Avoid Crypto Exchanges – What You Need to Know

When working with crypto exchanges, online platforms that let users buy, sell, or trade digital assets. Also known as CEXs, they typically require identity verification and hold your funds in a centralized wallet. That central control creates three major vulnerabilities: regulatory crackdowns, steep tax obligations, and exposure to fraudulent airdrops. If you’re looking to keep your portfolio safe, the first step is to understand how these risks stack up and what tools exist to work around them.

Why the Risks Matter and What Else Is Involved

The world of crypto regulation, government rules that dictate how digital assets can be used, traded, or taxed is changing fast. In China, a total ban came into effect in June 2025, shutting down every local exchange overnight. In India, a flat 30% tax on crypto gains forces traders to keep detailed records or risk hefty penalties. These examples show that a single exchange can become a liability if its home jurisdiction tightens rules.

Beyond regulation, crypto tax, the legal duty to report and pay taxes on crypto transactions can erode profits dramatically. Countries like Germany offer a 1‑year holding exemption, while others, such as the United States, treat every trade as a taxable event. Ignoring these nuances often leads to surprise audits and fines that could have been avoided with a more strategic approach.

Then there are the airdrop scams, fraudulent token giveaways that trick users into sharing private keys or signing transactions. Listings on popular exchanges amplify these scams because many users assume the platform has vetted the token. By sidestepping centralized listings, you can verify airdrops directly on‑chain and reduce the chance of handing over control of your wallet.

Fortunately, decentralized exchanges, peer‑to‑peer platforms that operate without a central authority provide a viable alternative. They let you trade straight from your own wallet, keep custody of your keys, and generally face less regulatory pressure. While DEXs aren’t immune to risk—smart‑contract bugs and low liquidity can bite—you gain transparency and often lower fees.

Putting it all together, the equation looks like this: avoiding crypto exchanges reduces exposure to sudden regulatory shutdowns, cuts down on complex tax filing, and limits the attack surface for airdrop scams. At the same time, it pushes you toward tools like DEXs, hardware wallets, and on‑chain analytics that give you full control.

Below you’ll find a curated set of articles that dive deeper into each of these points. From China’s 2025 crypto ban to India’s 30% tax guide, from the Bull Finance airdrop checklist to reviews of OpenSwap and SuperEx, the collection gives you practical steps, real‑world examples, and actionable insights to help you stay ahead without relying on risky centralized platforms.

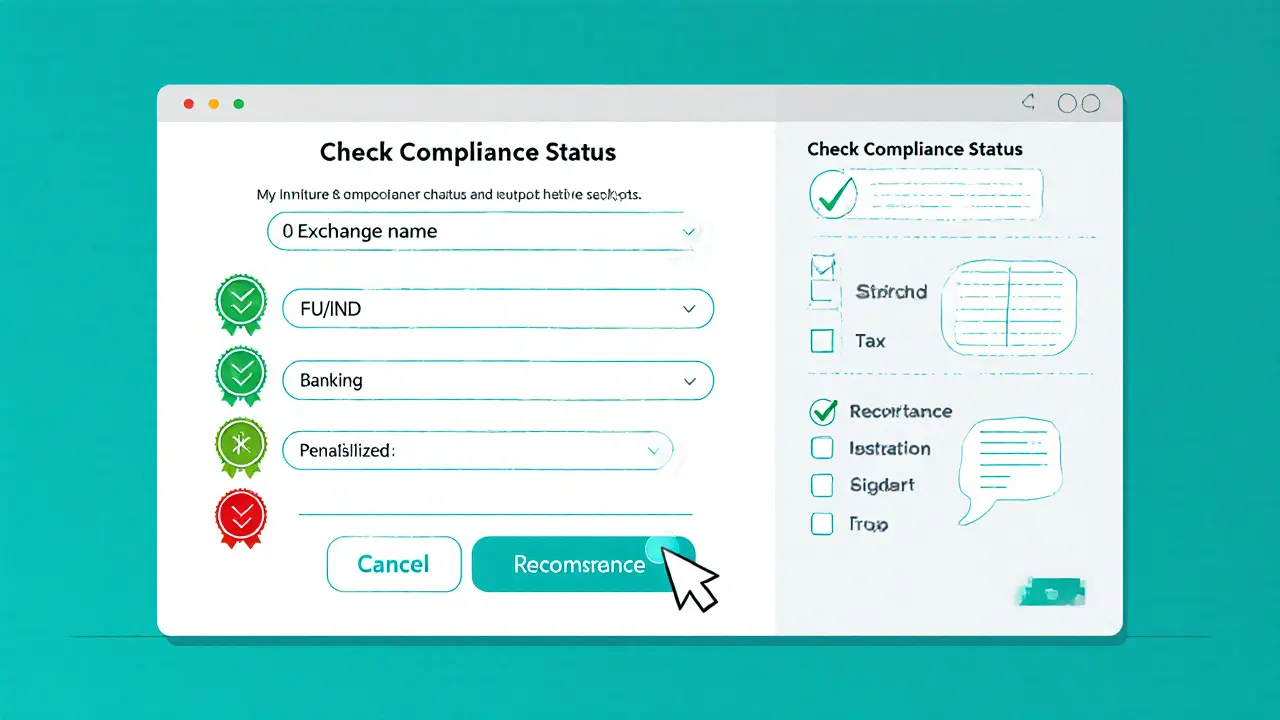

Learn which crypto exchanges Indian traders should avoid in 2025, why compliance matters, and how to pick safe platforms with practical checks and a handy checklist.

Finance

Finance