Loopring (LRC) Token Calculator

Monthly Transactions: 0

Total Monthly Cost: $0.00

Avg. Cost per Trade: $0.00

Monthly Transactions: 0

Total Monthly Cost: $0.00

Avg. Cost per Trade: $0.00

Estimated LRC Savings: 0 LRC

Savings Summary

By using Loopring's Layer 2 solution, you could save approximately $0.00 per month compared to Ethereum mainnet trading.

This estimate assumes standard gas fees and LRC pricing at current levels.

Imagine swapping Ethereum tokens in a blink, paying pennies instead of dollars. That’s the promise behind Loopring (LRC) - a protocol that brings Layer 2 scaling to decentralized finance.

Quick Take

- Loopring is an Ethereum‑based protocol that uses zkRollups to speed up trades.

- LRC is the native utility token; it pays fees and rewards liquidity providers.

- The DEX launched in February 2020 and supports ERC‑20 trading with millisecond settlement.

- Key partners include GameStop’s NFT marketplace and multiple DeFi projects.

- Risks: token volatility, competition from other Layer2 solutions, and Ethereum’s own scaling roadmap.

How Loopring Works

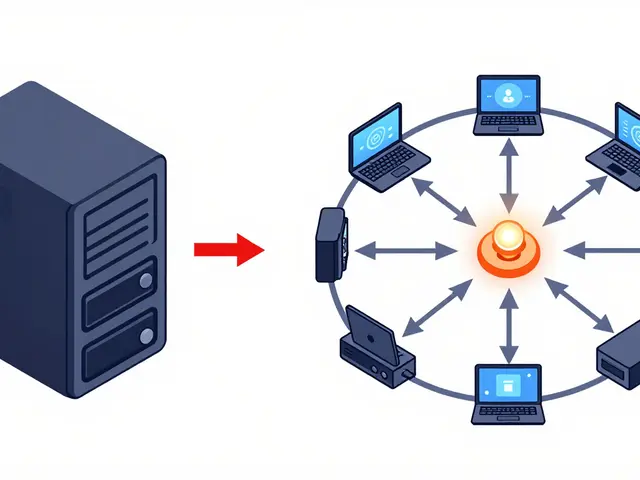

At its core, Loopring is a zkRollup cryptographic construction that bundles hundreds of transactions off‑chain, then posts a single proof to Ethereum. This proof guarantees that every bundled trade is valid without revealing individual details, keeping privacy intact while preserving Ethereum’s security guarantees.

Because the bulk of computation happens off‑chain, users experience near‑instant settlement and fees that are a fraction of those on the Ethereum mainnet. The protocol also adopts a non‑custodial model: your wallet never hands over private keys, so you stay in full control of your assets.

Token Economics (LRC)

The LRC token has a fixed supply of 1.375billion, with roughly 1.33billion circulating today. When you trade on the Loopring DEX, you pay fees in LRC. Those fees are split 80% to liquidity providers, 10% to insurers (who cover smart‑contract risk), and 10% to the protocol’s DAO.

This fee‑sharing model creates a direct incentive for users to stake LRC, provide liquidity, and help secure the network. Historically, LRC surged to $3.70 in late2021 after rumors of a GameStop partnership, then fell to $0.30 during the 2022 market crash, illustrating typical crypto volatility.

Real‑World Use Cases

Loopring’s most publicized partnership is with GameStop NFT Marketplace a platform that lets gamers buy, sell, and trade non‑fungible tokens using Loopring’s zkRollup technology. The integration proved that Loopring can handle high‑frequency, low‑fee NFT trades without sacrificing security.

Beyond NFTs, the protocol powers a suite of DeFi applications: payment channels, cross‑chain bridges, and automated market makers that benefit from fast settlement and reduced gas costs.

How Loopring Stacks Up Against Other Layer2 Solutions

| Protocol | Scaling Tech | Finality Speed | Typical Fee (USD) | Token Used for Fees |

|---|---|---|---|---|

| Loopring | zkRollup | ~1second | 0.001-0.005 | LRC |

| Optimism | Optimistic Rollup | ~10seconds | 0.005-0.02 | ETH |

| Arbitrum | Optimistic Rollup | ~10seconds | 0.006-0.025 | ETH |

| zkSync | zkRollup | ~2seconds | 0.001-0.006 | ETH |

Loopring’s edge lies in its focus on DEX functionality and its native token’s fee‑rebate system, while Optimism and Arbitrum excel in general smart‑contract compatibility. zkSync offers similar speed but currently lacks a dedicated DEX token economy.

