Fundamental Analysis Score Calculator

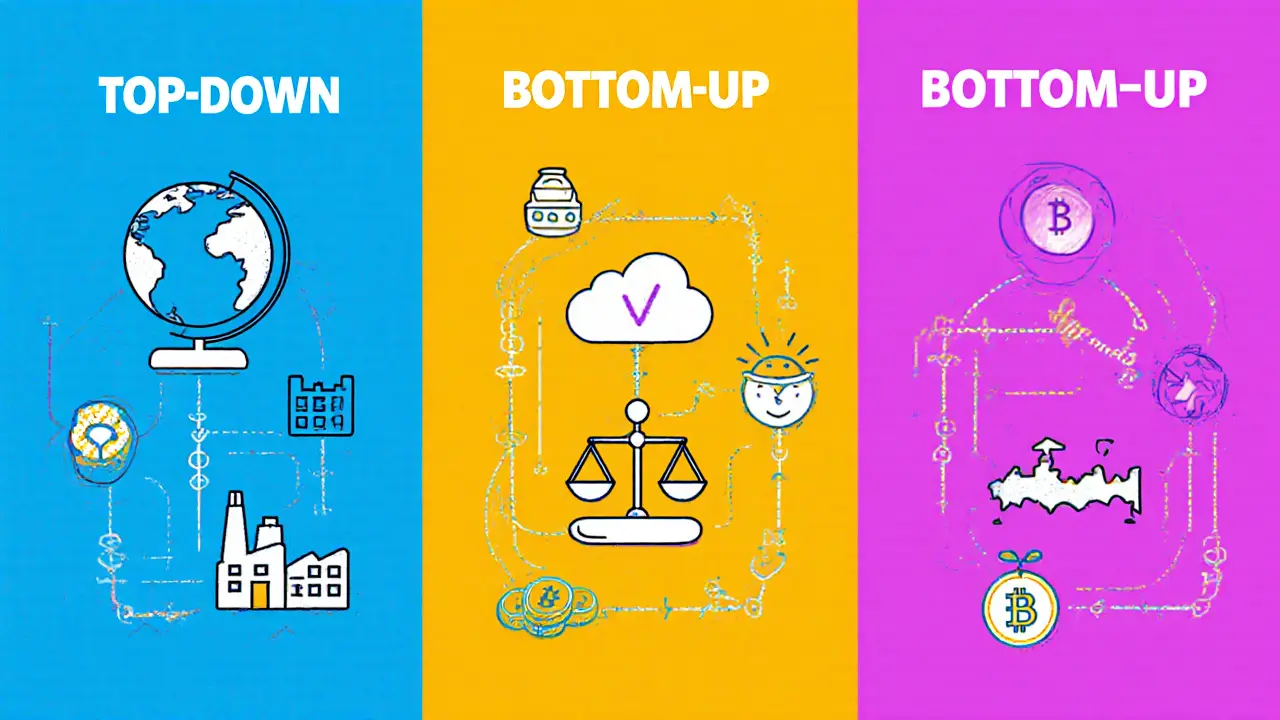

Select Your Investment Framework

Top-Down Analysis

Macro → Industry → Company (40% macro, 30% industry, 30% company)

Bottom-Up Analysis

Company → Industry → Macro (70% company, 15% industry, 15% macro)

Hybrid Framework

Balanced macro/micro view with risk scoring (40% macro, 30% industry, 30% company)

Input Your Analysis Scores

Your Investment Score

Investors chasing blockchain assets often wonder how to cut through hype and spot real value. That’s where Fundamental Analysis Frameworks systematic methods that assess economic, industry and company‑specific factors to estimate intrinsic worth come in. Whether you’re sizing up a Bitcoin‑linked ETF, a DeFi protocol token, or a traditional equity with a blockchain moat, a solid framework keeps emotions in check and decisions data‑driven.

What Makes a Framework "Fundamental"?

At its core, fundamental analysis scrutinises real‑world drivers-revenue streams, profit margins, balance‑sheet health, macro‑economic trends-rather than short‑term price swings. The approach dates back to Benjamin Graham and David Dodd’s 1934 classic Security Analysis, but today it’s been repackaged for everything from blue‑chip stocks to crypto projects.

