Layer 2 Liquidity

When working with Layer 2 liquidity, the amount of token supply that can be moved quickly on second‑layer scaling solutions. Also known as L2 liquidity, it lets users trade or transfer assets without clogging the main chain. Rollups, a type of Layer 2 that batches transactions and posts a single proof to the base layer are the primary highway for this fast flow. Together they create a shortcut where funds stay liquid while still enjoying the security of the underlying blockchain.

Why liquidity matters on second‑layer networks

On a rollup, having enough Layer 2 liquidity means traders can enter or exit positions without huge price swings. Liquidity mining, a program that rewards users for supplying assets to a pool fuels this depth. By staking tokens, participants earn extra yield, which in turn attracts more capital and tightens spreads on decentralized exchanges. Decentralized exchanges, platforms that match buyers and sellers directly on‑chain on Layer 2 benefit from lower fees and faster settlement, turning a thin order book into a bustling market.

But liquidity doesn’t stay on a single rollup forever. Assets need to move between chains or back to the main layer. That’s where Blockchain bridges, smart‑contract systems that lock tokens on one network and mint equivalents on another come in. A well‑balanced bridge ensures that liquidity can flow out to Ethereum, other Layer 2s, or even different ecosystems without bottlenecks. When bridges operate smoothly, liquidity providers can shift capital to where it earns the best returns, keeping the whole ecosystem healthy.

All these pieces—rollups, liquidity mining, DEXs, and bridges—are tightly linked. Rollups provide the fast layer, DEXs give the trading venue, liquidity mining supplies the depth, and bridges move the depth where it’s needed. Understanding how they interact helps developers design more efficient protocols and traders spot opportunities before the market catches up. Below you’ll find a curated set of articles that dive deeper into each component, from real‑world airdrop case studies to detailed reviews of emerging exchanges and scaling solutions.

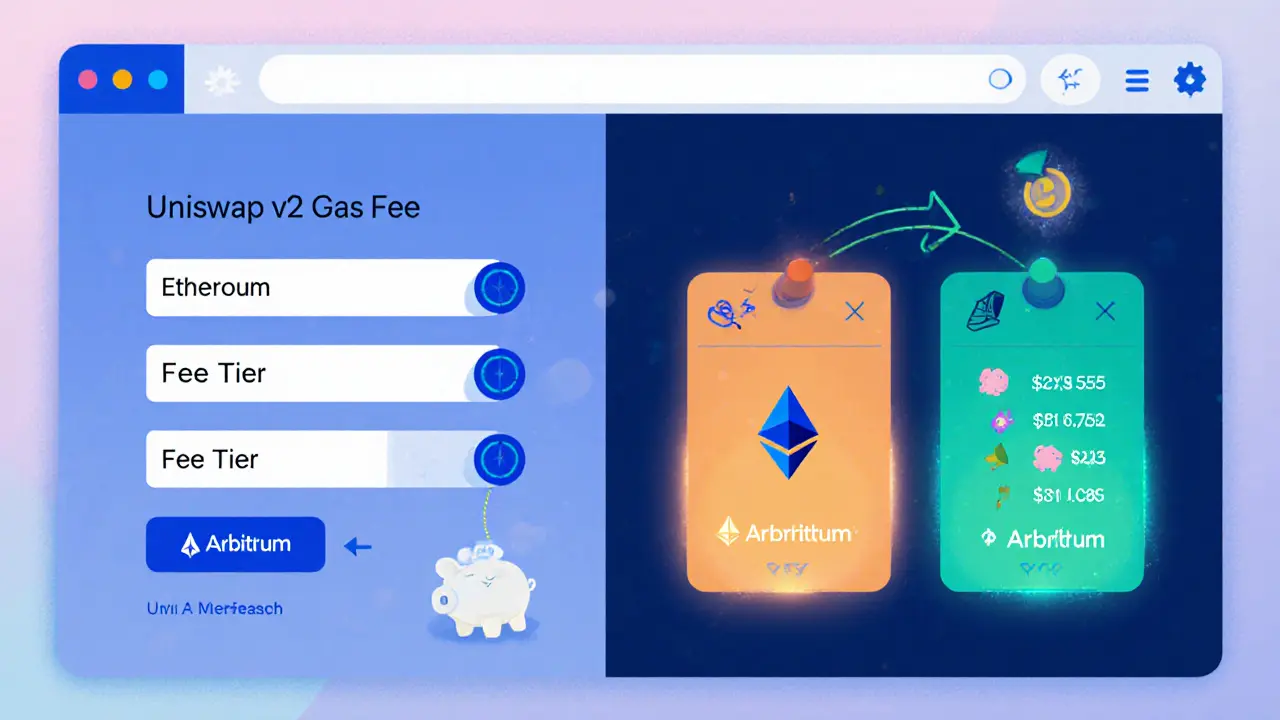

A 2025 review of Uniswap v2 on Arbitrum covering fees, liquidity, security, user experience, and how it stacks up against v3.

Categories

Archives

Recent-posts

Security Token Offerings (STOs) Guide: How Regulated Blockchain Tokens Are Changing Investing

Jan, 26 2026

Finance

Finance