Collateral Risk Management Calculator

Margin Calculation Results

Initial Margin: $0

Variation Margin (Daily): $0

Haircut Applied: 0%

Net Collateral Value: $0

Quick Take

- Collateral risk management uses pledged assets to guard against credit defaults.

- Key pieces are initial margin, variation margin, and haircuts.

- Automation, AI, and blockchain are reshaping how firms value and move collateral.

- Regulators demand strict reporting, capital ratios, and valuation standards.

- A solid optimization plan cuts costs while keeping liquidity on hand.

What Is Collateral Risk Management?

When institutions need to protect themselves from default, Collateral Risk Management is the practice of using pledged assets to limit credit exposure and ensure repayment. The idea is simple: if borrower A can’t pay, lender B can seize a pre‑agreed asset-cash, government bonds, or high‑grade corporate securities-to cover the loss. Though the concept dates back centuries, modern markets have turned it into a sophisticated, data‑driven engine that sits at the heart of banks, hedge funds, pension plans, and corporate treasuries.

Core Components: Collateral, Margin, and Haircuts

Three building blocks keep the system functional.

- Collateral is the actual asset pledged-cash, Treasury bills, or equities-that backs a credit exposure.

- Margin refers to the cash or securities required to cover potential losses. It’s split into initial margin (the upfront buffer) and variation margin (the day‑to‑day adjustment).

- Haircut is a percentage reduction applied to the market value of collateral to reflect liquidity risk and credit quality.

For example, a $10million Treasury bond might receive a 2% haircut, meaning only $9.8million counts toward margin requirements. The haircut protects the lender if market prices dip or if the bond becomes harder to sell.

How the Process Works: Mark‑to‑Market, Initial & Variation Margin

Every derivative or repo contract is marked‑to‑market (MtM) daily. If the market moves against PartyA, the MtM value drops, and PartyB must post additional collateral to restore the agreed‑upon exposure level. This extra posting is the variation margin.

At contract inception, both parties calculate the initial margin based on volatility, notional size, and the credit rating of the counter‑party. The calculation follows regulatory formulas such as the Basel III Standardised Approach or the ICE ISDA SIMM model, depending on the jurisdiction.

