Cardano DEX: What You Need to Know About Decentralized Exchanges on Cardano

When you trade crypto without a middleman, you’re using a Cardano DEX, a decentralized exchange built on the Cardano blockchain that lets users swap tokens directly from their wallets. Also known as a non-custodial exchange, it removes banks, brokers, and KYC checks—putting control back in your hands. Unlike centralized platforms like Binance or Coinbase, a Cardano DEX doesn’t hold your coins. You sign trades with your private key, and smart contracts handle the rest. That means no one can freeze your funds or shut down the service—unless the code itself has a flaw.

But not all Cardano DEXs are created equal. Some, like Plutus, the native smart contract language powering many Cardano DeFi apps, enable developers to build trading protocols that are secure and transparent. Others rely on third-party bridges or wrapped tokens that introduce new risks. You’ll find platforms offering low fees and fast trades, but many lack liquidity, making slippage a real problem. And while some claim to be "the next Uniswap on Cardano," few actually have the user base or audit history to back it up. The real winners are the ones with open-source code, active development, and clear tokenomics—not just flashy websites.

What makes Cardano DEXs different from those on Ethereum or Solana? It’s the design. Cardano’s proof-of-stake system uses less energy, and its layered architecture separates settlement from computation. That means trading can be cheaper and more stable over time. But because Cardano’s DeFi ecosystem is still growing, you won’t find hundreds of trading pairs. Most DEXs focus on ADA, stablecoins like FDUSD or USDT, and a few native tokens like $FIO or $VET. If you’re looking for exotic meme coins, you’ll likely be disappointed—or worse, scammed.

And that’s where things get dangerous. Many fake DEXs mimic real ones with similar names—like "CardanoSwap" instead of "SundaeSwap"—to trick users into connecting wallets. Once you sign a malicious approval, your funds can vanish. That’s why checking the official website, verifying contract addresses on Cardano’s block explorer, and reading community feedback matters more than ever. The best Cardano DEXs don’t just work—they’re trusted by real traders.

Below, you’ll find real reviews of platforms that actually exist, scams that look real, and tools that help you trade safely on Cardano. No fluff. No hype. Just what works—and what doesn’t.

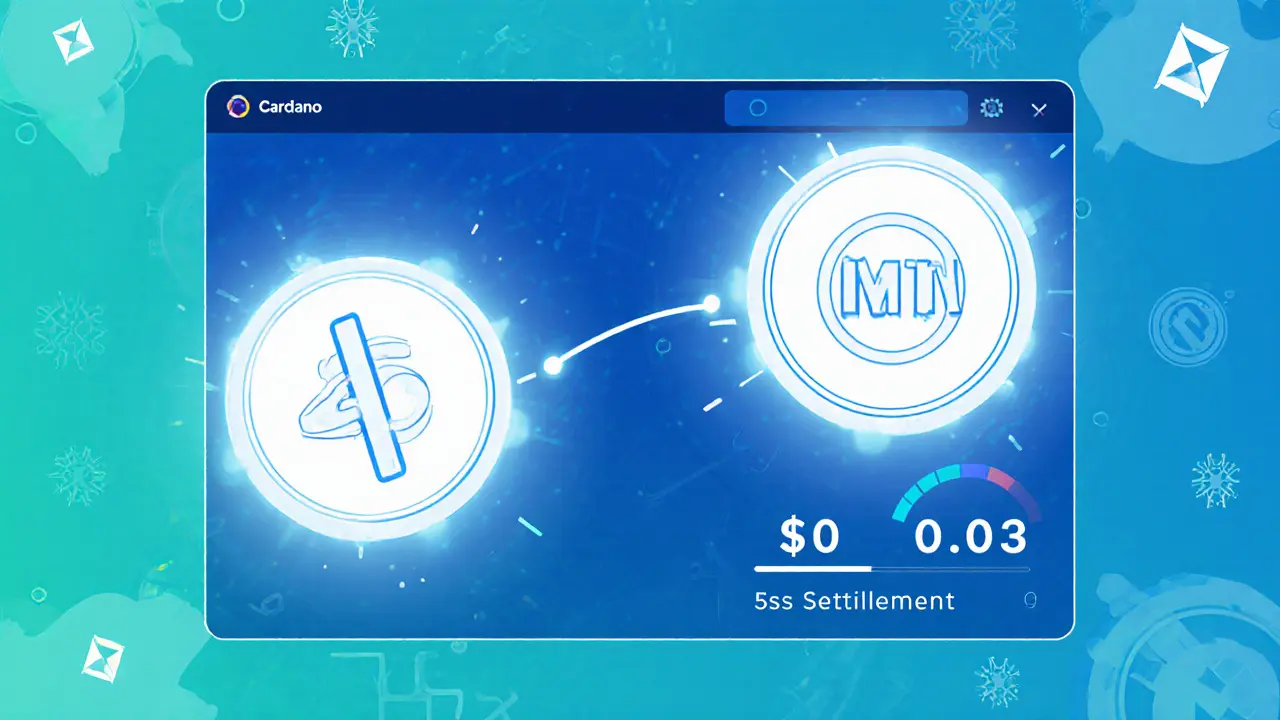

Minswap V2 is the fastest, cheapest DEX on Cardano with near-zero fees, smart routing, and a clean interface. Perfect for traders who want speed and control without the bloat of other platforms.

Finance

Finance