Risks & Considerations

- Token volatility: LRC’s price can swing dramatically, affecting the cost of trading.

- Competition: New scaling solutions (e.g., StarkNet) and Ethereum’s own roadmap could reduce demand for external L2s.

- Technical complexity: Bridging assets to the L2 requires understanding of rollup mechanics and occasional troubleshooting.

- Regulatory landscape: As a utility token, LRC may face different legal scrutiny across jurisdictions.

Despite these challenges, the protocol’s non‑custodial design and fee‑sharing DAO provide a solid foundation for long‑term community support.

Getting Started with Loopring

- Set up an Ethereum‑compatible wallet (MetaMask, Coinbase Wallet, etc.).

- Visit the official Loopring interface and click “Bridge to L2”. Follow the on‑screen prompts to move ETH or an ERC‑20 token onto the rollup.

- Once the bridge transaction confirms (usually a few minutes), you’ll see your balance on the L2 dashboard.

- Choose a trading pair, confirm the trade, and pay the fee in LRC. The trade settles in seconds.

- If you want to earn a share of fees, stake LRC in the liquidity mining program via the DAO section.

For troubleshooting, the community forum and official docs cover common bridge errors, gas‑price spikes, and UI glitches. Advanced users can inspect the on‑chain proof data using block explorers that support zkRollup verification.

Frequently Asked Questions

What makes Loopring different from other DEXs?

Loopring uses zkRollup technology to batch trades off‑chain, giving it millisecond settlement and ultra‑low fees while keeping the security of Ethereum. Most DEXs run directly on the mainnet and suffer from high gas costs and slower confirmation times.

Do I need LRC to trade on the Loopring DEX?

Yes, transaction fees are paid in LRC. You can acquire LRC on most major exchanges, then bridge it to the Loopring L2 to start trading.

Is Loopring safe for my funds?

The protocol is non‑custodial, meaning you retain full control of your private keys. Security audits have been conducted, but like any DeFi platform, smart‑contract risk remains, which is partially covered by the insurance pool funded by LRC fees.

How does the GameStop NFT marketplace use Loopring?

GameStop built its NFT trading layer on Loopring’s zkRollup infrastructure, allowing gamers to mint, list, and swap NFTs with near‑instant finality and low transaction costs. The partnership validates Loopring’s real‑world use case beyond pure token swaps.

What’s the future outlook for LRC?

Analysts project a modest average price of around $0.64 by 2030, with higher upside if Layer2 adoption accelerates. Long‑term value hinges on the protocol’s ability to stay ahead of competing scaling solutions and to expand real‑world partnerships.

Finance

Finance

Ayaz Mudarris

July 20, 2025 AT 23:38Loopring’s zk‑Rollup architecture fundamentally changes how trades settle on Ethereum.

By aggregating hundreds of transactions into a single proof, it slashes on‑chain data.

The resulting gas cost per trade often falls below a cent.

Moreover, settlement occurs within seconds, which dramatically improves user experience.

The native LRC token plays a dual role as fee medium and incentive vehicle.

When users pay fees in LRC, a portion is redistributed to liquidity providers, aligning interests.

This fee‑sharing model encourages deeper order books and tighter spreads.

Loopring’s non‑custodial design ensures that private keys never leave the user’s wallet.

Consequently, the protocol inherits the security guarantees of Ethereum while operating off‑chain.

Recent audits have confirmed that the smart‑contract core is free from known critical vulnerabilities.

Partnerships such as the one with GameStop’s NFT marketplace demonstrate real‑world applicability.

The platform also offers a suite of DeFi primitives, including payment channels and bridges.

As Ethereum continues to evolve, Layer‑2 solutions like Loopring are poised to bear the scaling burden.

Investors should monitor LRC’s circulating supply dynamics, as token burns can affect scarcity.

In sum, Loopring presents a compelling blend of speed, low cost, and economic incentives for traders and developers alike.