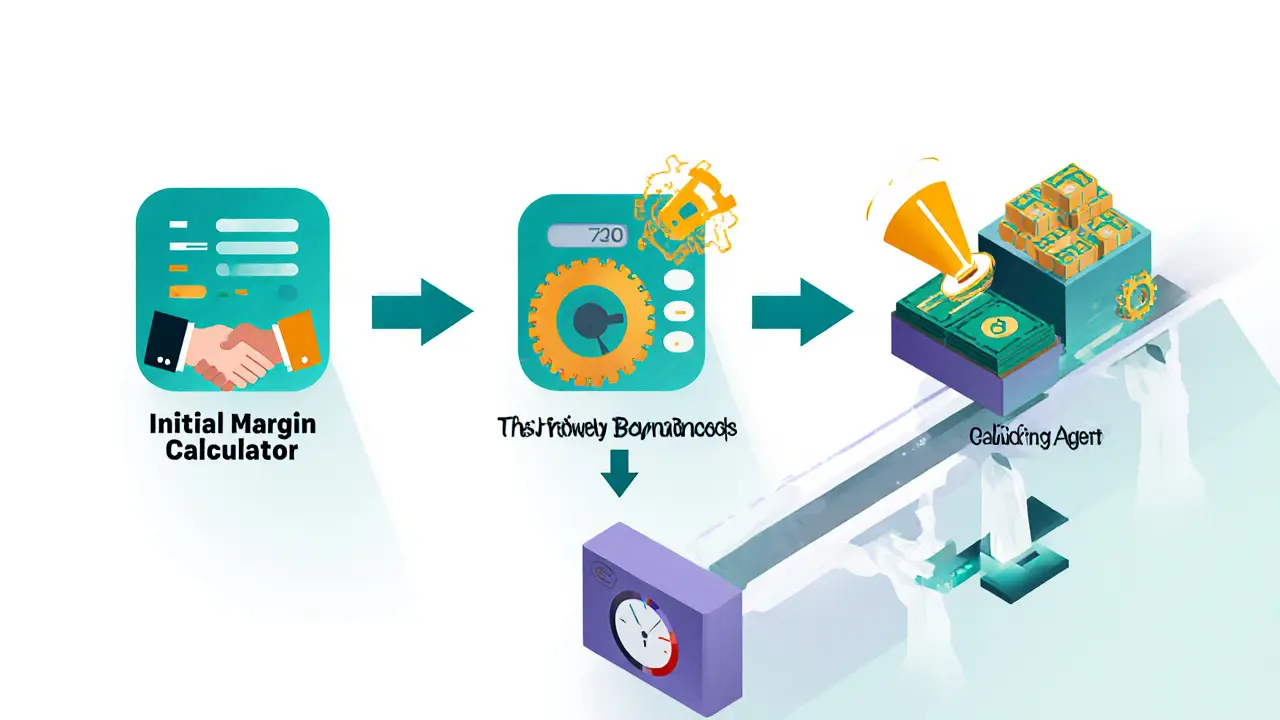

The flow typically looks like this:

- Trade is executed and valued at current market prices.

- Initial margin is calculated and posted.

- Daily MtM is performed; any change triggers a variation margin call.

- Collateral is transferred, often through tri‑party agents, and the haircut is applied.

- When the exposure shrinks, collateral is returned.

Risk Areas Addressed by Collateral Management

Good collateral risk management tackles three major risk dimensions.

- Credit risk - the chance the borrower defaults. Collateral provides a safety net that reduces potential loss‑given‑default.

- Liquidity risk - the need to meet margin calls quickly. High‑quality, low‑haircut assets like cash or sovereign bonds are preferred for this reason.

- Counterparty risk - the risk that the other side of a trade can’t meet its obligations. Ongoing credit assessments and real‑time exposure monitoring keep this in check.

By integrating credit scoring, real‑time market data, and automated collateral calls, firms can keep these risks within tolerable limits.

Valuation & Optimization Strategies

Accurate valuation is the hardest part, especially during volatile periods. Firms use a mix of market price feeds, discount curves, and liquidity‑adjusted models. When prices swing sharply, haircuts are widened to protect against sudden drops.

Collateral optimization seeks the cheapest way to meet margin while preserving portfolio returns. A typical workflow:

- Classify all eligible assets by liquidity, haircuts, and funding cost.

- Run a linear‑programming model that minimizes total funding cost subject to margin and liquidity constraints.

- Allocate cash first, then high‑quality bonds, and finally lower‑rated securities as a last resort.

Automation platforms now embed these models, allowing traders to see the optimal asset mix in seconds rather than hours.

Technology & Automation: Blockchain, Tokenization, and AI

The tech wave is changing every layer of collateral risk management.

- Blockchain provides an immutable ledger for collateral moves, making dispute resolution faster and reducing reconciliation mismatches.

- Tokenization turns real‑world assets-like a pool of mortgage‑backed securities-into digital tokens that can be transferred instantly across borders.

- Artificial intelligence enhances credit‑worthiness monitoring, predicts margin call timing, and flagges outlier valuations before they become breaches.

Leading banks now run end‑to‑end workflows where a margin call triggers a smart‑contract on a private blockchain, automatically moving tokenized collateral, while an AI engine validates the haircut applied.

Regulatory Landscape and Compliance

Regulators worldwide enforce strict rules on collateral usage.

- BaselIII mandates minimum high‑quality liquid asset (HQLA) ratios for banks, directly influencing haircut choices.

- EMIR (EU) and Dodd‑Frank (US) require real‑time reporting of collateral positions and daily MTM valuations.

- Local central banks often prescribe eligible collateral lists for sovereign borrowing.

Compliance teams must maintain a documented trail: agreement signed, collateral posted, haircut applied, and daily re‑valuation logs. Failure to meet reporting deadlines can result in hefty fines and capital charge penalties.