Three Core Frameworks

Most practitioners split their toolkit into three families, each suited to different investment horizons and risk tolerances.

| Framework | Primary Focus | Typical Weighting | Best For |

|---|---|---|---|

| Top‑down analysis | Macro‑economics → Industry → Company | 40% macro, 30% industry, 30% company | Strategic investors, pension funds |

| Bottom‑up analysis | Company fundamentals first | 70% company, 15% industry, 15% macro | Stock pickers, value investors |

| Hybrid analysis | Balanced macro‑micro view with risk scoring | Variable, often 40/30/30 | Multi‑asset managers, crypto‑equity blends |

Top‑Down Analysis Step‑by‑Step

- Gather macro data: GDP growth, inflation, central‑bank policy. Sources like the Federal Reserve Economic Data (FRED) or the IMF’s World Economic Outlook are reliable starting points.

- Identify sectors that benefit from the macro backdrop. For blockchain, look at fintech, cloud infrastructure, and data‑center services.

- Drill into industry dynamics using Porter’s Five Forces: entry barriers, supplier power, buyer power, threat of substitutes, and competitive rivalry.

- Screen individual companies or tokens that rank high on the macro‑industry matrix.

- Apply valuation tools-Discounted Cash Flow (DCF), Price‑to‑Earnings (P/E), or Network‑Value‑to‑Transactions (NVT) for crypto assets-to estimate intrinsic value.

Example: In 2023, rising interest rates pressured high‑debt crypto lenders. A top‑down screen would have flagged lower‑leverage protocols and shifted capital toward staking platforms with strong on‑chain economics.

Bottom‑Up Analysis Step‑by‑Step

- Start with the company’s (or protocol’s) financial statements. For blockchain firms, pull token‑omics reports, on‑chain metrics, and audited 10‑K filings where available.

- Check revenue consistency: look for quarterly growth rates above the sector median.

- Analyse margins-gross, operating, net. In DeFi, net margin often translates to net fee yield after incentivising liquidity.

- Assess balance‑sheet strength: debt‑to‑equity < 0.5 for traditional firms, or token reserve ratios above 20% for crypto platforms.

- Calculate return metrics: ROE > 15% for equities; for tokens, compare Annualised Yield to risk‑adjusted benchmarks like the Sharpe ratio.

- Cross‑check valuation: run DCF, P/E relative, and for tokens, discounted cash‑flow‑like models such as the Discounted Token‑Cash‑Flow (DTCF).

Case in point: A 2022 Reddit success story showed a user spotting an undervalued REIT by applying a bottom‑up checklist that highlighted a price‑to‑FFO ratio under 10×, generating 35% annual returns.

Hybrid Frameworks: Marrying Macro and Micro

Hybrid models blend the previous two approaches and add a dedicated risk layer. Modern platforms use quantitative scoring: assign 40% of the score to macro variables (GDP growth, inflation expectations), 30% to industry health (market share trends, regulatory outlook), and 30% to company‑level fundamentals.

Emerging tools also embed ESG and AI components. For example, BlackRock’s Aladdin Climate adds carbon‑intensity scores to the macro‑industry‑company matrix, while JPMorgan’s LOXM prototype uses natural‑language processing to read 10‑K narratives 20× faster, surfacing hidden risk factors.

Applying Frameworks to Blockchain Assets

Blockchain introduces quirks that require tweaks:

- Token economics replace traditional cash‑flow statements. Look at token supply schedules, staking rewards, and utility demand.

- On‑chain data (transaction volume, active addresses, hash‑rate) serve as real‑time operational metrics. Tools like Glassnode or Dune Analytics provide the raw numbers.

- Regulatory risk is a macro factor with outsized impact. Tracking EU’s Sustainable Finance Disclosure Regulation (SFDR) or the U.S. SEC’s crypto‑securities guidance is essential.

- Intangible assets dominate: white‑paper credibility, developer community health, and network effects matter more than book value.

When you plug these inputs into a hybrid score, you get a clearer picture of whether a token is truly undervalued or simply riding a hype wave.

Common Pitfalls and How to Avoid Them

- Over‑reliance on a single metric. A low P/E can be a red flag, but without considering growth prospects or macro headwinds you might buy a value trap.

- Ignoring ESG variations. The CFA Institute’s 2022 survey shows 87% of analysts admit ESG can swing valuations. Incorporate ESG scores early in the macro layer.

- Forgetting accounting differences. IFRS vs. GAAP can create 15‑20% valuation gaps. Normalize figures before comparison.

- Late‑stage analysis. Fundamental data lags price. Pair your framework with timing tools-e.g., moving‑average crossovers-to manage entry points.

- Complexity overload. Trustpilot reviews of tools like Simply Wall St reveal a steep learning curve. Start with a 10‑item checklist (debt‑to‑EBITDA < 3×, ROIC > WACC + 3%, etc.) and iterate.

