Minswap V2: What It Is, How It Works, and Why It Matters for DeFi Traders

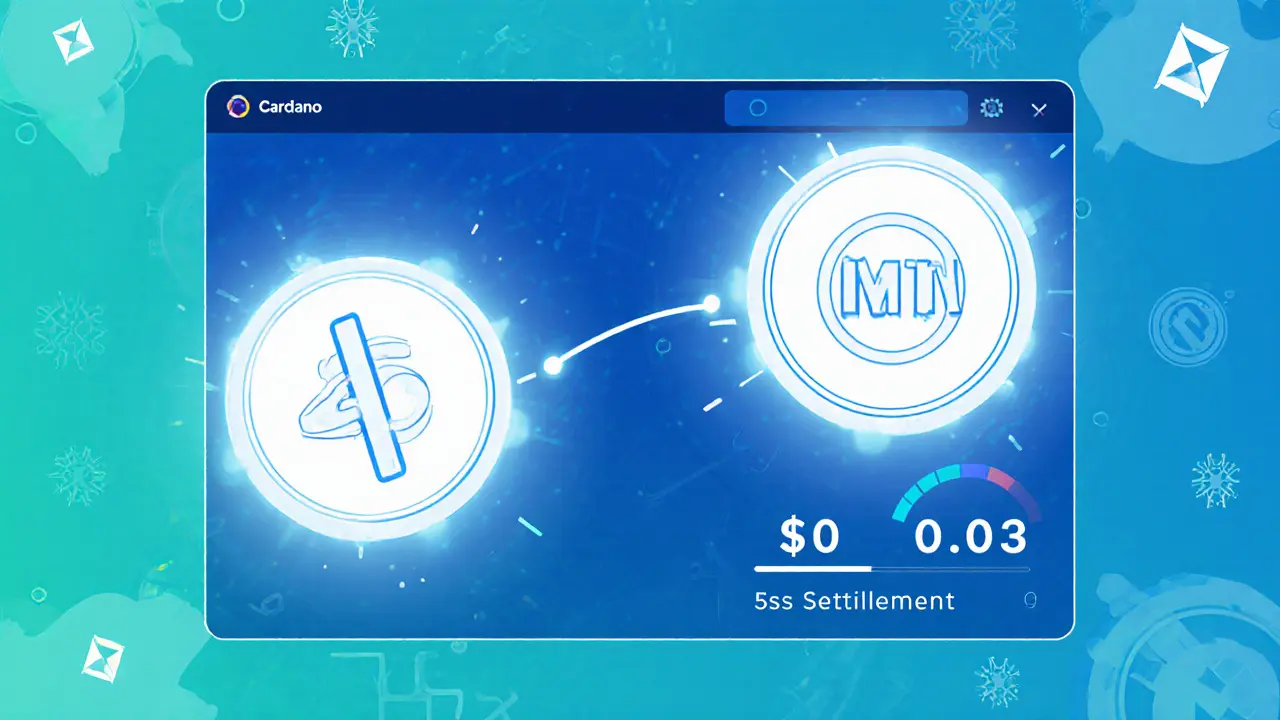

When you trade crypto on Minswap V2, a decentralized exchange built on the Cardano blockchain that lets users swap tokens without intermediaries. Also known as Minswap DEX, it’s one of the most active platforms for trading Cardano-based assets. Unlike centralized exchanges, Minswap V2 runs entirely on smart contracts—no sign-ups, no KYC, no middlemen. You connect your wallet and trade directly. That’s the core promise of DeFi, and Minswap V2 delivers it with real speed and lower fees than earlier versions.

What makes Minswap V2 different from its first version? It’s not just a tweak—it’s a full rebuild. The old system had high slippage and poor liquidity. Minswap V2 fixed that with a new automated market maker, a system that uses mathematical formulas to set prices and match trades without order books, better fee structures, and deeper liquidity pools, reserves of token pairs that enable smooth trading without relying on buyers and sellers to match directly. It also added support for multi-asset swaps and improved token listing rules, so you’re less likely to run into fake or low-quality tokens. These upgrades make it more competitive with Uniswap and SushiSwap—but on Cardano, where transaction costs are a fraction of Ethereum’s.

People use Minswap V2 for three main reasons: to swap ADA for other Cardano tokens, to earn fees by providing liquidity, and to access new projects early. But it’s not without risks. Like all DeFi platforms, smart contract bugs or sudden liquidity drains can hurt your funds. And while Minswap V2 is more secure than sketchy exchanges like BiKing or GCOX, it still demands you know what you’re doing. You need to understand impermanent loss, how to check pool depths, and why tokenomics matter before you deposit anything.

The posts below cover real-world cases: what happens when a new token launches on Minswap V2, how liquidity providers fare after price swings, and why some users lost money by ignoring basic safety checks. You’ll also find comparisons with other Cardano DEXs, breakdowns of recent token listings, and warnings about fake airdrops tied to the platform. This isn’t theory—it’s what traders actually experienced. Whether you’re new to DeFi or looking to optimize your strategy, the insights here will help you avoid costly mistakes and make smarter moves on Minswap V2.

Minswap V2 is the fastest, cheapest DEX on Cardano with near-zero fees, smart routing, and a clean interface. Perfect for traders who want speed and control without the bloat of other platforms.

Finance

Finance