Practical Implementation Checklist

Most readers arrive with a concrete need-either to set up a new collateral framework or to improve an existing one. Check off each step to ensure you’re covering all bases.

| Step | What to Do | Key Metric / Output |

|---|---|---|

| 1 | Map all eligible assets and assign haircuts. | Haircut matrix (e.g., cash0%, Gov‑bond2%). |

| 2 | Set up real‑time market data feeds. | Latency<1sec for prices. |

| 3 | Define margin calculation methodology (SIMM, VaR, etc.). | Documented model validation report. |

| 4 | Automate MTM and variation‑margin calls. | 95% of calls processed within 5minutes. |

| 5 | Integrate compliance reporting (EMIR, BaselIII). | Zero missed daily filing incidents. |

| 6 | Deploy AI‑driven counterparty monitoring. | Early‑warning alerts for credit downgrade. |

| 7 | Pilot blockchain token transfer for a single asset class. | Successful end‑to‑end tokenized collateral movement. |

Following this list helps you move from a manual spreadsheet regime to a fully automated, regulator‑ready platform.

Future Outlook

Collateral risk management will keep evolving. Expect broader adoption of tokenized assets, tighter integration of AI for stress‑testing, and more cross‑border regulatory harmonization. Firms that invest early in automation and data quality will capture lower funding costs and enjoy stronger relationships with counterparties.

Frequently Asked Questions

What is the difference between initial margin and variation margin?

Initial margin is the upfront collateral calculated at trade inception to cover potential future exposure. Variation margin is the day‑to‑day adjustment that reflects changes in market value after the trade has started.

How are haircuts determined?

Haircuts depend on asset liquidity, credit quality, and regulatory guidance. Highly liquid government bonds usually receive low haircuts (1‑3%), while lower‑rated corporate bonds may get 10% or more.

Can blockchain really replace traditional collateral settlement?

Blockchain offers immutable records and near‑instant transfer, which can reduce settlement risk and reconciliation time. However, full replacement requires legal recognition of tokenized assets and integration with existing clearing banks.

What role does AI play in collateral optimization?

AI models analyze historical price movements, funding costs, and counterparty behavior to suggest the most cost‑effective asset mix. They also flag mismatches before they become margin breaches.

How often must collateral be re‑valuated?

Regulators typically require daily MTM valuations for active derivatives. Some jurisdictions mandate intra‑day updates for large exposures or illiquid assets.

Finance

Finance

Chad Fraser

September 8, 2025 AT 22:15Nice tool, helps spot margin gaps fast.

Courtney Winq-Microblading

September 13, 2025 AT 19:25Collateral risk management, at its core, is a dance between asset liquidity and market volatility, a balance that no single calculator can fully capture.

Regulatory frameworks like Basel III inject an extra layer of nuance, demanding not just numbers but strategic foresight.

When you feed a government bond into the model, remember that its sovereign backing can mask hidden duration risk.

In practice, blending quantitative outputs with qualitative judgment yields the most resilient strategies.

katie littlewood

September 18, 2025 AT 16:36Understanding collateral risk begins with recognizing that each asset class carries its own set of idiosyncrasies, which means the one‑size‑fits‑all approach in many calculators can be dangerously simplistic.

For instance, cash appears risk‑free on the surface, yet its real‑time settlement risk in volatile markets can be significant.

Government bonds enjoy a perception of safety, but their price sensitivity to interest‑rate shifts can produce unexpected haircuts under stress scenarios.

Corporate bonds introduce credit spread volatility, which often correlates with macro‑economic cycles, making static haircuts inadequate.

Equities, while offering high liquidity, are subject to sharp drawdowns that can erode collateral value within minutes.

The credit rating of the counterparty is another pivotal factor; a downgrade from A to BBB can instantly double the required margin.

Moreover, the correlation between the collateral asset and the exposure it secures should be examined – a high correlation can amplify losses.

Regulatory capital calculations under Basel III require institutions to hold capital against potential future exposure, not just current mark‑to‑market values.

Stress testing frameworks often employ scenarios where volatility spikes to 30‑40%, rendering previously adequate haircuts insufficient.

Liquidity considerations are equally vital; during market dislocations, even supposedly liquid assets may experience delayed price discovery.

Operational risk, such as settlement failures or legal disputes over collateral ownership, adds another layer of complexity.

In practice, risk managers should maintain dynamic haircuts that adjust based on real‑time market data, including volatility indices and credit spreads.