Key Takeaways

- Fundamental analysis remains the backbone of long‑term investing, even for blockchain assets.

- Choose a framework that matches your horizon: top‑down for strategic allocation, bottom‑up for stock‑picking, hybrid for multi‑asset portfolios.

- Adapt traditional metrics to on‑chain data, tokenomics, and regulatory risk.

- Integrate ESG and AI tools gradually; avoid over‑engineering models with too many variables.

- Stick to a concise checklist to curb bias and speed up decision‑making.

How does top‑down analysis differ from bottom‑up?

Top‑down starts with the macro environment-GDP, inflation, policy-then narrows to industry and finally company. Bottom‑up flips the order, examining the firm first and only later considering sector and macro influences. The choice depends on whether you need a broad market view (top‑down) or a deep dive into a specific asset (bottom‑up).

Can fundamental analysis be used for pure crypto tokens?

Yes, but you replace traditional cash‑flow statements with token‑omics, on‑chain activity, and network‑value metrics like NVT or Metcalfe’s law. Blend these with macro factors such as regulatory outlook and macro‑crypto sentiment indices.

What are the most common valuation models for blockchain assets?

Discounted Token‑Cash‑Flow (DTCF), Network‑Value‑to‑Transactions (NVT), and Price‑to‑Earnings‑like ratios using token fee yield are the go‑to models. Each translates future cash or utility flows into a present‑value estimate.

How important is ESG when assessing blockchain projects?

Growing fast. European regulations (SFDR) now force asset managers to disclose climate risk, and many investors screen for energy‑efficient consensus mechanisms. ESG can add or shave several percentage points from a project’s intrinsic value.

Is AI really useful for fundamental analysis?

AI speeds data extraction-JPMorgan’s LOXM reads 10‑Ks 20× faster-and can spot patterns humans miss. However, models should augment, not replace, judgment; overly complex AI scores risk becoming "the tail wagging the dog."

Finance

Finance

Jenna Em

October 21, 2025 AT 08:18Ever wonder who's really benefitting from all these fancy analysis frameworks? Sometimes it feels like the models are crafted by the same people who push the hype, just with fancier charts. If you strip away the buzzwords, you might see a hidden agenda to keep capital flowing into their own projects.

Stephen Rees

October 25, 2025 AT 19:06The idea of a neutral framework is nice on paper, but in practice the data sources are often filtered through a lens of bias. I tend to trust anything that comes from a source that hasn't openly disclosed its stake in the tokens it evaluates.

Katheline Coleman

October 30, 2025 AT 04:54Dear colleagues, I appreciate the comprehensive overview provided herein. The delineation between top‑down, bottom‑up, and hybrid methodologies is both systematic and pedagogically sound. Moreover, the inclusion of on‑chain metrics as analogues to traditional cash‑flow statements demonstrates a thoughtful adaptation to the unique characteristics of blockchain assets. I would, however, recommend a more explicit discussion of model risk, particularly concerning the volatility of token‑omics inputs. Lastly, a concise checklist-perhaps limited to ten critical items-could substantially aid practitioners in operationalising the framework without becoming encumbered by analysis paralysis.

Amy Kember

November 3, 2025 AT 15:42Macro factors set the stage but the real story lives in the token economics; look at supply schedule, staking incentives and active address growth. Those three metrics alone separate viable protocols from hype machines.

Evan Holmes

November 8, 2025 AT 02:30Looks like another buzzword‑filled guide.

Isabelle Filion

November 12, 2025 AT 13:18Ah, the perpetual attempt to graft Wall Street's venerable valuation playbook onto the wild west of crypto-how delightfully naive. One must admire the sheer audacity of believing that a discounted cash‑flow model, originally designed for revenue‑generating enterprises, can accurately price a protocol whose primary asset is pure speculation. Yet, here we are, watching self‑styled analysts sprinkle DCF, NVT and ESG buzzwords like confetti at a corporate fundraiser. The result? A twelve‑page manifesto that feels less like rigorous research and more like a pretentious PowerPoint for the uninitiated. If only the authors would acknowledge the inherent uncertainty baked into on‑chain data, perhaps the framework would earn a smidge of credibility.

PRIYA KUMARI

November 17, 2025 AT 00:06The so‑called “hybrid” approach is nothing more than a buzzword salad designed to impress investors while hiding the fact that most models double‑count the same risk factors. You’ll see macro exposure weighted at 40% and industry risk also given 30%, yet both are often driven by the same macro‑policy trends. The result is an inflated confidence score that masks underlying volatility. Investors should demand transparent factor decomposition before buying into any hybrid scorecard.

