Loopring – ZK Rollup DEX on Ethereum L2

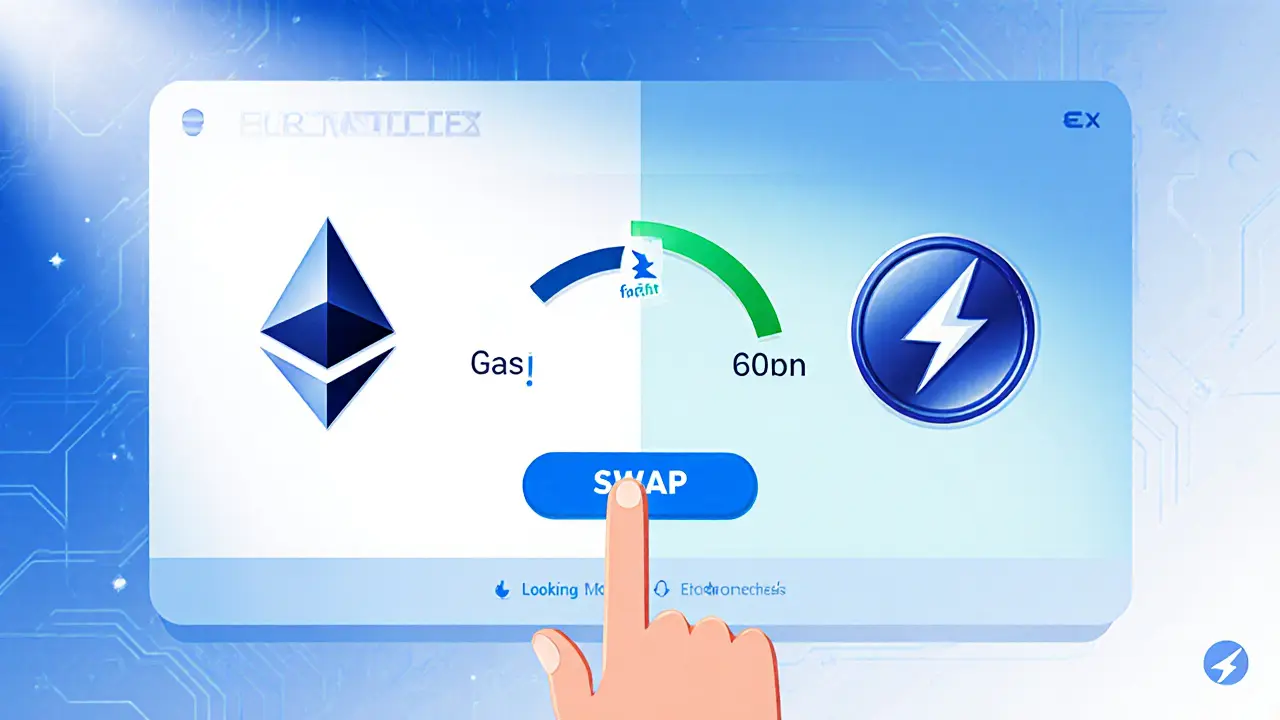

When working with Loopring, a zero‑knowledge rollup protocol that enables fast, cheap decentralized trading on Ethereum. Also known as Loopring Protocol, it provides the backbone for a ZK Rollup, a scalability method that batches transactions while preserving privacy and a Decentralized Exchange, an on‑chain marketplace where users trade directly from their wallets built on Ethereum, the leading smart‑contract platform. This mix of technologies creates a seamless experience for anyone who wants to swap tokens without paying high gas fees.

Why Loopring Matters

The core advantage of Loopring lies in its use of ZK Rollup mechanics. By compressing hundreds of transactions into a single proof, the protocol cuts on‑chain data to a fraction of what a normal Ethereum transaction would require. The result? Near‑instant settlement, dramatically lower fees, and the same security guarantees that Ethereum provides. For traders, that means you can move in and out of positions quickly, a key factor when markets swing hard.

Loopring’s Decentralized Exchange, often called Loopring DEX takes the rollup benefits a step further. Instead of relying on a traditional order book, it matches orders off‑chain and only writes the final state to Ethereum. This design reduces congestion and eliminates the need for a central operator, keeping custody in the user’s own wallet. The DEX also supports advanced order types like ring‑matching, which lets multiple trades settle together for better price efficiency.

While Loopring runs on its own layer‑2, it never abandons Ethereum’s security model. Every rollup block is anchored to the main chain with a cryptographic proof, so any attempt to tamper with the data would be immediately rejected by the Ethereum network. This “security inheritance” lets developers build high‑throughput applications without starting from scratch on a new blockchain, and it reassures users that their assets remain as safe as on Ethereum itself.

Beyond swaps, Loopring’s ecosystem has expanded into NFTs, liquidity mining, and even airdrop opportunities. Several projects have used Loopring’s low‑cost environment to launch token giveaways, rewarding early adopters with extra tokens or NFTs. Because the protocol’s fee structure is predictable, users can calculate how much a potential airdrop is worth before participating, making it easier to compare offers across the market.

Security is another pillar of the protocol. The codebase undergoes regular audits by reputable firms, and the open‑source nature lets the community inspect contracts for vulnerabilities. Loopring also implements a “fee‑back” system where a portion of transaction fees is redistributed to active traders, creating an incentive loop that encourages volume and enhances liquidity.

If you’re curious about how Loopring fits into the broader crypto landscape, the articles below will walk you through real‑world use cases. You’ll find step‑by‑step guides on claiming airdrops, deep dives into DEX mechanics, comparisons with other L2 solutions, and practical tips for trading on a ZK‑rollup platform. With this background, you’ll be ready to explore Loopring’s features and decide if it’s the right tool for your next move in the market.

Learn what Loopring (LRC) is, how its zkRollup Layer2 tech works, token economics, real‑world use cases, risks, and how to start trading.

Finance

Finance