Global Crypto Exchange List

When exploring global crypto exchange list, a curated collection of cryptocurrency trading platforms from around the world. Also known as worldwide exchange directory, it helps traders compare options in a single place. A crypto exchange an online service where users buy, sell, or trade digital assets can be either a centralized exchange a platform run by a single entity that holds users' funds and order books or a decentralized exchange a peer‑to‑peer market that operates without a central authority. The list groups these services by region, trading volume, and feature set, so you instantly see which CEX dominates Europe, which DEX offers the deepest liquidity on Solana, and where niche platforms serve specific token communities. In short, the global crypto exchange list provides the scaffolding for every later decision you’ll make about where to trade.

Key factors every trader checks

Once you have the list in front of you, the real work starts: weighing fees, security, regulatory standing, and user experience. Exchange fees the charges taken on deposits, withdrawals, and each trade directly affect profitability, especially for high‑frequency strategies, so the list ranks platforms by maker‑taker spreads, withdrawal costs, and hidden fees. Security measures protocols like cold storage, two‑factor authentication, and insurance coverage influence trader confidence; a platform with a solid audit trail and bug bounty program will score higher than one with a sketchy history of hacks. Regulation shapes availability, too—some exchanges comply with AML/KYC rules in the EU, while others operate in jurisdictions with looser oversight. The list flags each service’s compliance status, letting you avoid platforms that might disappear overnight. Liquidity, supported assets, and UI design round out the picture; a deep order book reduces slippage, a wide asset range offers diversification, and an intuitive dashboard cuts learning time. By mapping these attributes side by side, the global crypto exchange list creates a clear cause‑and‑effect chain: lower fees reduce costs, stronger security boosts confidence, and clear regulation ensures longevity.

Beyond the basics, the list connects to tools that make trading smoother. Trading bots automated scripts that execute orders based on predefined strategies often require API access, so exchanges that provide robust, well‑documented APIs rank higher for algorithmic traders. Market data aggregators feed real‑time price feeds into the list, helping you spot arbitrage opportunities across regions. Finally, the list notes whether an exchange offers staking, lending, or yield‑farm options, giving you a quick glance at extra income streams. All these connections form a web: the global crypto exchange list not only catalogs platforms but also stitches together fees, security, regulation, and auxiliary services into a single, actionable resource. Below you’ll find detailed reviews, security analyses, fee breakdowns, and real‑world tips for each exchange, so you can move from curiosity to confident trading in minutes.

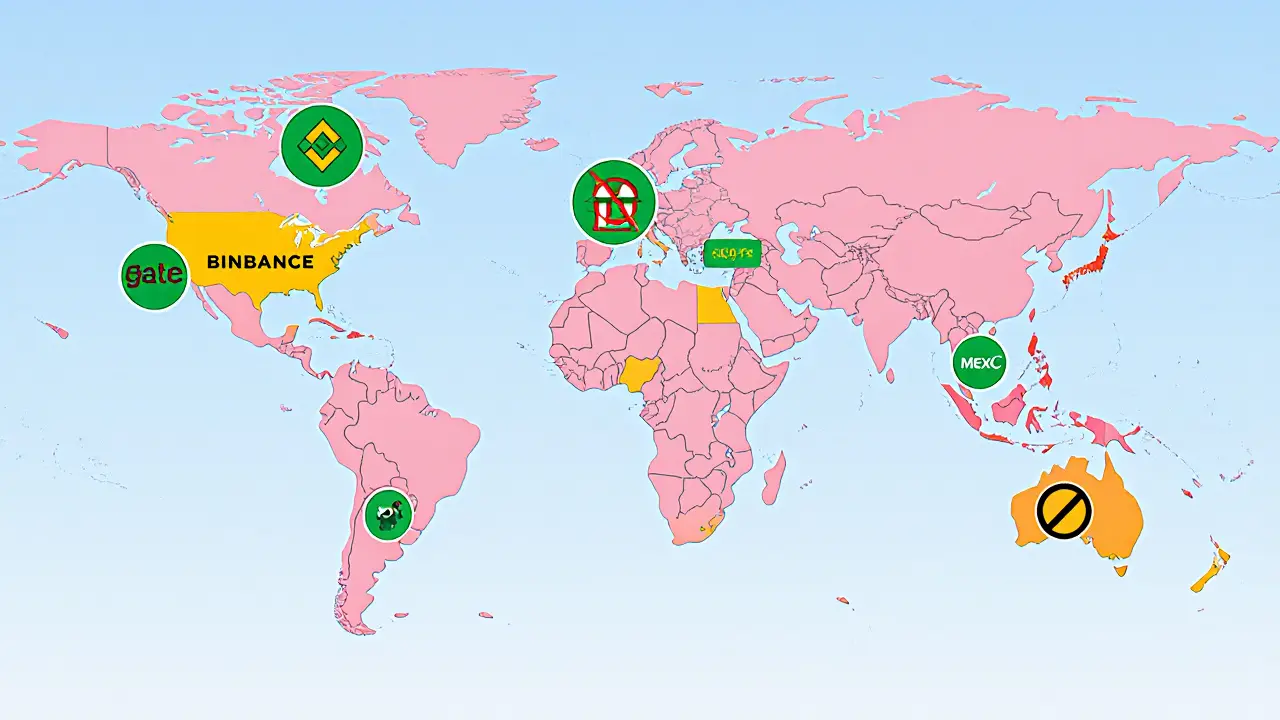

Explore how crypto exchange availability varies worldwide, what regulations shape access, and which platforms serve each region in 2025.

Categories

Archives

Recent-posts

State Control of Crypto Mining in Venezuela: How the Government Manages and Restricts Digital Mining

Jan, 30 2026

Finance

Finance