Molly van der Schee

November 21, 2025 AT 10:54Great breakdown! I especially like the reminder to keep ESG in the mix – it’s easy to overlook but can really shift a token’s risk profile. Looking forward to trying out the NVT metric on some of my smaller projects.

Mike Cristobal

November 25, 2025 AT 21:42We have a responsibility to educate novices about the pitfalls of chasing quick gains; spreading sound fundamentals is the only ethical path. 🌱

Erik Shear

November 30, 2025 AT 08:30While good intentions matter, the market rarely rewards patience; most retail traders succumb to fear of missing out despite best‑intent advice.

Johanna Hegewald

December 4, 2025 AT 19:18If you’re new to on‑chain analysis, start by tracking active addresses and transaction volume over a 30‑day moving average. Those two figures give you a quick health check before diving into more complex token‑omics.

Benjamin Debrick

December 9, 2025 AT 06:06Indeed, but one must also consider the statistical significance of any observed trend; a simple moving average can be misleading if the data sample is insufficient, especially in low‑liquidity environments where price manipulation is prevalent.

Mike GLENN

December 13, 2025 AT 16:54The landscape of crypto valuation is evolving at a breakneck pace, and anyone who clings to outdated spreadsheets risks being left behind. First, recognize that traditional discount rates must be adjusted for the heightened systematic risk inherent in decentralized protocols. Second, incorporate network‑effect multipliers, such as Metcalfe’s law, to capture the exponential value creation as user adoption expands. Third, always cross‑validate on‑chain metrics with off‑chain fundamentals like regulatory developments and partnership announcements. Fourth, remember that token supply dynamics are not static; vesting schedules can dramatically alter scarcity projections. Fifth, when applying DCF‑like models, use a range of cash‑flow scenarios to reflect volatility in transaction fees and staking rewards. Sixth, factor in consensus mechanism energy consumption, as ESG considerations increasingly influence institutional capital flows. Seventh, monitor developer activity on platforms like GitHub to gauge long‑term sustainability beyond price charts. Eighth, be wary of “whale‑driven” price spikes that can temporarily inflate valuation ratios without underlying growth. Ninth, maintain a disciplined exit strategy that aligns with your risk tolerance and the token’s market depth. Tenth, stay transparent with your own assumptions; documenting them prevents hindsight bias. Eleventh, leverage third‑party analytics tools, but treat them as supplementary rather than definitive sources. Twelfth, periodically rebalance your portfolio to account for shifting macro‑economic conditions such as interest‑rate changes that affect crypto risk premiums. Thirteenth, keep an eye on cross‑chain interoperability, as assets that can bridge ecosystems often enjoy a competitive edge. Fourteenth, engage with community governance discussions to anticipate protocol upgrades that may impact tokenomics. Finally, remember that no model can eliminate uncertainty, but a rigorous, multi‑dimensional framework dramatically improves the odds of identifying true value in a sea of hype.

Tom Grimes

December 18, 2025 AT 03:42Sometimes I feel like the analysts are just feeding us numbers to keep us glued to the screen, while the real story is hidden in the code commits and the silent whispers of the community that no one seems to listen to. It’s almost like they’re building a wall of data and expecting us to walk through it without noticing the cracks that could bring the whole thing down.

Paul Barnes

December 22, 2025 AT 14:30Everyone’s chasing the next big thing, yet the safest bets often sit quietly under the radar.

John Lee

December 27, 2025 AT 01:18Picture this: a kaleidoscope of data points swirling together-macro trends, token velocity, developer zeal-forming a mosaic that, when viewed from the right angle, reveals the hidden pulse of a blockchain project. It’s not just numbers; it’s a living, breathing ecosystem.

Jireh Edemeka

December 31, 2025 AT 12:06Ah, another “must‑read” guide that pretends to demystify crypto while secretly reinforcing the echo chamber of hype; how original.

del allen

January 4, 2026 AT 22:54i think this is reall helpful but i wish there were more simple examples lol :)

Rebecca Kurz

January 9, 2026 AT 09:42Beware! The authors are likely feeding us a pre‑packaged narrative designed to steer capital toward their own hidden holdings; read between the lines!!!

Nikhil Chakravarthi Darapu

January 13, 2026 AT 20:30Our nation’s technological sovereignty depends on mastering blockchain fundamentals; relying on foreign frameworks is a betrayal of our progress.

Lindsey Bird

January 18, 2026 AT 07:18Oh, the drama of yet another “framework” that promises to save us all-can’t wait to see how it collapses under its own weight!