Crypto Exchanges in India: Reviews, Fees, Security & Tax Insights

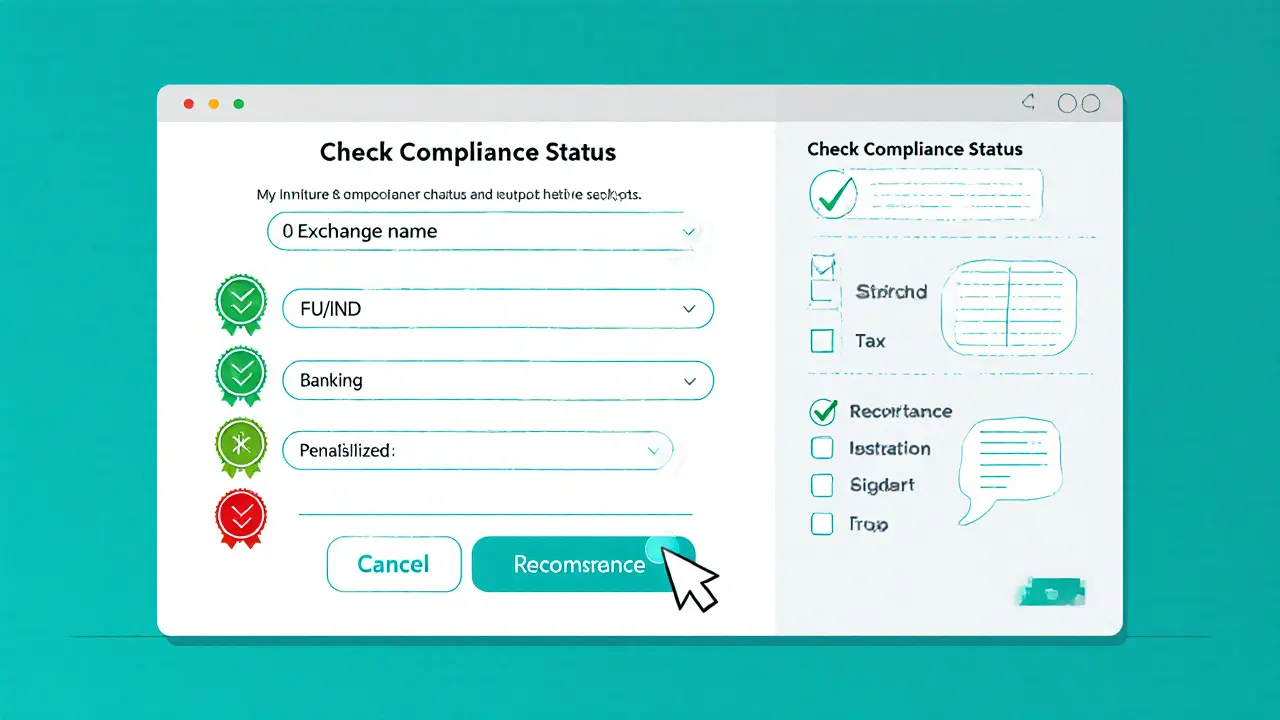

When working with Crypto Exchanges in India, online platforms that let Indian users buy, sell, and trade digital assets while linking global markets to the rupee. Also known as Indian crypto exchanges, they operate under Indian Crypto Regulation, rules from the RBI, SEBI and other authorities that govern licensing, KYC, and AML compliance and must factor in the 30% Crypto Tax in India, a flat tax on gains that shapes trader profitability and reporting obligations. Knowing how these three pillars—platform features, regulatory compliance, and tax obligations—interact is the first step to picking a safe, cheap and liquid exchange.

Key Factors Shaping Indian Crypto Exchanges

Regulation influences exchange fees because licensed platforms often absorb compliance costs in their pricing models. Security is another checkpoint: exchanges that meet Indian AML standards typically boast cold‑storage wallets, multi‑factor authentication, and regular audits. Liquidity, meanwhile, determines how quickly you can convert rupees to crypto without slippage; high‑volume Indian exchanges pair with global order books to keep spreads tight. Together, these attributes create a semantic chain: Indian Crypto Regulation drives security requirements, which affect user trust, while tax rules shape fee structures and ultimately impact liquidity choices.

Below you’ll find a curated set of articles that break down each of these elements. From in‑depth reviews of top Indian platforms to step‑by‑step guides on filing your 30% crypto tax, the collection gives you actionable insights you can apply right away. Dive in to see how specific exchanges stack up on fees, security, and compliance, and learn practical tips for staying on the right side of the law while maximizing your trading efficiency.

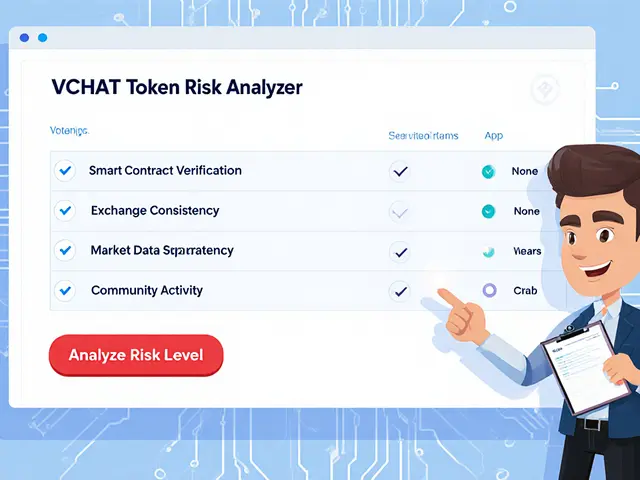

Learn which crypto exchanges Indian traders should avoid in 2025, why compliance matters, and how to pick safe platforms with practical checks and a handy checklist.

Categories

Archives

Recent-posts

Security Token Offerings (STOs) Guide: How Regulated Blockchain Tokens Are Changing Investing

Jan, 26 2026

Finance

Finance