Digital Asset Compliance

When dealing with digital asset compliance, the process of ensuring crypto projects follow legal, regulatory, and industry standards, you also need to understand utility token regulation, rules that govern tokens used for accessing a platform’s services, crypto tax compliance, the set of reporting and payment obligations for digital‑asset earnings, AML/KYC requirements, anti‑money‑laundering and know‑your‑customer checks that every exchange and DeFi protocol must perform, and the EU’s MiCA framework, the Markets in Crypto‑Assets regulation that standardises rules across Europe. Together, these pieces form the backbone of a compliant digital‑asset strategy.

In practice, digital asset compliance isn’t a single checklist; it’s a web of inter‑related obligations. For instance, the MiCA framework requires issuers to publish a detailed white‑paper, which directly influences utility token regulation because the same document is used to assess whether a token is a security or a service‑access token. Meanwhile, AML/KYC rules shape how exchanges collect user data, and that data feeds into tax reporting systems, linking crypto tax compliance to every on‑ramp and off‑ramp activity.

Regulatory Landscape Across Regions

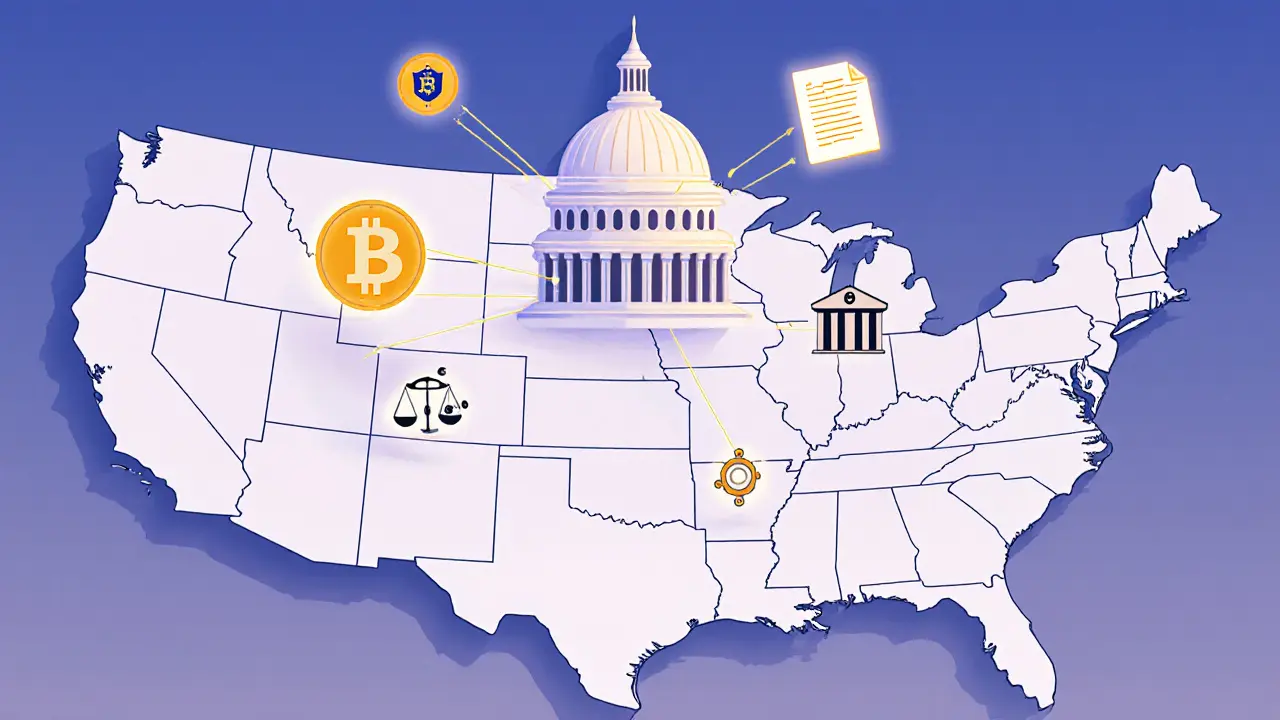

Europe has taken a unified approach with MiCA, setting clear capital‑adequacy, custody, and disclosure standards. North America leans on existing securities laws—think Howey test—and state‑level crypto‑specific bills. Asia presents a patchwork: China bans private crypto but pushes the digital yuan, while Taiwan introduces selective banking restrictions and VASP registration. Each jurisdiction adds a layer to the compliance puzzle, meaning projects must map local rules before they roll out globally.

Tax compliance adds another dimension. India’s 30 % flat crypto tax, the United States’ capital‑gains reporting, and Brazil’s emerging tax guidelines all require accurate transaction tracking. Failure to file can trigger hefty penalties—up to five years in prison in the U.S. and $250 K fines in many jurisdictions. The key is real‑time record‑keeping, which many of our posts explain through practical tools and spreadsheet templates.

Utility token regulation sits at the intersection of security law and product design. If a token grants access to a platform’s features, it usually falls outside securities classification, but the line blurs when the token also promises profit participation. The EU’s MiCA provides a “service‑token” carve‑out, while the U.S. Still uses the Howey test case‑by‑case. Our articles walk through checklists that help you decide whether to register as a security, a utility token, or use a hybrid model.

AML/KYC is the gatekeeper for both exchanges and DeFi protocols. Strong identity verification, transaction monitoring, and suspicious‑activity reporting keep regulators happy and protect users from fraud. Many of the guides detail how to integrate on‑chain analytics, use third‑party verification services, and stay ahead of evolving sanctions lists. When you combine these safeguards with proper tax logs, you create a compliance‑first product that can scale across borders.

All of these strands—regulation, tax, utility token rules, and AML/KYC—are covered in the posts below. Whether you’re a trader looking for the latest tax guide, a founder navigating MiCA, or an exchange needing an AML checklist, you’ll find concrete steps, real‑world examples, and actionable insights. Dive in to see how each piece fits together and to get the tools you need to stay on the right side of the law.

A 2025 guide that breaks down US crypto regulation state by state, covering federal laws, New York's BitLicense, California's DFPI, other key states, compliance steps, and future outlook.

Categories

Archives

Recent-posts

NFTs in the Creator Economy: How Digital Ownership Is Changing How Creators Earn in 2026

Feb, 18 2026

BiKing Crypto Exchange Review: Risks, Security Issues, and Why It’s Not for Most Traders

Nov, 28 2025

Finance

Finance