TRUF crypto

When you dive into TRUF crypto, a niche of crypto projects built around transparent, utility‑first token designs, you instantly notice three big connections: legal rules, community rewards, and platform choices. TRUF crypto isn’t a vague buzzword; it’s a concrete set of ideas that tie token economics to real‑world compliance, to the way airdrops hand out value, and to which exchanges let you trade safely. In practice, this means a TRUF token must follow the same tax reporting that a Bitcoin transaction does, must survive the latest regulatory crackdown, and must be listed on a trusted exchange that respects user security. Those three pillars – regulation, distribution, and trading – shape every article you’ll find below.

Why TRUF crypto matters today

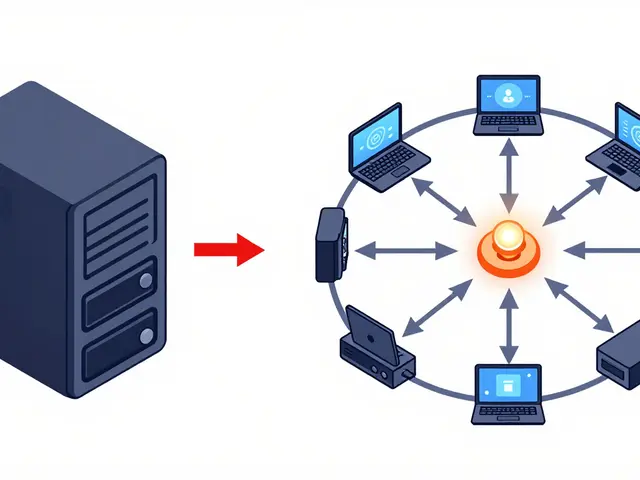

One of the most decisive forces shaping TRUF crypto is cryptocurrency regulation, the collection of laws and guidelines that govern how digital assets are created, traded, and taxed worldwide. Recent moves in China, India, and Taiwan illustrate how a new rule can instantly affect token liquidity, user onboarding, and even token design. For instance, China’s 2025 ban forced many TRUF projects to shift their smart‑contract deployment from Mainland servers to offshore cloud providers, while India’s 30% crypto tax reshaped how investors calculate net returns. Understanding these regulatory shifts is essential because they dictate whether a TRUF token can be listed on a major exchange, how its airdrop must be disclosed, and what tax forms you’ll file at year‑end. At the same time, airdrop, a promotional distribution method where free tokens are given to eligible wallets to spark adoption has become a primary growth engine for TRUF projects. A well‑run airdrop not only boosts community size but also creates real‑world utility by encouraging holders to use the token on a platform or service. The latest Bull Finance airdrop, the POTS giveaway on Moonpot, and the SupremeX token promotion each demonstrate how airdrops can be structured to comply with anti‑money‑laundering rules while still delivering value. Knowing the eligibility criteria, claim steps, and safety tips protects users from scams and positions them to reap the upside when the token’s market price climbs. Finally, the choice of crypto exchange, the online venue where users buy, sell, or trade digital assets, often with built‑in security, fee structures, and liquidity pools determines how smoothly a TRUF token moves from a wallet to a trading pair. Reviews of OpenSwap, SuperEx, Coinext, and Azurswap highlight differences in fee models, security audits, and compliance checks that matter for TRUF token holders. An exchange that offers low withdrawal fees and strong KYC procedures reduces the risk of frozen accounts, while platforms that support advanced order types help traders maximize returns on volatile TRUF assets. Alongside exchange selection, crypto tax, the set of reporting obligations and rates that apply when you realize gains or losses on digital assets rounds out the user journey, ensuring that every transaction—whether airdrop claim, trade, or staking reward—fits within your tax plan. By grasping how regulation, airdrops, exchanges, and tax rules intersect, you’ll be ready to navigate the fast‑moving world of TRUF crypto with confidence. Below you’ll find the curated articles that break each of these pieces down into actionable steps and real‑world examples.

Learn what TRUF.Network is, how the TRUF crypto coin works, its tokenomics, key products, market data, and how it stacks up against other oracle solutions.

Categories

Archives

Recent-posts

Government Blockchain Voting Pilots: Real-World Experiments and Why They Haven't Taken Off

Dec, 12 2025

Finance

Finance