deposits to crypto only. Remember to review the KYC/AML procedures; a thorough process often indicates stronger consumer protection. If you’re in the U.S., Coinbase and Kraken remain the primary fully licensed options. Lastly, keep an eye on regulator announcements, as policy shifts can affect service continuity overnight.

Lara Cocchetti

October 13, 2025 AT 00:29Undoubtedly, the so‑called “regulatory convergence” is nothing more than a coordinated narrative pushed by global banking elites to maintain their monopoly over monetary sovereignty. The selective promotion of “crypto‑friendly” jurisdictions masks hidden clauses that funnel user data to surveillance networks. One should remain skeptical of any exchange touting “full compliance” without disclosing its ultimate corporate beneficiaries.

kishan kumar

October 26, 2025 AT 02:29When contemplating the geographic dispersion of cryptocurrency exchanges, one is reminded of the ancient philosophical discourse on the nature of freedom versus restraint. The modern financial landscape mirrors this dichotomy, wherein regulatory bodies oscillate between safeguarding investors and stifling innovation. It is evident that jurisdictions with transparent legal frameworks foster a fertile environment for exchange proliferation. Conversely, opaque or hostile regimes engender clandestine operations that evade oversight. The data presented illustrates this bifurcation with striking clarity, particularly in the contrast between the European Union’s MiCA rollout and the United States’ fragmented state‑level approach. Moreover, the emergence of regional specialists in Eastern Europe underscores the adaptive capacity of markets to fill regulatory vacuums. This phenomenon can be interpreted through the lens of economic determinism, wherein supply responds to demand irrespective of legislative constraints. Yet, one must also consider the ethical implications of operating in gray‑area jurisdictions, where consumer protections are minimal. The proliferation of DeFi platforms further complicates the regulatory calculus, as they bypass traditional custodial models. Nonetheless, traditional exchanges are responding by integrating DeFi‑like features to retain relevance. The iterative feedback loop between regulation and market innovation suggests a dynamic equilibrium rather than a static hierarchy. From a philosophical standpoint, this equilibrium reflects a broader human tension between order and chaos. In practical terms, traders should therefore cultivate a nuanced understanding of both legal obligations and market opportunities. Ultimately, the intersection of law, technology, and human behavior will continue to sculpt the contours of crypto exchange availability for years to come.

Anthony R

November 8, 2025 AT 03:29Indeed, the landscape, as illustrated, presents a myriad of considerations-regulatory compliance, market liquidity, user security, and technological infrastructure-all of which demand meticulous scrutiny, especially for newcomers navigating these turbulent waters.

Vaishnavi Singh

November 21, 2025 AT 05:29The regional adoption indices reveal a fascinating correlation between economic instability and crypto uptake. This suggests that users in volatile economies perceive digital assets as a hedge against conventional financial systems. Observing these trends can inform prudent investment strategies.

Linda Welch

December 4, 2025 AT 07:29It is absolutely astounding that the same exchanges that brag about global dominance and champion financial freedom are silently bowing to the whims of a select few powerful nations that dictate terms impose sanctions and manipulate market access while the average trader is left scrambling to decipher cryptic notices navigate ever‑changing compliance requirements and wonder why their favorite platform suddenly disappears from their country without warning which in my humble opinion is nothing short of a betrayal of the decentralization ethos that crypto originally promised.

Peter Johansson

December 17, 2025 AT 09:29Keep your eye on the regulatory updates and always double‑check the exchange’s licensing before you commit large sums – it’s the best way to stay safe and confident in your trades 😊. Remember, knowledge is your strongest ally in this evolving market.

Cindy Hernandez

December 30, 2025 AT 11:29If you’re based in a region with limited exchange options, consider using reputable P2P platforms that enforce escrow and identity verification. Additionally, monitor local news for any regulatory changes that could affect service continuity.