Irene Tien MD MSc

July 24, 2025 AT 12:58Oh, because we all needed another glossy brochure about yet another “miracle” scaling solution, right? Loopring’s promises sound like a sci‑fi writer’s fever dream, dripping in buzzwords while the real world still pays gas like it’s a carnival ride. The whole thing is wrapped in a velvet cloak of “zk‑Rollup” mystique, which, let’s be honest, most of us pretend to understand while nodding politely. Still, if you enjoy watching token prices swing like a yo‑yo, LRC might just be your next amusement.

Vaishnavi Singh

July 28, 2025 AT 02:18The philosophical implication of trusting a rollup is that we delegate trust to mathematics rather than institutions. Yet, the elegance of zk‑proofs remains a quiet whisper in the chaotic market.

Peter Johansson

July 31, 2025 AT 15:38Nice dive into the tech, Ayaz! 🚀 Your breakdown really highlights why Loopring feels like a breath of fresh air for traders stuck on pricey gas fees. Keep those insights coming!

Cindy Hernandez

August 4, 2025 AT 04:58Irene, you’ve got a flair for drama, but let’s set the record straight: Loopring’s fee‑rebate mechanism actually does cut costs for high‑volume users, not just a marketing gimmick. The zk‑Rollup math isn’t magic; it’s a provable reduction in data on‑chain.

victor white

August 7, 2025 AT 18:18One must wonder if the architects of Loopring are in cahoots with the shadowy cabal that controls Ethereum’s roadmap. Their “zk‑Rollup” narrative feels like a veiled attempt to divert attention from the inevitable centralization of power.

Angela Yeager

August 11, 2025 AT 07:38Peter, your enthusiasm is contagious – thanks for cheering everyone up! It’s refreshing to see community members uplift each other while navigating these complex protocols.

Darren R.

August 14, 2025 AT 20:58Honestly, the whole Loopring hype train feels like a melodramatic soap opera where everyone’s yelling about “revolutionary speed” while the plot twists around token price volatility. If I were a playwright, I’d title this act “The Great Gas Fee Charade”.

Millsaps Delaine

August 18, 2025 AT 10:18Ah, the grandiose tapestry of Loopring-woven with threads of zk‑Rollup wizardry, tokenomics alchemy, and the ever‑present specter of market frenzy. One could pen an entire epic about how LRC seeks to dethrone the high‑fee behemoths of old, only to be humbled by the fickle tides of investor sentiment. The narrative is dense, dripping in technocratic jargon, yet beneath it lies a simple truth: speed and cost matter, even if the story is told in ornate prose.

Jack Fans

August 21, 2025 AT 23:38Wow-Darren, your drama is *chef’s kiss*-but just a heads‑up, “zk‑Rollup” isn’t a typo, it’s spelled exactly like that. Also, the phrase “gas fee charade” could use a comma for clarity, but hey, we all slip sometimes!!!

Krithika Natarajan

August 25, 2025 AT 12:58Correcting the typo helped, thanks. Loopring’s approach still sounds efficient.

Rebecca Stowe

August 29, 2025 AT 02:18Great read!

Aditya Raj Gontia

September 1, 2025 AT 15:38Loopring’s crypto‑stack is a prime example of lazy-layered protocol integration-more buzz, less substance-if you ask the jargon‑heavy crowd.

Kailey Shelton

September 5, 2025 AT 04:58Another layer‑2, another promise. Time will tell if it lives up to the hype.

vipin kumar

September 8, 2025 AT 18:18Victor’s shadowy insinuations mirror the deep‑state narratives that swirl around every “new” blockchain tech-yes, even Loopring is not immune to the conspiratorial lens.

Mark Briggs

September 12, 2025 AT 07:38So you think Loopring is part of some grand scheme? Sure, and I’m the queen of England. It’s just a rollup, not a plot twist.

mannu kumar rajpoot

September 15, 2025 AT 20:58Mark, while sarcasm is your forte, dismissing concerns outright ignores the valid scrutiny the community deserves. Let’s keep the discourse constructive, even if we disagree.

Tilly Fluf

September 19, 2025 AT 10:18In a formal assessment, the prior remarks lack substantive engagement with the technical merits of Loopring’s implementation. A measured analysis would consider both performance metrics and security audits.

Hardik Kanzariya

September 22, 2025 AT 23:38Mark, I hear your frustration-still, many users find real value in lower fees and faster trades. If you give Loopring a try, you might discover benefits beyond the sarcasm.