Uniswap: The Leading Decentralized Exchange and How It Powers Crypto Trading

When you trade crypto without a bank or broker, you’re likely using Uniswap, a decentralized exchange built on Ethereum that lets users swap tokens directly from their wallets. Also known as a DEX, it removed the need for order books and middlemen, turning trading into a simple, automated process anyone can use. Before Uniswap, swapping tokens meant trusting a centralized platform like Coinbase or Binance. Now, you connect your wallet, pick two tokens, and click swap—no KYC, no account, no waiting. It’s not magic—it’s smart contracts doing the work, powered by Ethereum’s blockchain.

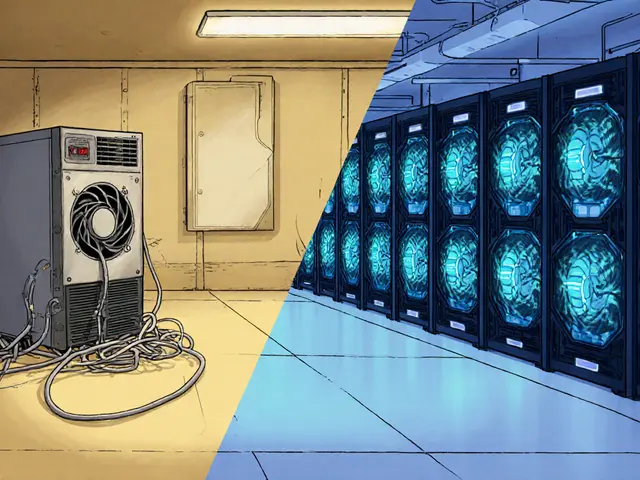

Uniswap isn’t just a trading tool. It’s the engine behind DeFi. It enables liquidity pools, where users like you lock up tokens to earn fees every time someone trades. That’s how tokens like Uniswap’s own UNI token gained value—not from hype, but from real usage. Related to this are Ethereum, the blockchain where Uniswap runs and where most of its liquidity lives, and decentralized exchange, a broader category that includes platforms like SushiSwap and Curve, but none with Uniswap’s scale. You can’t understand Uniswap without knowing how it uses automated market makers (AMMs), which replace traditional buyers and sellers with math-based pricing. That’s why prices shift slowly on low-volume pairs and crash fast on high-volume ones.

People use Uniswap for everything: swapping new tokens before they hit exchanges, farming yield, testing DeFi projects, or just moving ETH to a stablecoin before a market drop. But it’s not perfect. High Ethereum fees during busy times can make small trades useless. Slippage can eat your profits if you’re trading big amounts. And while it’s open to everyone, that also means scams and fake tokens are everywhere. That’s why our collection here doesn’t just show you how to use Uniswap—it shows you what to watch out for. You’ll find real reviews of tokens traded on it, breakdowns of liquidity risks, and guides on spotting fake tokens before you click confirm. Whether you’re swapping your first ETH for a new meme coin or managing a portfolio of DeFi assets, these posts give you the no-fluff facts you need to move safely and smartly.

Learn how to calculate impermanent loss in DeFi liquidity pools using simple formulas, real examples, and key insights on when fees offset losses. Avoid common mistakes and make smarter liquidity decisions.

Finance

Finance