Technology plays a role – integrating live data feeds into margin calculators can reduce lag and improve accuracy.

Governance is essential; clear policies on collateral eligibility, valuation frequency, and dispute resolution protect institutions from systemic shocks.

Finally, communication between front‑office traders and back‑office risk teams ensures that the assumptions embedded in the models reflect actual market behavior.

By weaving together quantitative analytics, qualitative judgment, and robust processes, firms can navigate the intricate landscape of collateral risk more effectively.

Jenae Lawler

September 23, 2025 AT 13:46The presented methodology, while ostensibly comprehensive, neglects critical counterparty concentration risk, a factor paramount to systemic stability.

Furthermore, the reliance on static volatility inputs fails to accommodate the stochastic nature of market turbulence, thereby potentially under‑estimating margin requirements.

It would be prudent to supplement this calculator with a dynamic stress‑testing module that incorporates tail‑risk scenarios reflective of recent financial upheavals.

Jayne McCann

September 28, 2025 AT 10:57I think the haircut percentages are arbitrary.

Richard Herman

October 3, 2025 AT 08:08From a macro‑level perspective, collateral adequacy must be aligned with both regulatory capital buffers and the institution's internal liquidity cushions.

When you juxtapose the credit rating of a counterparty with the asset's liquidity profile, you uncover hidden mismatches that a simple calculator might overlook.

Integrating real‑time market data, such as implied volatilities and credit default swap spreads, can substantially enhance the fidelity of margin computations.

Parker Dixon

October 8, 2025 AT 05:18Great overview! 👍 The emoji‑friendly interface makes it easier for junior analysts to grasp the concepts.

Just remember to cross‑check the output with your internal VaR models for consistency.

Stefano Benny

October 13, 2025 AT 02:29While the tool is user‑friendly, it glosses over the intricacies of collateral optimization-particularly the trade‑off between liquidity and credit risk. In practice, firms must navigate the thin line between regulatory compliance and capital efficiency, often resorting to bespoke haircuts derived from proprietary analytics.

Bobby Ferew

October 17, 2025 AT 23:39Honestly, the calculator feels a bit cold, like it’s missing the human nuance that comes from years of market experience. It’s okay for a quick glance, but don’t let it replace a seasoned risk manager’s intuition.

celester Johnson

October 22, 2025 AT 20:50It’s surprising how many users accept these default settings without questioning the underlying assumptions. A critical eye reveals that the model’s risk‑weight tables are outdated, leading to potentially misleading margin calls.

Prince Chaudhary

October 27, 2025 AT 17:00Respectfully, the simplicity of the interface is commendable, yet one should remain vigilant about the data sources feeding the calculations, ensuring they are both timely and accurate.

John Kinh

November 1, 2025 AT 14:11Looks like another glorified spreadsheet with a fancy UI.

Mark Camden

November 6, 2025 AT 11:22While the interface may seem polished, a thorough examination reveals that the underlying assumptions are overly simplistic and fail to capture the complex interplay of market forces, regulatory constraints, and counterparty credit dynamics that truly drive collateral requirements.

Evie View

November 11, 2025 AT 08:32That calculator totally ignores the high‑frequency volatility spikes we see during market stress – you need a more aggressive hair‑cut regimen.

Sidharth Praveen

November 16, 2025 AT 05:43Even if the tool looks basic, it can serve as a solid springboard for junior analysts to develop a deeper appreciation of margin dynamics.

Sophie Sturdevant

November 21, 2025 AT 02:53Building on Mark’s point, I’d add that a pragmatic approach-combining this calculator with proprietary stress‑testing-can bridge the gap between theoretical haircuts and real‑world risk exposure.

Nathan Blades

November 26, 2025 AT 00:04In the grand theatre of finance, tools like this are merely props; it’s the seasoned actors-risk managers, traders, and regulators-who deliver the performance that truly safeguards the capital base.

Somesh Nikam

November 30, 2025 AT 21:15Overall, the calculator provides a useful baseline, but I recommend augmenting it with a dynamic hair‑cut framework that reacts to live market indicators and incorporates counterparty concentration metrics for a more robust risk posture.