BSW Token – All You Need to Know

When diving into the world of crypto yields, BSW token, the native utility token of the Beefy Finance ecosystem that powers auto‑compounding vaults across many blockchains. Also known as BeefySwap Token, it enables fee rebates, governance voting, and cross‑chain liquidity incentives. In simple terms, BSW is the engine that lets users capture higher returns without constantly moving funds. It ties directly into the broader DeFi landscape, meaning that any shift in liquidity or staking demand instantly reflects on its price. That connection creates a clear semantic triple: BSW token enables yield‑optimizing strategies, tokenomics guides reward distribution, and DeFi platforms benefit from the token’s utility. Understanding this trio is the first step before you look at market charts or airdrop alerts.

Key Aspects of BSW Token

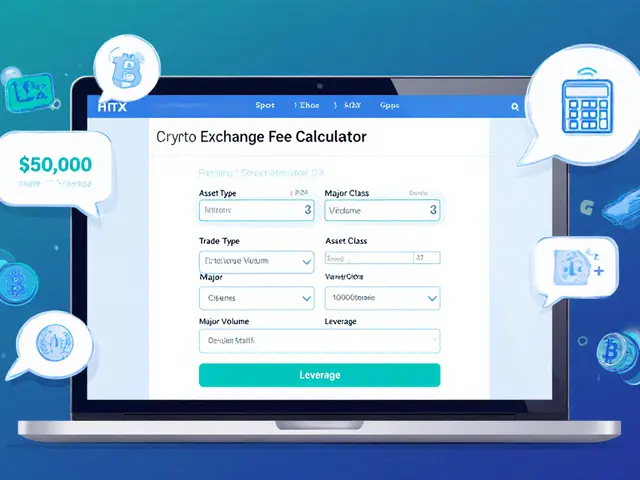

Understanding Tokenomics, the economic design that controls supply, distribution, and incentives of a crypto asset is crucial for any BSW holder. The token’s supply schedule, inflation rate, and fee‑reduction mechanisms dictate how attractive it is for stakers and liquidity providers. At the same time, Crypto Exchange, any platform where users can trade, deposit, or withdraw digital assets listings determine accessibility and price discovery. When BSW appears on a major DEX or CEX, trading volume spikes, which in turn feeds back into its tokenomics by increasing fee rebates for active participants. Regulation also plays a hidden but powerful role: Regulation, the set of legal frameworks that govern crypto activities in different jurisdictions can affect exchange listings and the ability of projects to run incentive programs. A recent trend shows that tighter compliance checks on major exchanges lead to more transparent tokenomic disclosures, helping investors gauge real‑world risk. Together, these elements form a network of relationships: tokenomics influences staking demand, exchange presence boosts liquidity, and regulation shapes both market access and investor confidence.

If you’re ready to dig deeper, the collection below covers everything from real‑time BSW price snapshots to detailed guides on staking rewards, airdrop eligibility, and how recent regulatory shifts might impact future listings. You’ll also find side‑by‑side comparisons of the top crypto exchanges that support BSW, practical tips for navigating fee structures, and expert takes on the token’s long‑term sustainability. All these pieces help you form a holistic view before you commit capital or claim an airdrop. In short, the articles ahead give you actionable insights, whether you’re tracking market moves, planning a staking strategy, or just curious about how BSW fits into the wider DeFi puzzle.

Learn the truth behind Biswap's supposed airdrop, spot scams, and discover safe ways to earn BSW through farming, NFTs, and official incentives.

Finance

Finance