Cryptocurrency Exchange Regulation: What You Need to Know

When working with cryptocurrency exchange regulation, the collection of laws, licensing standards and compliance obligations that govern how digital‑asset platforms operate. Also known as crypto exchange rules, it shapes everything from user onboarding to market surveillance. A key piece of the puzzle is MiCA, the EU’s Markets in Crypto‑Assets framework that sets licensing, consumer‑protection and market‑integrity requirements for crypto firms, sometimes referred to as EU crypto regulation. Equally important is AML compliance, the set of anti‑money‑laundering procedures that exchanges must implement to monitor transactions, verify customers and report suspicious activity, also called anti‑money‑laundering rules. Another pillar is crypto exchange licensing, the official permission granted by a regulator that allows a platform to offer trading services in a specific jurisdiction, often referred to as exchange permit. Finally, utility token regulation, the legal framework that determines how tokens providing access to a product or service are treated under securities law, sometimes known as token utility rules.

Key Areas of Exchange Regulation

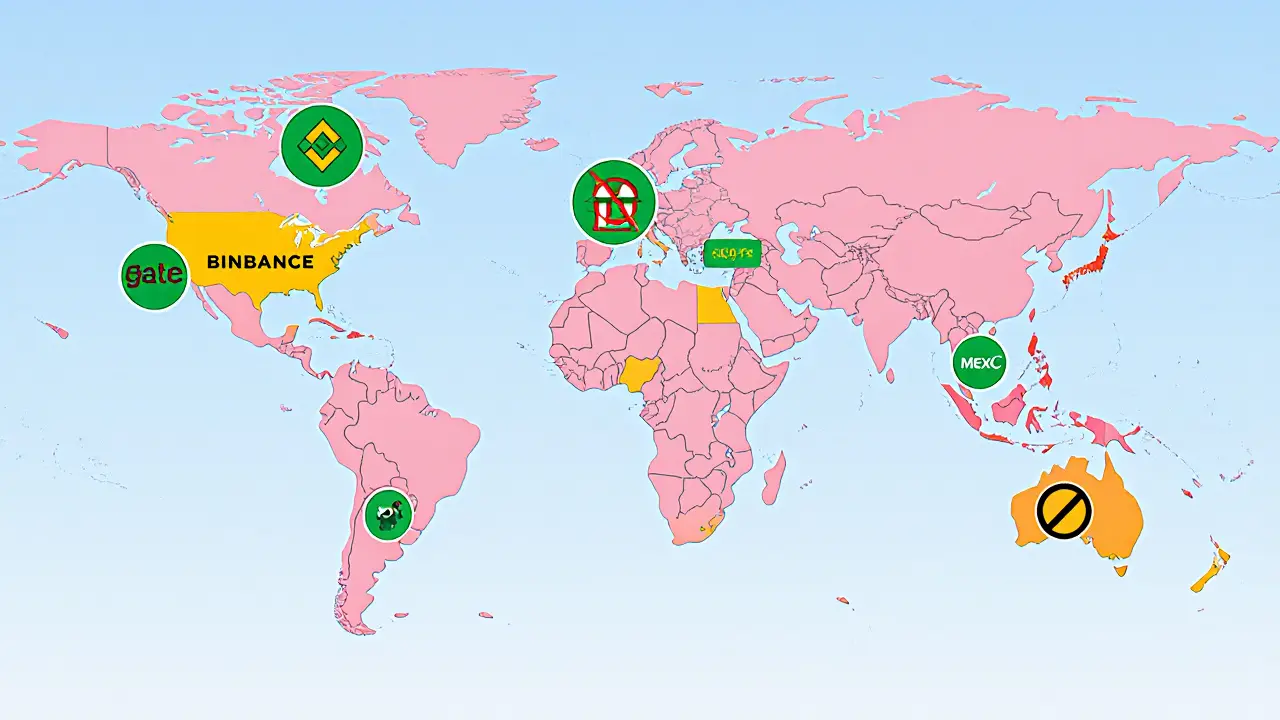

Understanding cryptocurrency exchange regulation starts with three semantic triples that capture its core: the regime encompasses licensing requirements, it requires robust AML compliance, and it influences utility token treatment. Licensing decides whether an exchange can list new assets, collect fees, or offer derivatives, and regulators often tie it to capital‑adequacy ratios and cybersecurity audits. AML compliance adds a layer of transaction monitoring, KYC (Know‑Your‑Customer) checks and regular reporting, which protects both the platform and its users from illicit activity. Meanwhile, utility token regulation determines if a token is classified as a security, affecting disclosure obligations, investor rights and market access. Across regions, the rules vary: the United States focuses on the FinCEN framework, the EU leans on MiCA, and Asian jurisdictions like Singapore blend MAS guidelines with local licensing. All these elements interact, creating a compliance matrix that exchanges must navigate to stay operational and avoid fines.

The articles below break down the most pressing topics you’ll face in 2025. You’ll find deep dives on country‑specific bans and bans reversals, step‑by‑step licensing guides for Brazil, Taiwan and India, and practical checklists for AML program setup. There’s also coverage of how utility token regulation under MiCA changes the way projects launch on European exchanges, plus case studies on enforcement actions that illustrate the cost of non‑compliance. Whether you’re a trader looking to pick a safe platform or an operator building a new exchange, this collection equips you with the facts, tools and real‑world examples needed to move forward confidently.

Explore how crypto exchange availability varies worldwide, what regulations shape access, and which platforms serve each region in 2025.

Finance

Finance